I flew a budget carrier for the 1st time. Here’s what it was like

It was 6 a.m. Groggy, I was slowly waking up to a dark and gloomy Wilmington, Delaware, freshly coated with a light dusting of snow.

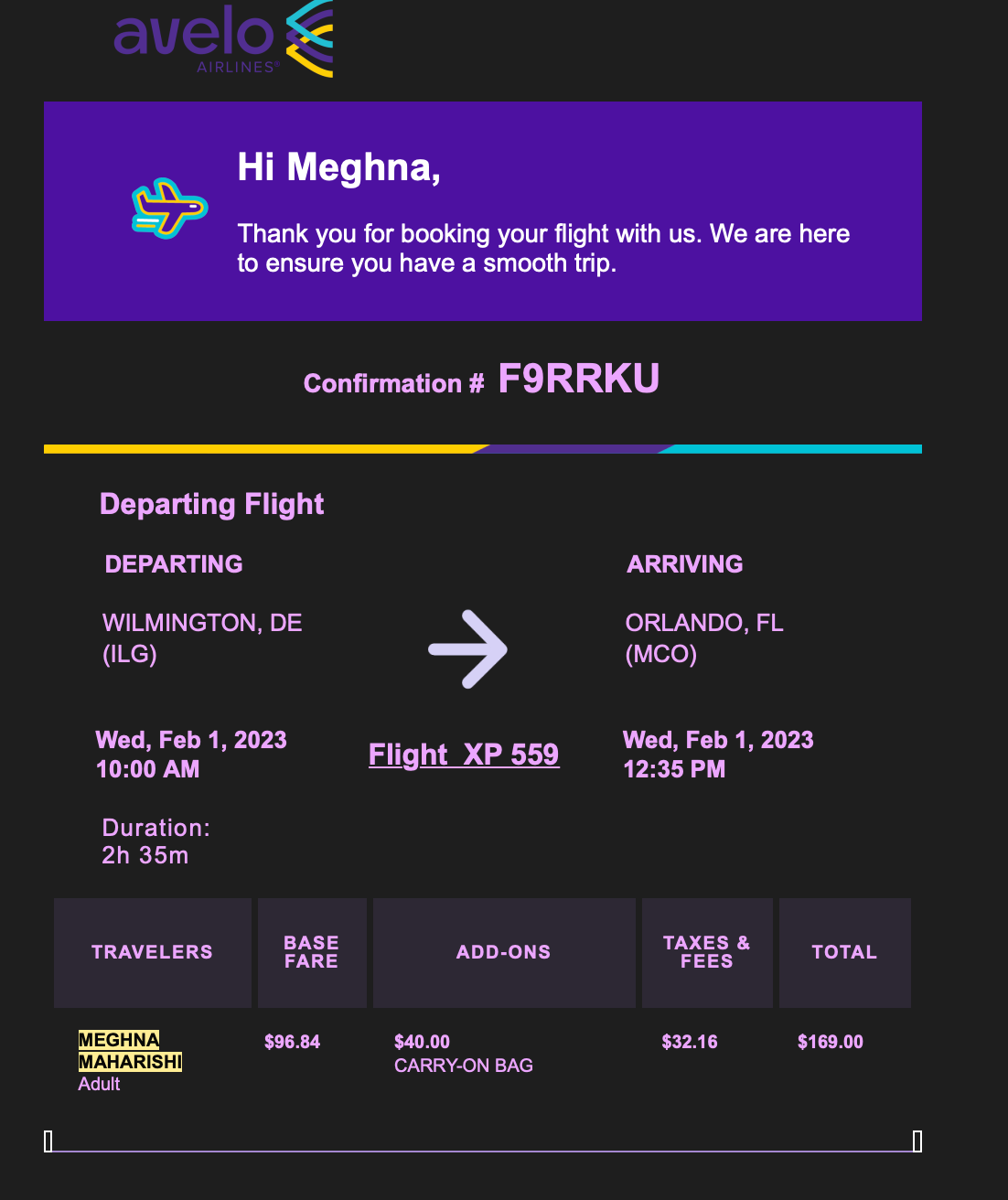

I was in town to cover ultra-low-cost carrier Avelo Airlines' inaugural flight from Wilmington to Orlando, which also marked the return of commercial air service to Delaware for the first time in nearly seven months.

As part of the story, I was also taking the flight — my first flight on a true no-frills budget carrier.

Having grown up near Newark Liberty International Airport (EWR), I've mostly flown with United Airlines, which operates a major hub there.

With that experience, I know what to expect from a full-service airline like United. As for a budget carrier like Avelo, I was wary. I had heard mixed reviews, and the idea of paying a bunch of extra fees for carry-ons, checked baggage and seat selection wasn't very appealing.

Related: 6 ways to improve your low-cost flight experience

That's exactly the experience I expected to have with this assignment to cover Avelo's Wilmington inaugural.

First, though, a little bit about inaugural flights. Many of my colleagues here at TPG have covered them for other airlines, so I knew a little about what to expect. Still, taking one myself was a unique experience.

Inaugural flights are typically met with fanfare, and that was the case for my flight. The mascots for the University of Delaware and Delaware State University paraded around the small Wilmington Airport (ILG) while airport staff handed out commemorative goodie bags to passengers.

Avelo CEO Andrew Levy spoke at the event. Although Delaware Gov. John Carney was scheduled to make an appearance, he tested positive for COVID-19 just days before and had to cancel.

For all the balloons, noise and goodie bags at the airport, Avelo's inaugural flight from Wilmington felt more like a standard flight than an inaugural one.

Focusing on that, here's what I thought of my flight experience.

Booking was seamless. Just go to Avelo's website and choose the date you'd like to fly.

However, since Avelo is a far smaller airline and routes aren't as frequent, flights to Orlando are primarily limited to Mondays, Fridays and Saturdays.

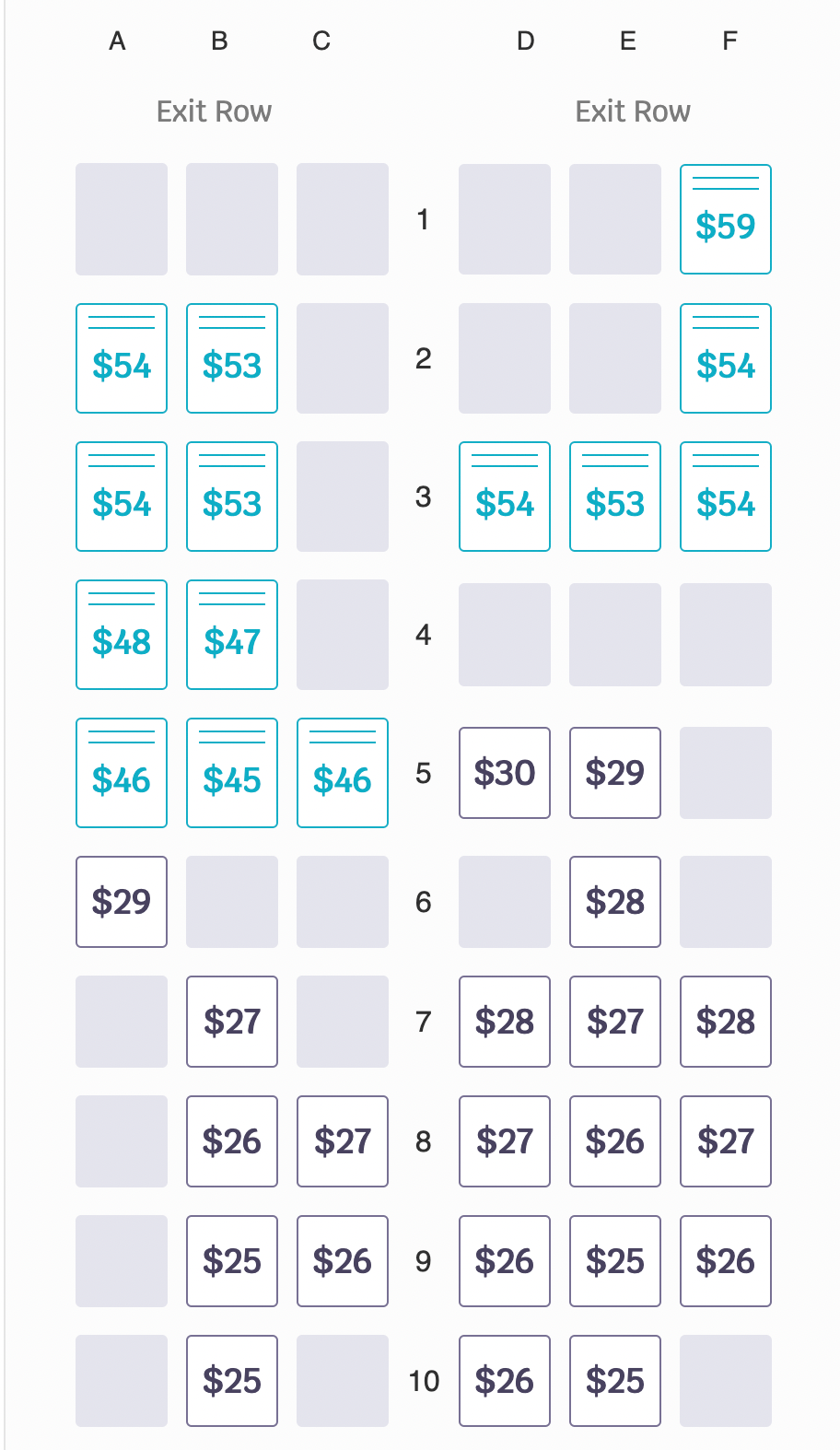

For a one-way flight booked seven days in advance, my base fare was $96. Avelo also offered seat selection, ranging from $12 to $54. The more expensive seats had more legroom, but I decided to forgo seat selection in my purchase.

However, since I was there on assignment, Avelo managed to place me in a window seat toward the front of the plane.

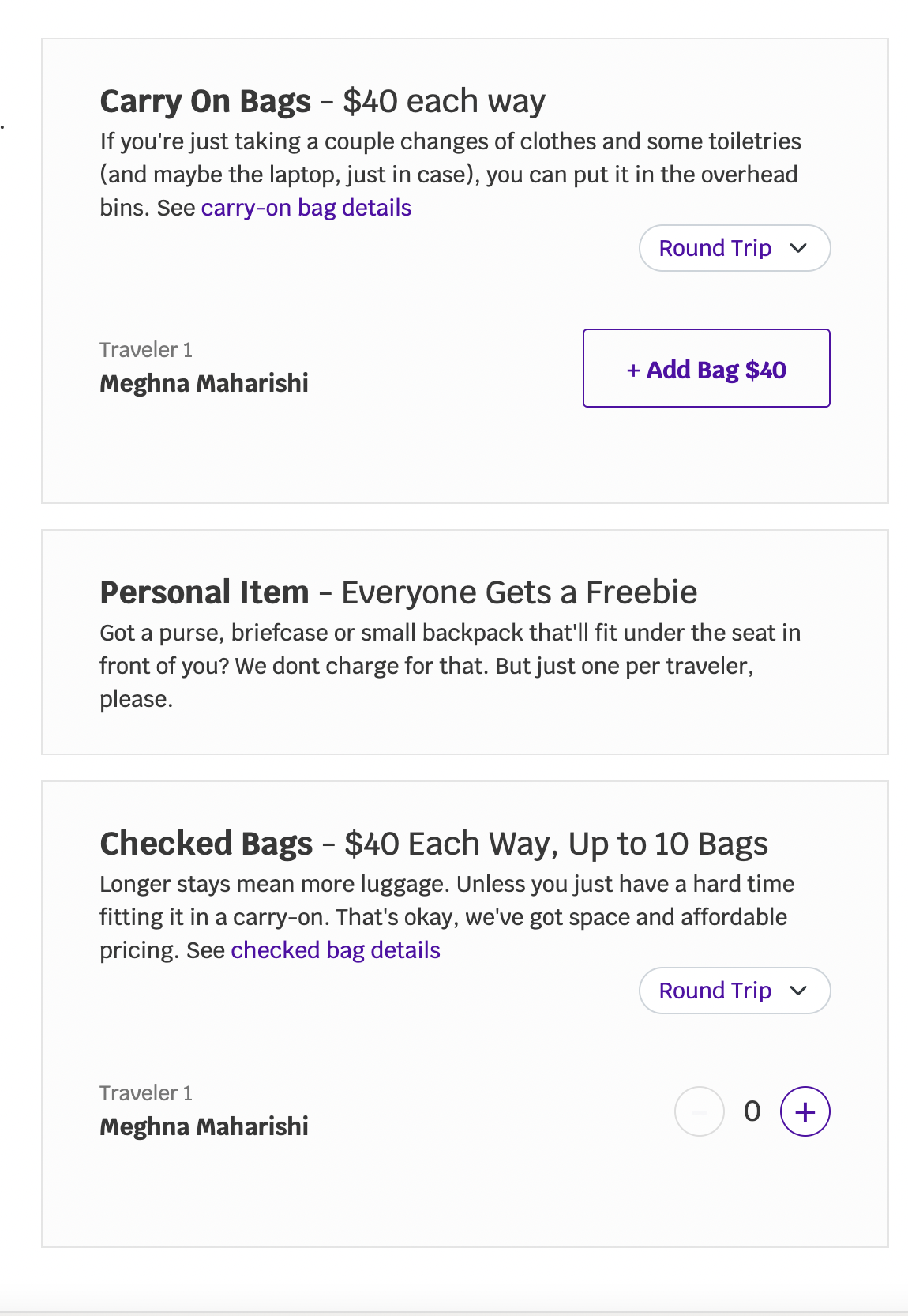

While I didn't spend extra on seat selection, I did decide to pay $40 one-way for a carry-on because I didn't want to be limited to just my work bag as my personal item. Checked baggage also costs $40 each way.

I spent a total of $169 for the one-way flight to Orlando, which seemed steep for what I would expect from the type of airline that touts rock-bottom one-way fares of $59 or less. It also felt more aligned with what I'd pay on a full-service airline like American, Delta or United.

However, I did book relatively close in — just seven days in advance — perhaps leading to a higher base fare before adding the extras I wanted.

As I boarded my flight, I was disappointed to find that there was barely any overhead bin space left, even though I wasn't in one of the last groups to board.

I figured the overhead bin space was nearly full since this was an inaugural flight, and many passengers from the area were excited to be able to fly out of Wilmington.

I made my way to my seat, which was surprisingly comfortable. It felt no different than flying economy with a bigger carrier like United or Delta. The legroom was standard, and I didn't feel cramped.

While the service was bare-bones, the staff was very friendly. Similar to other ultra-low-cost carriers like Spirit Airlines and Frontier Airlines, Avelo only served water on board, which didn't bother me since the flight was only 2 1/2 hours.

Despite an otherwise low-key inaugural flight with not too many frills, we were greeted by a water cannon salute as we landed at Orlando International Airport (MCO).

In the end, we were on time, and despite my reservations about the price, I'd definitely book the flight again if I lived in Wilmington. It's convenient to have a nonstop option to Florida rather than having to drive to other big airports in the region, like Philadelphia International Airport (PHL) or Baltimore/Washington International Thurgood Marshall Airport (BWI).

For other airports where Avelo is — places like New Haven, Connecticut; Burbank, California; and Raleigh, North Carolina — that's a nice advantage that may outweigh some of the lack of frills on a carrier like Avelo.

Would I do it again? The answer is not so black and white. If I happened to live near an airport with an Avelo flight, I probably would.

Even though I felt as if I spent a lot on a one-way flight, it felt like a standard economy flight, and I appreciated the convenience.

The biggest pro to me was that the seats were comfortable for economy. I've definitely been on economy seats in the past where all I could think was, "When are we going to land? I want to get out of here." I didn't have that feeling with this Avelo flight since the seats felt a bit more cushioned.

While the service is bare-bones, I do think flying with Avelo or any ultra-low-cost budget carrier can be a worthy option, especially if it offers the most convenient route, flight time or the lowest fare.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app