Nearly 1,100 Marriott Properties Are Changing Categories for 2017

Update: Some offers mentioned below are no longer available. View the current offers here.

Earlier today, we told you about the 325 SPG properties that are changing categories, but Marriott's making big changes to non-SPG hotels as well, from EDITION to Ritz-Carlton. These category adjustments are also taking effect on March 7, 2017.

With this year's changes, nearly 1,100 properties in the entire Marriott Rewards and Ritz-Carlton Rewards programs are moving up or down in categories or tiers, with 60% moving up in category or tier and 40% moving down. 1,100 may sound like a ton of properties, but not for this hotel giant — of the entire program portfolio, 77% of hotels are not changing categories at all. You can see the full list of properties that are changing categories on the Marriott website.

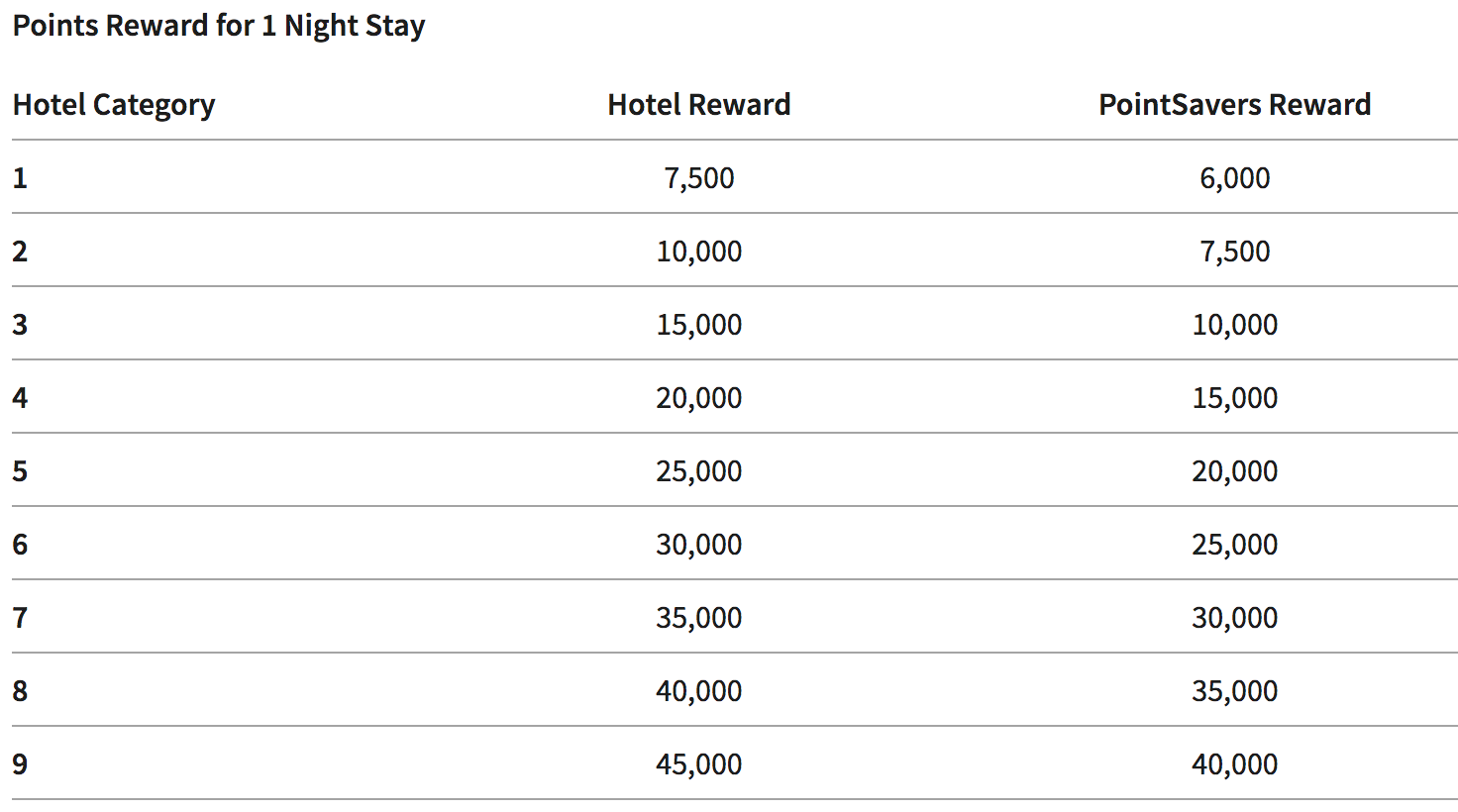

As a reminder, here's how many points you'll redeem at each category level:

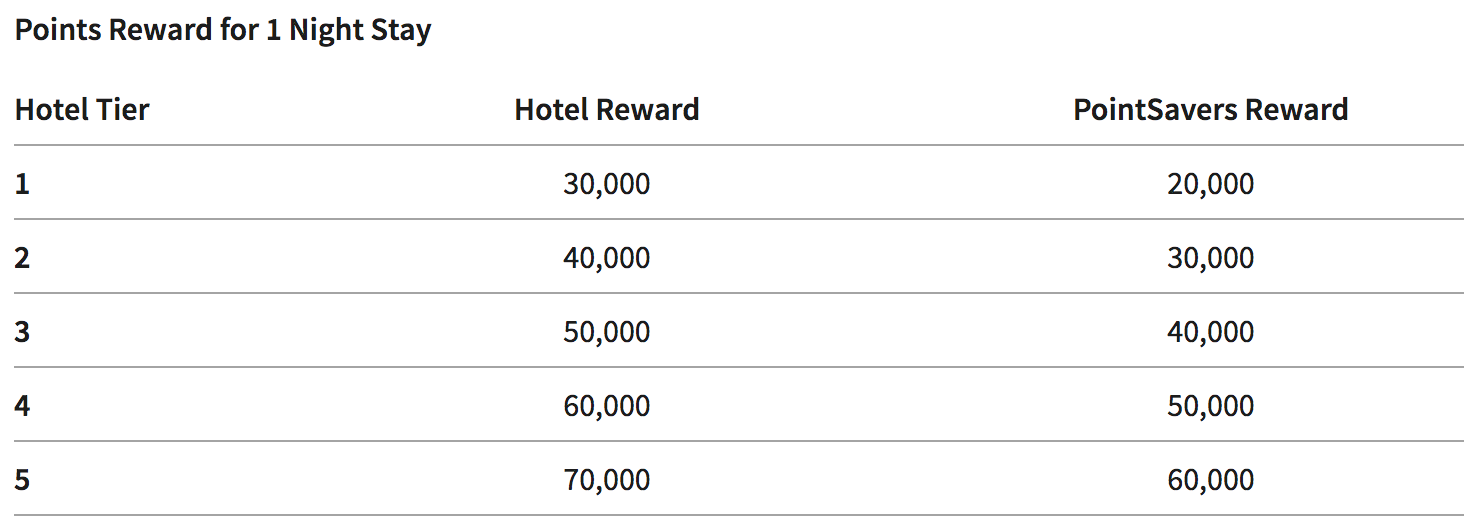

And here's how many points you'll need for Tier 1-5 properties:

Before jumping into some notable changes, here's a look at several highlights on the category changes as a whole:

- 3 Ritz-Carlton properties in the US are moving up in tiers and 3 international Ritz properties are moving down

- The vast majority of these changes are in the US

- Most of the movements in the US are for less premium brands, such as Courtyard, Fairfield and Residence Inn

Here are some notable property changes:

The Ritz-Carlton Highlands, Lake Tahoe

With these changes, the Ritz-Carlton Highlands, Lake Tahoe is moving from a Tier 4 property (60,000 points per night) to a Tier 5 property (70,000 points per night). This is especially notable because this is the last opportunity to use your free night certificates at the property, as they're only good for Tier 1-4 properties.

The London EDITION

As of March 7, the London EDITION will be moving up in the Marriott Rewards program. The property is jumping from a Tier 3 property (50,000 points per night) to a Tier 4 property (60,000 points per night).

The Ritz-Carlton Bali

The Ritz-Carlton Bali is dropping in the Ritz-Carlton Rewards program. The luxury property is moving from a Tier 3 property (50,000 points per night) to a Tier 2 property (40,000 points per night), which means you can still use your Free Night certificate at this hotel and it'll cost you fewer points for each night.

With this announcement, travelers are getting just less than a month of warning, meaning you still have time to take advantage of the 2016 rates. If a property you've been eyeing is dropping in category or tier, it'd be best to wait until March 7 to book your stay, as you'll get to redeem at the lower rate. You can find the full list of properties for both Marriott and Ritz-Carlton that will be changing categories or tiers here.

If you're looking for more Marriott Rewards points to use toward your next redemption, consider signing up for the Marriott Rewards Premier Credit Card. The card comes with a sign-up bonus of 75,000 points after you spend $3,000 in the first three months. You'll earn 5x points on Marriott and SPG stays, 2x points on restaurants, car rental agencies and airline tickets purchased directly with the airline and 1x points on everything else. The card comes with one free night stay at a Category 1-5 hotel every account anniversary, and there are no foreign transaction fees.

Featured image courtesy of the JW Marriott Macau.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app