Broadway blues: 2 of the 8 shows I booked this year have already been canceled

I have tickets for eight Broadway shows this year. Yes, eight. And it's only January. Unfortunately, I won't be seeing them all, thanks to omicron-related cancellations.

Broadway reopened in September, but I wasn't quite ready to get back to it. Finally, in December, after nearly 24 months of musical withdrawal, I took full advantage of Black Friday and Cyber Monday sales, making plans to see shows every weekend for the first three weeks of the year and adding performances to my calendar well into April.

After booking, my friends and I chattered incessantly about how excited we were. Then, the news came: "Jagged Little Pill," which had its final performance on Dec. 17, 2021, was closing permanently. Just a week later, I learned "Mrs. Doubtfire" — for which I also had tickets last year — was going on a temporary hiatus due to illness within the cast.

Here, I'll recap which shows have shut down (either temporarily or permanently), what the requirements are for attending performances in the near future (there are some changes for kids) and what my recent experience was like.

[table-of-contents /]

Canceled and postponed Broadway shows

The following shows have been affected:

- "Jagged Little Pill" (permanently canceled)

- "Waitress" (permanently canceled)

- "Thoughts of a Colored Man" (permanently canceled)

- "Mrs. Doubtfire" (resumes March 14)

Other productions — including "Little Shop of Horrors," "The Music Man," "The Lion King," "Aladdin," "Harry Potter and the Cursed Child," "Dear Evan Hansen," "Hadestown," "Six" and "Come From Away," which recently did a show with a full standby cast — also have had to cancel a performance or two due to breakthrough cases.

What to do if you have tickets to a canceled show

Check reliable sites like Broadway.org, Playbill.com and Broadwayleague.com for updates. Also check your email frequently. If your show has been canceled, you will likely receive notification from the entity where you purchased your tickets, along with information about rescheduling your show for another date or requesting a refund, if applicable.

If you know your show has been canceled, but you haven't received communication from your booking outlet, contact customer service to inquire.

I booked my tickets through the TodayTix app, and the funds were automatically processed in the form of a TodayTix credit that I can use to rebook for a later date or to buy tickets to other shows.

Currently, most ticket sellers are offering flexible cancellations as part of Broadway's "Book With Confidence" initiative. For example, Telecharge is allowing patrons with tickets for performances through April 30, 2022, to request refunds or transfer their performance dates up to 48 hours prior to showtime. Similarly, Broadway Inbound, which specializes in group ticket sales, offers exchange and refund options for individuals up to two hours prior to curtain and up to 24 hours prior for groups. (Check with your ticket seller for its specific policies.)

New COVID-19 requirements you should know about

As has been the case since performances resumed last year, everyone must be masked for the entire performance, regardless of age, and all adults and children 12 and older must show proof of full vaccination in order to enter the theater.

A new rule handed down in early December also requires 5- to 11-year-olds to show proof of at least one dose of an approved vaccine. According to a Monday statement from the Broadway League, all 41 Broadway theaters in New York will require full vaccination for this age group by Jan. 29, 2022, and all mask and vaccination requirements will remain in place through at least April 30, 2022.

Related: What it's like to see a Broadway show with kids during COVID-19

My experience during omicron

Of the shows I've booked, 25% have now been canceled or postponed on the dates I was supposed to attend. Another three shows for which I have tickets have had to cancel a performance or two (thankfully, not ones I was scheduled to see). It would be easy to sulk, but as they say, the show must go on. And go on it did when I saw my first performance since February 2020 on Saturday.

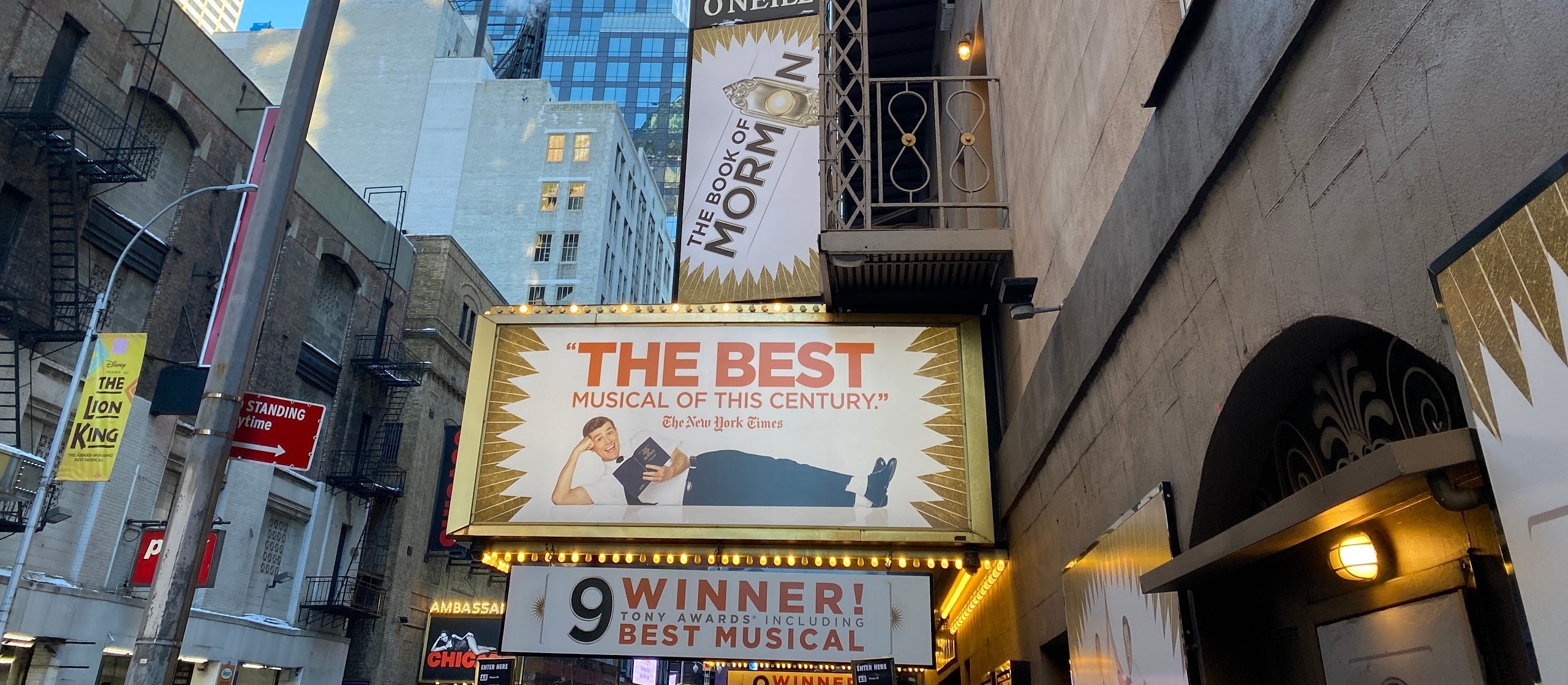

Vaccine cards emerged from pockets and purses at the entrance to the Eugene O'Neill Theatre, where a small group of theatergoers gathered to see "Book of Mormon."

I beamed as I showed my proof of inoculation to the gentleman working the door, but he couldn't see just how happy I was to be back because my face was covered by my mask. It's amazing how much has changed in just a couple of years.

Evidence of the "new normal" was everywhere — ushers held giant signs to remind us to "Mask up!" and workers stood at the entrances to the theater's bars to let us know that they were closed. (The bars originally reopened in fall when performances restarted, but they later closed again due to surging omicron cases, according to one of the workers.)

Some things never change, though. The line for the women's restroom spanned two flights of stairs at intermission, and the show ended with a standing ovation. (I saw "Book of Mormon" for the first time 10 years ago, and it's just as funny and irreverent now as it was then.)

During the final rounds of thunderous applause, I gazed up at the beautifully ornate theater ceiling and realized how lucky I was to be there — even with a mask on.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app