2 US senators are targeting airlines' frequent flyer and loyalty programs

In the latest congressional push dubbed consumer advocacy in the travel rewards credit card space, two U.S. senators are looking into "unfair and deceptive practices in airlines' frequent flyer and loyalty programs," per a joint press release.

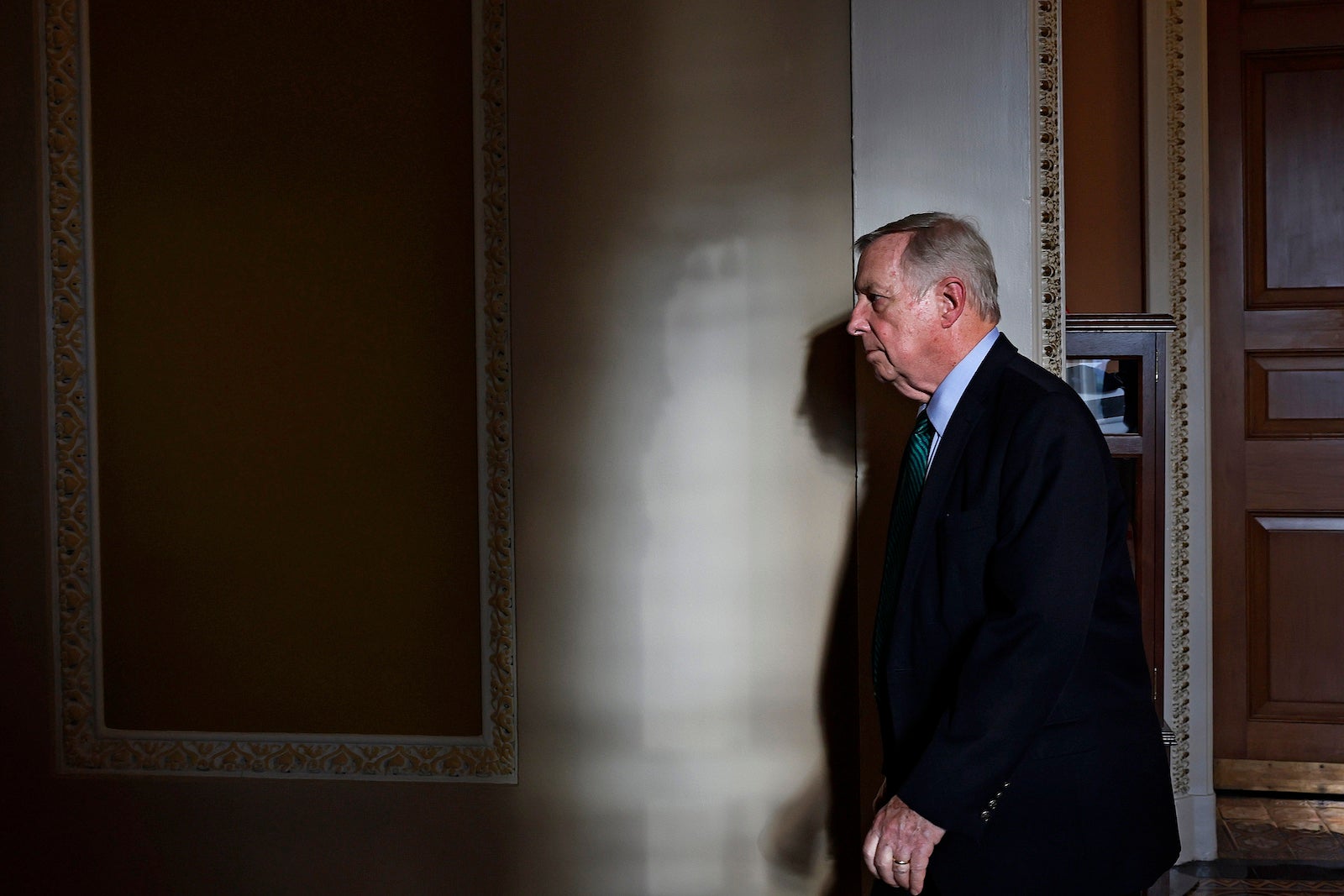

On Monday, U.S. Senate Majority Whip Dick Durbin, D-Ill., and Sen. Roger Marshall, R-Kan., asked the U.S. Department of Transportation and the Consumer Financial Protection Bureau how they protect consumers against "deceitful marketing tactics" incentivizing award spending generated from cobranded credit cards.

"There are troubling reports that airlines are engaged in unfair, abusive, and deceptive practices with respect to these loyalty programs," Durbin and Marshall said in a statement. "For example, reports have suggested that airlines are changing point systems in ways that are unfair to consumers, including by devaluing points, meaning it takes more points than initially marketed to achieve the promised rewards."

Additionally, the senators allege that airline frequent flyer programs "incentivize consumers to purchase goods and services, obtain credit cards, and spend on those credit cards in exchange for promised rewards—all while retaining the power to strip consumers of those rewards at any moment," per DOT rules allowing airlines to change their programs without notice to consumers via their terms of service.

Approximately 30 million Americans, or 1 in every 4 households, have cobranded airline credit cards, per data from Airlines for America, a trade group representing the major U.S. airlines. In 2022, airline credit cards generated $23 billion in economic activity, according to A4A.

In their letter to the DOT and CFPB, Durbin and Marshall also cited the cost of purchasing points from airlines at a higher value than the points are worth themselves while flagging the transaction fee airlines charge for transferring points to partners.

"This means that consumers can spend three cents to purchase a point worth roughly one cent," they said. "This disparity between the value of points at purchase and at redemption can be even more extreme, depending on when, how many, and even where on the website the points are purchased."

A CFPB spokesperson confirmed receipt of the letter and said the agency is "reviewing it."

The joint Durbin-Marshall effort stems from their Credit Card Competition Act, which they introduced in 2022 to inject more competition into the credit card industry to lower the fees merchants pay whenever shoppers swipe their credit cards. The bill would direct the Federal Reserve to require credit card-issuing banks to offer a minimum of two networks for merchants processing electronic credit card transactions, prohibiting a Visa-Mastercard duopoly.

This is not Durbin's first attempt at legislation aimed toward rewards credit cards. In 2011, Congress enacted the so-called Durbin Amendment as part of Dodd-Frank, a series of financial regulations implemented in response to the 2007-2008 financial crisis to prevent future crises. The Durbin Amendment established a fixed fee on debit card transaction processing instead of a fee based on a percentage of the total transaction. In response, banks limited the rewards offered for debit card purchases, effectively ending most debit card perks for consumers.

Opponents of the Credit Card Competition Act have expressed concern about the bill being applied to credit cards in the same way the Durbin Amendment was to debit cards, with credit card companies potentially significantly scaling back or discontinuing rewards programs due to decreased revenue from interchange fees.

"This is no coincidence. It is ... a calculated attempt to try to silence and intimidate any U.S. company or American worker who opposes their harmful legislation," said Richard Hunt, executive chairman of the Electronic Payments Coalition, whose organization has been outspoken against the bill.

Since the 2011 implementation of the Durbin Amendment, card issuers have lost $106 billion in swipe fees from debit card transactions, per the Electronic Payments Coalition.

Spokespersons for Durbin and Marshall declined to comment beyond the press release.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app