Why the Sapphire Presents concert series should be on your bucket list this summer

Editor's Note

Chase cardholders can access music events in select cities throughout the year, including Sapphire Presents, a concert series hosted by Chase Experiences.

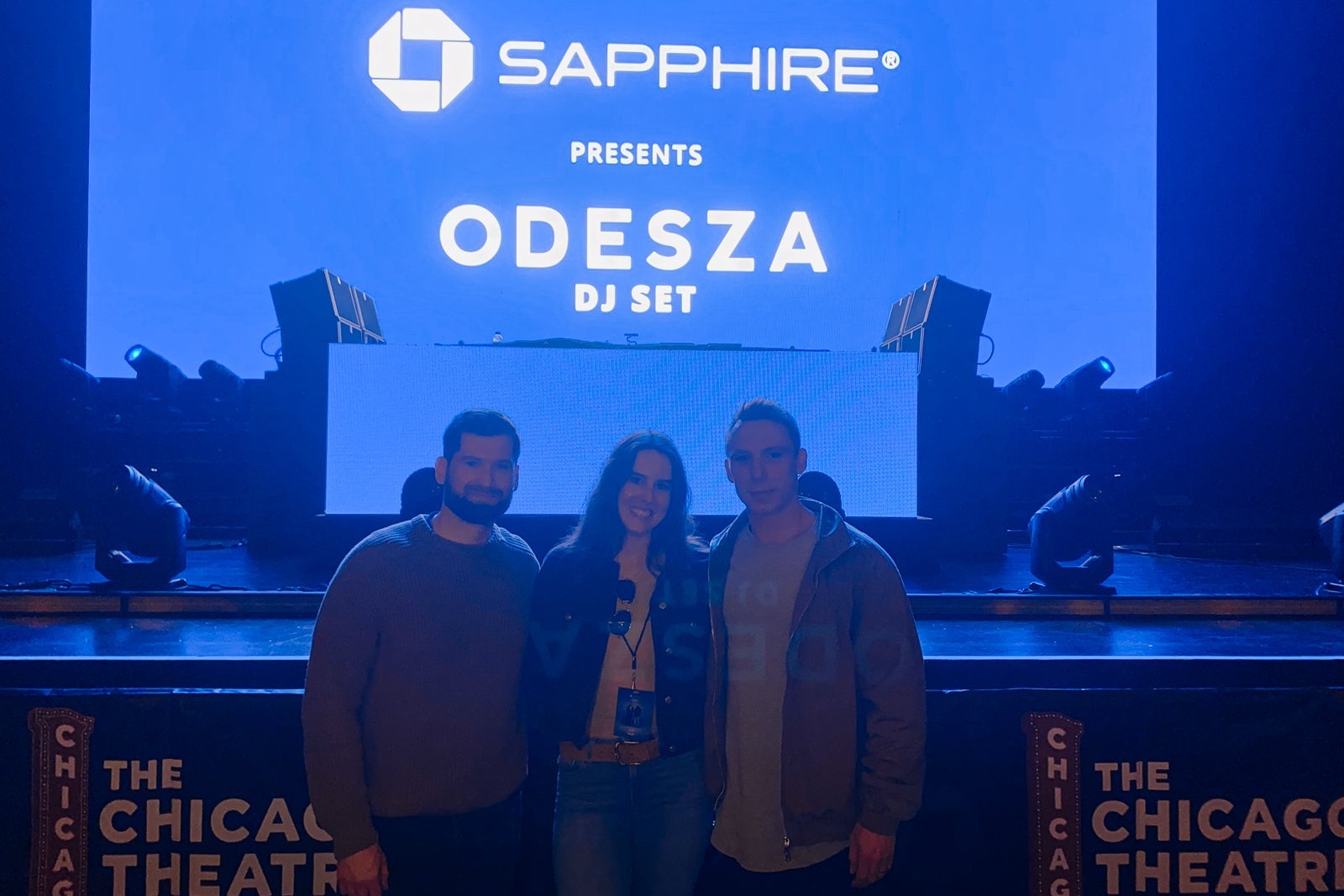

Recently, I attended the Sapphire Presents Odesza DJ Set at the Chicago Theatre, which was exclusively available for Chase credit and debit cardholders.

Here's what Chase cardholders need to know about Sapphire Presents events.

Accessing Chase Sapphire Presents

These events are restricted to Chase credit and debit cardholders and their guests, with access available through Ticketmaster.

Chase Sapphire Reserve® (see rates and fees) cardholders can buy tickets with additional access and perks — including packages with premium artist experiences, such as a meet-and-greet before the show — through the Chase Ultimate Rewards portal.

For this particular show, those additional perks included best-in-house tickets, access to the Chase Lounge which was decked out with complimentary food and beverages before the show as well as an artist meet-and-greet. Those with the Chase Sapphire Reserve and Chase Sapphire Preferred® Card (see rates and fees) can access musical festivals via the portal as well.

The first few rows of orchestra seating were reserved for Sapphire Reserve cardholders who purchased tickets using their Chase Ultimate Rewards points. There was also a VIP section in the pit.

The Chase Lounge

After going through security at the Chicago show, Sapphire Reserve cardholders who got their tickets through the Ultimate Rewards portal and wanted to visit the Chase Lounge were directed to a separate entrance; they were then escorted to the area. After a few minutes in the lounge, cardholders who had signed up for the meet-and-greet were taken to the main stage to meet the men behind the Odesza duo: Harrison Mills and Clayton Knight.

After talking to the electronic artist pair for a few minutes, we returned to the Chase Lounge to enjoy complimentary food and beverages, which were available from 7 to 8:30 p.m.

Nonalcoholic and alcoholic beverages were available at the bar, but you could also order from one of the many servers walking around. The featured drinks paid homage to the main act, with cocktails named Summer's Gone-tequila (featuring a margarita-based drink dosed with a bit of mango-flavored bubbly and garnished with dried mango) and A Moment Apart (a fun mix of gin, lemon juice, and a splash of sparkling wine garnished with a candied lemon peel).

Other beverage options included RedBull, High Noon hard seltzer, Modelo, White Claw, Stella Artois, red and white wines as well as a variety of soft drinks.

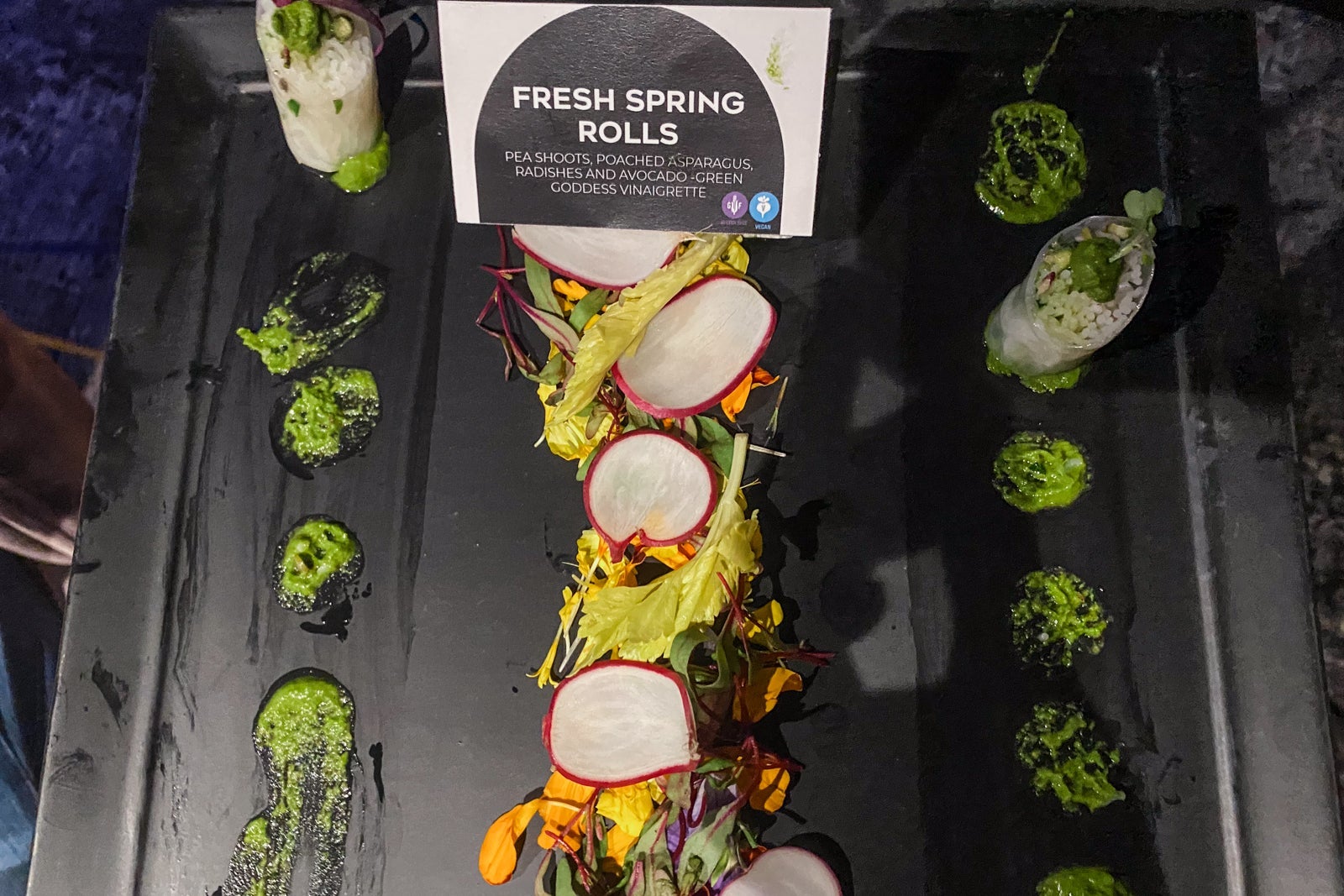

Hors d'oeuvres were served in the lounge beginning at around 7 p.m. The menu included short rib tacos, bacon-wrapped filet mignon bites, pulled blackened chicken polenta, feta saganaki served with hot honey, spring rolls, and truffle mac and cheese Parmesan cones. For dessert, there were carrot cake pops, chocolate chip dough lollipops and brown butter caramel sea salt petit fours.

Sapphire Reserve cardholders who purchased the meet-and-greet package received a signed Odesza album; anyone could take their photo in a photo booth.

Bottom line

The current offer on the Chase Sapphire Preferred® Card allows new cardholders to earn 75,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

With the Chase Sapphire Reserve®, new cardholders can earn 125,000 bonus points after spending $6,000 on purchases within the first three months of opening an account.

As one of the most valuable rewards travel credit cards, the Sapphire Reserve offers 8 points per dollar spent on all purchases made through the Chase Travel℠ portal. The Sapphire Preferred offers 5 points per dollar on travel booked through Chase Travel.

Sapphire Presents tickets are available to Chase credit and debit cardholders for events nationwide in various locations. Sapphire Reserve cardholders can purchase VIP packages through the Chase Ultimate Rewards portal.

Upcoming Sapphire Presents events include Bleachers at The Chicago Theatre on June 3. Additionally, Sapphire Reserve members can access exclusive packages for music festivals nationwide, including Boston Calling, Lollapalooza, Outside Lands and Roots Picnic.

Related reading:

- How to book travel (and save points) with Chase Travel

- Why the Chase Sapphire Preferred is more than just a starter card

- How to redeem Chase Ultimate Rewards points for maximum value

- 6 reasons why the Chase Sapphire Preferred is the perfect card for the average traveler

- Why you'll want to pay the $95 annual fee on the Chase Sapphire Preferred

- Is the Chase Sapphire Reserve worth the annual fee?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app