Major FICO changes could be bad news for your credit score

Editor's Note

Editor's note: This post has been updated with new information.

The way FICO scores are calculated is changing pretty dramatically, and it could lower your credit score.

Fair Isaac Corporation — more commonly known as FICO — announced it will score consumers more harshly based on their debt levels and loan payments starting this summer. The purpose of this change is for FICO to be able to more accurately calculate the risk of a consumer to lenders.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter.

While the changes are set to take place during summer 2020, consumers likely won't see changes, if any, to their credit score until summer 2021 or later. That's because the new reporting version is released in phases. This summer, the credit bureaus will adopt the new version as a part of phase two, but it could take a year or longer before phase three — when lenders adopt the change — is initiated.

What is the new scoring system?

FICO 10 T — the new reporting version — will place a greater weight on missed payments, meaning that consumers who have fallen behind on repayments will likely see a drop in their credit score. On the plus side, consumers could see a credit score increase if a delinquency is over a year old.

The Wall Street Journal reported that "FICO updates its scoring model every few years to reflect changes in consumer borrowing behavior and performance. When it last announced such changes, in 2014, they were viewed as likely to help boost consumers' credit scores."

Related reading: How to improve your credit score

FICO will reportedly flag certain customers who sign up for personal loans. That could ding you if you transfer credit card balances and then rack up more credit card debt. They'll also continue a recent industry trend of including information from bank account balances and utility payments.

Related reading: 4 incorrect assumptions about your credit score

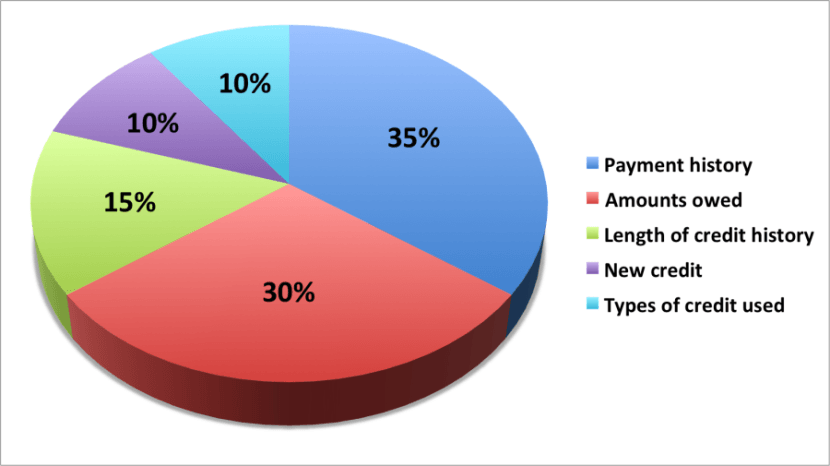

In the fourth quarter of 2019, the Federal Reserve reported that that U.S. consumers had accumulated $930 billion in debt. This may help explain why FICO made adjustments to its scoring model, although the five factors it considers will remain the same.

"Unlike previous FICO scores, 10 T will assess how consumers' debt levels have changed during the past two or so years. FICO scores so far have reflected consumers' balances during roughly the most recent month tracked. This change will place more weight on rising debt levels. Consumers who previously paid their credit-card bills in full but shift to carrying growing balances for several months will likely end up with a lower score," reported AnnaMaria Andriotis of The Wall Street Journal.

That said, not all lenders will adopt the new scoring systems.

What does this mean for you?

If you have and continue to follow the first commandment of travel rewards cards — thou shalt pay thy balance in full — then you shouldn't have too much to worry about.

Related reading: 5 ways to improve your credit score

The new version of FICO will most notably affect borrowers who have been carrying balances over the past 24 months. FICO estimates that roughly 110 million consumers will see a change to their credit score. Of those, approximately 40 million consumers should see an upward shift over 20 points, while another 40 million will see a shift downward.

However, given the current economic situation due to the coronavirus pandemic, you may be carrying more balances than you had prior.

If you find yourself in this situation, you can call your lender or credit bureau and ask that a "natural disaster code" be applied to your credit report. This is by no means a cure-all solution — nor will it protect your credit score — but it will protect your VantageScore (the complimentary credit score you can see through programs such as Chase's Credit Journey) from any delinquent reporting being added to your account.

Related reading: 5 ways the global recession is affecting credit cards and banks — and the upside for some cardholders

In the meantime, FICO is encouraging credit holders to practice credit vigilance. This is something that you should always do, but here's your reminder on how important it is.

Bottom line

If you've been a responsible borrower, then this new model will likely improve your credit score. However, if you've been carrying a balance, it's time to bring your bills up to date.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app