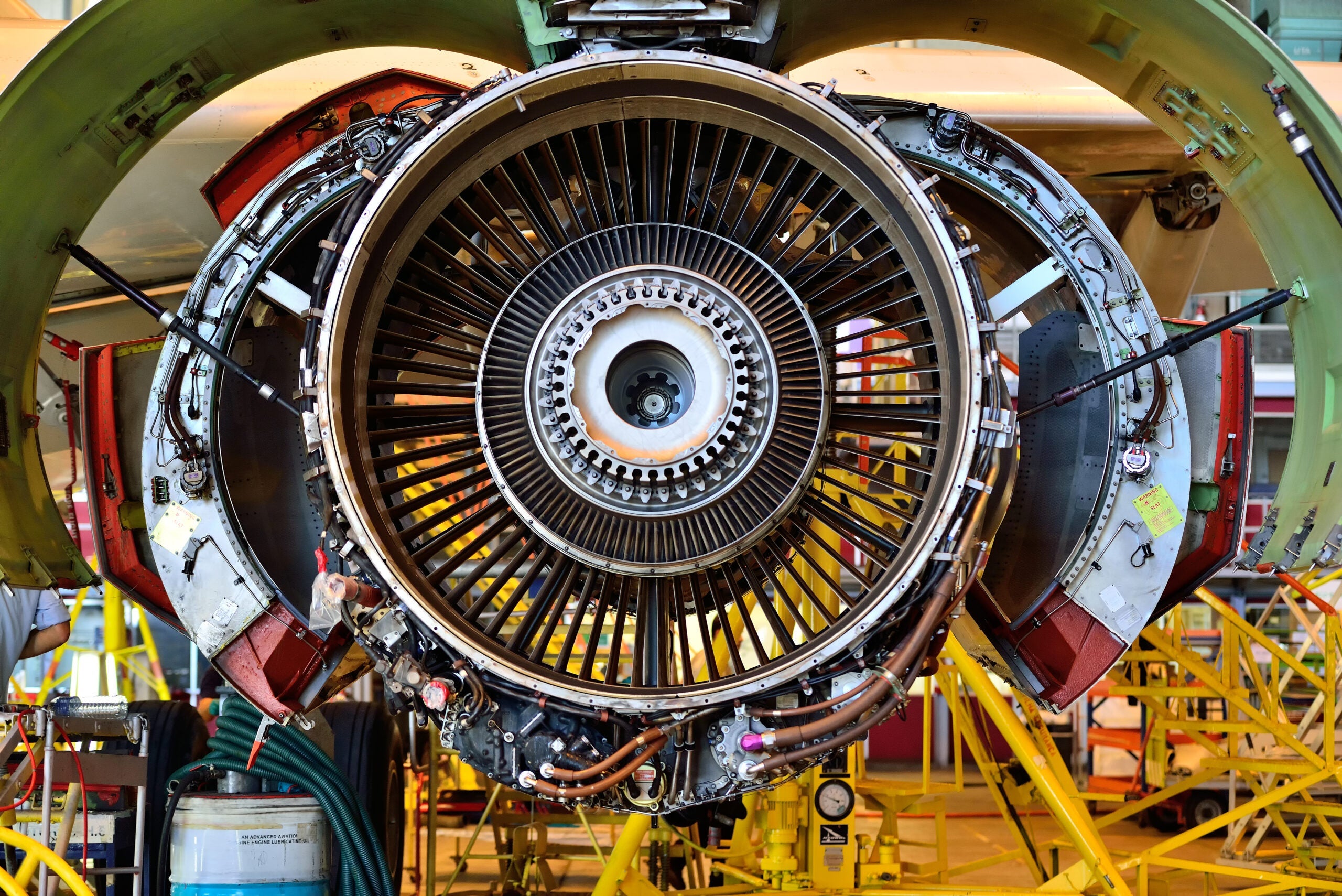

What you need to know about the counterfeit airplane engine parts scandal

Airlines worldwide are checking their aircraft amid reports of counterfeit documents surrounding engine parts installed in certain jet engines.

More than 100 aircraft have been found to contain questionable parts in engines manufactured by CFM International, a joint venture between General Electric and French aerospace firm Safran. Several of those aircraft are operated by U.S. carriers, including American Airlines, Delta Air Lines, Southwest Airlines and United Airlines.

At the center of the scandal is a U.K. firm called AOG Technics, which serves as a broker for spare aircraft parts. CFM has accused the company of forging safety documentation for various engine parts, which were eventually installed on the aircraft during maintenance. The specific engine that has been affected, the CFM56, is used on a variety of aircraft, including some older Boeing 737 and Airbus A320 family jets.

A total of 126 engines globally contain parts sold by AOG Technics, according to an accounting by Bloomberg, while 95 falsified documents have been uncovered.

What remains unclear is whether the engine parts in question are actually shoddy or if it's simply the documentation that is unreliable.

The Federal Aviation Administration typically must approve all parts that are used as replacements on aircraft through its Parts Manufacturing Approval program, an FAA spokesperson told TPG. Parts that have not undergone the PMA process can make it into the supply chain, however. This led the FAA to create a specific program to investigate Suspected Unapproved Parts in the 1990s.

In some cases, the FAA spokesperson said, companies may produce parts but will skip the PMA application "to avoid the time and cost of the process and the uncertainty whether we'll agree the part is of equal or better quality than the original," which is the FAA's standard for replacement parts. That means that even if those parts are built at full quality, the FAA has not verified it.

In an advisory posted to the SUP webpage, the FAA noted that the parts sold by AOG Technics came with PMA documentation that appears to be fraudulent, with improper formatting and missing boilerplate text.

Ultimately, however, it does not necessarily matter whether the parts are substandard or whether they're just missing the authentic documentation. Without genuine documentation that verifies that the parts meet all quality and safety standards, the FAA requires that they be removed.

So far in the U.S., the scandal does not appear to have impacted any airlines' operations. Each of the affected airlines has pulled the impacted aircraft from service.

Delta, the latest U.S. carrier to find parts supplied by AOG Technics, said it was working to replace those parts.

"Delta has been informed by one of our engine service providers that a small number of engines they overhauled for us contain certain parts that do not meet documentation requirements," the airline said. "Working with the overhaul provider, we are in the process of replacing those parts and remain in compliance with all FAA guidelines - because safety is always our priority."

A spokesperson for American said the carrier had identified a "small number of aircraft" with the affected parts and removed them from its operation until the parts could be replaced.

Southwest and United both said they had already replaced the impacted parts and returned the aircraft to service.

"Our suppliers conducted a review of Southwest parts and identified one engine that contained two low-pressure turbine blades from this vendor," a Southwest spokesperson said in a statement. "In an abundance of caution, we made an immediate decision to promptly replace those parts on that single engine."

"We'll continue to investigate as new information becomes available from our suppliers," a United spokesperson said.

As investigators continue to comb through records and get to the bottom of how these unapproved parts made their way into the supply chain, it remains possible that more aircraft will be identified with parts sold by AOG Technics.

In the meantime, passengers can continue traveling without seeing any direct impact from the scandal.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app