Earn 5,000 bonus TrueBlue points for your first Capital One transfer to JetBlue

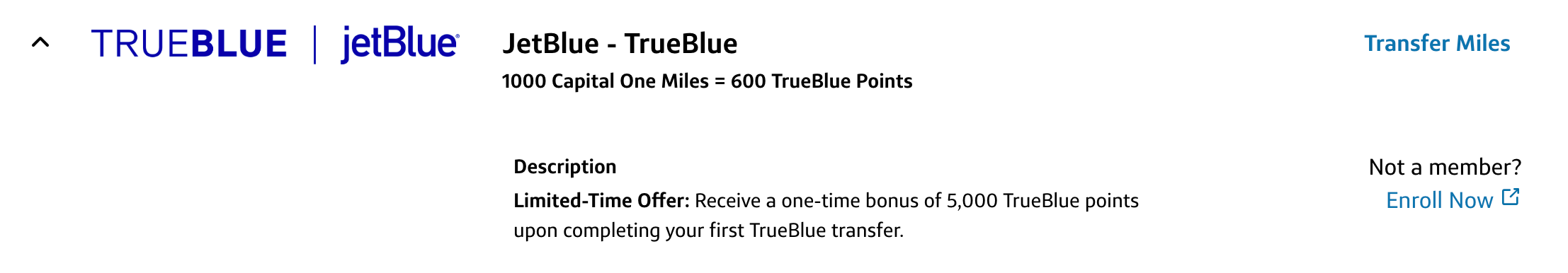

If you were unimpressed by Capital One's poor transfer ratio for its newest partner, JetBlue TrueBlue, it's time to take another look. Capital One is offering a one-time transfer bonus of 5,000 TrueBlue points, as first reported by Frequent Miler.

Capital One's transfer ratio for JetBlue is a less-than-ideal 5:3, meaning every 1,000 Capital One miles you transfer will give you only 600 TrueBlue points. In many cases, you'd use significantly fewer Capital One miles by booking a JetBlue flight with cash and redeeming your miles to cover the purchase at a rate of 1 cent apiece.

But now, Capital One has launched a transfer bonus that can give you an extra 5,000 TrueBlue points upon your first transfer. You must transfer a minimum of 1,000 miles in increments of 100 miles.

This means you could transfer the minimum 1,000 Capital One miles to JetBlue and come out with 5,600 TrueBlue points — an excellent transfer ratio of 1:5.6. If you transfer 10,000 Capital One miles, you'll get a total of 11,000 TrueBlue points — slightly better than a 1:1 ratio.

This is a one-time bonus. So, after you use it, you'll be back to the usual disappointing 5:3 ratio. But if you have a specific JetBlue redemption in mind, this could be a great opportunity to transfer the points you need.

Or, if you also collect another currency that transfers to JetBlue at a better ratio, you're probably better off using a combination of rewards. Chase Ultimate Rewards points and Citi ThankYou Rewards points transfer to JetBlue at a 1:1 ratio, while American Express Membership Rewards points transfer to JetBlue at a ratio of 5:4. You could transfer 1,000 Capital One miles to TrueBlue to snag the 5,000 bonus TrueBlue points, then transfer the rest of the points you need from Chase, Citi or Amex at a better ratio.

JetBlue redemptions start at 700 TrueBlue points, so this transfer bonus alone could be enough to get you to and from your next vacation. This offer doesn't have a published end date and could disappear at any time, so start thinking about your travel plans to decide if you want to take advantage of it.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app