All you need to know about Sentri, the only trusted traveler program available widely to foreign travelers

Editor's Note

Thus far, I've detailed three of the five trusted traveler programs designed to assist travelers in passing through security lines at U.S. airports and crossing domestic borders.

This week, I take a look at Sentri, the Mexican counterpart to Nexus, which, unlike other TTPs, is accessible to foreign travelers outside of the U.S.

Here are this week's top five questions:

[table-of-contents /]

1. What is Sentri?

Sentri not only allows drivers (or walkers) expedited passage into the U.S. from Canada and Mexico via Sentri-specific lanes but also grants access to TSA PreCheck lanes at airports within the U.S. and overseas territories.

The other big TTPs, Global Entry, TSA PreCheck and Nexus, are primarily restricted to U.S. citizens and lawful permanent residents, although Canadian citizens/permanent residents can use Nexus. Sentri, on the other hand, is open to all those groups plus all foreign nationals.

"SENTRI was established to expedite movement along the Southwest Land Border of eligible, pre-screened, low-risk, pre-approved travelers through designated vehicle traffic lanes," says the U.S. Department of Homeland Security. "There is no citizenship or residency requirement to apply for SENTRI."

Despite this, Sentri is most beneficial for people who live in or frequently cross border states, specifically those along the northern border with Canada or southern border with Mexico.

2. How do I apply for Sentri?

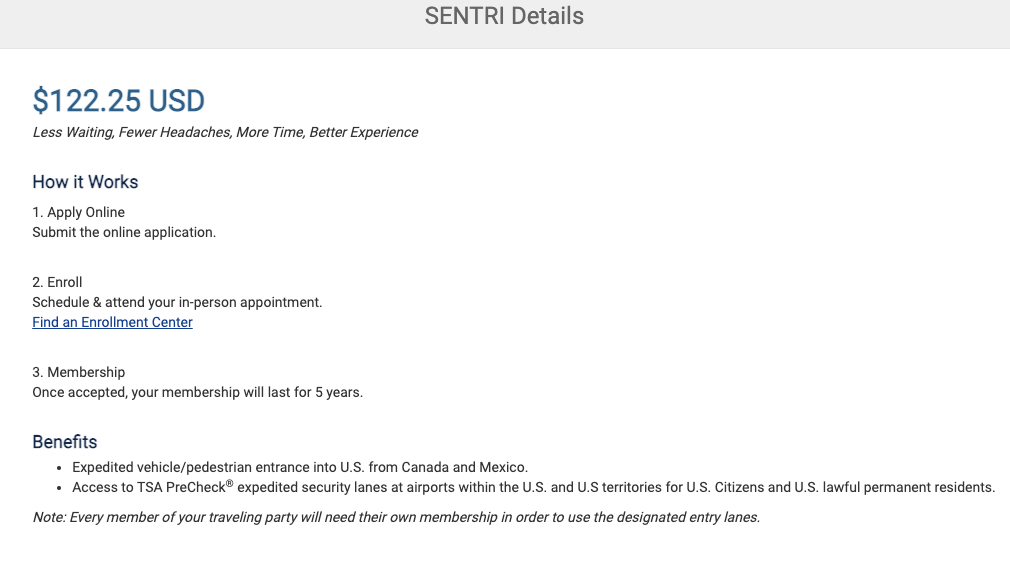

Interested people can apply for Sentri online, in addition to submitting a $122.50 fee.

"Applicants must voluntarily undergo a thorough biographical background check against criminal, law enforcement, customs, immigration, and terrorist indices; a 10-fingerprint law enforcement check; and a personal interview with a Customs and Border Protection (CBP) Officer," per the DHS.

If your application is approved, you'll be asked to schedule and attend an in-person appointment at one of 13 locations across Arizona, California and Texas.

Currently, the soonest available appointments are in Laredo and Mission, Texas, so note that you may have to wait for an appointment depending on your desired enrollment center location.

Once approved, a Sentri membership lasts for five years.

3. Are there any other application steps?

In order to access a Sentri lane, all vehicles must be registered. Those registered as part of your initial application to the program are free; however, any additional vehicle registrations cost $42 per car.

You can register up to four vehicles for use in the Sentri lanes and up to eight members per vehicle.

"Approved SENTRI members are able to use the Global Entry kiosks when re-entering the United States by air and TSA Pre-check, as long as they meet the citizenship requirements for Global Entry and their fingerprints and passports are on file," says the DHS.

4. Does Nexus allow me to use the Sentri lanes (and vice versa) when traveling back to the US from Mexico?

Per the DHS, Sentri members are not "entitled to any benefits under the NEXUS program through their SENTRI membership," but Nexus members have the option to register their vehicle for use in Sentri lanes when entering the U.S. from Mexico.

5. Is there a way to expedite a Sentri application when I already hold a Nexus card?

Unfortunately, no. Your status in one program does not affect the speed at which your application is processed for another.

Have a question for next week? Email me at caroline.tanner@thepointsguy.com or tips@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app