Everything you need to know about travel disruption in Germany next week

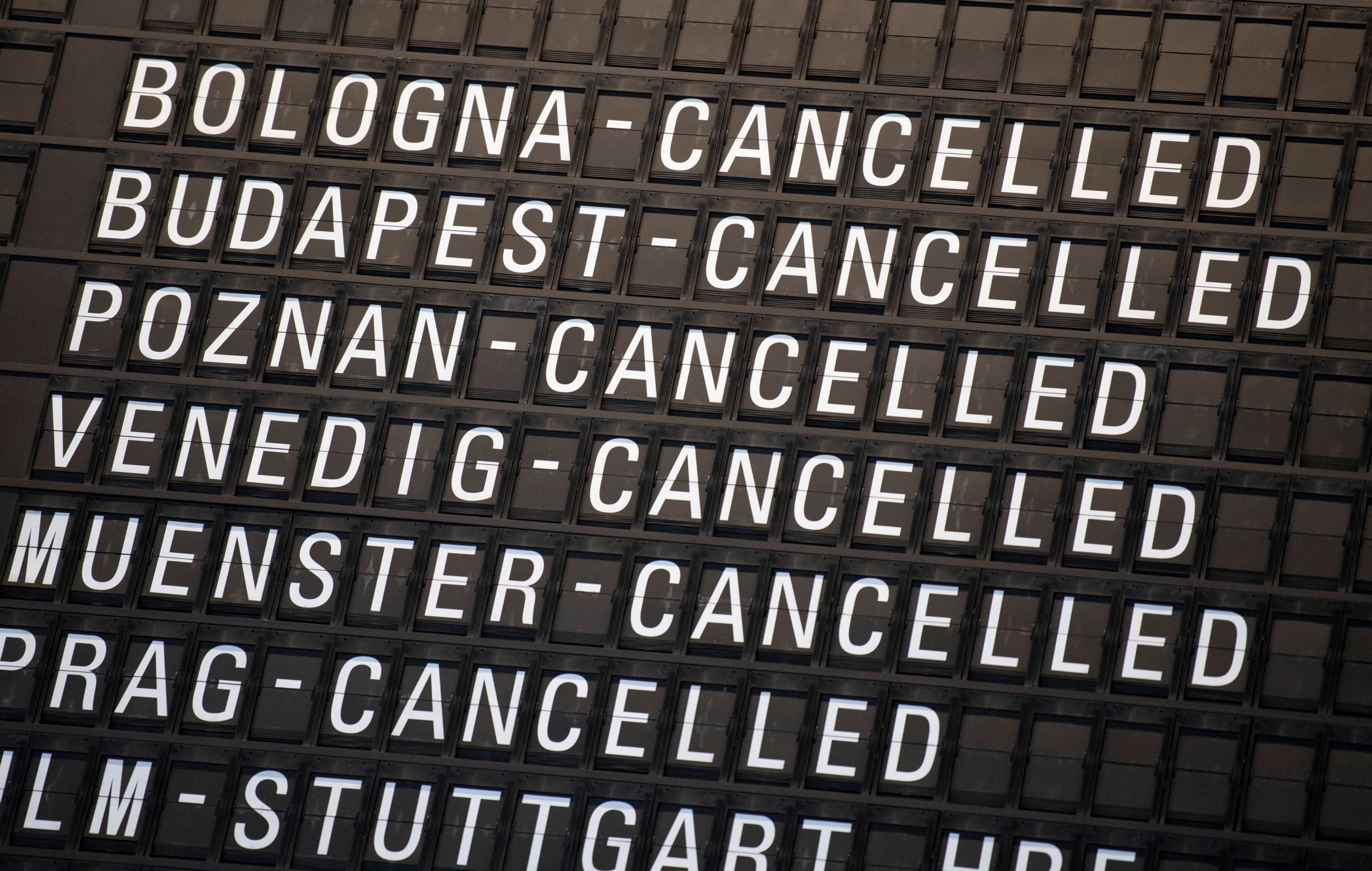

Frankfurt Airport (FRA) is warning of a "massive disruption" to air travel this coming Monday after officials confirmed a 24-hour walkout.

As Germany's largest airport — serving 250 destinations with more than 80 airlines — it's likely to affect flights within Europe and worldwide.

Monday's action is just one part of a national dispute over staff pay at airports across Germany. It is set to coincide with Munich International Airport's (MUC) closure for commercial air travel March 26 and 27. There will be a double whammy of strikes on public transport Monday, as rail union EVG has also given the go-ahead for strikes.

Here's everything you need to know.

Why is the strike happening?

Monday's planned standoff is the latest in many workforce disputes affecting travel. Led by Ver.di labor union — representing everyone from baggage handlers to airport security in Germany — representatives have been asking for a fair pay raise to reflect skyrocketing national inflation and an uptick in living costs.

Because aviation and airport bosses have been unwilling to meet these demands, strategically staged walkouts have crippled air travel across the country numerous times this year. Often, the walkouts affect multiple airports at once.

Earlier this month, hundreds of flights were axed at four German airports — Karlsruhe/Baden-Baden Airport (FKB), Cologne Bonn Airport (CGN), Dusseldorf International Airport (DUS) and Stuttgart Airport (STR) — after staff walkouts over pay. Similar action occurred at airports in Berlin, Bremen and Hamburg this month.

Union bosses hope a one-day strike at Germany's biggest airport might speed up negotiations.

What are the chances of making my flight at Frankfurt?

Slim, but not impossible. In previous weeks plenty of flights have operated at airports hampered by strike days. However, these events have led to increases in security wait times and delays in takeoff times. So even if your flight looks OK on paper, remain vigilant.

Germany's flagship carrier Lufthansa is predominantly based out of Frankfurt and will bear the brunt of the chaos. It will likely suffer more cancellations and delays than any other outfit. With international giants, such as American Airlines, running multiple services to Frankfurt, the forthcoming 24-hour action will also have implications on the other side of the Atlantic.

Are other German airports affected?

Frankfurt acts as the biggest connecting hub for domestic and international travelers in Germany. So, the disruption at Frankfurt will certainly cause ripple effects at other airports.

If you have plans to fly to or from other airports on your way to Frankfurt, you may want to seek guidance from your airline in case of cancellations closer to travel time.

Additionally, don't rule out further strike action at other airports. On March 22 and 23, Hamburg Airport (HAM) was crippled by a bout of similar industrial action. In something of a planned domino effect, walkouts at Munich are set to follow this Sunday and Monday before staff members at Frankfurt join the picket line themselves.

What should I do if I think my plans are affected?

Don't panic. If there's a whiff of trouble, your airline should already be taking measures to contact you and let you know that cancellations are expected. Keep tabs on your email inbox, text messages and the app.

There's no harm in checking with the company on Twitter or by phone if you think your travel will be affected by a strike. Remember that you should be fully covered for a refund if your chosen airline can't rebook you on another flight.

However, travel insurance is a pretty gray area regarding strikes because they're very much a "foreseeable" disruption. Read up on the small print of your insurance policy and check out this guide on insurance coverage you may have with your credit card. If you're based in the United Kingdom, check out this in-depth guide.

Should I be wary of anything else?

Absolutely. If you're traveling in Germany next Monday, expect a wave of union strikes over pay to cause cancellations on buses, trains and trams as well.

Deutsche Bahn is just one operator already warning of disruption and has canceled all of its long-distance trains for March 27. Regional services are also likely to face plenty of cuts.

This strike will affect 230,000 staff members nationwide for EVG. Ver.di, which counts over 2.5 million staff members, will ask many of its followers to stand down from their stations. As a result, it's feared that Monday's mass strike action could also spill over into the preceding days.

If you're traveling across Europe on a business trip (perhaps with multiple stop-offs in financial hubs like Frankfurt), be aware that strikes are occurring across the continent. This could affect your travel in a major way.

For example, neighboring France has seen millions take to the streets in protest over government plans to increase the age for retirement. This ongoing strife has correlated with strikes in practically every aspect of public transport — ranging from air traffic controller walkouts to train operators bringing their services to a grinding halt.

Stay prepared for last-minute changes by always checking the situation on the ground before you travel.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app