Huge offer: Limited-time 40% transfer bonus from Chase to Virgin Atlantic Flying Club

Book your European summer getaway now!

To celebrate Valentine's Day, Chase Ultimate Rewards is offering a 40% transfer bonus to Virgin Atlantic Flying Club. That's a larger-than-normal transfer bonus, and you have until Feb. 28 to take advantage of the deal.

Chase points transfer to Flying Club at a ratio of 1:1. However, with this transfer bonus, 1,000 Chase points are worth 1,400 Flying Club points.

Since Virgin Atlantic offers Saver fares, you could book a business-class seat to Europe by transferring as few as 21,000 Chase points.

Here's what you need to know about this great deal.

Related: How I booked lie-flat business-class seats to London for just 21,000 points

Chase Ultimate Rewards 40% transfer bonus to Virgin Atlantic Flying Club

With Virgin Atlantic's Saver-level award rates, you could potentially book one-way flights from select U.S. cities to London starting at the following rates:

- Economy: 6,000 points

- Premium economy: 10,500 points

- Upper Class: 29,000 points

However, with Chase's 40% transfer bonus, you'd only need to transfer the following amounts to Flying Club:

- Economy: 5,000 points

- Premium economy: 8,000 points

- Upper Class: 21,000 points

Note that while Saver fare redemption rates may be low, Virgin Atlantic imposes high carrier surcharges, with those on Upper Class rates exceeding $500 one-way. Plus, taxes on flights departing from London will be even higher due to the U.K. Air Passenger Duty. That being said, redeeming your points and paying $500 for a lie-flat business-class flight is still a great deal, potentially saving you thousands of dollars.

While snagging a Saver-level seat is a great deal, Virgin Atlantic does use dynamic award pricing, which means some business-class fares can cost well over 200,000 points. Consider using the program's handy reward seat checker to find the best prices.

How to transfer your Chase points to Virgin Atlantic Flying Club

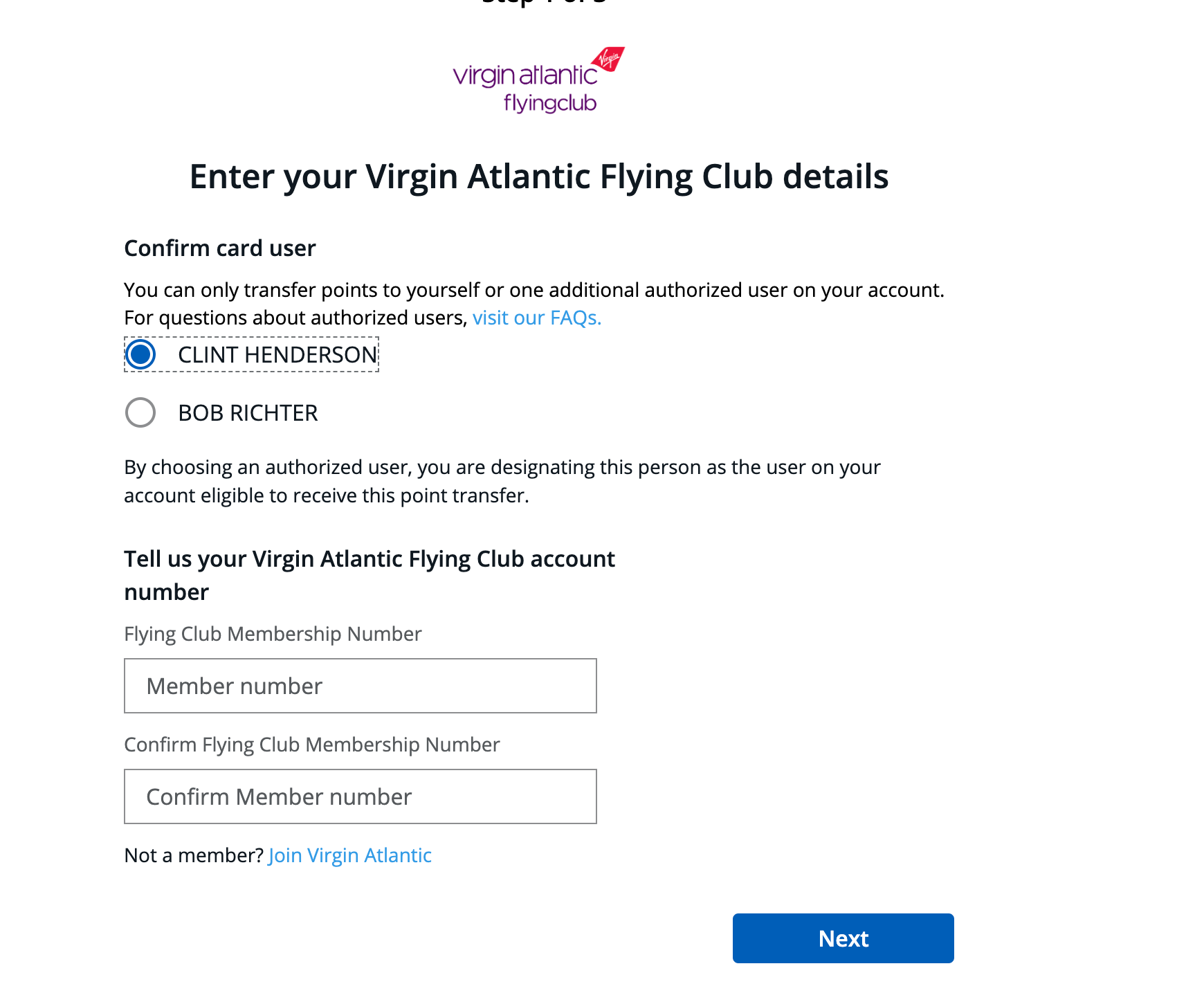

The transfer process is easy. Once you have created a Virgin Atlantic Flying Club account, log in to your Chase Ultimate Rewards account, hit the transfer button and then enter your Flying Club member number.

You must transfer Chase points in increments of 1,000. Additionally, transfers are irreversible, so make sure to check for award availability before transferring your points.

Remember, to receive 40% bonus points, you must transfer your Chase points by Feb. 28.

Bottom line

Capitalizing on this amazing transfer bonus could be a lucrative option for you. Plus, even if you don't have plans to fly to the U.K. or book a Virgin Atlantic flight, you could always use your Flying Club points to book on a partner airline such as All Nippon Airways, Delta Air Lines, Air France or KLM.

When you can find availability, there are some great deals out there.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app