AA CEO Loses Stock Price Bet, Finishing $10 Billion Shy of Goal

In September 2017, American Airlines CEO Doug Parker took to the stage of the airline's "Media and Investor Day" (the first in more than five years) to announce a bet he'd made with a UBS stock analyst back in October 2016: Before the analyst turned 60 years old in November 2018, American Airlines' stock (ticker: AAL) would hit $60 per share. The wager: a bottle of wine.

Parker meticulously reviewed a graph of the stock's peaks and valleys between the origin of the bet and that day's value of the stock, around $48 per share. While the share price was lagging behind the straight-line growth needed to hit the goal, Parker made it clear that he intended to win the bet.

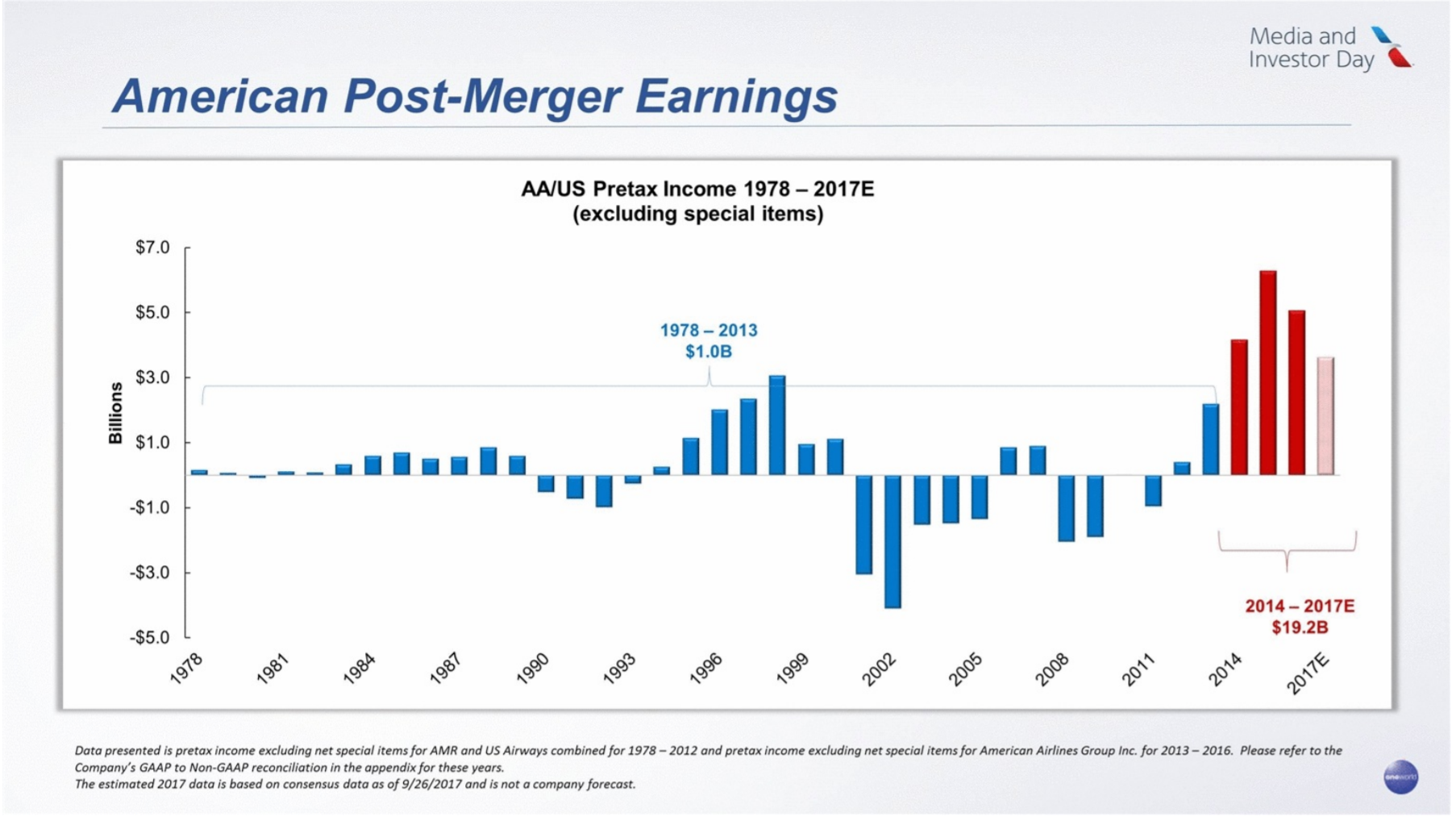

This isn't where the positive statements ended. The CEO went on to explain how American Airlines would never lose money again, citing that executive bonuses were based on the airline making $5 billion in pre-tax profits per year.

When I spoke with Parker shortly after this presentation, he was still glowing with optimism — even though I'd just put him in a tough spot with a question about seat pitch during the Q&A session.

That confidence seemed justified in the months following the event. By mid-January 2018, the bet was looking to be a sure win for the CEO. On January 12, the stock hit $58.47 — needing to climb just another 2.6% to hit the $60 mark. In late January, AA would post a 2017 pre-tax profit of $3.8 billion excluding special items — short of the $5 billion goal but still one of most profitable years in the combined airline's history.

Since then, profits, shareholder confidence and stock price have all been downhill for the world's largest airline:

On the last day of trading before the analyst's birthday on November 25, American Airlines stock closed at just $37.95 per share. That $22.05 shortfall multiplied by the 460 million outstanding shares of American Airlines meant that the market capitalization (company value) of the airline was $10 billion less than what Parker had confidently predicted.

In the two weeks since, American Airlines' stock price has continued to slide. This Friday, the American Airlines stock shed more than 9% of its value to close at $33.57 per share. While many airline stocks have taken a hit in recently, AA's share price has significantly lagged its peers since both the bet in October 2016 and Media Day in September 2017:

| Change in stock price since... | The Bet (10/27/2016) | Media Day (9/28/2017) |

|---|---|---|

American (AAL) | -16% | -29% |

Southwest (LUV) | 31% | -9% |

Delta (DAL) | 36% | 16% |

United (UAL) | 60% | 44% |

Admitting defeat, the CEO is willing to pay up. In a statement to Bloomberg, an American Airlines spokesperson said Parker and the analyst plan to meet for dinner, with the CEO paying for the drinks.

However, what's unclear is what's next for American Airlines and for Parker. Along with shareholder value, the boastful predictions from the CEO have also disappeared. Will shareholders continue to allow Parker to pursue the vision he confidently presented a year ago? Or, will shareholders look for a different captain for the helm of the world's largest airline?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app