How Earny Can Save You Lots of Cash With Little Effort

What's better than getting money back on a purchase you've already made? One of the best — most overlooked — part about credit cards is price protection. Select credit cards offer travelers the comfort of knowing they're eligible to pocket the difference if the price of an item drops after purchase. Still, there are steps involved in order to actually get ahold of that saved cash — and it often requires a lot of back and forth with the issuer and filing claims.

Thankfully, there's a service that will go through the process and do the filing for you. Earny is a (virtual) personal assistant that follows your credit card's price protection guidelines and files a claim with the issuer for you. What happens if a price on an item drops? You'll get a check in the mail or credit for the difference in price. Currently, Earny covers all Chase and Citi credit cards that come with price protection. According to Earny's website, each of the issuers have different policies:

- Chase cards: Allows you to request up to $2,500 of price drops per year. The request must occur within 90 days of the initial purchase.

- Citi cards: Allows you to request $2,500 of price drops per year. The request must occur within 60 days of the initial purchase.

When you sign up for an Earny account, you'll link your email account along with your credit card. Once you have an account, Earny monitors your purchases via e-receipts in your inbox and checks back on those items to see if there is a price drop. Earny, a yellow figure whose eyes follow your movements in the app, automatically tracks every purchase you make at any of its partnered retailers.

Currently, Earny covers the following retailers: Amazon, Best Buy, Bloomingdale's, Carter's, Costco, the Gap Group (including Gap, Banana Republic, Old Navy, Athleta and the factory stores), J.Crew, Jet, Kohl's, Macy's, Newegg, Nike, Nordstrom, Overstock, Sears, Staples, Target, Walmart and Zappos. Earny monitors your email for purchases from any of the above retailers and if it spots something, it's able to automatically track the purchased item(s) for the next 60 or 90 days, depending on your credit card issuer.

How Does It Work?

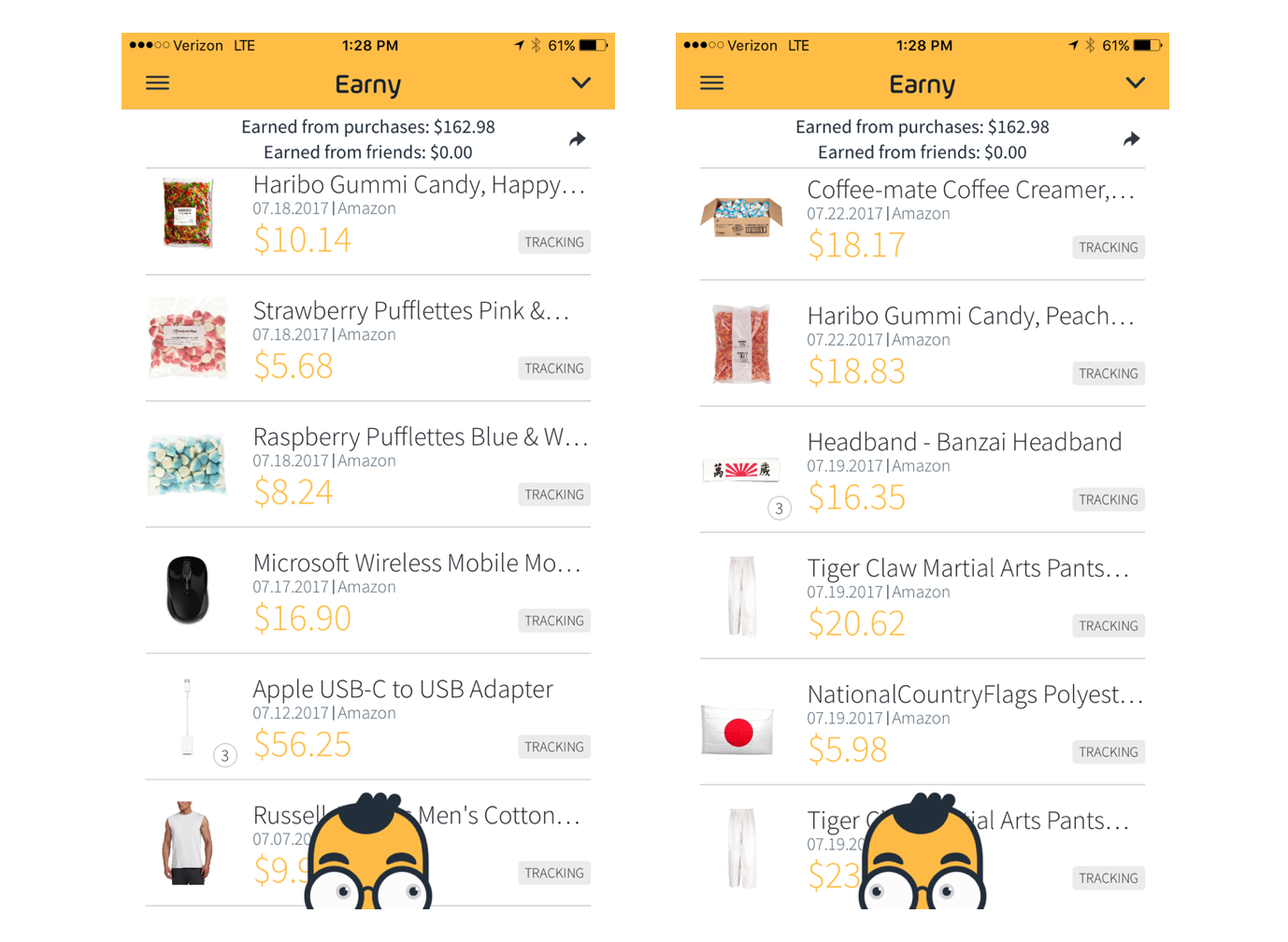

The app itself is easy to use: Once an account is created, Earny starts tracking all any purchases you make with its included retailers. In the example below, Earny is tracking purchases made via Amazon over the course of a few days. These purchases will appear in the "Tracking" option at the top of the screen.

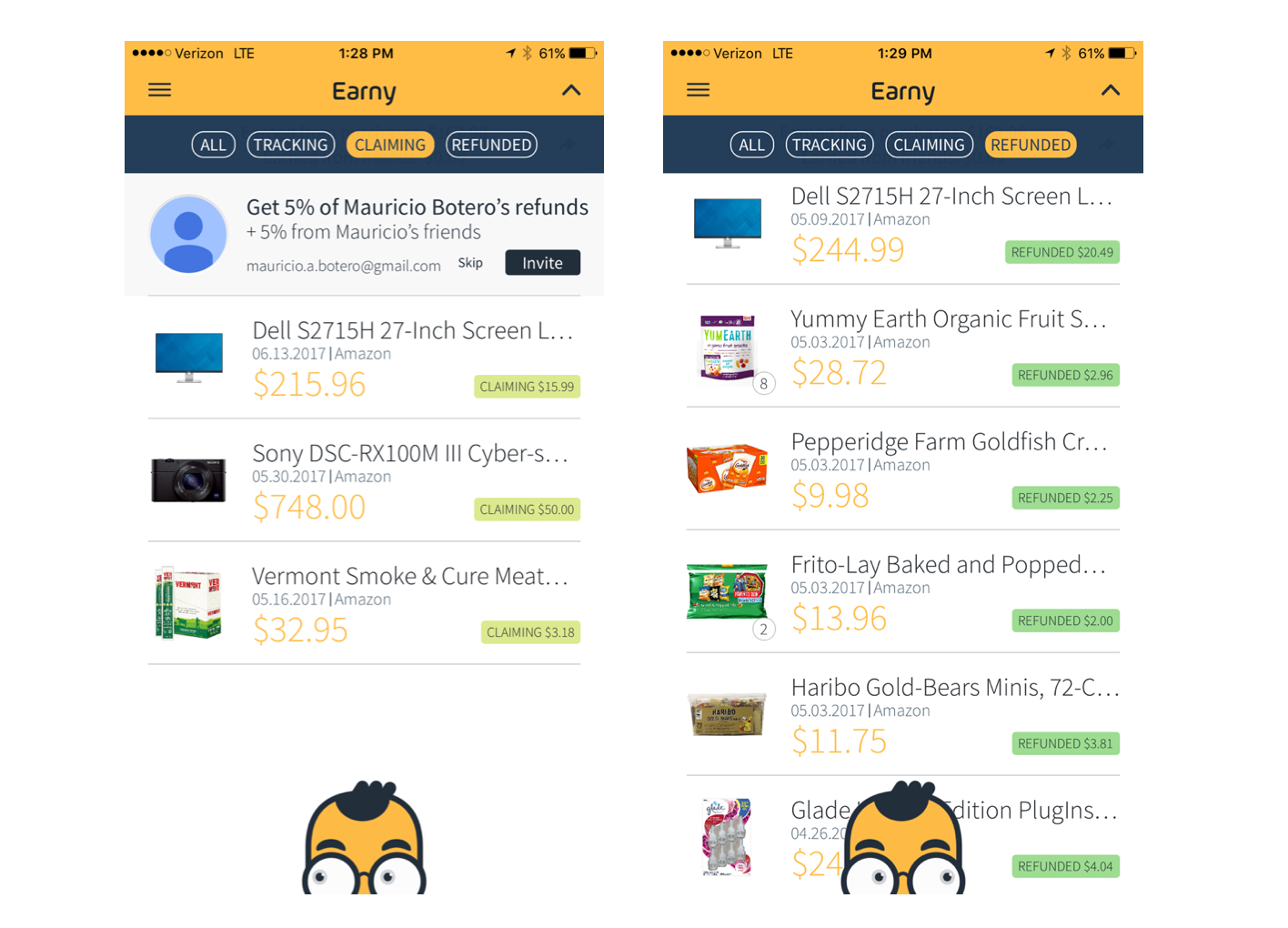

If the price drops on one (or more) of your purchases, Earny will automatically file a claim with the credit card company, allowing you to pocket the difference. Once the price of something has been reduced, it moves to the "Claiming" option (shown in the image on the left). If the claim is approved by the credit card issuer — which could take anywhere from a few days to a few weeks — it will then move on to the "Refunded" tab, indicating the amount of the refund. If and when any claims are approved, you'll receive an email from the "assistant" alerting you of a refund.

So where does the money go? Soon after an item appears in your "Refunded" tab, you'll either receive a physical check in the mail or the payment back in another form — depending on the issuer. Since Earny files the claims on your behalf, the credit card issuer will send you the check for the refunded amount (it won't come from Earny). Some of the earnings will be bigger than others: TPG Chief of Staff Adam Kotkin tried out the service and reported overall good results; some of his refunds totaled less than $1, while others netted him more than $60 on a single purchase.

At the end of each month, Earny comes to collect his dues. While there's no annual or monthly fee for the service, Earny takes 25% of the total amount refunded for the month. Note: Earny doesn't take a chunk of each refund (i.e. 25% of a $0.77 refund), but rather the total amount refunded for the entire month (i.e. 25% of $93 in total refunds). Earny will then charge the credit card on file the amount of commission from your returns; the company won't take it directly from the refund you've earned.

Bottom Line

Earny offers a service that helps you earn some cash without any real legwork and if you're interested in signing up, you can do so here. You'll be prompted to enter your email so Earny can monitor for e-receipts to track your purchases and a credit card so Earny can take advantage of the price protection and file claims on your behalf. There are no other costs involved.

Where can Earny grow? As of now, it's only available for purchases made at select merchants. In order for the app to excel — especially for road warriors — it will need to grow to include travel purchases. If Earny could eventually track a hotel rate or airfare changes, there could be the potential to save even larger amounts of cash. But as it stands, Earny is a great way to pocket some extra change every month just for making purchases as usual.

Would you try Earny? Let us know in the comments below.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app