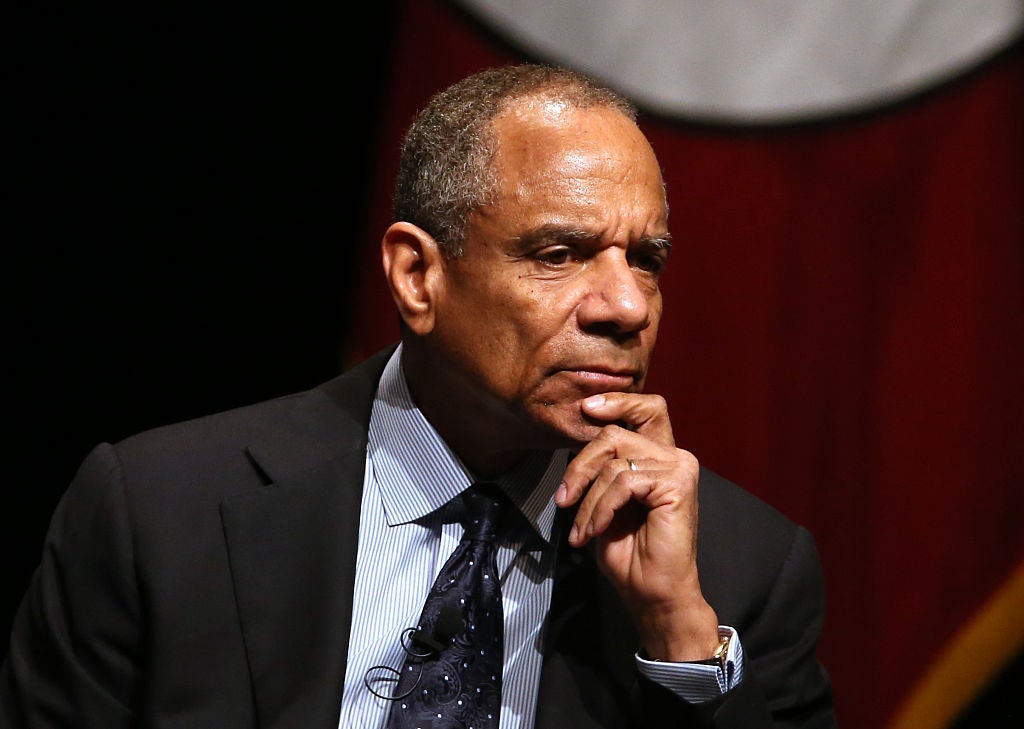

American Express CEO to Retire Next Year

Update: Some offers mentioned below are no longer available. View the current offers here.

Kenneth I. Chenault, the chairman and chief executive of American Express, announced on Wednesday that he will retire next year. Stephen J. Squeri, the company's vice chairman since 2015, will succeed Chenault as Amex CEO beginning February 1, 2018.

Chenault began his 37-year career at American Express as a director of strategic planning before eventually becoming the company's CEO in 2001. The 66-year-old is known for expanding Amex's business beyond its traditional core of wealthy and corporate customers and moving it into a broader market. During his tenure, Chenault expanded the Amex brand to many of the co-branded airline and hotel credit cards that consumers know today — Hilton, Delta and more. In all, the expansion helped Amex to become the credit card issuer with the highest consumer spending in the US.

"I've treasured every day of my 37-year career here," Chenault said on a conference call with analysts. "It's been a journey that spanned profound changes in the world of business."

Revenues at American Express grew from around $21 billion in 2001 to about $34 billion in 2014. But, the company has struggled in recent years as other issuers have entered the market with competitive premium consumer products. Case in point: the Chase Sapphire Reserve. When the card was released in August 2016, it shocked consumers with its 100,000-point sign-up bonus, premier earning structure and other perks. To respond, the issuer was forced to refresh its premium Platinum Card from American Express, increasing its earning structure and adding more benefits for cardholders.

Between 2015 and 2016, revenues and share prices dropped for Amex, however, the share prices have rebounded this past year. Chenault's successor, Stephen J. Squeri, has been with the company for 32 years, and has been in charge of running its corporate card division.

Squeri said the company is "moving into a period of growth." According to The New York Times, Squeri said his first priorities will be in the realms of digital innovation, establishing Amex's position at the top of the premium consumer market and expanding its share of commercial payments on the global scale.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app