My new 'trick' for avoiding pesky resort and destination fees on last-minute stays

Few things grind my gears as much as resort fees — and their relatively new in-town equivalent, the "destination fee."

While they're typically disclosed at checkout, these fees give hotels a revenue boost without bumping up the room rate — if you're doing some comparison shopping, you'll likely see the base rate, before taxes and fees.

Related: 5 pitfalls to avoid when booking hotels

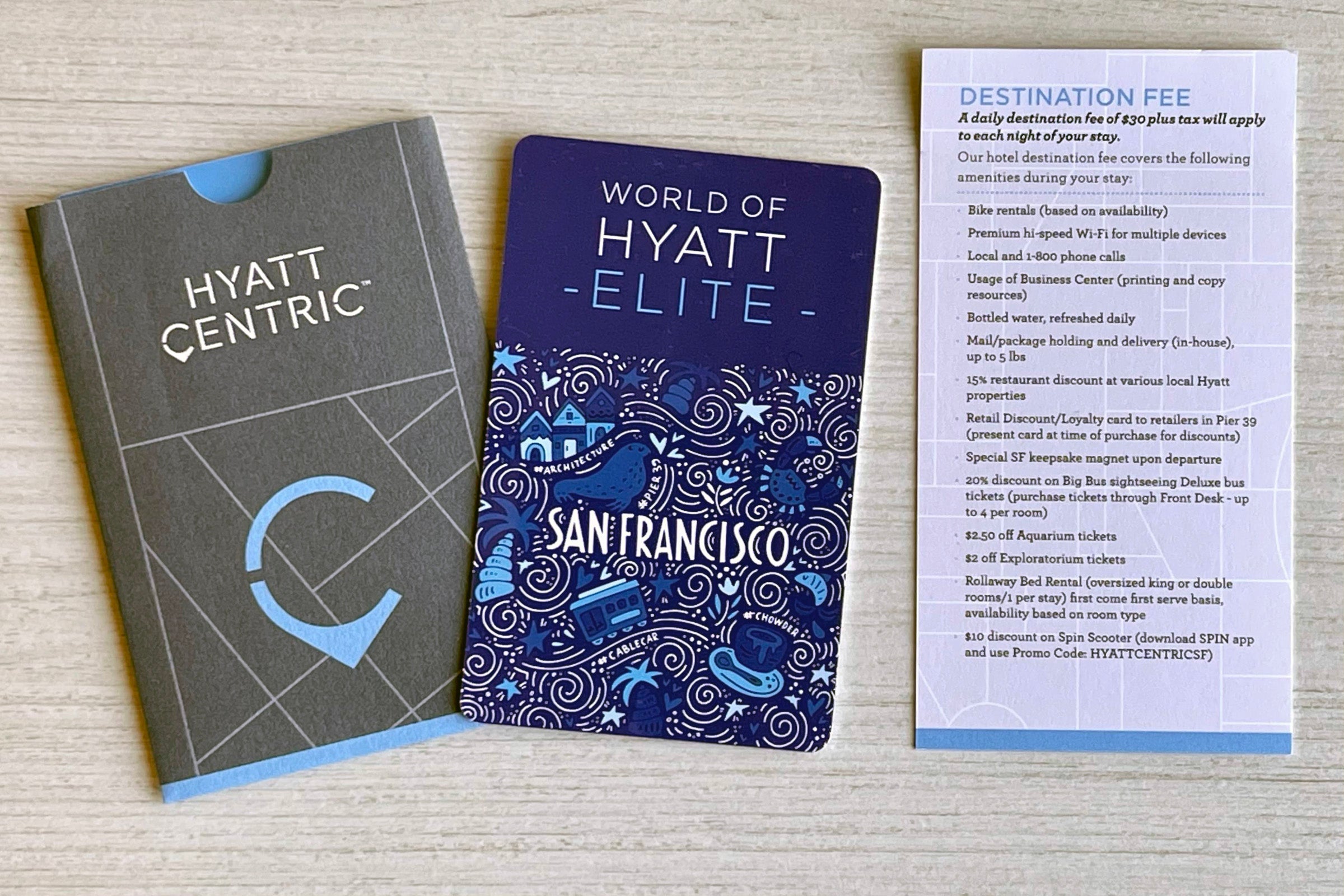

As a result, travelers end up paying more than initially advertised for benefits they may not need, like long-distance calls or discounts on scooter rentals or, in the case of Wi-Fi and fitness center access, perks other hotels include for free.

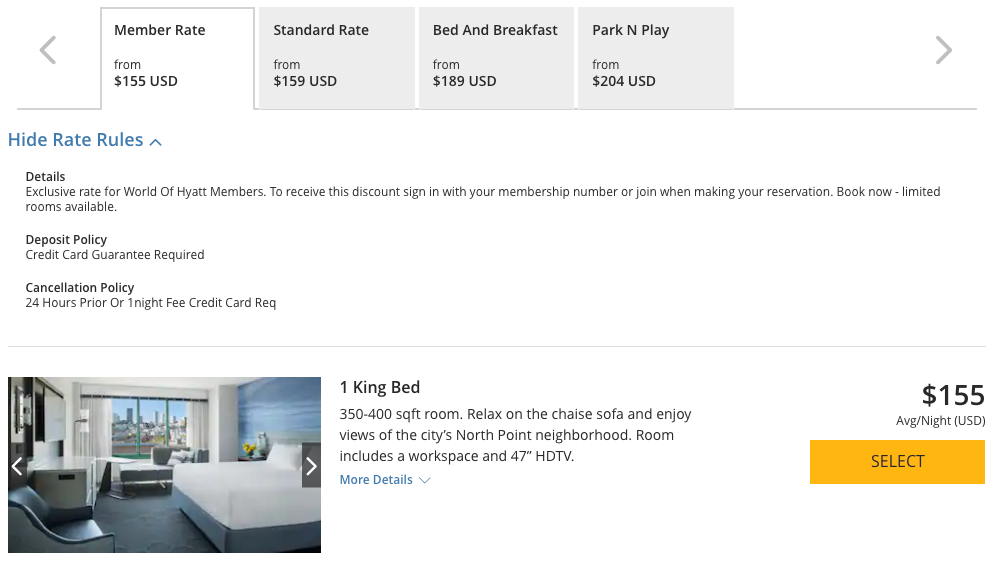

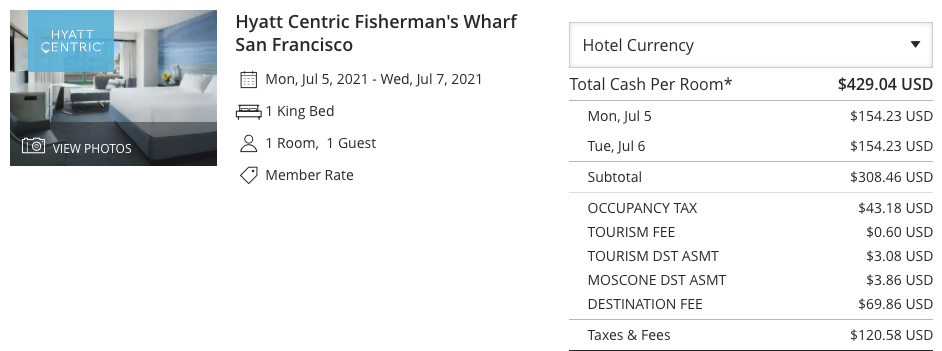

I'll usually avoid staying at a hotel that charges a resort or destination fee, but in the case of my most recent booking, I really didn't want to miss out on a $155 last-minute rate at San Francisco's Hyatt Centric Fisherman's Wharf, so I figured I'd try a different approach.

After confirming availability via Hyatt's app, I called up the hotel and politely explained that I was planning to make a same-day booking until I noticed the destination fee. I wouldn't be using any of the amenities, so if they were willing to waive the fee, I'd book a two-night stay.

The agent agreed to make a "one-time exception." She instructed me to book my stay and said she'd remove the fee from my account. Sure enough, at check-in, another agent confirmed that the roughly $35 daily "destination fee" wouldn't apply on this stay.

Related: How to avoid resort fees

Still, she was friendly as can be and handed me a card outlining the destination fee perks, saying I was free to take advantage even though I wouldn't be paying this time around. Score!

There was one challenge left to overcome: avoiding the hotel's $62 parking fee. I ended up driving around for a few minutes and found a lot for $25 per night just up the street — combined with the resort fee, I saved more than $70 each night with just a bit of extra effort, enough to cover two fantastic dinners in San Francisco.

Bottom line

Is this "trick" guaranteed to help you avoid a resort or destination fee every time? No, I'm sure some properties won't be willing to budge, but in this case, it was a win-win, giving the hotel some extra revenue it would have otherwise missed out on while saving me a bundle on my stay.

If you're looking for a bit more of a sure thing, I'd book an award with Hilton or Hyatt (they don't charge resort fees on award stays), or simply avoid hotels and resorts that work in sneaky fees. I feel much better about giving my business to properties that don't try to trick consumers into paying extra fees.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app