ANA Increases Fuel Surcharges Overnight

Changes to frequent flyer programs are typically never good. And they're even worse when they happen with no notice to members. Well, unfortunately, ANA did just that last night with its Mileage Club program.

As of August 1, award tickets on ANA metal incur higher carrier-imposed surcharges. The reason? Increasing fuel costs.

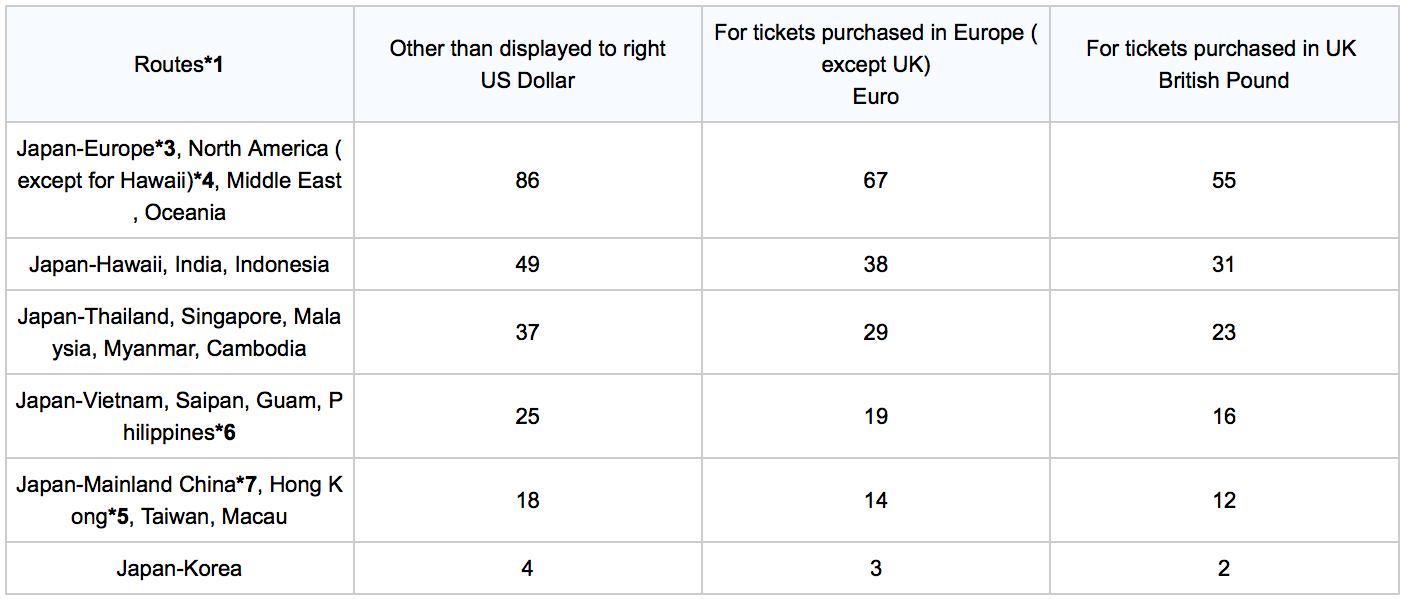

Up until July 31, awards from North American to Japan incurred $86 in fuel charges each way.

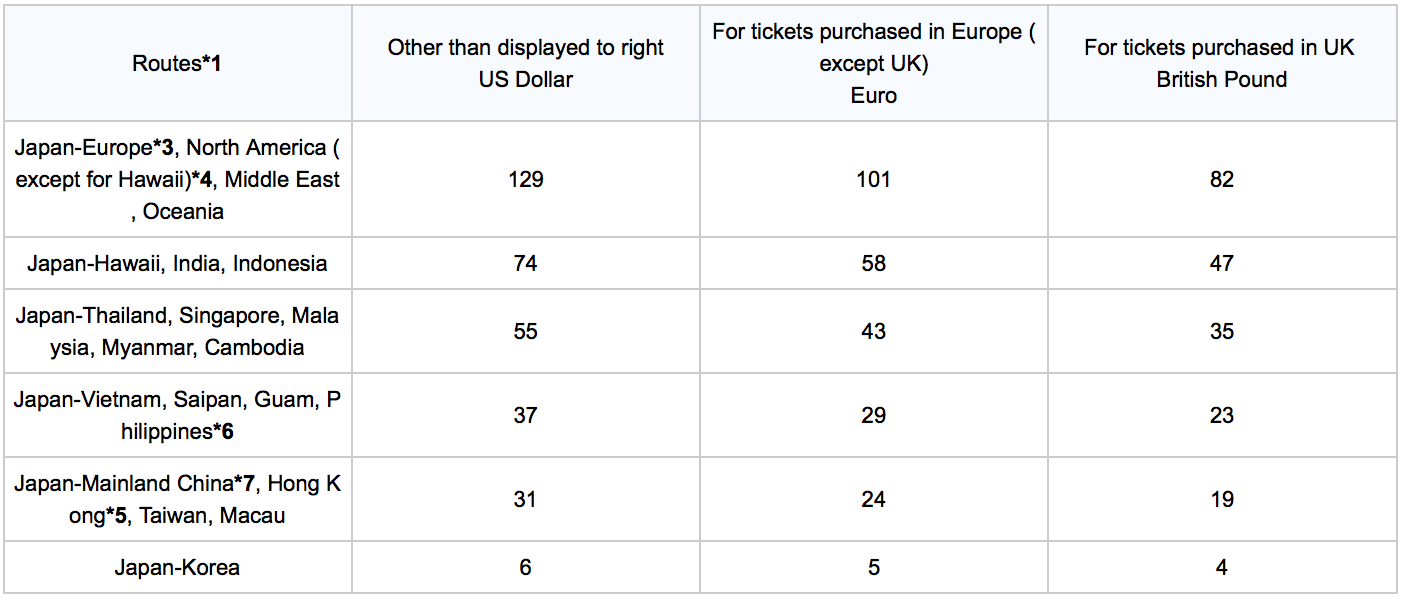

Now, they'll run you $129 each way. And awards between North America and Japan aren't the only ones seeing a jump in surcharges — they increased across ANA's network.

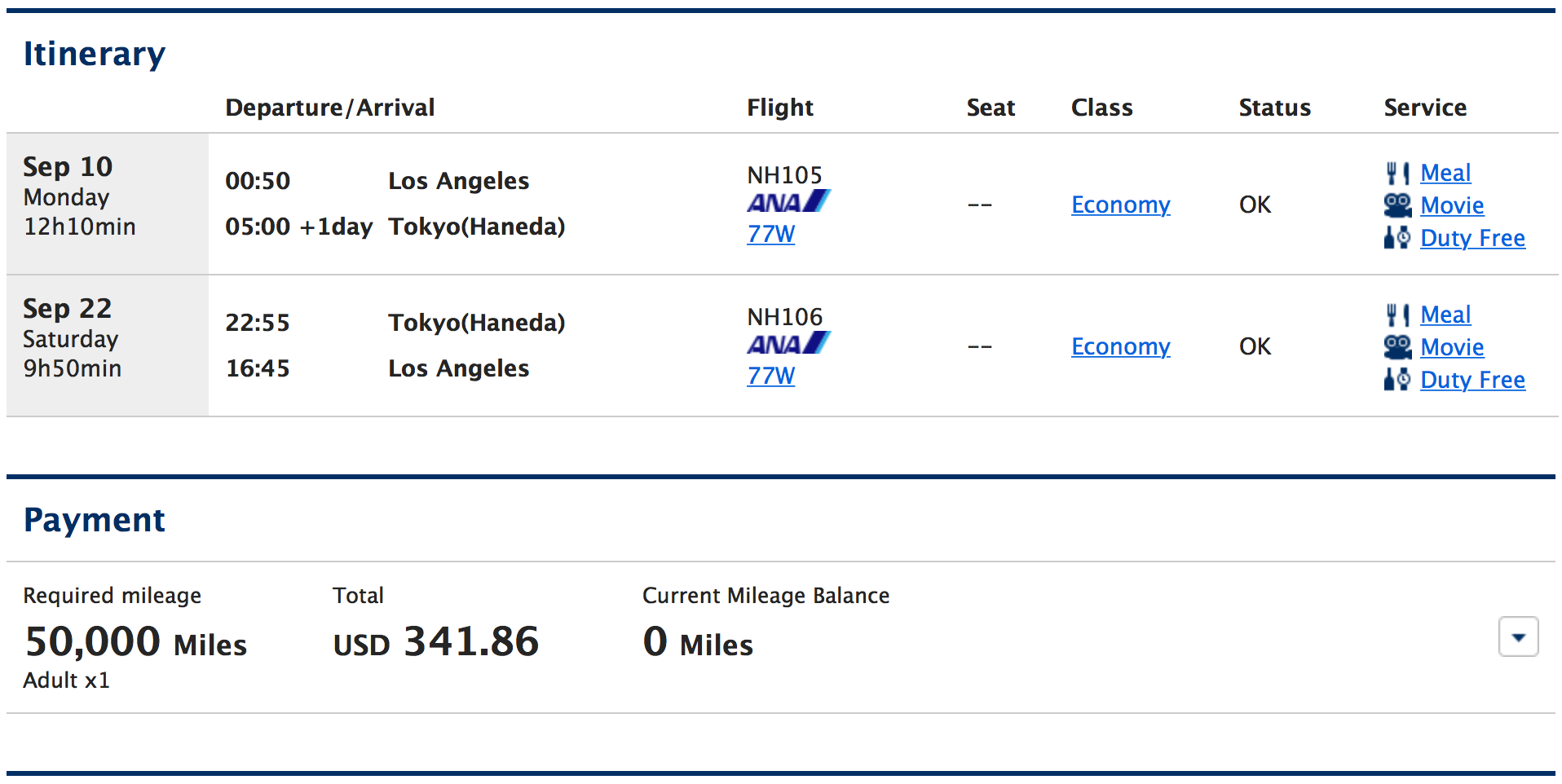

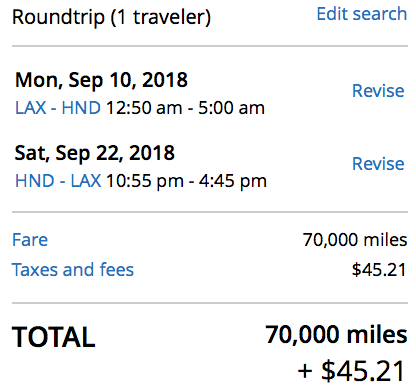

This definitely hurts, especially because ANA's carrier-imposed surcharges were already hefty before these changes. That said, ANA still charges fewer miles than its partners for awards to Japan. For instance, while a round-trip ANA ticket between the US and Japan in economy will set you back 70,000 United miles, it'll only cost you 50,000 ANA miles.

On the flip side, ANA charges about $340 in taxes and fees, while United only charges about $45 for the same award, so it's up to you to decide whether you'd rather spend fewer miles or pay less out of pocket.

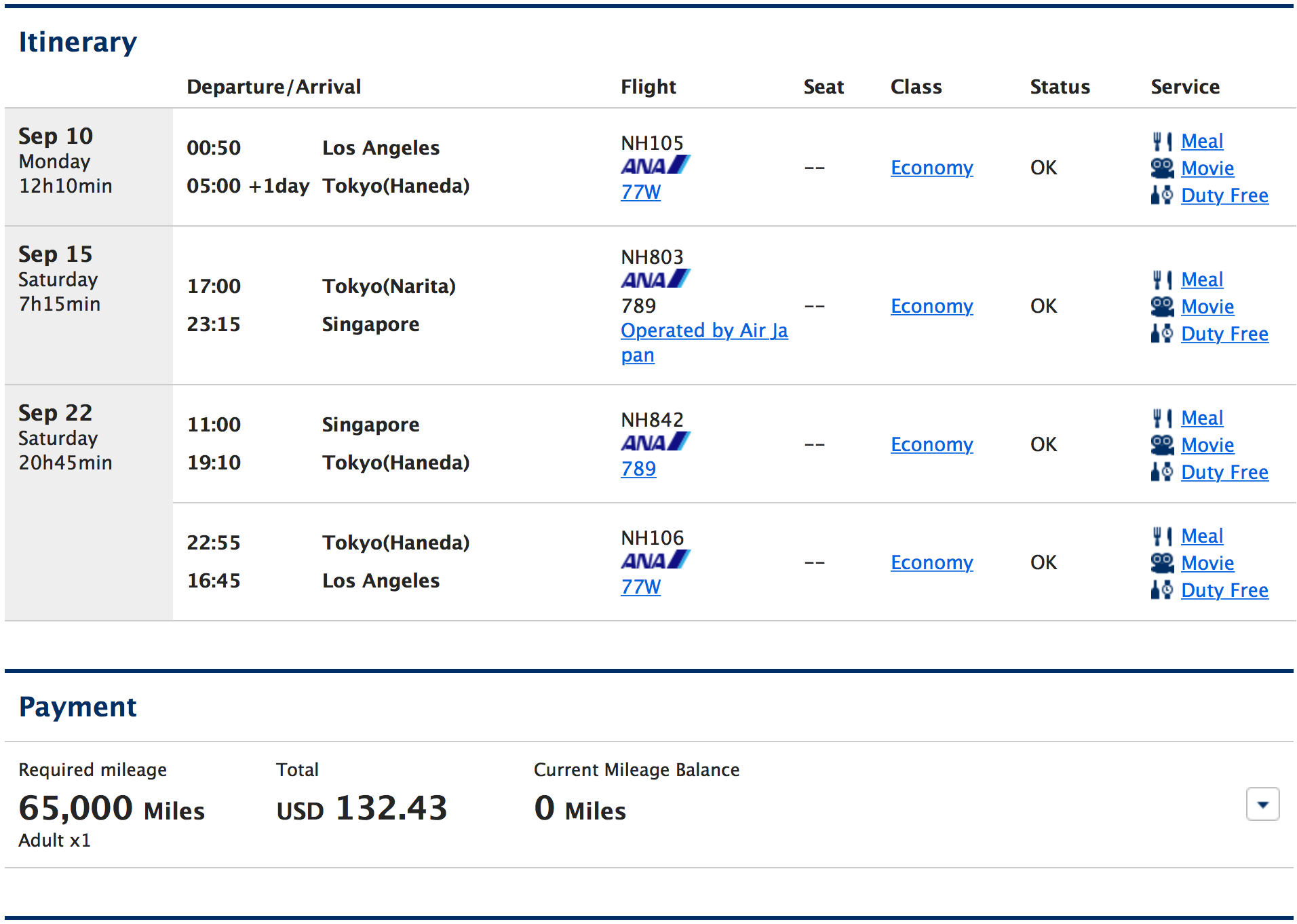

There is a way to lower the fuel surcharges when booking through ANA, though. One stopover, other than your destination, may be made on flights departing from overseas, and by doing so, you'll often pay less in surcharges. Although it varies based on the destination, when adding a stopover in Singapore (SIN), we were able to wipe out the fuel surcharges completely (the $132 is for taxes and other fees).

Although this change came without any notice, this isn't the first time ANA's adjusted its fuel surcharges based on fluctuating oil prices. For instance, the carrier reduced the charges in 2016 based on the declining price of oil. As of now, ANA's website says that the prices are in effect through September 30, 2018, but it's unclear what will happen after that date. After all, American Airlines CEO Doug Parker has hinted several times that consumers should prepare for higher airfare as airlines deal with increasing fuel costs.

As a reminder, ANA's program is a 1:1 transfer partner of American Express Membership Rewards. For a limited time, Amex cardholders can also score incredible ANA redemptions by maximizing the 30% transfer bonus to Virgin Atlantic Flying Club, though the higher fuel surcharges will still apply.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app