New survey signals softening US travel demand heading into 2026

Travel has proven remarkably resilient in 2025 despite some pretty significant economic headwinds.

In their just announced third-quarter earnings, airlines suggested that things have stabilized after a weaker-than-expected start to the year — but all the major carriers have lower expectations than they did at the beginning of 2025.

Tariffs, inflation and high interest rates continue to weigh on consumers, which is causing some weakness in demand for airlines and hotels. We've also seen a substantial drop in international visitors to the U.S.

Still, recent polling from YouGov commissioned by TPG suggests that while some American consumers are planning on cutting back on travel next year, a majority will still spend the same or even more in 2026.

Related: Need to know: The 6 top travel trends for 2025

Consumers are still eager to travel

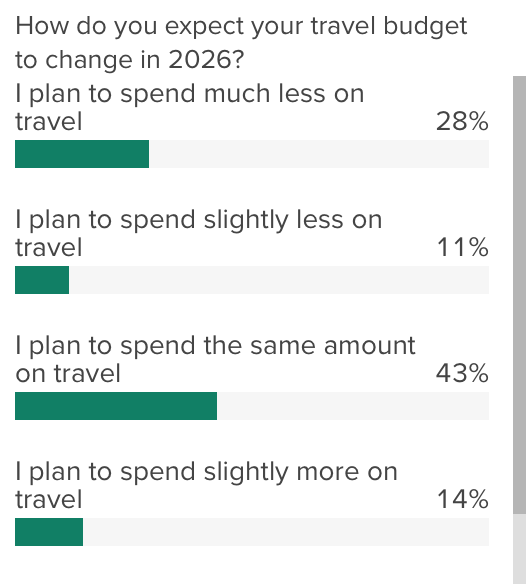

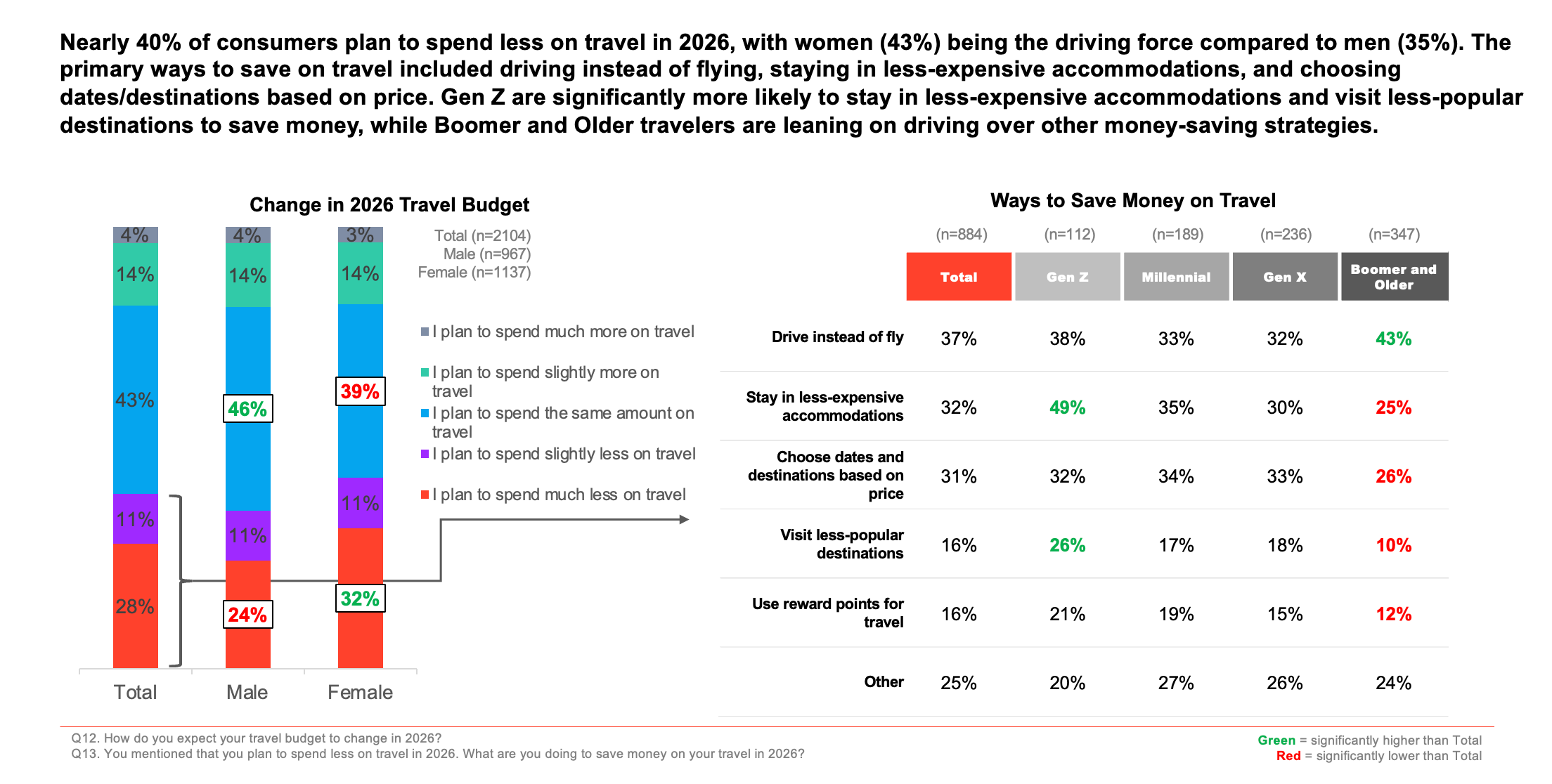

Nearly 40% of consumers (39%) plan to spend less on travel in 2026, but 57% said they plan on spending the same or slightly more.

Interestingly, according to our new polling, when it comes to spending less, women (43%) are the driving force, not men (35%).

While just 39% of consumers plan on spending less in 2026 than they did in 2025, this still presents a stark change from just a few months ago. In polling TPG commissioned earlier this year, only 9% were traveling less in 2025 than the year before. That suggests that the number of people who are cutting back is increasing, a worrisome sign for the travel industry.

Consumers are looking for ways to save

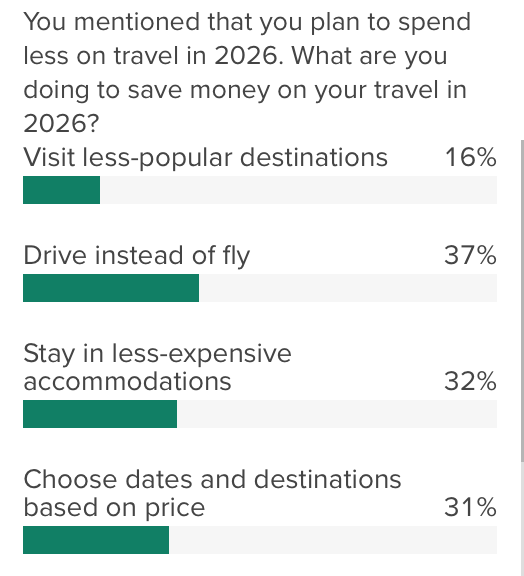

Consumers are making efforts to cut trip expenses. The primary ways to save on travel include driving instead of flying, staying in less expensive accommodations and choosing dates and destinations based on price. That means some consumers are choosing to stay in less popular places.

That follows our general advice at TPG to go where the dollar is strong, travel during off-peak dates and visit secondary cities or countries that are a bit more off the beaten path (think: Albania, Slovenia or Hungary in Europe instead of Switzerland or Italy).

Related: 13 underrated summer travel destinations

Generation Z is significantly more likely to save money by staying in less expensive accommodations and visiting less popular destinations, while baby boomers and older travelers prefer driving over other money-saving strategies.

A falling dollar is playing a role

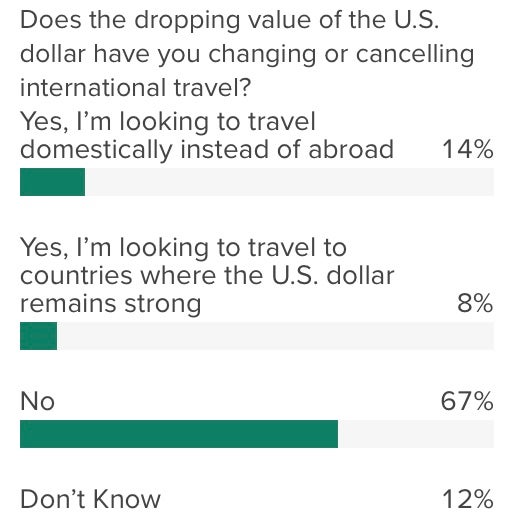

The dollar has lost about 10% of its value so far in 2025. That has some consumers shifting their plans, with 14% saying they will travel domestically instead of internationally and another 8% saying they are traveling to countries where the dollar remains strong.

Still, 67% of those polled said it wasn't making a difference.

Some are reconsidering international travel

It's been a year of upheaval in international relations, with reports of foreign visitors being questioned extensively at U.S. borders and an ongoing trade war rattling markets and nerves. All of that has some folks rethinking international travel.

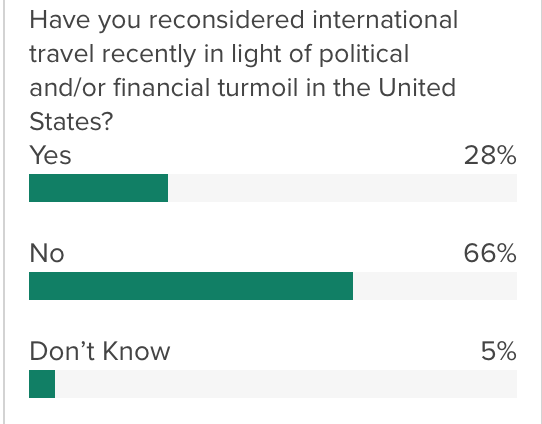

According to our new YouGov/TPG polling, slightly more than a quarter of individuals are reconsidering international travel in light of recent turmoil in the U.S.

Younger generations are less likely to cancel or change their international travel habits compared to Generation X and older generations.

Bottom line

While the appetite for travel remains strong, more Americans are planning to travel less next year and are looking for ways to spend less when they do travel.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app