Get 2,500 free Avios when you sign up for Qatar Privilege Club, more when you use Cash + Avios

If you're not a member of Qatar Airways' Privilege Club loyalty program, now is a great time to sign up.

When you sign up for an account and use promo code "FLYQR3," you will be rewarded with 2,500 welcome Avios.

And since Privilege Club members can link their Avios accounts to British Airways Executive Club, you can transfer your Qatar Avios (including the 2,500 welcome Avios) to British Airways at no charge.

Plus, you can earn even more free Avios when you take your first flight and use the new Cash + Avios feature.

Let's take a closer look at how you can benefit from each of these promotions.

[table-of-contents /]

How to get 2,500 free Avios

As mentioned, Qatar Airways is currently running a promotion that awards 2,500 bonus Avios to new members. You can join the program by registering on this page.

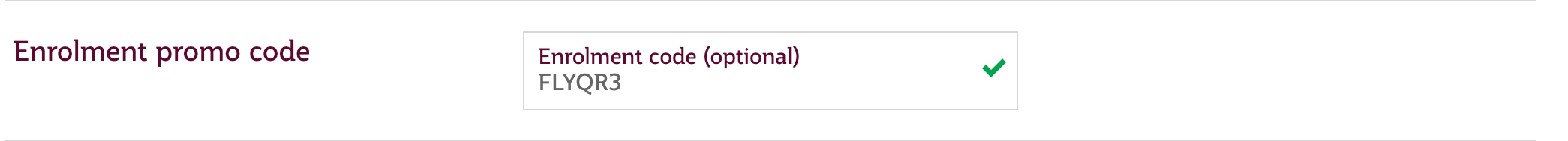

As with signing up for any airline loyalty program, you will be prompted for a variety of personal details. But you'll want to take special note of the "Enrolment promo code" section. Add "FLYQR3" to that box before continuing to the next screen.

After you submit your application, you will be given a membership number, and 2,500 Avios will instantly be deposited into your account.

If you fly with Qatar Airways by Sept. 30 and credit the flight to your new membership account, you will receive an additional 5,000 bonus Avios.

Keep in mind that this promotion expires on March 31.

Earn up to 10,000 Avios with this Cash + Avios promotion

Qatar is also giving members up to 10,000 bonus Avios when using its new Cash + Avios feature. When you book a flight by March 31 and fly before Oct. 31, you'll earn 5,000 Avios when you book an economy ticket and 10,000 Avios when you book a first- or business-class ticket using this feature. You will only earn the bonus on flights operated by Qatar Airways.

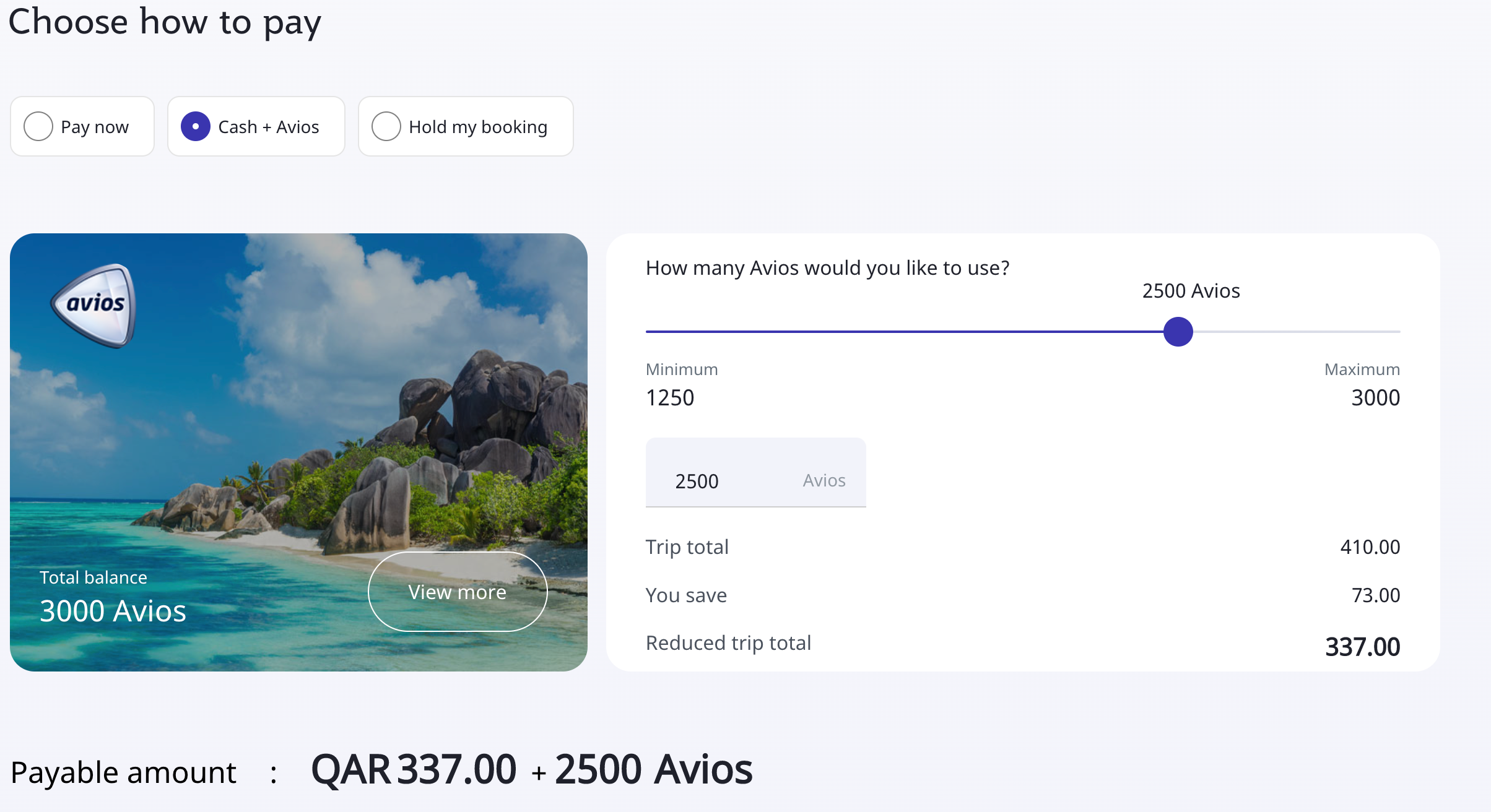

This feature lets you use a mixture of cash and Avios to pay for an award ticket. You can use as many Avios as you'd like, with more Avios equaling a higher discount.

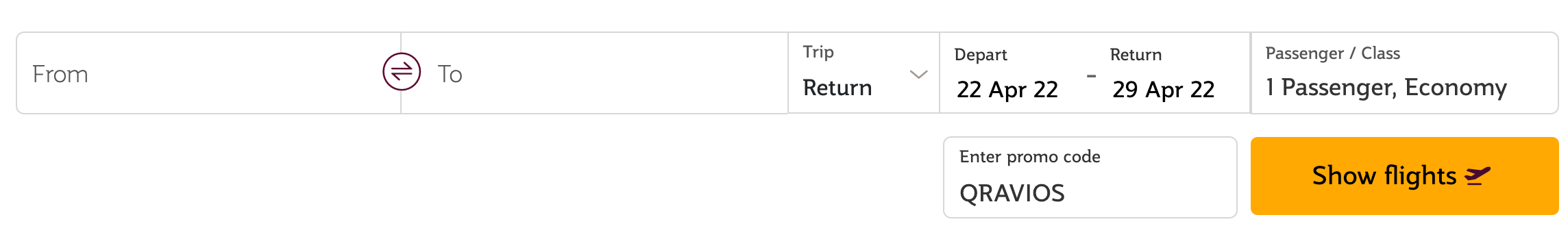

When booking your ticket, make sure that you're logged in to your account. You'll also need to use promo code "QRAVIOS" when you search for your flight.

When you get to the payment page, you'll find a slider where you can select your preferred ratio of cash to Avios. On an economy-class flight from Doha, Qatar, to Sharjah, United Arab Emirates, costing 410 Qatari riyals (about $112), you can use a minimum of 1,250 Avios, which takes 36 riyals (about $10) off the bill. If you want to use 2,500 Avios, you will save 73 riyals (about $20).

Any combination of cash and Avios should trigger the 5,000 Avios (economy class) or 10,000 Avios (business or first class) bonus promotion, even if the amount of points you use is less than the bonus you earn.

You can transfer these Avios to British Airways

To transfer your Qatar Avios to British Airways Avios, you first have to link your British Airways and Qatar Airways accounts. You can do this on the British Airways or Qatar Airways website, following the instructions found in this article.

We value each Avios at 1.5 cents apiece, so the 2,500 Avios earned with the sign-up promotion are worth $37.50, while the 5,000 earned from an economy Cash + Avios booking is worth $75. Stacking the two promotions would give you over $100 in value, which isn't too shabby if you're already considering booking a Qatar Airways flight.

There are plenty of British Airways Avios sweet spots too. For example, short-haul domestic award tickets on American Airlines and Alaska Airlines start at just 7,500 Avios. This includes all routes under 651 miles, like Washington, D.C., to New York; Portland, Oregon, to Seattle; and Phoenix to Los Angeles. Longer routes cost more Avios, but there are many great deals to be had.

You can also top off your Avios account by transferring American Express Membership Rewards points, Capital One miles, Chase Ultimate Rewards points or Marriott Bonvoy points to British Airways, and from there, you could transfer the points to Qatar. Citi ThankYou points also transfer directly to Qatar, so you can seamlessly top up your balance for an award ticket.

Bottom line

It's great to see Qatar Airways ring in the addition of Avios with a handful of excellent promotions. And let's be real: It doesn't get better than earning Avios just for signing up for an account. Make sure to take advantage of the new account promotion if you don't already have a Qatar Privilege Club account, and keep the others in mind if you're planning a trip with Qatar Airways in the near future.

TPG featured card

at American Express's secure site

Terms & restrictions apply. See rates & fees.

| 3X | Earn 3X Miles on Delta purchases. |

| 1X | Earn 1X Miles on all other eligible purchases. |

Pros

- Delta SkyClub access when flying Delta

- Annual companion ticket for travel on Delta (upon renewal)

- Ability to earn MQDs through spending

- Various statement credits for eligible purchases

Cons

- Steep annual fee of $650

- Other Delta cobranded cards offer superior earning categories

- Earn 100,000 Bonus Miles after you spend $6,000 or more in purchases with your new Card within the first 6 months of Card Membership and an additional 25,000 bonus miles after you make an additional $3,000 in purchases on the Card within your first 6 months, starting from the date that your account is opened. Offer Ends 04/01/2026.

- Delta SkyMiles® Reserve American Express Card Members receive 15 Visits per Medallion® Year to the Delta Sky Club® when flying Delta and can unlock an unlimited number of Visits after spending $75,000 in purchases on your Card in a calendar year. Plus, you’ll receive four One-Time Guest Passes each Medallion Year so you can share the experience with family and friends when traveling Delta together.

- Enjoy complimentary access to The Centurion® Lounge in the U.S. and select international locations (as set forth on the Centurion Lounge Website), Sidecar by The Centurion® Lounge in the U.S. (see the Centurion Lounge Website for more information on Sidecar by The Centurion® Lounge availability), and Escape Lounges when flying on a Delta flight booked with the Delta SkyMiles® Reserve American Express Card. § To access Sidecar by The Centurion® Lounge, Card Members must arrive within 90 minutes of their departing flight (including layovers). To access The Centurion® Lounge, Card Members must arrive within 3 hours of their departing flight. Effective July 8, 2026, during a layover, Card Members must arrive within 5 hours of the connecting flight.

- Receive $2,500 Medallion® Qualification Dollars with MQD Headstart each Medallion Qualification Year and earn $1 MQD for each $10 in purchases on your Delta SkyMiles® Reserve American Express Card with MQD Boost to get closer to Status next Medallion Year.

- Enjoy a Companion Certificate on a Delta First, Delta Comfort, or Delta Main round-trip flight to select destinations each year after renewal of your Card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. Delta Basic experiences are not eligible for this benefit.

- $240 Resy Credit: When you use your Delta SkyMiles® Reserve American Express Card for eligible purchases with U.S. Resy restaurants, you can earn up to $20 each month in statement credits. Enrollment required.

- $120 Rideshare Credit: Earn up to $10 back in statement credits each month after you use your Delta SkyMiles® Reserve American Express Card to pay for U.S. rideshare purchases with select providers. Enrollment required.

- Delta SkyMiles® Reserve American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

- With your Delta SkyMiles® Reserve American Express Card, receive upgrade priority over others with the same Medallion tier, product and fare experience purchased, and Million Miler milestone when you fly with Delta.

- Earn 3X Miles on Delta purchases and earn 1X Miles on all other eligible purchases.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- $650 Annual Fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- See Rates & Fees