SLH properties continue joining and leaving Hilton Honors: Here are some recent moves

After snagging the Small Luxury Hotels of the World alliance from Hyatt in February 2024, Hilton added select SLH properties to its program in spurts between June and September 2024. The initial additions are finished, but SLH properties continue to periodically join and leave the Hilton Honors program.

In February, we covered when 30 additional SLH properties became bookable through Hilton Honors. However, Loyalty Lobby and Frequent Miler have since noticed that several more SLH properties have become bookable through Hilton Honors (while several are no longer bookable through that platform). So, here's what you should know about the alliance and these recent moves.

SLH and Hilton Honors alliance

SLH is a collection of luxury, often boutique, hotels and resorts, some of which have decided to participate in Hilton Honors. You can earn and redeem Hilton Honors points at those SLH properties participating in Hilton Honors.

Hilton Honors members also enjoy free Wi-Fi and complimentary late checkout (subject to availability) at participating SLH properties when booking through Hilton. And Hilton Honors Gold and Diamond members enjoy space-available room upgrades and continental breakfast for themselves and one additional guest on eligible stays at participating SLH hotels.

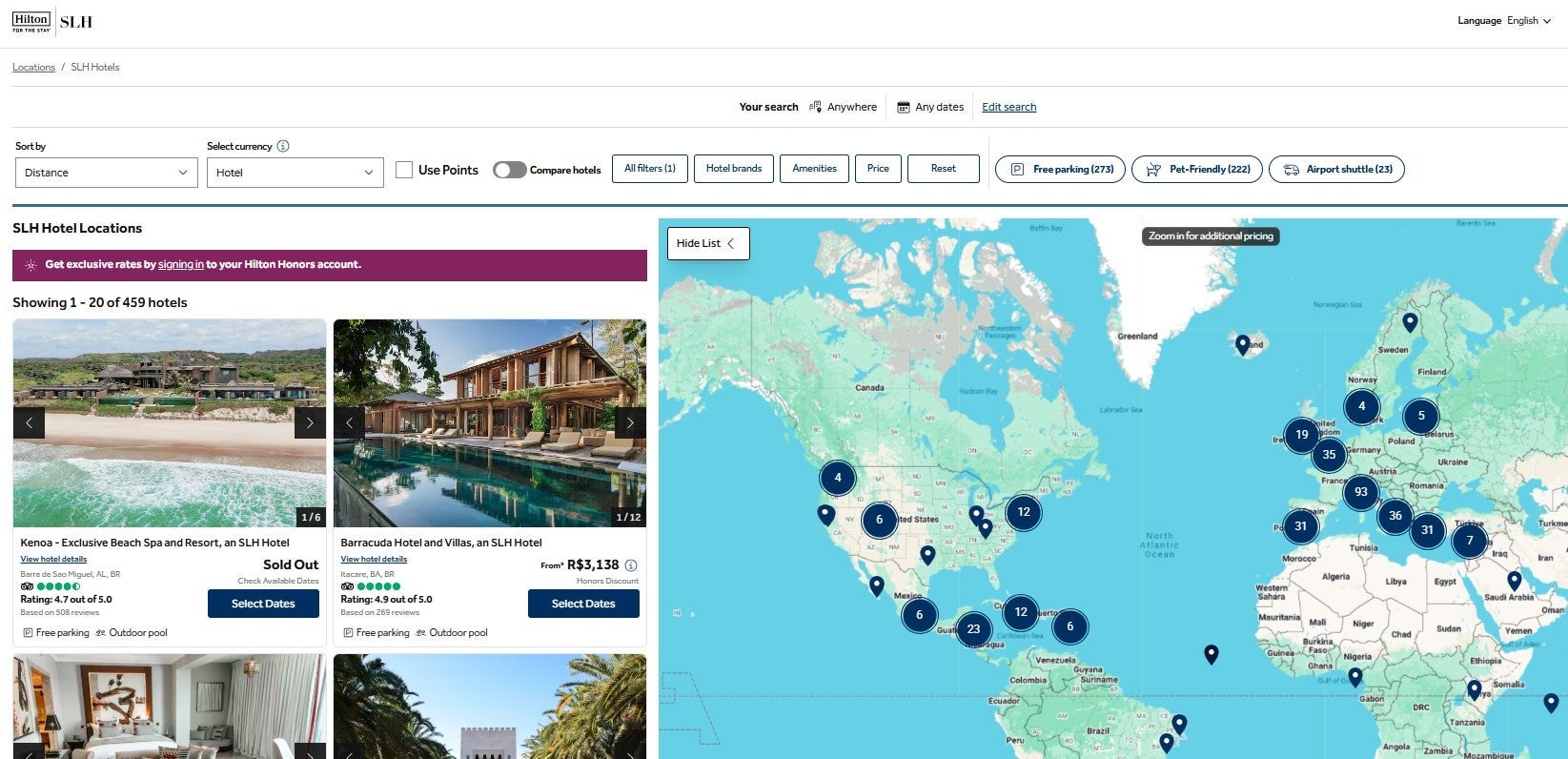

The best way to see which SLH properties participate in Hilton Honors is to view Hilton's map of SLH properties.

SLH properties that participate in Hilton Honors change periodically, usually without any fanfare from Hilton Honors. In the rest of this article, I'll discuss some of the most notable recent additions and departures.

SLH properties recently added to Hilton Honors

Within the last few months, the following SLH properties have become bookable through Hilton Honors:

- Al Mashreq Boutique Hotel in Riyadh, Saudi Arabia

- Amaya in Darwa, India

- Cuvee J2 Hotel Osaka by Onko Chishin in Japan

- Eriro in Ehrwald, Austria

- Hotel Le Pigonnet in Aix-en-Provence, France

- Hotel Lucia in Portland, Oregon

- L’Auberge de Sedona in Arizona

- Masseria Palombara Relais & Spa in Oria, Italy

- Phaea Blue in Crete, Greece

- Roso Guest House in Mexico City

- Sant’Angelo Matera in Italy

- Tamarind Hills Resort and Villas in St. Mary's Parish, Antigua and Barbuda

- The Agora Hotel in Pano Lefkara, Cyprus

- The Capital Hotel, Apartments & Townhouse in London

- The Mansion at Ocean Edge in Brewster, Massachusetts

- The Moon Mansion in Tengchong, China

- The Plein Hotel in Milan

- The Prince Akatoki London

- Twinpalms Tented Camp Phuket in Thailand

- Valsana Hotel Arosa in Switzerland

- Villa Santa Cruz in Todos Santos, Mexico

- Wakax Hacienda — Cenote and Boutique Hotel in Tulum, Mexico

- Yndo Hotel in Bordeaux, France

- Zelda Dearest in Asheville, North Carolina

Be sure to compare award rates with paid rates before booking any of these properties. Keep in mind that TPG's June 2025 valuations peg the value of Hilton points at 0.5 cents each, so you'll usually only want to redeem Hilton points when you can get more than 0.5 cents per point in value.

Related: Which credit card should you use for Hilton stays?

SLH properties that recently left Hilton Honors

Over the last few months, several SLH properties have left Hilton Honors. These properties include:

- Casa Lucia in Buenos Aires, Argentina

- Grand Hotel Parker's in Naples, Italy

- Hotel Eclat Taipei in Taiwan

- Hounds Tooth Inn in Oakhurst, California

SLH properties can choose whether to participate in Hilton Honors, so they may leave if they don't believe they're getting enough value from the alliance. However, Grand Hotel Parker's, Hotel Eclat Taipei and Hounds Tooth Inn seemingly left the SLH program entirely, as none of these properties currently appear on the SLH website.

Related: The 21 best Hilton hotels in the world

Bottom line

It's not surprising to see SLH properties join and leave Hilton Honors. As such, it's a good idea to periodically check Hilton's map of participating SLH properties to see the current options in your upcoming travel destinations. I loved the two SLH stays I've had to date at Calala Island in Nicaragua and Nanuku Resort in Fiji and may redeem a Hilton free night certificate at a SLH property later this year.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.