How Maps Show the Evolution of Airlines

Even in the era of GPS and Google Maps, good old paper maps are thriving in at least one place: inflight magazines.

The humble airline map is pretty much as old as the airline industry itselfm and it's one of the places where airlines get the most creative. The oldest airlines in existence are about a century old — KLM, the oldest in the world, turns 99 this year — and their maps, with distinctive styles throughout the decades, are as good a lens as any to look at their evolution.

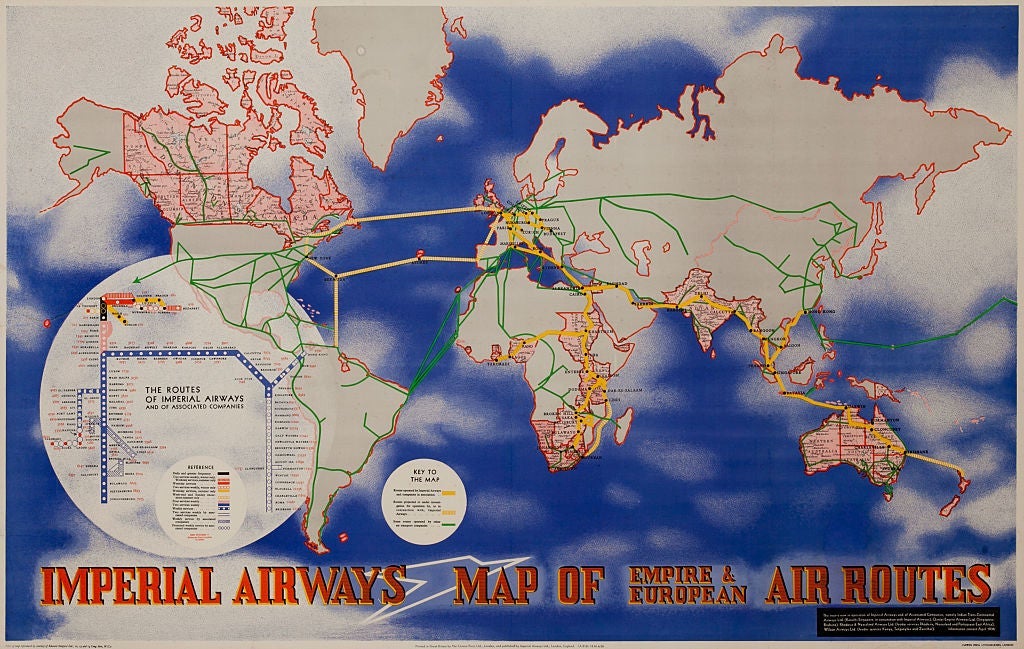

"During the pioneering years, aviation maps had essentially a prestige function. Just as the travel posters that were also in vogue during those years, the airline map provided a glimpse of the exotic, of the adventurous nature of flight," says Victoria Johnson, a cartographer who has studied extensively the history of airline maps. "Some airlines, such as KLM, Air France and Imperial Airways, went as far as commissioning their maps from artists that gave them a rather unique look and feel."

When airlines were the fastest link to the far reaches of Europe's colonial empires, getting there was no small feat. KLM's route to Indonesia above, for example, took weeks and 20-plus stops. The map is a throwback to an age long gone, with its depiction of the links to the Imperial Airways and Air France lines to the British and French colonies. Today, it's a nonstop jet flight from Amsterdam to Jakarta.

The postwar growth and consolidation of the airline industry and the sustained growth in passenger numbers led to airline maps becoming, inevitably, more utilitarian, but there was still some room for imagination.

"Some airlines even gave postcards with a route map, where you could underline the itineraries you had flown and then send it to friends and family" Johnson says.

The advent of the jet age in the 1960 brought innovations for maps too. SAS Scandinavian emphasised its edge on early polar routes from Europe to Asia via Alaska with this "spiral-polar projection" map. Those early jetliners didn't have the range of today's: the maps shows that even getting from Copenhagen to Los Angeles, a distance of under 6,000 miles, required stopping for fuel in Greenland.

By the 1970s flying had already lost most of its adventurous allure. The airline map came to be seen as an addition to inflight magazines, often just a means to show the vast reach of an airline (and, in those days of state-owned carriers at least in Europe, of its home nation's clout in the world.)

The development of the hub-and-spoke system also meant that route maps became incredibly dense. Try to make out every single connection in this one. (It's Air France-KLM, and the style has changed a bit since the 1930s — also because of airline alliances and transnational mergers.)

The "spaghetti-style" mess doesn't get any better when looking at long-haul maps. Air France-KLM's route network is just as dense when looking at the Atlantic. Those maps may not rank high in terms of beauty, but are also a corporate statement: the dense bundles of routes are a visualisation of the prominence and reach of the large network carriers. You may find it impossible follow the lines on the map, but you can just pull up the app on your phone to find a particular flight.

Daniel Huffman, a Wisconsin-based cartographer who recently worked on a new map design for a major Middle Eastern airline, is no fan of those spaghetti jumbles. "Those clusters of lines can look intimidating. Design has to be human," he says. "The key point of a map should be to inform people, it should be easy to follow. Those using it should feel there is a person behind it."

His map proposal for that airline client looks far more like something organic, with routes depicted as branches that spring out of a central hub.

The airline client ended up turning down this particular proposal in favor of a more conventional design.

Besides the more traditional designs with their thin lines connecting the dots, a more abstract style has also emerged. Some airlines have opted for a minimalistic approach and done away completely with lines on the map. Vueling, the low-fare subsidiary of IAG, the parent company of British Airways and Iberia, follows this approach in its inflight magazine:

Virgin Atlantic uses different colors to convey information, for example to differentiate between destinations served by its own planes or through codeshare agreements.

Exact geographical features or even landmass contours may even be absent altogether from route maps. This is the case, for example, of the map Vueling uses on its website, as opposed to the inflight magazine:

Airline maps are going to keep evolving as airlines use digital tools more and more to communicate. Inflight magazines are an increasingly threatened species, and airline maps might move more and more to online only. But whatever the support they use, maps are likely to continue playing a role.

"Airlines will still be willing to impress and the map acts a bit as showcase of the whole firm," Huffman says. "After all, if the map is not good because the airline skimps on it, what deters the passenger from thinking, 'What else are they willing to skimp on?'"

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app