4 easy rules to maximize your travel budget

Spending money on vacation shouldn't be stressful, but, alas, the costs are often in the back of your mind as you're traveling. Airfare, rental cars, accommodations, eating out and attraction fees can add up quickly — especially given recent inflation data.

Thankfully, the team at You Need a Budget has a few tips you can put into practice to ensure you maximize your travel spending every time you hit the road.

YNAB is a money management app and method that teaches customers how to gain control of their money. Their easy-to-follow method helps new users save an average of $6,000 a year — an amount that could easily help fund a comfortable trip.

Learn how to apply YNAB's Four Rules method to plan for stress-free spending on vacation.

Rule one: Give every dollar a job

You might be familiar with the envelope method of budgeting. With this method, you literally put your cash into different envelopes designated for different types of purchases. But it can easily be adapted for vacation budgeting.

For example, say there are three trips you want to take next year. You would assign an envelope to each trip and put a certain amount of money into each envelope every payday.

I remember using the envelope method when I was first out of college to save for a trip to New York City to visit my brother. I was working as a restaurant server, and every night after my shift, I'd put $20 into my NYC envelope. It took some time, but eventually I'd saved enough for airfare, museum tickets and eating out.

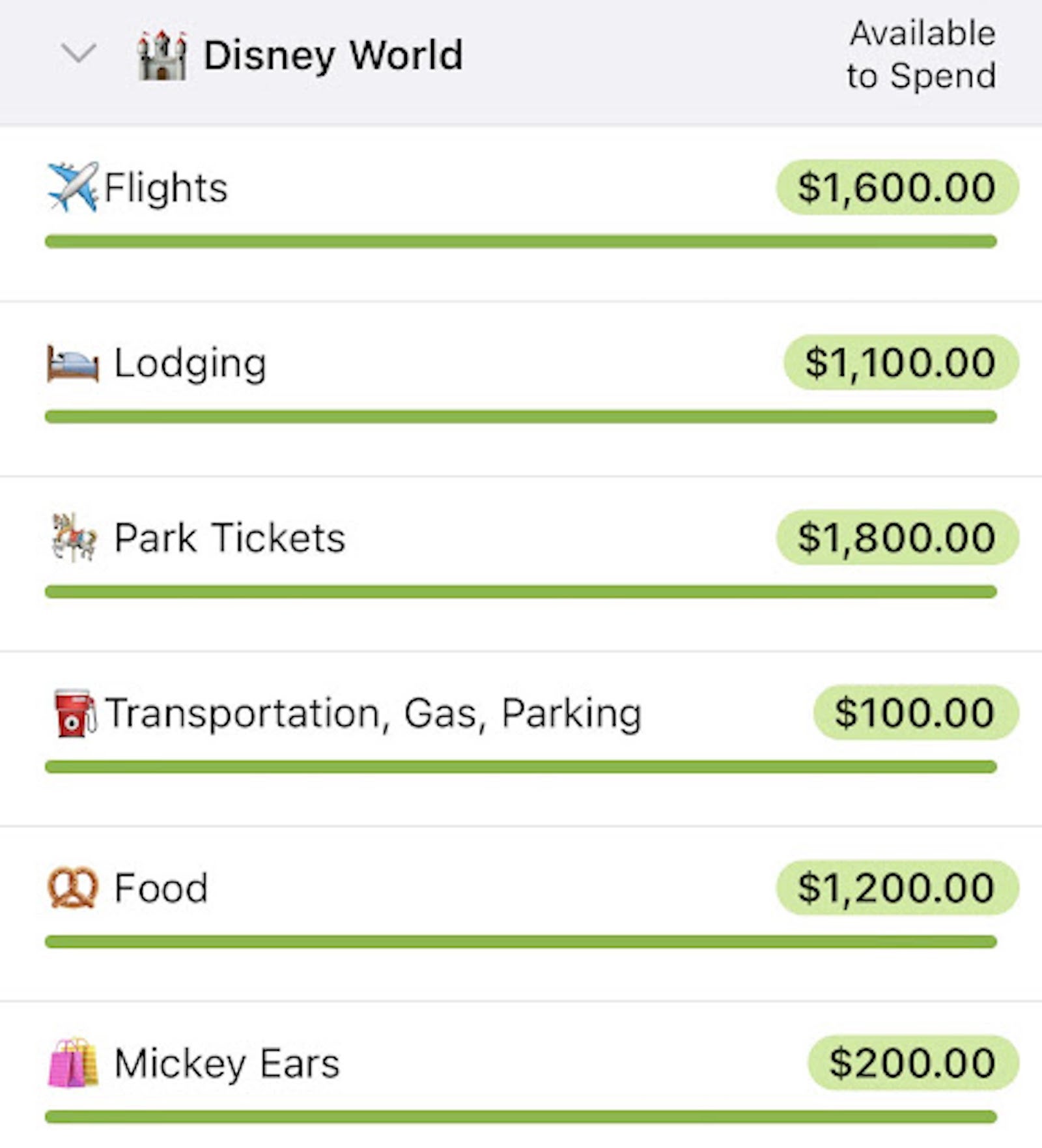

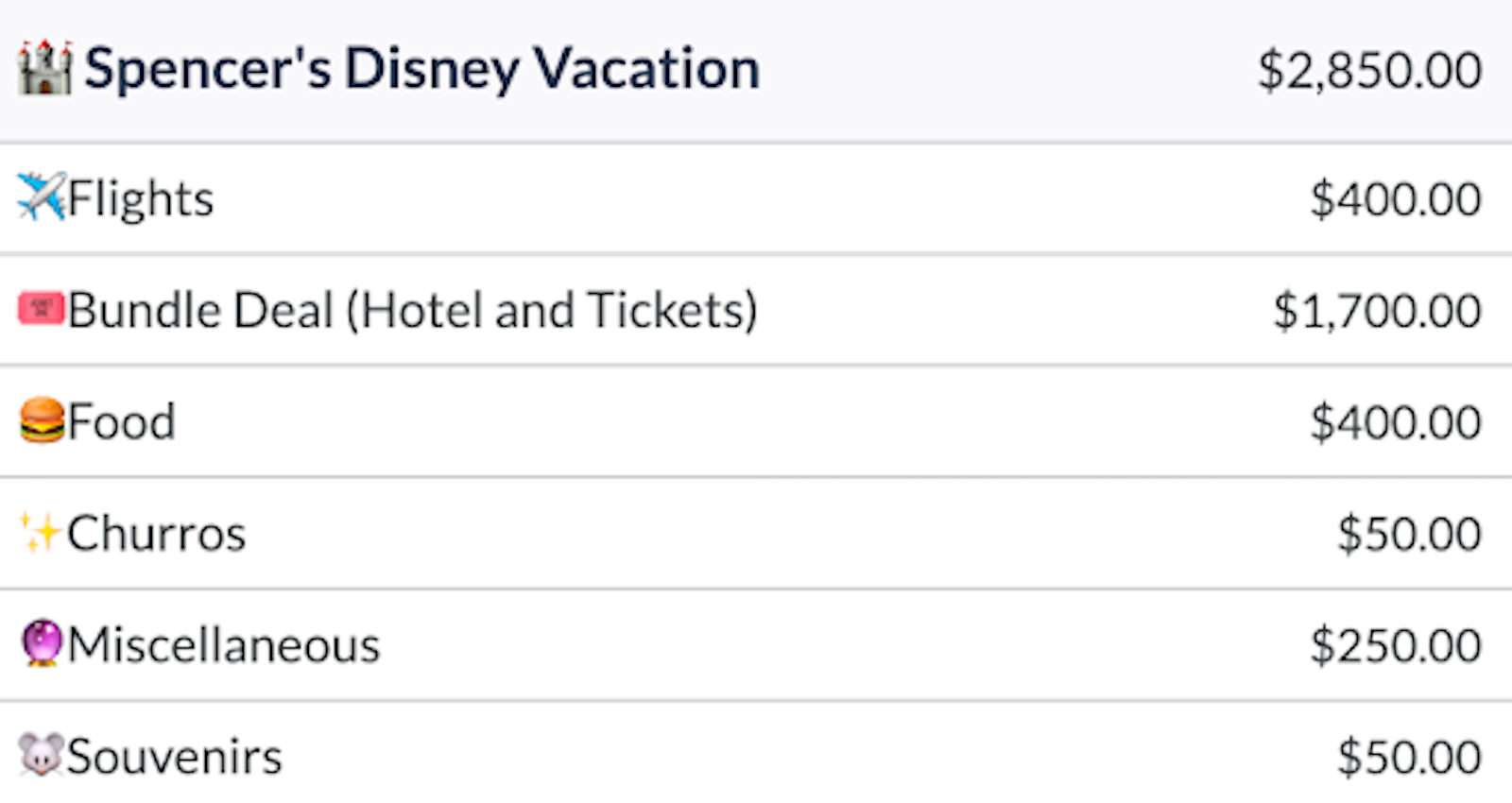

YNAB's first tip for maximizing your travel spending is to give every dollar a job — just like in the envelope method of budgeting. The idea is that when you have a plan for your money, you're less likely to splurge on short-term wants and remain focused on your long-term goals (the trip). Then, when you take the trip, the money is all there for stress-free spending so you can fully relax.

Related: How I treat credit cards like debit cards: The updated envelope system

Rule two: Embrace your true expenses

True expenses can be defined as the things that come up for which you're never quite prepared. An example would be when you take your car in for an oil change and learn that there's something else wrong with it — and it'll cost hundreds of dollars to fix.

The same thing can happen when traveling.

There are many ways to cover unexpected trip interruptions with the right credit card, but no coverage is exhaustive, and there's likely something that you'll have to pay for out of pocket. Consider this rule almost like having an emergency fund at home, but specifically for travel. It's all about peace of mind that no matter what goes wrong, you won't have to worry about it being such a financial burden.

I'll never forget facing this myself. We were on the way to the airport for a two-week trip to France and Switzerland — and realized that we'd forgotten my son's stroller at home. Let's just say there was no way we would have survived without one. But we'd prepared for the unexpected, and the extra expense didn't break the bank.

A true travel expense might cost you more than the new stroller cost us that day, but with the right planning, you'll be OK.

Rule three: Roll with the punches

On vacation, it's important to have a plan but to simultaneously be flexible. Spending more than you budgeted can happen, but with this next tip, it doesn't have to be something to stress over for too long.

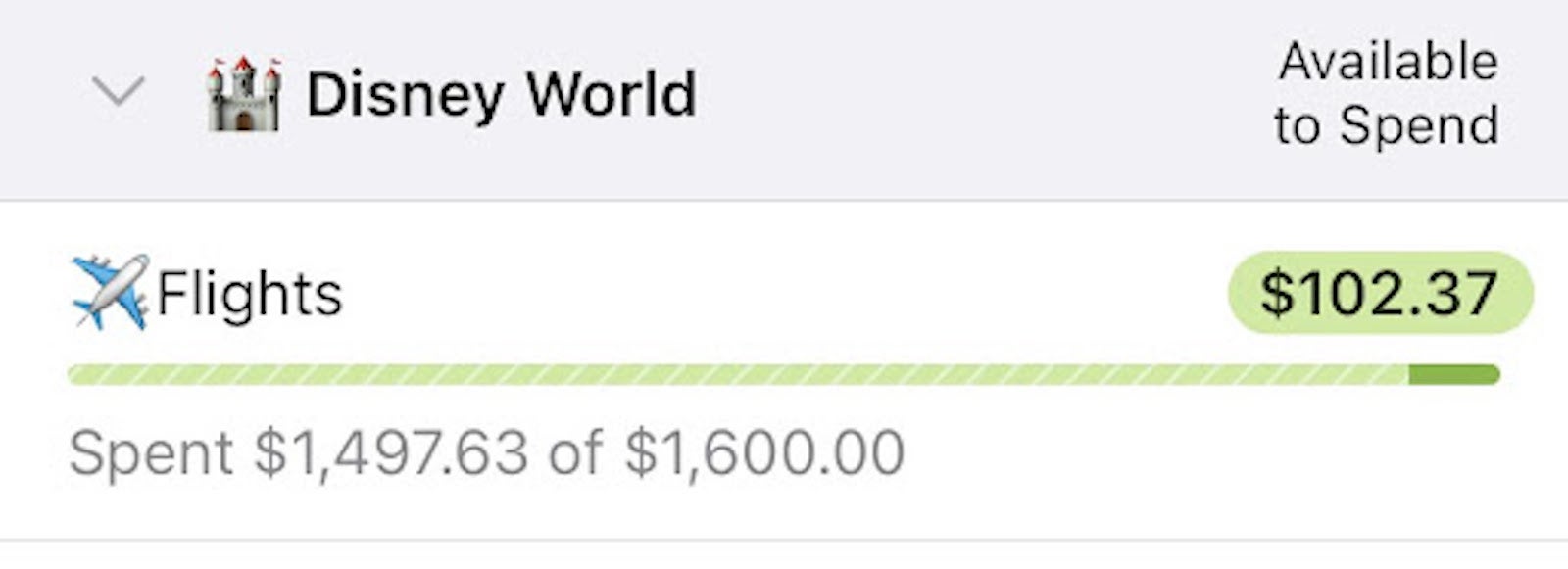

When your initial budget turns into the reality of actual expenses, you might find that you've under-budgeted in some categories or over-budgeted in others. In these cases, just transfer the savings from one category to cover the higher-than-expected costs in another one.

As an example, I like to over-budget for airfare, since it always seems to be the largest expense of traveling as a family of four (when I don't use points and miles, of course). So if there's ever any money left over from that line of my travel budget, I like to put it toward an extra activity for that trip — or even set it aside for the next trip.

Rule four: Age your money

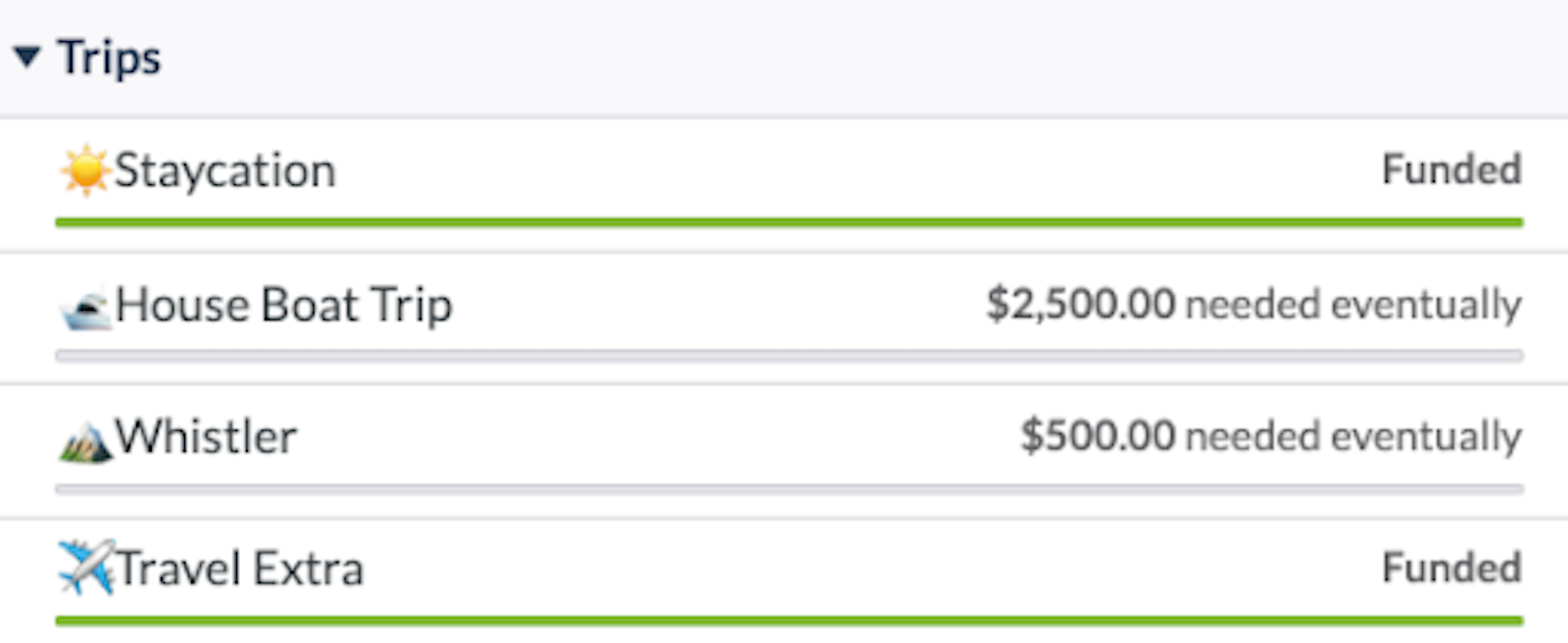

YNAB's last rule is to build a buffer between when money comes in and goes out. With vacation spending, this means you get to start planning your next trips sooner. If you have dream vacations on your travel bucket list, you can start turning them into reality.

Begin by asking yourself a simple question: Where else do you want to go?

Then, make a category for each trip, and start saving month by month. Maybe your trip is a year away, and by the time it arrives, you'll be spending money you set aside months ago. When you age your money, you get further and further away from the financial edge to give you more mental margin — and more cash for what you want.

Bottom line

YNAB offers tangible tips to help you maximize your travel spending. Start by giving every dollar a job as soon as you get paid. Include your true expenses — anything that could surprise you down the line — and start to save little by little to avoid a sudden, often large, expense later. And for the sake of simplicity, give yourself some grace when you overspend anywhere and adjust your travel budget as necessary.

Making the most of your money on vacation is possible, even with continued pressures from inflation. And YNAB offers easy-to-follow tips to get you firmly in control financially for that next trip.

Put YNAB's Four Rules into use in the easiest way possible. Start your free trial of the YNAB app — no credit card required — to turn your trip dreams into a reality.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app