Ouch: Hilton Honors devaluation sees award redemptions skyrocket up to 250,000 points per night

It's a rough day for Hilton Honors loyalists. Hilton, once again, has raised points pricing on a number of top-tier properties around the world, noted by a crew of rightfully angry travelers — many with plans and points to spend — on Reddit and reported by Danny the Deal Guru. In fact, some of these dreamy properties have now increased to a whopping 250,000 Hilton Honors points per night for a Standard Room Reward.

What's worse, many of the same properties saw significant hikes as recently as May of this year.

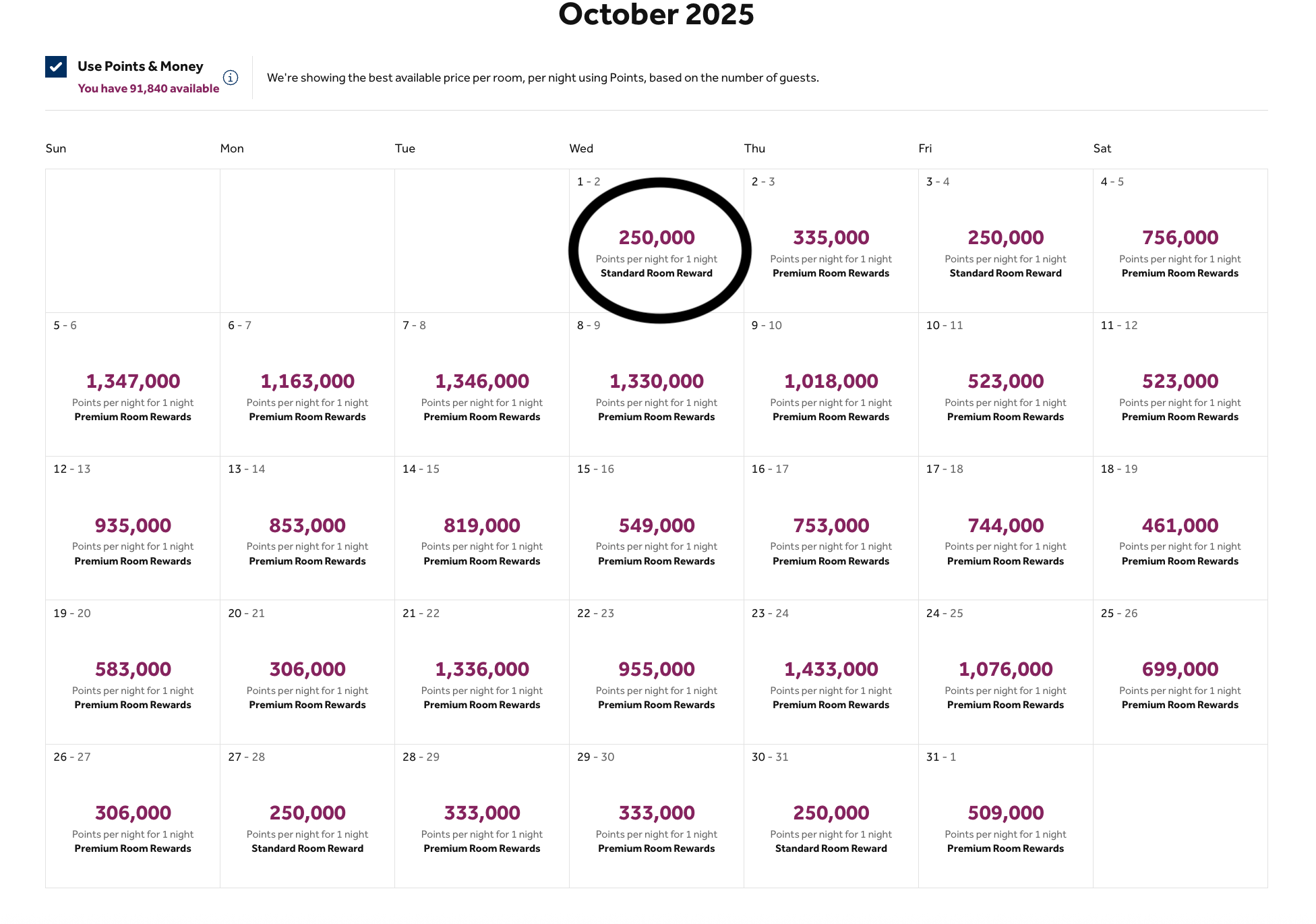

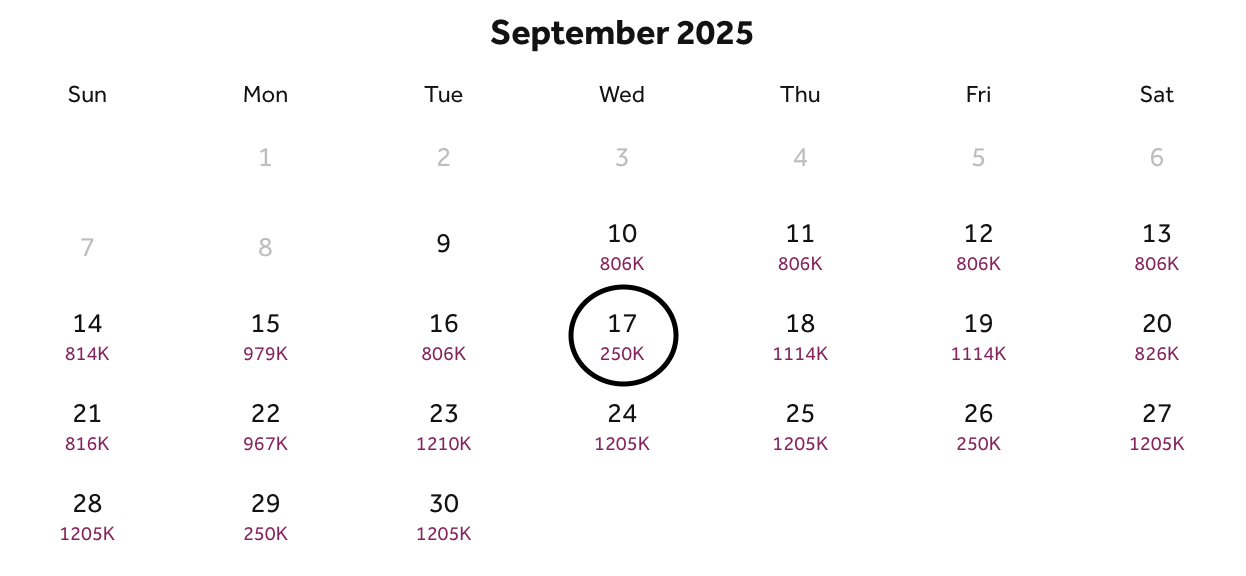

Take the Waldorf Astoria Los Cabos Pedregal, a TPG favorite, for example. At the start of the year, you could book from 140,000 points a night. After the May pricing cap changes, we spotted 190,000 points per night. Now, the lowest Standard Room Reward nights we could find sit all the way at 250,000 points, a whopping difference of over 78% in a matter of months.

Other devalued properties include the Waldorf Astoria Maldives Ithaafushi, which had a handful of 250,000-point nights on the flexible booking calendar (though those were few and far between). Those Standard Room Rewards started the year at 150,000 points max.

Other properties with reported changes include favorites like Conrad Tokyo, Conrad Maldives Rangali Island, Hermitage Bay and Waldorf Astoria Seychelles Platte Island. Though some of these properties saw smaller increases, an increase is still an increase.

In May, TPG reported that rates at South Bank in Turks and Caicos rose from 130,000 points per night to 180,000. Today, you're looking at 210,000 points per night.

"Similar to how our hotels adjust their room rates based on supply and demand, we routinely monitor and occasionally adjust Hilton Honors reward pricing to more closely correlate to market demand," a Hilton Honors spokesperson told TPG via email. "The Hilton Honors program continues to offer incredible value, flexibility and choice to our most loyal guests."

Luckily, the loyalty program still has some benefits that can help offset the pricing hikes. With the fifth-night-free benefit, elite members can pay for four nights with points and get the fifth night for free. Folks with free night certificates, offered with certain Hilton American Express cards, don't have a cap for Standard Night Rewards — so those are still usable for nights at hotels that have seen significant pricing hikes.

Bottom line

Major devaluations are never fun, especially when they come hard and fast without notice. Visiting some of Hilton's most legendary properties will now likely cost more points, sometimes significantly more than at the end of last year. Even lesser-known hotels and resorts, like towering city properties, are taking a hit. Unfortunately, devaluations continue to happen across the board and across brands, but it's never fun to find out — as many folks did — while trying to plan a trip and realizing that yesterday's numbers don't match up with today's.

It serves as a solid reminder that "pointsflation" happens, and if you sit on your stash for too long, you might get burned.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app