How the Capital One Venture X travel credit can save you $300 on your next trip

Editor's Note

As the saying goes, don't judge a book by its cover. The same phrase applies to a credit card's annual fee.

Take the Capital One Venture X Rewards Credit Card, for example. While this premium rewards card has a $395 annual fee, several valuable ongoing perks help offset the full cost.

Those perks are in addition to a substantial welcome bonus: 75,000 bonus miles after spending $4,000 on purchases in the first three months from account opening.

One of the ongoing principal benefits that Venture X cardholders receive each year is a $300 annual credit toward Capital One Travel bookings. Let's take a closer look at the Venture X annual credit, how you can make the most of it — and why you might want to apply now.

What is the Venture X $300 travel credit?

Venture X cardholders receive $300 in credits each cardmember year (not calendar year) toward travel, including the year you open the card. That means you can get $300 in value from the Venture X immediately.

But there's one caveat: The credit only applies to bookings made through the Capital One Travel portal.

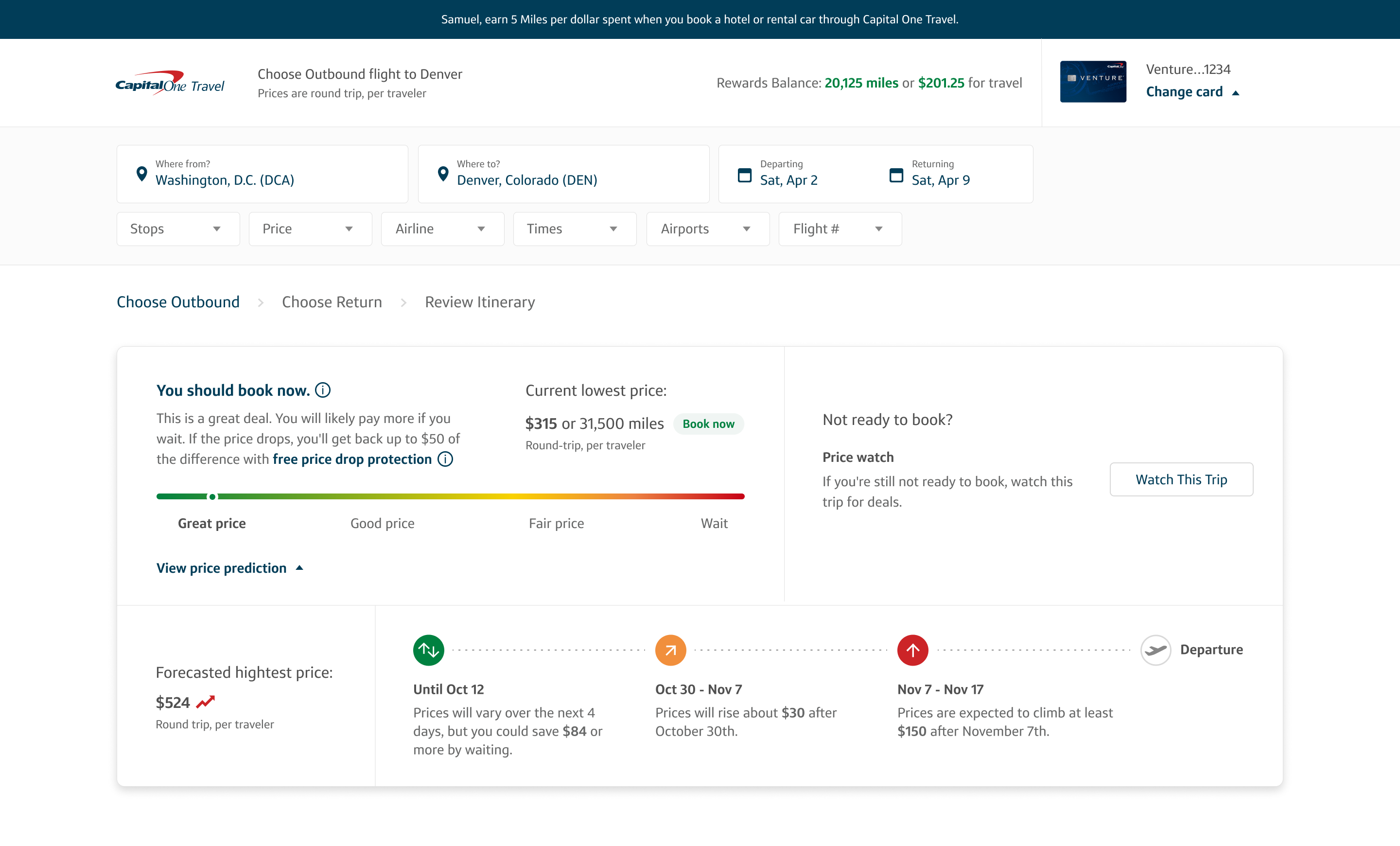

The Capital One Travel portal is an online travel agency best compared to those offered by other issuers, such as Amex Travel and the Chase Travel℠ portal. What sets Capital One's portal apart is its partnership with Hopper. Hopper is a travel booking app that uses predictive pricing technology to help cardholders get the best price.

Eligible cardholders can log in to the Capital One Travel portal to book things like airfare, hotel stays and rental car reservations. Then, they can apply the $300 credit like a coupon to reduce the overall cost of the booking. The card's Capital One Travel credit can be used across one or multiple transactions.

TPG credit cards writer Augusta Stone used her annual Venture X travel credit to book a three-night stay at the Conrad Las Vegas at Resorts World last January. She was already traveling to Las Vegas for an expensive concert, and the $300 credit helped reduce the cost of a hotel stay that would've cost nearly $1,000.

Related: A full review of Capital One Venture X

Booking through Capital One Travel vs. booking directly

At face value, the requirement to use the Capital One Travel portal might feel like a limitation, especially when you consider the benefits of booking travel directly.

For instance, when booking certain hotels through any third-party service — including Capital One Travel and other credit card issuers' travel portals — you will typically forfeit elite status benefits and the ability to earn elite qualifying credits and points within these loyalty programs.

However, for flights and independent hotels (including Disney resorts), booking through the Capital One Travel portal makes a lot of sense since you wouldn't earn hotel points anyway. Meanwhile, flights booked through Capital One Travel still earn points and elite qualifying miles, just like booking directly.

Finally, Capital One Travel has several unique features thanks to its partnership with Hopper. This includes an integrated price-prediction and -matching tool, along with a best-price guarantee. Capital One also offers the option to purchase cancel-for-any-reason flight coverage and price-freeze protection. This allows folks to lock in a price they find on the portal for a fee until they're ready or able to book.

Earning miles through Capital One Travel

Aside from how easy it is to maximize that $300 credit, there is one other excellent reason to use the Venture X to book travel through the Capital One Travel portal: the bonus-earning opportunities.

The Venture X has a simple earning structure, accruing 2 miles per dollar spent on most charges. However, it features elevated earning rates when you book through Capital One Travel:

- 10 miles per dollar spent on hotels and car rentals booked via Capital One Travel

- 5 miles per dollar spent on flights, vacation rentals and trip activities booked via Capital One Travel

By using the Venture X for Capital One Travel purchases, you can ensure you take full advantage of your $300 annual credit and then earn bonus miles on your other bookings above and beyond that threshold. Just note that the $300 credit does not earn Capital One miles on its own, as it effectively reduces the cost of your booking.

You should also look into how you can stack rental car perks using Hertz and the Venture X; this will save you a lot of time, money and hassle when leaving the airport to start a vacation.

Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at that status level through the duration of the offer. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g., at hertz.com) will not automatically detect a cardholder as being eligible for the program, and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

How does this travel credit compare to other premium cards?

Two major competitors to Venture X in the premium card space are the American Express Platinum Card® and Chase Sapphire Reserve® (see rates and fees).

Both the Chase and Amex products have higher annual fees, but they also offer an array of additional perks that may be useful for some consumers. They each carry travel-specific benefits that are worth comparing to the Venture X.

Chase Sapphire Reserve

The Chase Sapphire Reserve charges a $795 annual fee, and one of its standout perks is a highly flexible $300 annual travel credit. Unlike Capital One's requirement to use a proprietary booking portal, Chase allows Sapphire Reserve cardholders to earn their $300 back on a wide variety of travel transactions. This applies regardless of whether they book directly with a hotel or airline or through Chase Travel.

Amex Platinum

The Amex Platinum charges an $895 annual fee (see rates and fees), with an array of built-in statement credits that help offset the yearly cost of the card.

One of the perks most similar to Capital One's is an up-to-$200 statement credit for airline incidental fees each calendar year. Another similar perk: up to $600 (up to $300 semiannually) in statement credits on prepaid Amex Fine Hotels + Resorts or The Hotel Collection bookings (of two or more nights for THC) made through American Express Travel® when you pay with your Amex Platinum. Enrollment is required for select benefits.

These credits are more restrictive than the Venture X. The airline incidental fee credit can be used only for fees (seat selection, checked bags, etc.) with a single airline, while the hotel credit can be used only for eligible hotels. Meanwhile, the Venture X credit can be redeemed toward anything bookable on Capital One Travel.

Bottom line

Premium credit cards often have high annual fees. But often, the protections, credits and perks they offer make up for a large chunk of those annual fees. In the case of the Venture X, a $300 annual credit applied to Capital One Travel bookings significantly offsets the card's $395 annual fee. This effectively reduces the annual fee to $95 once you've maxed out the $300 credit.

If you plan to apply for the Capital One Venture X — or have the card already — familiarize yourself with the travel portal to ensure you get the most out of this benefit.

To learn more, read our full review of the Capital One Venture X.

Learn more: Capital One Venture X with 75,000 bonus miles after spending $4,000 on purchases in the first three months from account opening.

For rates and fees of the Amex Platinum Card, click here.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app