How to avoid losing money with 'no-fee' United flight changes

Editor's Note

Through July, United Airlines is offering customers an opportunity to book tickets for future travel without change fees. As of now, tickets booked through July 31, 2020 — for travel on any date — can be changed without the usual $200 reissue fee.

That sounds like a win-win on the surface. United can raise some much-needed cash, while customers can lock in travel at a great rate with the flexibility to make adjustments as needed, given the uncertainty surrounding future travel. But the airline included an especially restrictive policy in the terms and conditions, significantly limiting this option's appeal.

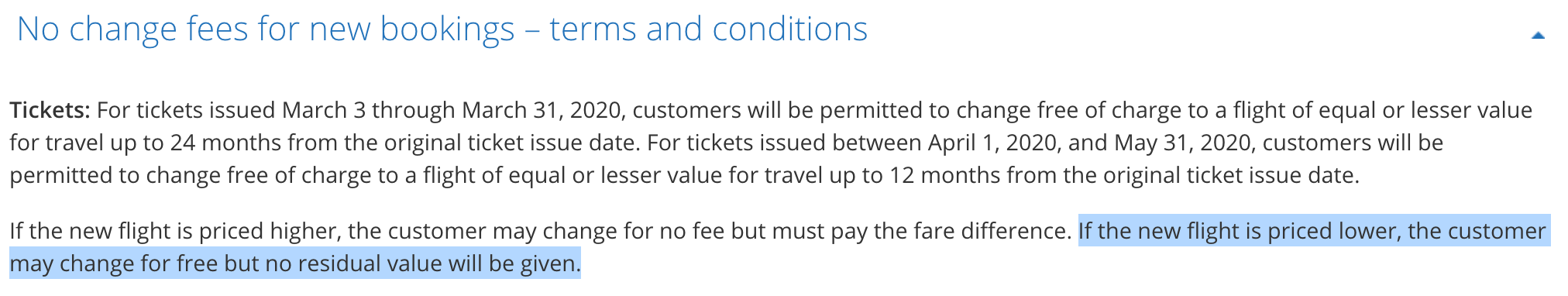

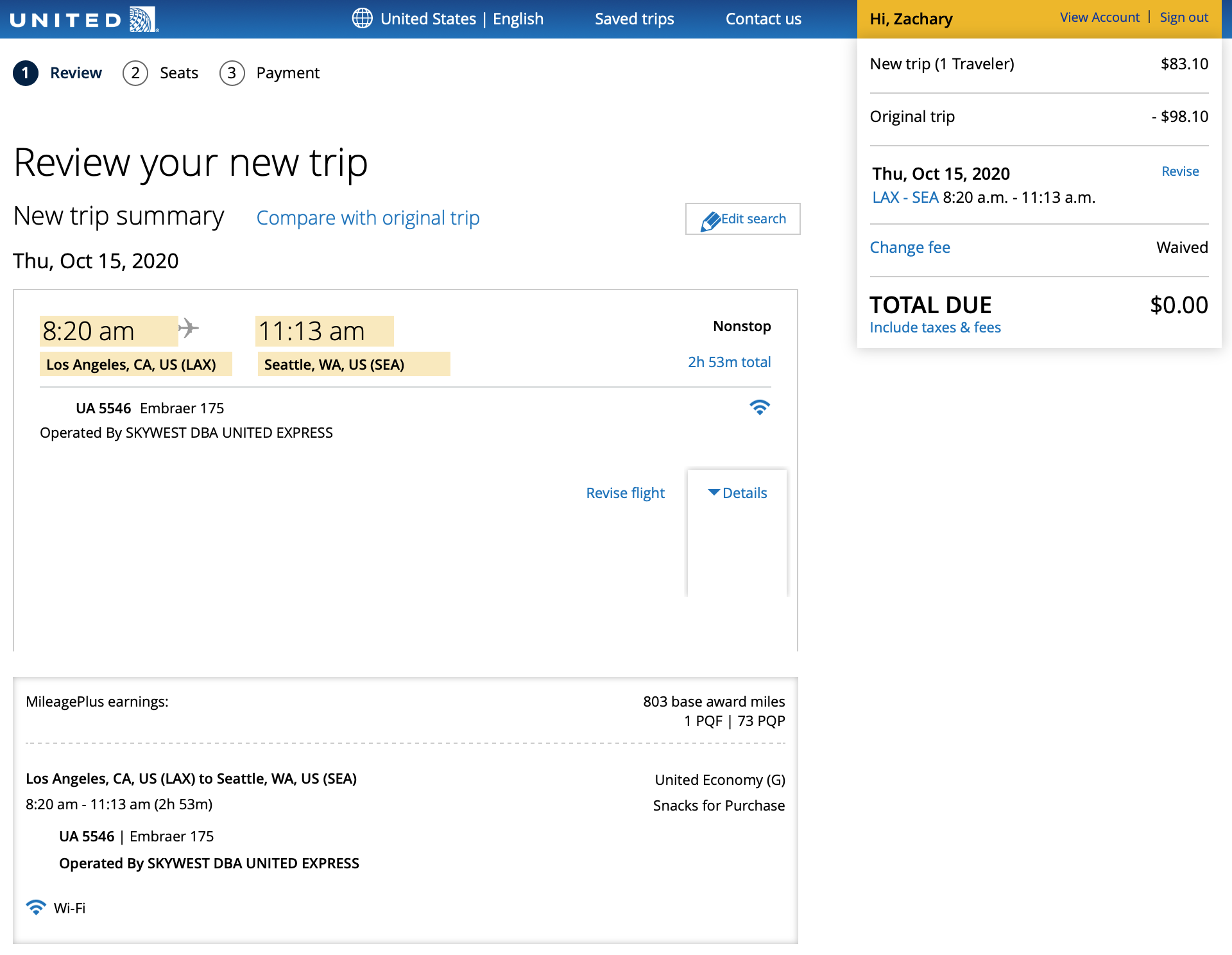

As United explains in the terms and conditions, you'll end up forfeiting any residual value if you change to lower-cost flights. In the example below, I booked a flight for $98.10 and selected new flights for $83.10 — while the $200 change fee was waived, the difference in cost of $15 would have been lost, had I completed the change.

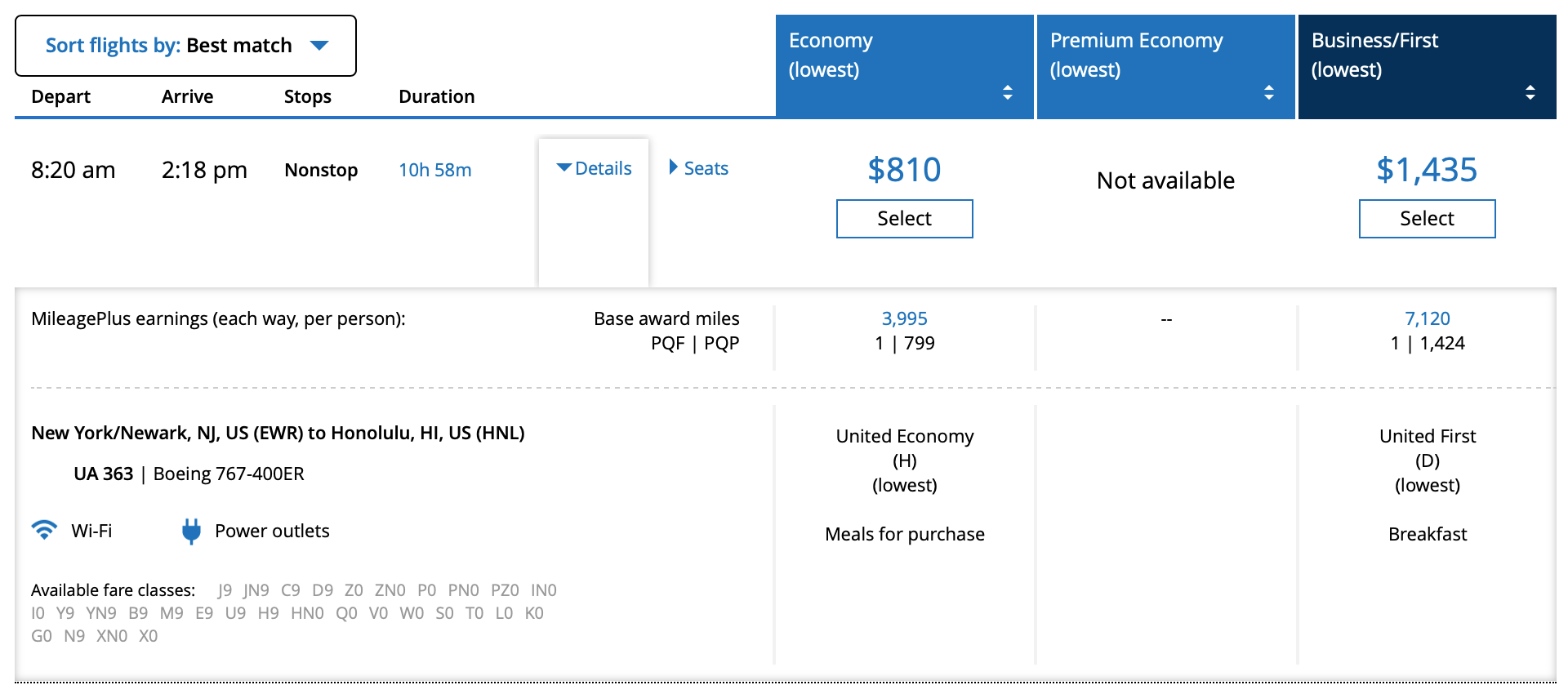

Of course, losing $15 in value is preferable to paying a $200 change fee, but there are plenty of situations where you'll end up at a significant disadvantage. Take, for example, this $1,435 one-way first-class flight from Newark to Honolulu. If I later decide to change my date and/or origin and destination, and the new fare is, say, $435, I'll forfeit that $1,000 difference.

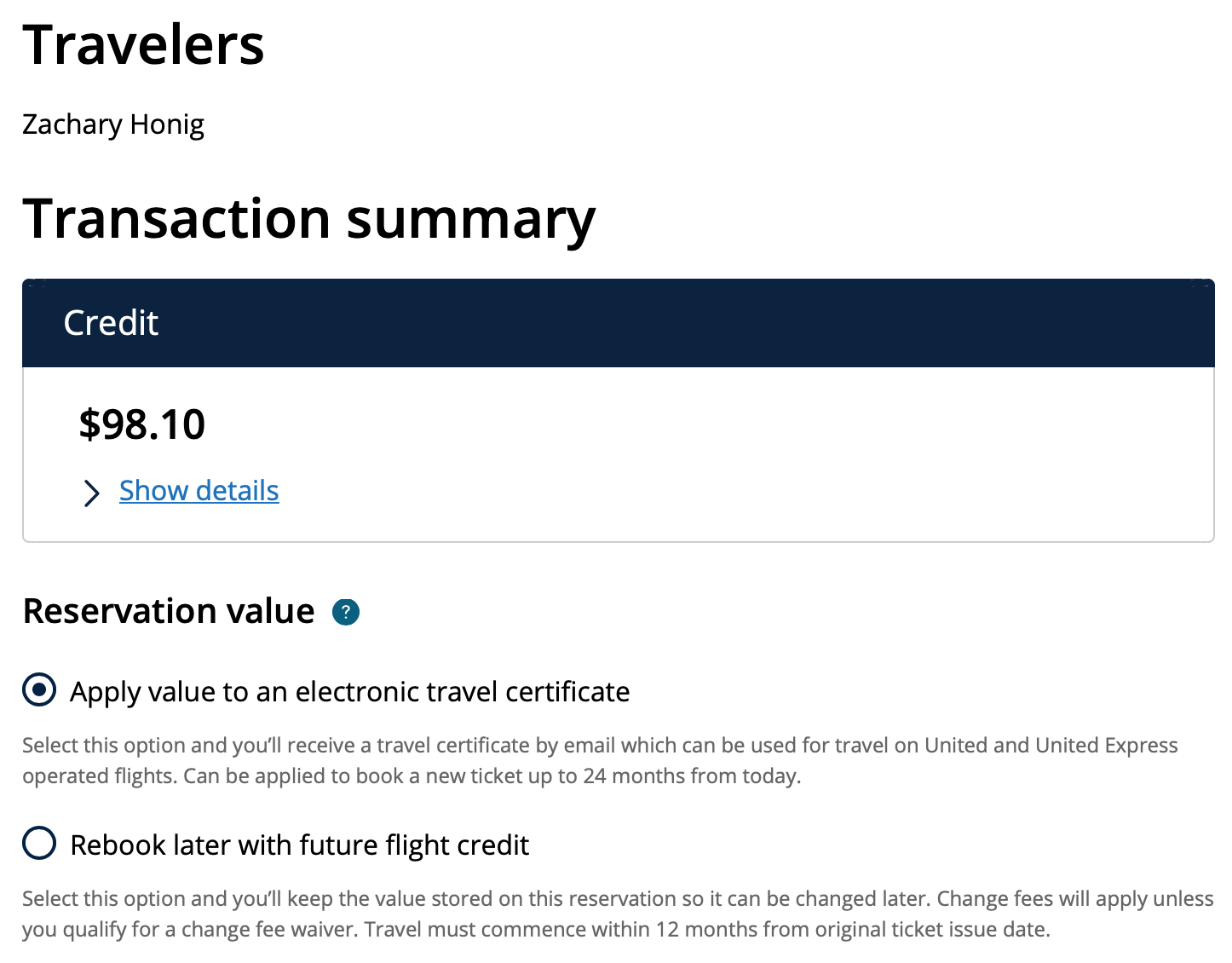

Fortunately, there's now a workaround. If you cancel a flight, rather than change it, you can choose to receive an electronic travel certificate (ETC) for the full value of the original booking. Then, you can use that ETC to rebook your new flights, and the residual value will remain on the certificate, which you can use towards the cost of a second flight in the future.

I selected the ETC option, and my credit arrived in my email instantly. And, thanks to United's recently extended expiration policy, certificates are valid for 24 months from the issue date; I just need to redeem mine by April 13, 2022, for travel anytime in the future.

While the above ticket was booked with a credit card, I was also able to receive an ETC refund after canceling a flight I booked with an existing travel certificate. In that case, the option didn't appear online, but a phone agent was able to make the request, and the new ETC was in my inbox just four days later.

Although tickets booked under the current flexible policy are intended to lose value if changed to a lower-cost flight, this is a reasonable workaround. Still, in line with the current terms and conditions, United could always choose to require customers to return to their original reservation to make changes, eliminating the option of an ETC.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app