How American Express' extended warranty saved me $150 — and a huge headache

I have an embarrassing admission to make: I spent $150 on a toothbrush. I had been pricing a couple out for a while, and when The Platinum Card® from American Express offered me 6% back on the purchase, I couldn't resist the promise of Bluetooth capabilities and — perhaps the most alluring and unnecessary bit — colored lights to indicate when I was brushing too hard.

Looking back, perhaps it wasn't the best decision I've ever made, given that the brush broke after less than three years, just four months outside of its two-year warranty.

This is a tale of how I leveraged American Express' extended warranty perk to recoup the loss.

A great deal ... sort of

In August of 2021, I was lazing in the Greek sun onboard Azamara Quest, gushing to one of my best friends about the perks I was receiving with my one-month-old Amex Platinum card.

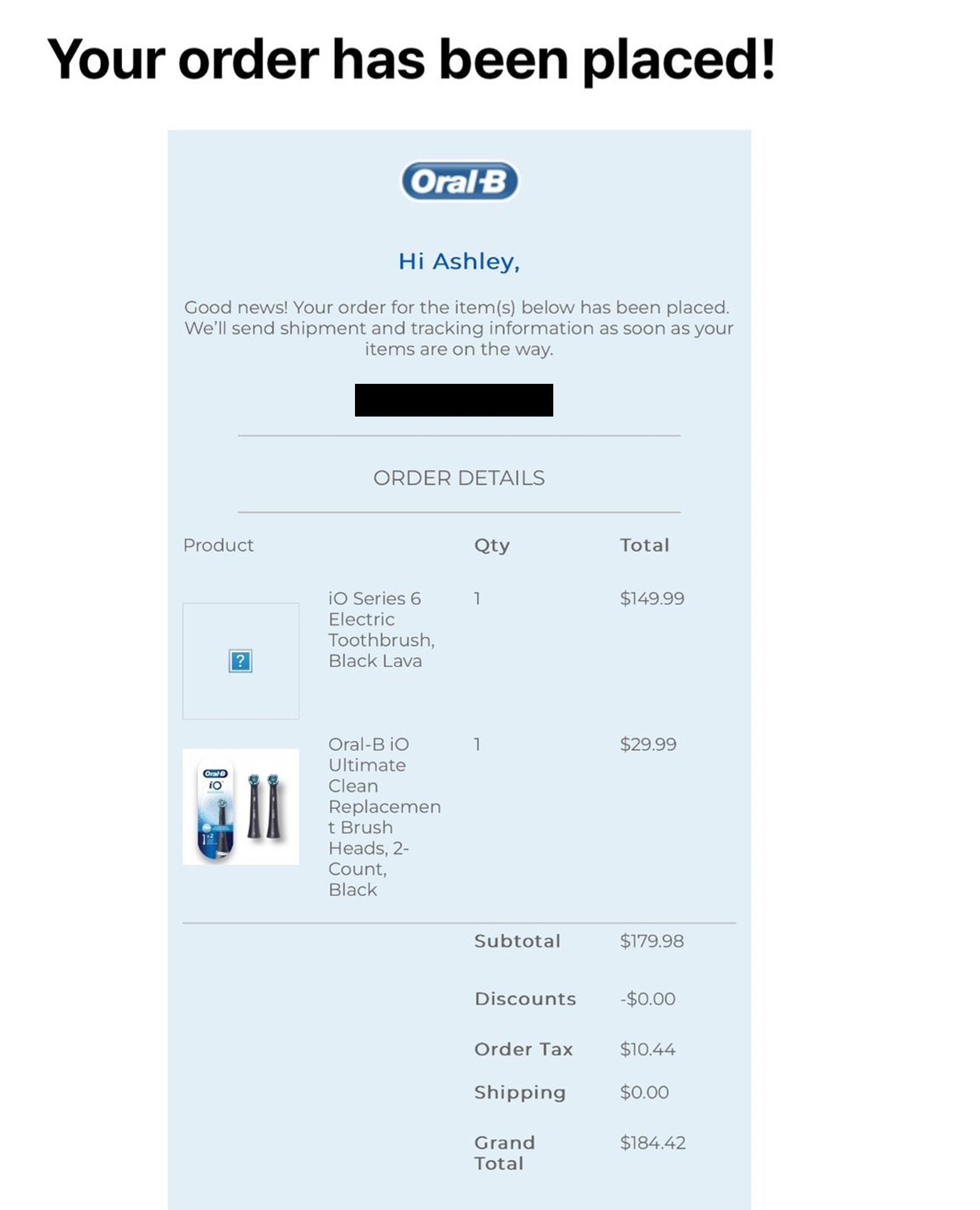

As I pulled up the app to show her some of the deals, I noticed one that stood out: 6% back on Oral-B purchases. It just so happened that the same brush my dentist recommended was part of the offer, so I bit the bullet (figuratively, of course, in case my dentist is reading this) and purchased it right then and there.

Fast-forward two years and four months. I woke up and went to brush my teeth, as I normally do. When I turned the brush on, the brush head wasn't working properly, and the entire apparatus was making an extra-loud vibrating sound.

Related: The best cards for extended warranties

After switching the brush head failed to fix the issue, I discovered that the handle's magnetic component, which holds the brush head in place, had dislodged from the handle and was stuck inside the first brush head. I pulled it out with tweezers, put it back inside the handle and hoped it would solve the problem.

It didn't.

What I did first

Since many companies tend to be the most responsive on Twitter, I sent a message to Oral-B, the brush's manufacturer, showing them photos of what happened and a video of the noise the brush was making.

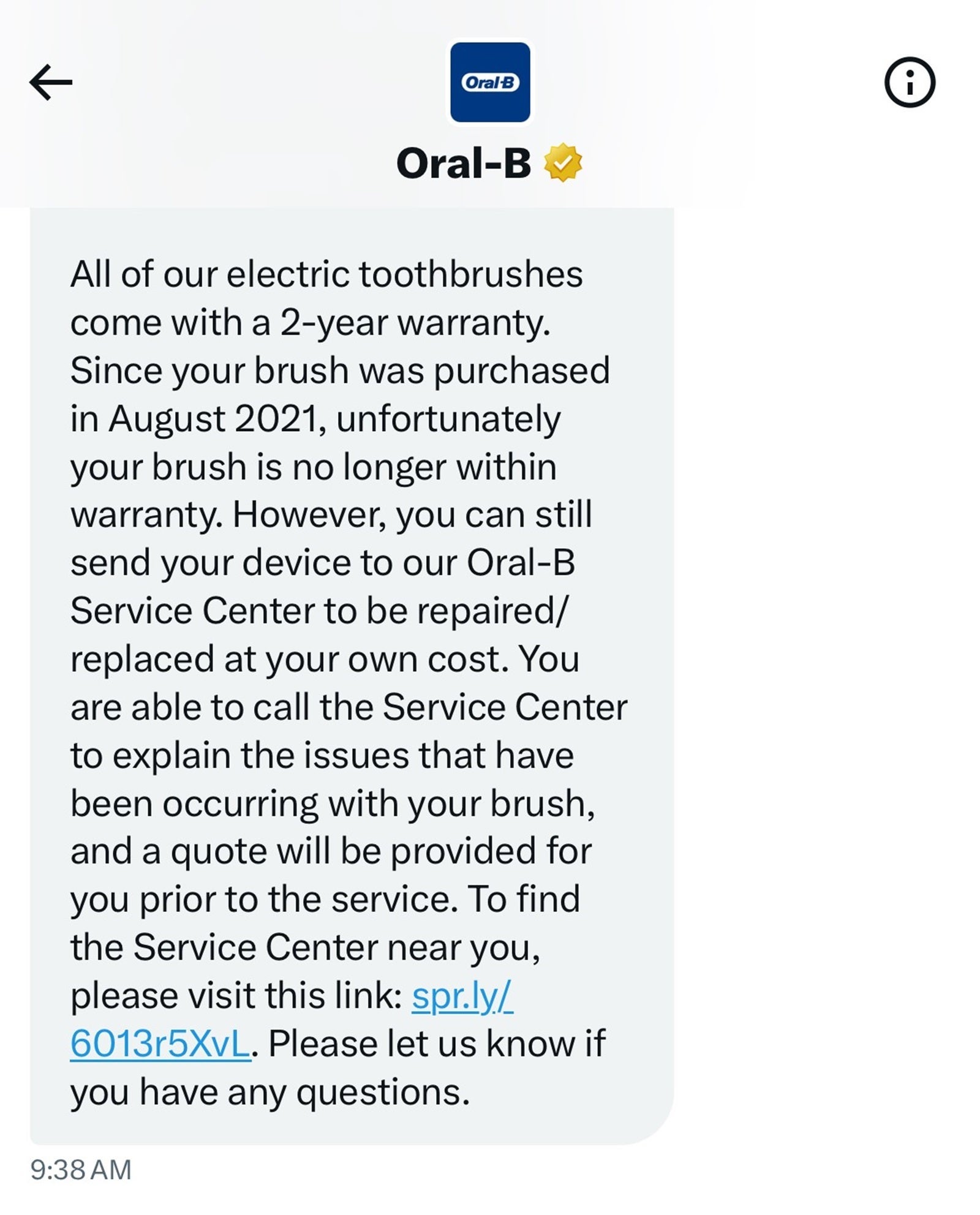

They responded the same day, asking for my receipt and some additional information. I provided it, and the following day, they denied my request for assistance because the brush was four months out of warranty.

I asked one more time if there was anything they could do and mentioned that I wouldn't be spending that kind of money on another one of their toothbrushes if it was just going to break. They said they'd look into it, but I didn't hear back for almost 24 hours.

What I did next

In the meantime, I remembered that Amex offers travel protection for trips booked with certain cards, and it made me wonder if there was some sort of protection for other purchases. Because I'm new to the cards game, I searched The Point Guy's site and found that Amex offers an additional one-year extended warranty on many purchases.

When you purchase eligible items with your qualifying American Express card, Amex's extended warranty provides one additional year of coverage equal to what's offered by the manufacturer's warranty, as long as the original warranty is five years or shorter. Coverage limits are $10,000 per item and $50,000 per coverage year.

*Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

I called and spoke with an agent over the phone, who took a report to initiate my claim. He told me the cost of the brush should be covered and asked how much I wanted to request. (Although he was able to pull up the charge by looking at my statements, the total amount included taxes and extra brush heads, so I requested $149.99, the pre-tax amount of the brush.)

He told me to expect an e-mail within 48 hours, asking me for additional information in order to complete the claim.

Two unexpected surprises

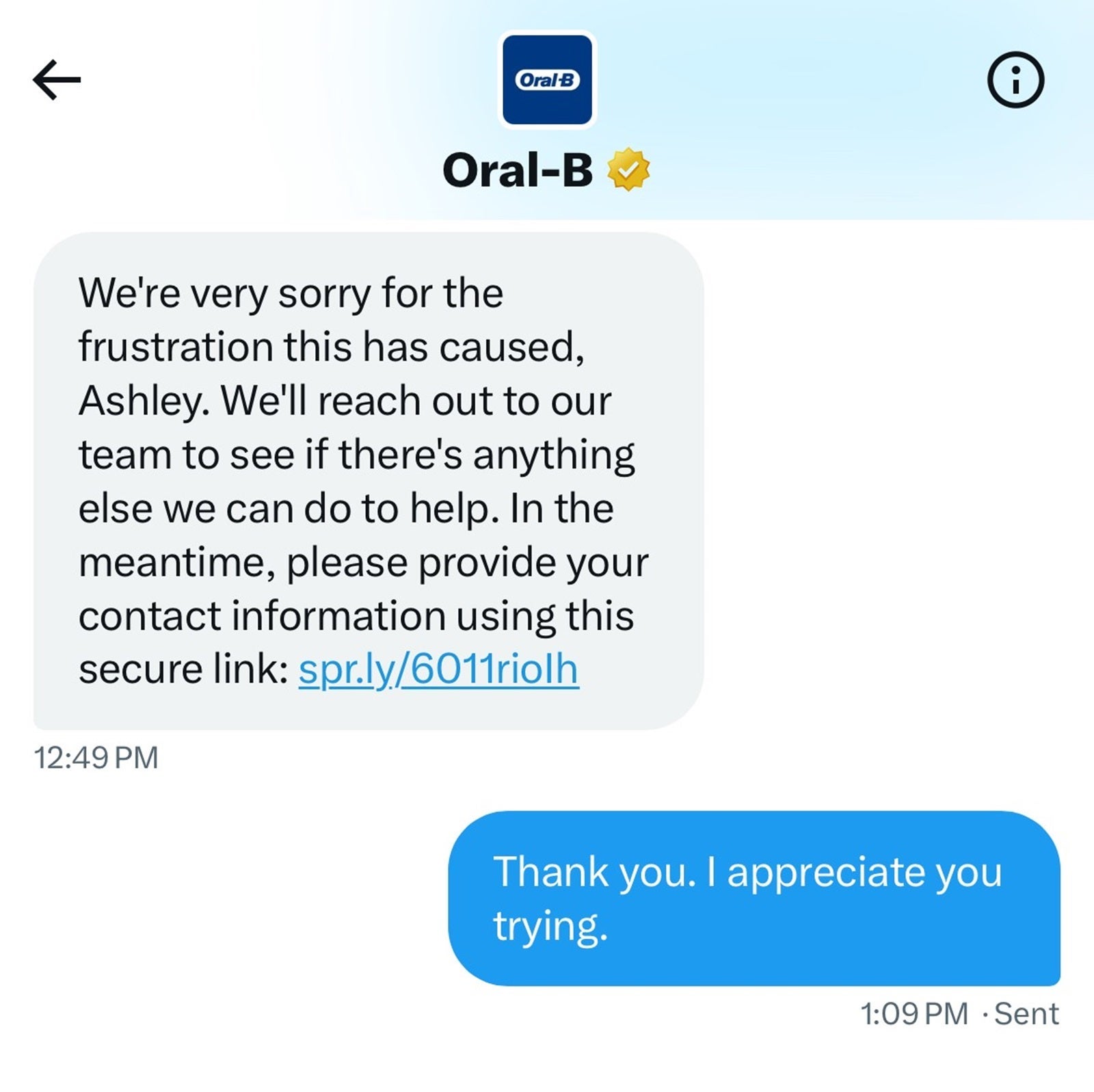

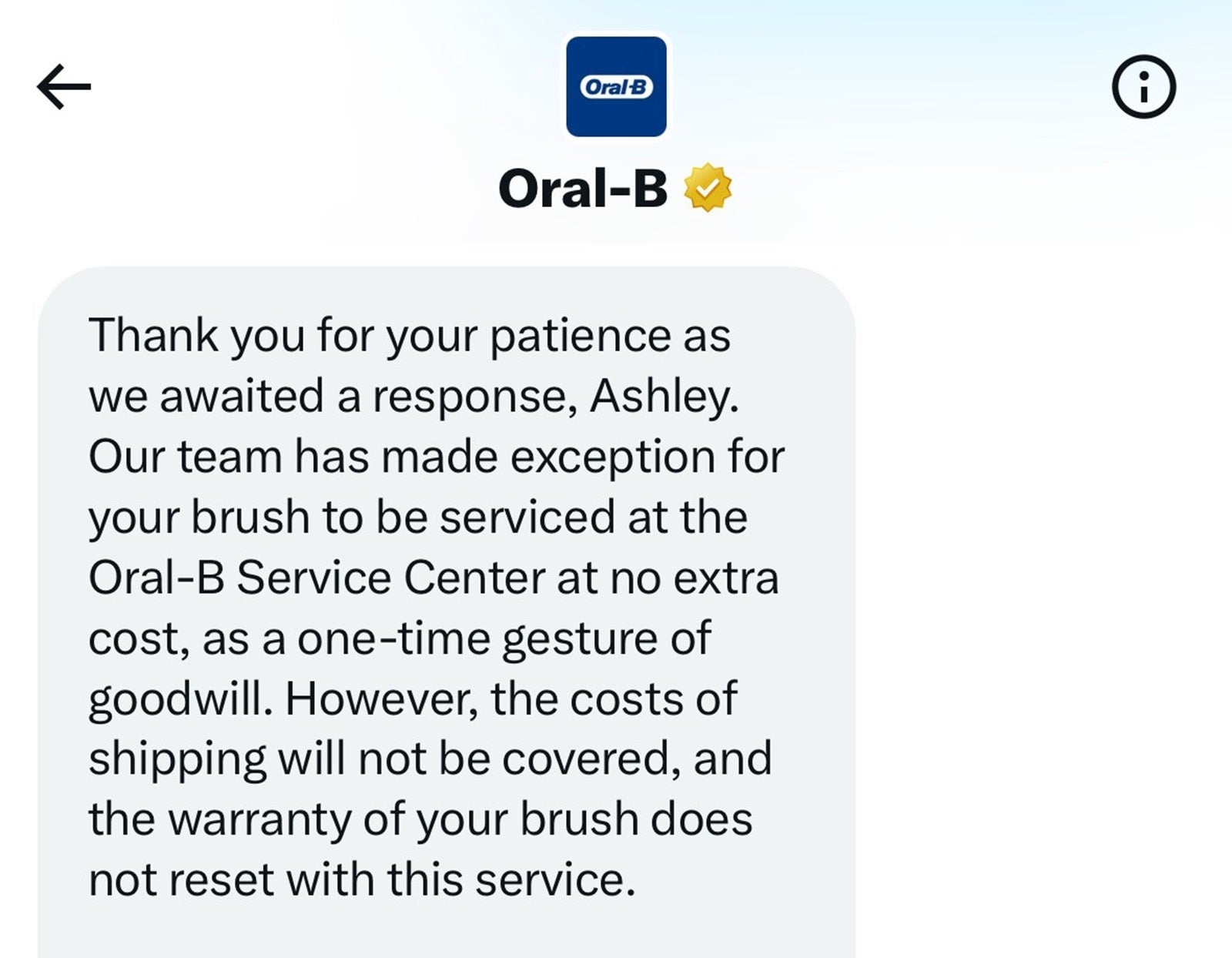

The next day, Oral-B replied on Twitter to say that it had changed its mind and "made a one-time exception ... as a gesture of goodwill." However, instead of refunding me or completely replacing the brush at no cost, they offered to repair the broken brush. They said I'd have to pay for shipping, and there would be no new warranty.

Those terms weren't acceptable to me, given that I'd be out even more money for a potentially faulty toothbrush.

I tried to decide whether I should take Oral-B up on its offer or continue with my claim through Amex. (After all, the idea behind an extended warranty is that it offers you the same warranty as the original one provided by the manufacturer. If I had fallen within Oral-B's original warranty time frame, I would have gotten a full replacement, according to the terms.)

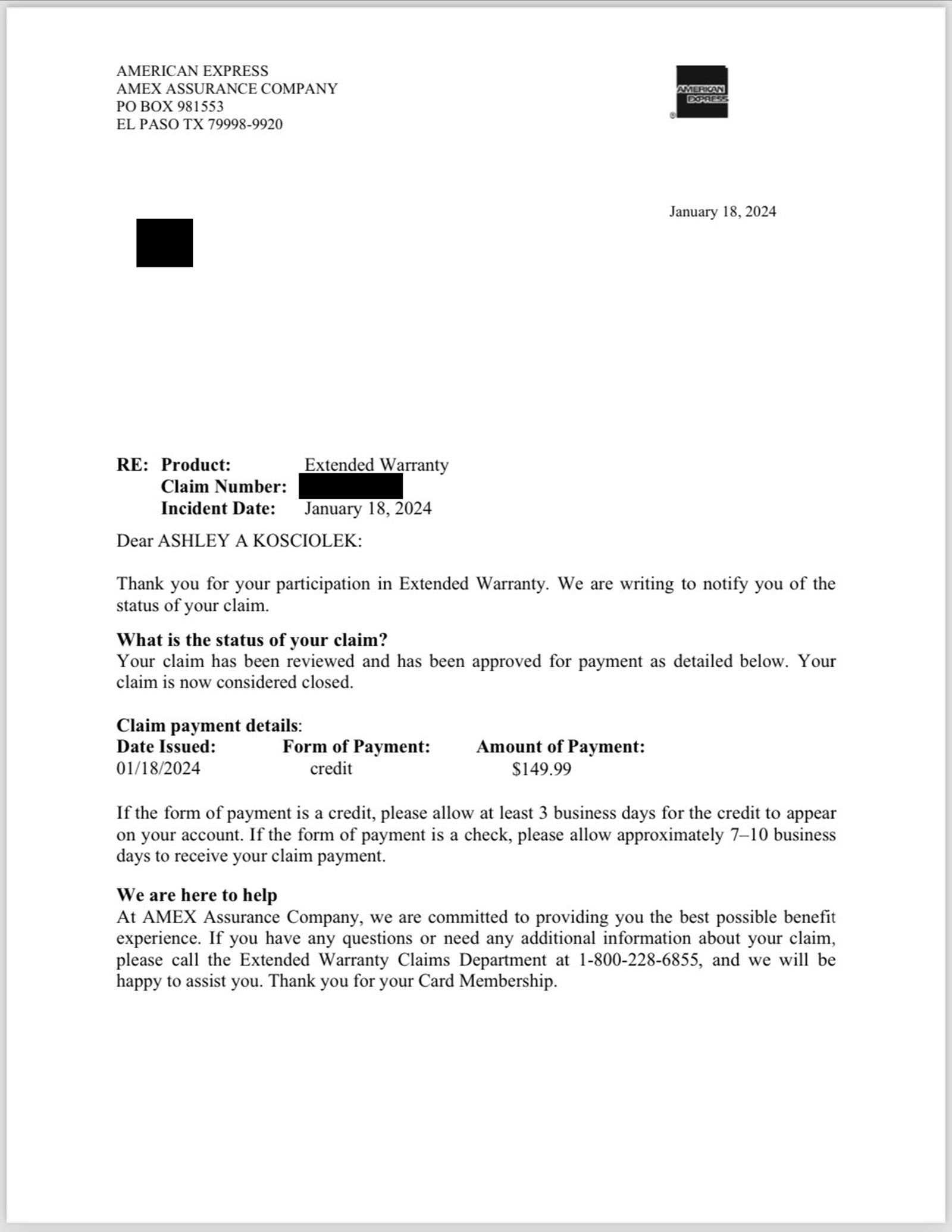

As it turns out, I didn't have to decide because, by the time I heard back from Oral-B, I already had a message waiting in my inbox from American Express, sent the day before (the same day I called), telling me that they had processed my claim and credited $149.99 — the cost of the brush — to my account.

Related: Choosing the best American Express card for you

Amex didn't ask for further documentation and when I checked, my account had already been credited. That means I was able to purchase a brand-new brush, which comes with another two-year warranty through Oral-B, plus another year of protection through American Express.

Bottom line

I have never had such a smooth claims experience with anything — whether it be car insurance, travel insurance or broken luggage reimbursement. This process with Amex was easy and unbelievably fast.

I'm not sure why I didn't have to provide additional information. Perhaps it was a fluke. Maybe it's because it was such a small claim amount, or maybe it's because the agent was able to immediately look up my receipt for the purchase.

Regardless, consider this your reminder to check on whether your card offers this type of protection and, if so, to use it for your next pricey purchase.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app