JetBlue expands redemptions for travel-booking platform — and gives it a new name

JetBlue is renaming its travel platform that allows customers to book and then earn points on travel beyond flights — whether they're renting a car, staying in a hotel or booking an activity.

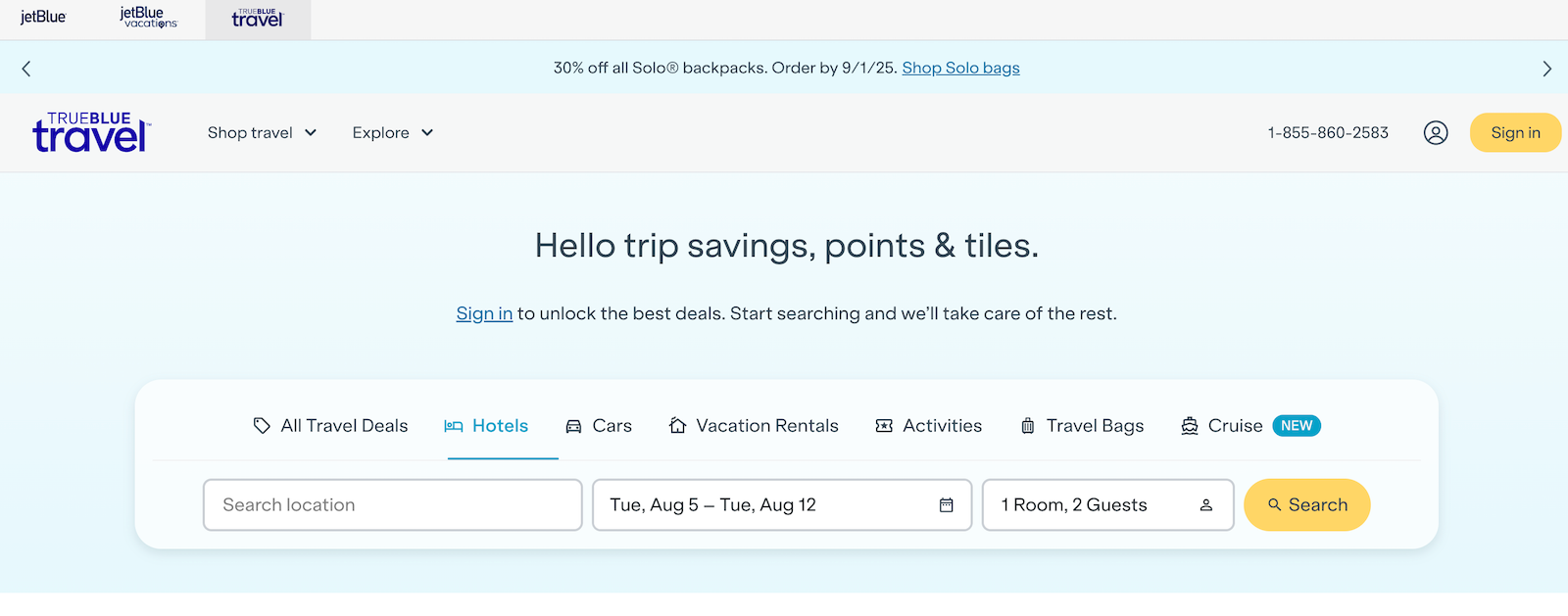

The New York-based carrier on Tuesday announced the launch of TrueBlue Travel, the airline's non-air, travel-booking arm.

Let's say you're traveling to the beach and want to make a reservation for a car rental or a beach house. This platform will allow you to do it.

And, one of the biggest pieces of news: JetBlue revealed that members of its TrueBlue loyalty program will now be able to redeem their points on a much larger portion of those reservations.

Here's what to know about TrueBlue Travel, what's changing and what it means for travelers.

What is TrueBlue Travel?

TrueBlue Travel is JetBlue's rebranded travel booking platform that allows customers to make different types of travel reservations, including:

- Hotel stays

- Car rentals

- Vacation rentals

- Activities

- Purchasing luggage

Top off your points: The best credit card welcome offers we're seeing right now

On some trips, vacation packages like these can be a way to save on each element of the trip while still taking advantage of elite status benefits and earning airline points.

JetBlue is also quick to note its platform offers 24-hour human assistance when problems arise, something some third-party travel sites lack and have previously received criticism over.

Earning points on TrueBlue Travel bookings

If you're a TrueBlue member and log in with your account, you'll be able to earn points and Tiles toward JetBlue Mosaic elite status through these bookings.

If you're a TrueBlue member and log in with your account, you'll earn points and Tiles toward Mosaic status when booking through TrueBlue Travel:

- 1 point per dollar spent on hotels, rental cars, activities, and travel bags

- 1 Tile for every $100 spent on eligible purchases

You'd earn even more points if you paid for your trip with a JetBlue credit card.

Plus, for a limited time, customers who book travel packages between Aug. 5 and 8 can earn 2 Tiles (instead of 1) per $100 spent on car and hotel reservations booked through the platform. Travel must be completed by Nov. 30.

Read more: JetBlue partners with Vrbo, allowing TrueBlue earnings on home rentals

New: Redemptions

Going forward, TrueBlue members can now redeem their points on a wider array of bookings, too.

Previously, TrueBlue members could redeem their points on combined flight-and-hotel packages through JetBlue Vacations.

Now, members will be able to redeem JetBlue points on:

- Standalone hotel stays

- Standalone car rentals

Keep in mind, you can transfer points to JetBlue from several major credit card rewards programs.

What's happening to Paisly?

If you're a frequent JetBlue flyer, this may sound pretty similar to the services the airline has previously offered through its Paisly platform ... and for good reason. This is more of a rebrand than an entirely new site.

Paisly, a Florida-based, wholly owned subsidiary of JetBlue, is technically the tech that powers the airline's booking platform — the white-label engine behind it, if you will.

And recently, JetBlue announced that United Airlines will adopt Paisly as the provider of its booking platform as part of the same deal that led to the "Blue Sky" partnership between the two airlines.

My take: Why I'm excited about United and JetBlue's new partnership, and where there's room to grow

Going forward, JetBlue will refer to its booking platform as "TrueBlue Travel, powered by Paisly."

Bottom line

JetBlue sees the growth of Paisly and the rebranding of its vacations platform as the latest step in its "JetForward" plan to return the company to profitability for the first time since 2019 — the same overarching plan that will soon usher in airport lounges and domestic first-class seats.

"By expanding how and where members can redeem points through TrueBlue Travel, and delivering that experience through Paisly, our in-house travel services company, we're bringing more flexibility and value to the program," Edward Pouthier, JetBlue's vice president of loyalty and personalization, said in a statement announcing the news.

Related reading:

- TPG's 2025 travel trends report

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2025: The 29 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app