How to take control of your credit with Chase Credit Journey

Good credit grants you more than just the ability to open premium credit cards. It can often make the difference in getting a home or car loan, or even successfully renting an apartment. Your credit score tells lenders — and potential landlords — about your spending history and habits, and it indicates how likely you are to pay your bills on time. The ability to borrow money through home loans and even credit cards is also an important tool in wealth building.

But what if you don't know where to start to even begin understanding your credit?

Enter Chase Credit Journey, a free, all-in-one credit tool designed to give you full access to your credit — including your credit report and score alongside credit and identity monitoring — all for no cost.

And the best part? It's available to everyone, even if you don't currently bank with Chase or have one of its credit cards.

Here is your comprehensive guide to Chase Credit Journey and how you can use it to take control of your credit.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

[table-of-contents /]

What is Credit Journey?

Credit Journey is a free, online tool that can help you monitor your credit report and improve your credit score with round-the-clock customer support and identity monitoring. Your credit score is updated every time there's a change to your report, keeping you up to date on exactly where you stand.

This free tool is available to both existing Chase customers as well as those who've never done business with the issuer before.

With Credit Journey, you can finally take control of your credit score — and in turn your finances — with educational resources and support from one of the nation's largest financial institutions. And unlike similar credit monitoring products out there, you get even more with Credit Journey. This includes free identity monitoring and up to $1 million in identity theft insurance for certain expenses associated with restoring your identity.

Here are some of the key features you can use with Credit Journey.

Check your score for free every week — with no impact on your credit

Your credit score ranges from 300 to 850 and is an indicator of your creditworthiness. In other words, it tells potential lenders how likely you are to repay your debts and is thus the gateway to many opportunities to borrow money. Your score consists of several factors, including your payment history, your ratio of debt to available credit and the age of your credit history.

TPG recommends — among other regular tasks — that you check your credit score every month to stay on track with your credit card spending. But when you use Credit Journey, you can check your score at any time, and doing so won't affect your credit. In fact, thanks to 24/7 credit monitoring, your score is updated weekly and whenever there's a change to your credit report, and you can be alerted of this change to make sure it's accurate.

Credit Journey also allows you to view your credit usage, limits and balances, and you'll receive a monthly summary with helpful tips — all conveniently presented in a single location at no cost to you.

Get up-to-the-minute credit monitoring alerts

When issues arise with your credit report or score, you'll want to know about them immediately. The sooner you see something you don't recognize in your report, the more quickly you can address it. That's why Credit Journey comes with just-in-time alerts, so you're never in the dark about what's going on with your credit score.

This means you'll be immediately notified of changes or new activity linked to your identity.

In the unfortunate event that one of your cards is used fraudulently or someone tries to apply for credit in your name, there are steps that you can take to make it right. However, the most important step may be a proactive one — enrolling in Credit Journey.

Protect your identity (for free) with 24/7 identity monitoring

In addition to credit monitoring, Credit Journey also provides free 24/7 identity monitoring. While credit monitoring keeps track of fraudulent activity on your credit report, identity monitoring offers dark web surveillance, data breach monitoring, social security number tracking and identity verification alerts.

Many other companies charge for these services, but Credit Journey offers them for free.

Millions of people suffer from identity theft each year, and it can sometimes take years to recover from the damage of having your identity stolen. The earlier you're made aware of identity theft, the sooner you can take the steps necessary to get your life back — and Credit Journey can help you do just that.

Related: Credit card fraud vs. identity theft — how to know the difference

Why is a credit score important?

As mentioned before, your credit score is a numeric representation of your creditworthiness. Essentially, it indicates to potential lenders how likely you are to pay back the money they'll loan to you. Your credit score is checked not just when you want to open a new credit card or take out a mortgage — it's also checked when you apply for a car loan and maybe even when you rent an apartment.

And a low credit score could prevent you from doing any of that (or could increase your interest rate and thus make borrowing more expensive or entirely unaffordable).

The following factors are factored into your overall credit score, with some weighing more heavily than others:

- Payment history.

- Credit utilization.

- Length of credit history.

- New credit inquiries.

It's true that it takes time to build good credit, but there's no better time to start than today. And Credit Journey can help you make it happen.

How to sign up for Credit Journey

It's easy to sign up for Credit Journey, even if you don't already have an account with Chase. Simply follow this link.

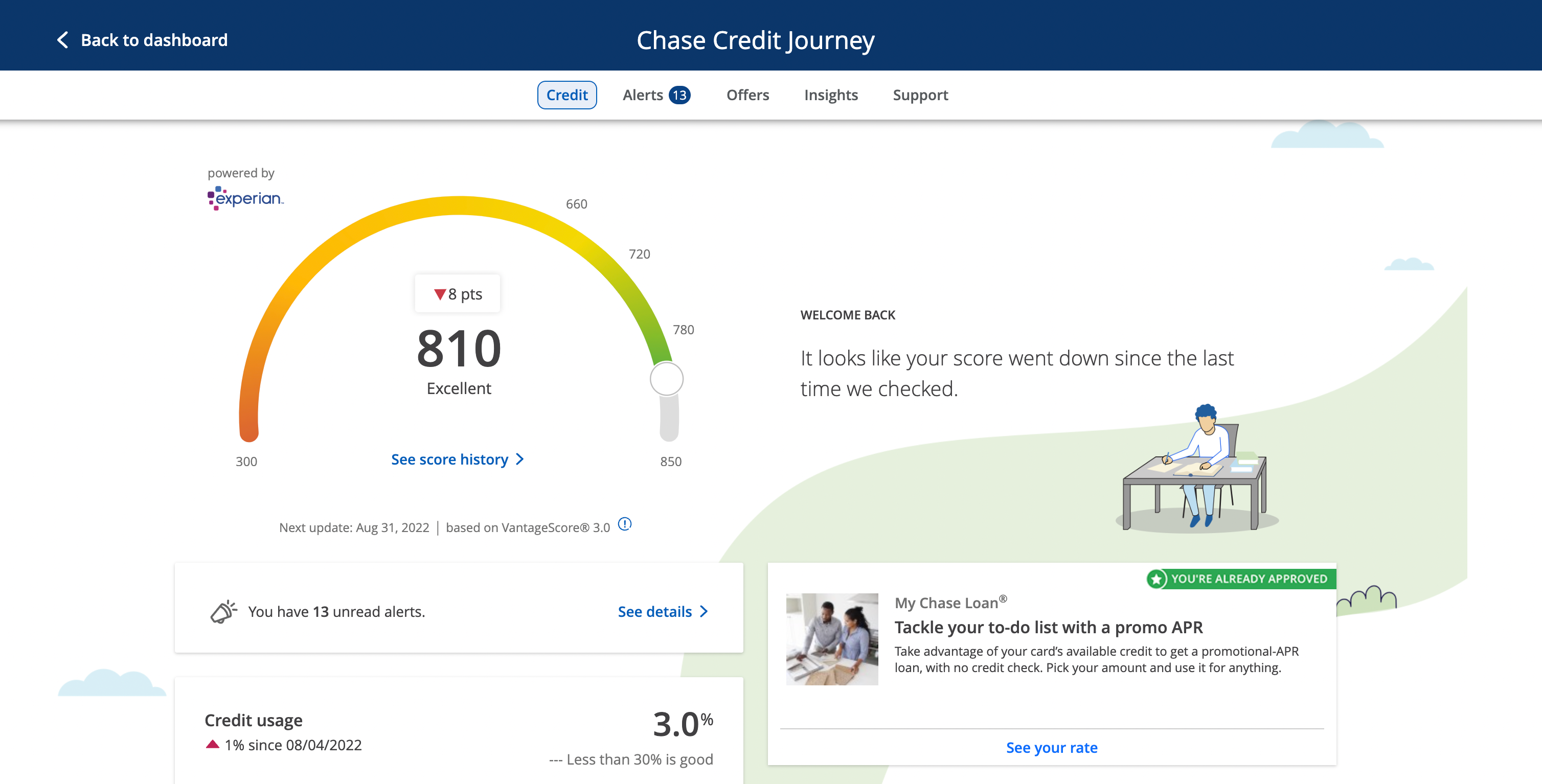

Once you enroll, your VantageScore 3.0 is displayed right from the dashboard. This number is based on a consumer credit scoring model from the three major credit reporting agencies (Experian, Equifax and TransUnion) and may differ slightly from other credit scores.

In addition, the Credit Journey dashboard displays your available credit, total balances across all of your accounts, a summary of the factors that affect your score, and even a six-month graph of your credit usage (after you've been a member for six months). And the bar across the top includes a link to the Alerts page, which will display all urgent notices regarding your credit profile and identity monitoring.

Bottom line

Your credit score is an important indicator of how well you handle debt, but keeping track of your score can seem daunting when you go it alone. Thankfully, you won't have to with Credit Journey, the free online tool designed to help everyone take control of their credit.

With Credit Journey, you not only can check your credit score for free every week. You'll also automatically receive a summary email every month with tips and other information to help you stay on track, meaning less work for you. Plus, you get access to a free identity monitoring service to watch out for fraudulent activity — when others charge for this service.

Most importantly, these services are available (and free) to everyone — no Chase account is required.

Whether you're a recent graduate, a new retiree or somewhere in between, make sure you have a handle on your credit score so you're ready for life's biggest moments. Sign up for Credit Journey for free today.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app