Credit Card Competition Act will not face a vote, despite threats from Judiciary Committee

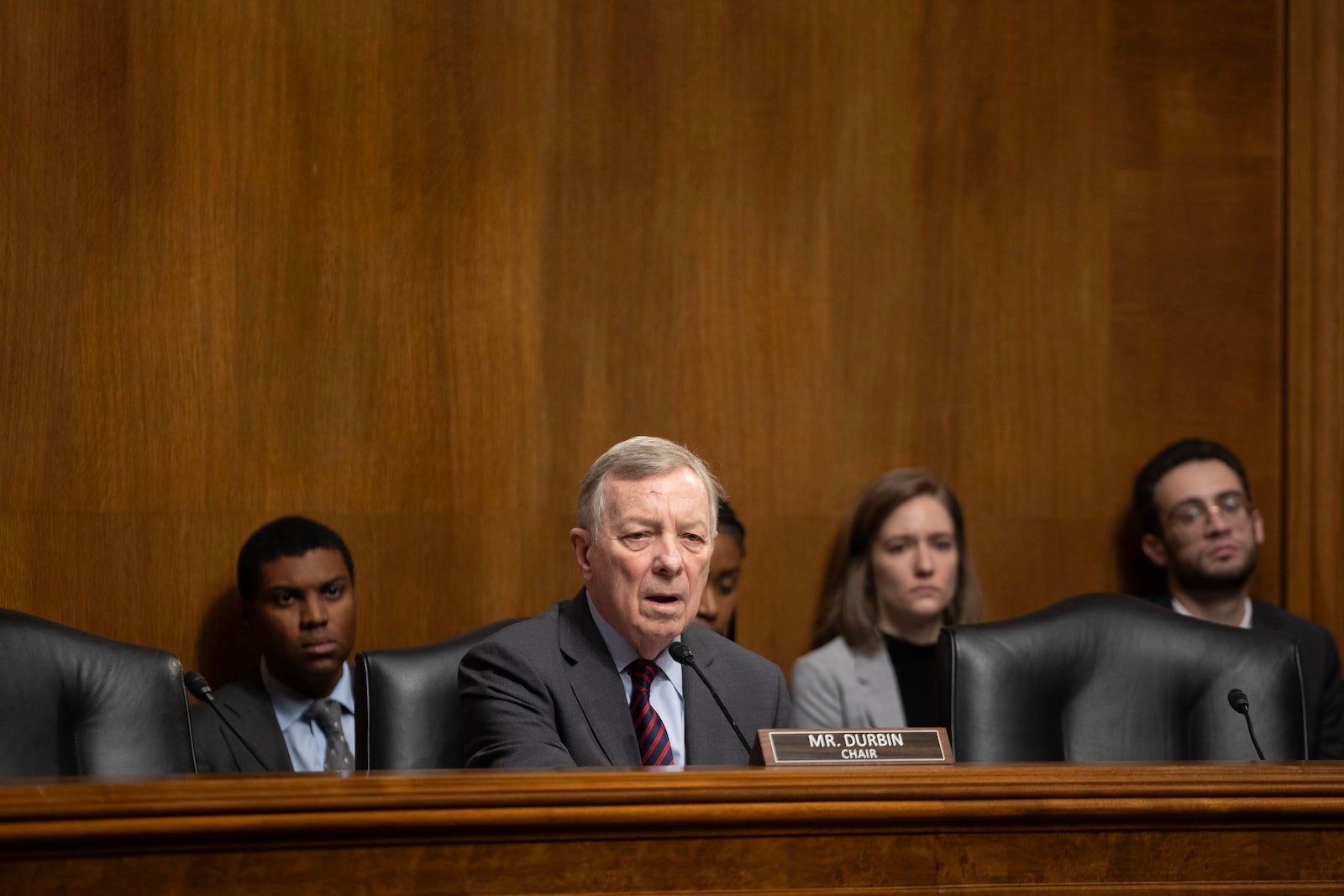

The Credit Card Competition Act will remain stalled into the start of the 119th Congress in January, based on Tuesday's Senate Judiciary Committee hearing in Washington, D.C.

Senate Bill 1838 would require credit card-issuing banks to offer a minimum of two networks for merchants processing electronic credit card transactions, prohibiting Visa and Mastercard from acting as a duopoly as the largest market share of cards. The bill claims forced competition would lower fees charged by merchants for consumers using their credit cards.

Sens. Roger Marshall, R-Kan, and Richard Durbin, D-Ill., introduced the bipartisan legislation in 2022 before reintroducing it with additional support in 2023, including from Vice President-elect J.D. Vance. Despite momentum from high-profile public support, including from President-elect Donald Trump, the bill has largely remained stalled for most of 2023 and 2024 thus far.

The lack of movement beyond its introduction did not stop the Senate Judiciary Committee from holding its final hearing on the bill this year. During the hearing, members largely urged Visa and Mastercard to modify their practices prior to congressional action.

Sen. Thom Tillis, R-N.C., reiterated his belief that the bill would not pass in this Congress. He suggested that the bill would actually "create more problems." However, he urged the two credit card operators to act on their own before congressional intervention.

"The solution coming from Congress will not be good for anyone," he said on Tuesday.

Tillis had support from Sen. Josh Hawley, R-Mo., who has garnered a reputation for being among the most outspoken members of Congress, despite being a junior senator.

"This is not a sustainable solution," he said. "I am here to tell you this will not stand."

Hawley was the only member who offered an alternative to the bill. He piggybacked on previous proposals, including those by both himself and Trump, to require credit card companies to cap interest rates to lower the $1.14 trillion debt among American credit card users. Reporting on those efforts, which have also been proposed by Democrats, suggests that the credit card industry would similarly oppose that legislation in the way it has with the Credit Card Competition Act.

If the Credit Card Competition Act were currently up for a vote, Louisiana Republican Sen. John Kennedy said he "didn't know how he would vote," but that Congress would act in some form or fashion ... eventually.

Kennedy directly addressed Visa and Mastercard representatives at the hearing and said there were two possible outcomes.

"When we are done with you, you could end up looking like either the post office or the Dallas Cowboys," he said. His office did not respond to a request for comment by the time of publication seeking clarification on his statement.

Critics, including Airlines for America, warn that the bill would negatively affect loyalty programs, such as those offered by cobranded credit cards.

Airlines for America is a trade group representing major North American airlines such as United Airlines, American Airlines and Delta Air Lines. It launched an anti-legislation campaign highlighting this concern called Protect Our Points. (TPG is among the many organizations with a vested interest in this cause and launched its own campaign, Protect Your Points. The campaign is in collaboration with the Electronic Payments Coalition, which advocates for credit unions, community banks, payment card networks and other banking institutions involved in the electronic payment process.)

"This hearing was so blatantly biased and one-sided, it practically needed a disclaimer saying it was bought, paid for, and sponsored by the campaign donations of the nation's largest corporate mega-stores," Electronic Payments Coalition executive chairman Richard Hunt said in a statement following the hearing.

In response to the bill's claims that competition would lower fees for consumers and small businesses, the group pointed to a Congressional Research Service report. The report concludes that the bill is "unlikely to lower prices for consumers or help small businesses," citing a lack of evidence that credit card routing mandates yield savings for consumers.

Financial industry critics of the bill routinely reference the Durbin Amendment, which established a fixed fee on debit card transaction processing in lieu of a percentage fee based on the total transaction. The Durbin Amendment is largely blamed for limiting rewards banks offered for debit card purchases and, therefore, terminating most debit card perks for consumers.

If history is any precedent, credit card loyalty programs could falter in the same way. If frequent flyer programs are curtailed, travelers could see airlines respond to a revenue loss by raising costs for travelers, such as the price of airfare.

"It turns out that most of the airlines make more money on the credit card branded cards and frequent flyer programs than they do on airline operations," Durbin noted. "This legislation scares the living hell out of them."

Various tourism industry stakeholders oppose the bill, warning it could negatively impact state tourism.

"If signed into law, this bill could suppress travel and tourism by eliminating the foundation of credit card rewards and loyalty programs that countless visitors to Florida — as well as Floridians — rely on to travel," nine Miami-area stakeholders wrote in a letter to Republican Florida Sens. Marco Rubio and Rick Scott, which was shared with TPG. These stakeholders include the Greater Miami Convention & Visitors Bureau, Greater Miami & the Beaches Hotel Association and the Greater Miami LGBTQ Chamber of Commerce.

Proponents say the proposed legislation will improve competition within credit card exchanges, as Visa and Mastercard account for a large proportion of general-purpose credit cards.

On Nov. 18, the American Bankers Association spearheaded an opposition letter to chairman Durbin and ranking member Lindsey Graham, a South Carolina Republican. According to the letter, the bill would "open the door to fraud, hamper rewards programs, and limit the allocation of credit to individuals and small businesses."

In contrast, Sen. Peter Welch, D-Vt., said Visa and Mastercard fees are "killing small businesses in America" at the hearing, despite small businesses relying on Visa and Mastercard to process payments.

The European Union capped interchange fees in 2015 at 0.2% of the transaction value for consumer debit cards and 0.3% for Visa and Mastercard consumer credit cards. Bill Sheedy, senior adviser to the CEO of Visa, said this resulted in the majority of the loyalty programs being eliminated or greatly devalued.

"Those changes were bad for European consumers due to higher fees and thus fewer rewards," he said. Indeed, the credit card rewards landscape in Europe is much smaller than in the United States. Europeans have access to very few high-value sign-up bonus credit cards or charge cards.

Bottom line

As of Nov. 20, the Credit Card Competition Act has yet to progress beyond committee discussion. Based on Tuesday's Senate Judiciary Committee hearing, this bill is not likely to pass this congressional session.

In the interim, bill supporters urged Visa and Mastercard to pursue a path of modification outside of a congressional mandate.

"The most liberal and conservative members agree we have to do something about this," Durbin said. "What the hell is going on here?"

It's worth noting that Durbin is up for reelection in 2026, and he has not confirmed whether he will be seeking it. Even if he retires, the bill appears to have enough bipartisan support to remain relevant.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app