British Airways Confirms Reduced Fees on Select Routes Between the UK and US

Award redemptions for flights between the United States and the United Kingdom are now a little cheaper thanks to one airline's decision to reduce carrier-imposed fees on select routes.

A British Airways spokesperson has confirmed to TPG that the airline has reduced carrier-imposed fees (CIFs) on a number of routes between the US and the UK. Routes on which the reduced carrier-imposed fees apply will now incur fees of just $65 one-way, down from $175. Routes that do not feature the reduced carrier-imposed fees will continue to incur fees of $175.

Routes With Reduced Carrier-Imposed Fees

- Boston (BOS) — London (LHR)

- Los Angeles (LAX) — London (LHR)

- Miami (MIA) — London (LHR)

- Newark (EWR) — London (LHR)

- New York City (JFK) — London (LGW, LHR) [Excludes JFK-LCY]

- Orlando (MCO) — London (LGW)

- San Francisco (SFO) — London (LHR)

- San Jose, CA (SJC) — London (LHR)

- Seattle (SEA) — London (LHR)

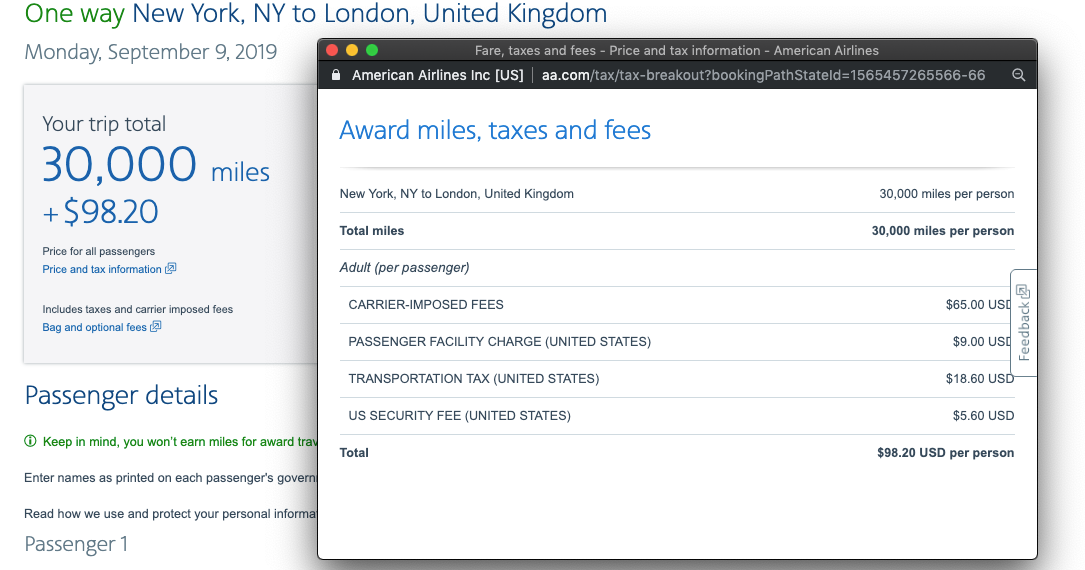

Reduced carrier-imposed fees apply to both cash fares and award tickets, including those booked through partner airlines. With award tickets on select routes no longer incurring such high fees, economy award tickets make much more sense. For example, AAdvantage Mile SAAver award flights booked in economy from New York (JFK) to London-Heathrow (LHR) will incur a total of $98 in taxes and fees, down from $203.

It is unclear why British Airways made the decision to reduce carrier-imposed fees on select routes, but the move does allow British Airways to offer more competitive fares in select markets. Regardless of the reason, British Airways flights are now more attractive thanks to this latest move.

For the latest travel news, deals and points and miles tips please subscribe to The Points Guy daily email newsletter.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app