Major Ice Storm to Affect Texas Airport Hubs Tuesday

Update: Some offers mentioned below are no longer available. View the current offers here.

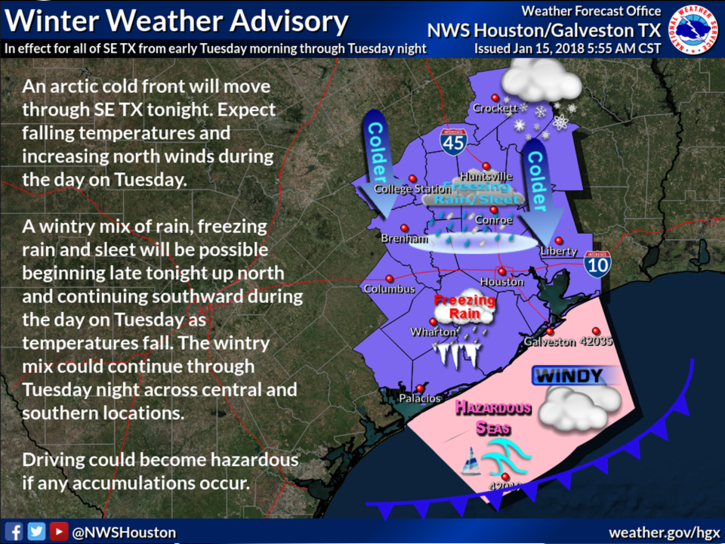

Millions of Texas residents are waking up Monday morning to find themselves under winter storm warnings, with up to two inches of ice and snow forecast to wreak havoc on travel to and from the state Monday evening and Tuesday.

The two major airport hubs in the state, Dallas/Fort Worth (DFW) and Houston Intercontinental (IAH), are outside of the main warning area and are currently only under winter weather advisories. However, any winter precipitation could have a large impact on flights at these busy airports due to their tight scheduling and lack of large-scale de-icing equipment.

As of 9:30am Central Time onMonday morning, only United has released travel waivers for Texas airports. This waiver allows flexible travelers to rebook flights for a later date through January 20 or to rebook their flights to connect through a hub other than Houston.

Remember, if you can't delay your itinerary, airlines aren't going to be responsible for paying for your meals or hotels in the case of weather-related delays/cancellations. But some top cards have flight delay/cancellation insurance that can reimburse you for weather issues, including the Citi Prestige ($500 per passenger for 3+ hour delay), the Chase Sapphire Reserve ($500 per ticket for 6+ hour or overnight delay) and Chase Sapphire Preferred Card ($500 per ticket for 12+ hour or overnight delay).

Delta

- Travel date: January 16

- Airports covered: Austin, TX (AUS); Dallas, TX (DAL); Dallas, TX (DFW); Houston, TX (HOU); Houston, TX (IAH); San Antonio, TX (SAT)

- Ticket must be reissued on or before: January 20

- Rebooked travel must begin no later than: January 20

- Travel date: January 16

- Airports covered: Houston, TX (IAH); Austin, TX (AUS); San Antonio, TX (SAT)

- The change fee and any difference in fare will be waived for new United flights departing on or before January 20, as long as travel is rescheduled in the originally ticketed cabin (any fare class) and between the same cities as originally ticketed.

We will update this post as other airlines issue travel waivers for Texas.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app