American revamps Business Extra program with new awards, strict account requirements

Did you know that American Airlines doesn't just offer a loyalty program for individual travelers?

In addition to its AAdvantage program, the Fort Worth-based carrier also runs a loyalty program for small- and medium-size businesses, dubbed Business Extra. (If your business isn't yet a member of Business Extra, you can read all the details in our handy guide.)

On Tuesday, the airline unveiled some noteworthy changes to the Business Extra program, including new redemption options and stricter account requirements, through a program email sent to members.

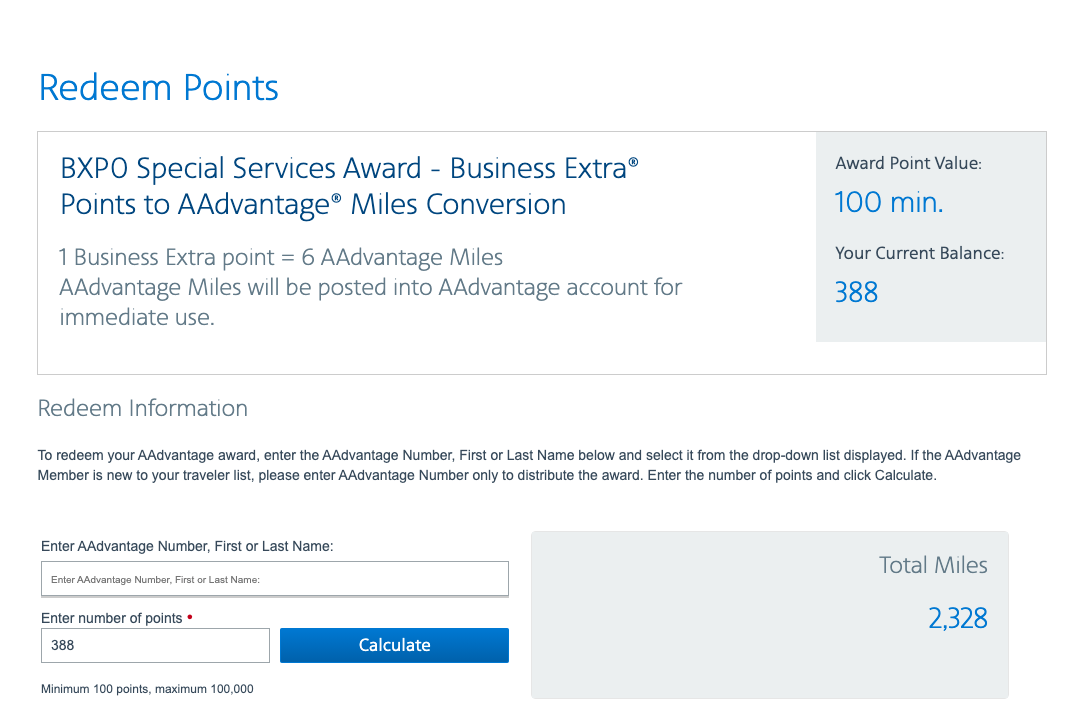

Perhaps the most exciting is that you can now convert your Business Extra points into AAdvantage miles. Effective immediately, you can send between 100 and 100,000 Business Extra points to your AAdvantage account. The transfer ratio is 6:1, and the miles will be posted immediately.

Whether this is a good deal depends on how you redeem your Business Extra points. TPG's go-to award is the BXP1 — a one-way, one-segment domestic upgrade — that costs 650 Business Extra points, which would now equate to 3,900 AAdvantage miles. If you can find upgrade availability, redeeming for BXP1s continues to be a great deal. (A domestic upgrade using AAdvantage miles for a discounted coach ticket would put you out 15,000 miles and $75.)

Of course, if you redeem for other awards, like a one-way domestic coach ticket, it could make sense to convert your Business Extra points into AAdvantage miles. That award costs 2,000 Business Extra points, which now convert into 12,000 AAdvantage miles. American often offers domestic AAdvantage rewards for lower than 12,000 miles, making for a lucrative transfer in this situation.

And if you have fewer than 650 Business Extra points with no plans to grow your account balance, then cashing them out for AAdvantage miles makes the most sense. You'll want to crunch the numbers before you convert since the process is final.

Related: Guide to earning and burning with American Airlines' Business Extra program

In addition to the new conversion offer, you can now redeem 6,600 Business Extra points for a year of American's mid-tier Platinum status. Previously, the airline only offered the ability to redeem for entry-level Gold status.

Finally, the airline is offering a new carbon emissions offset reward. You can use 300 Business Extra points for one carbon emissions tonnage offset through Cool Effect.

While the airline is adding redemption options, it's also clamping down on who can access the program.

Beginning on Jan. 1, 2023, current members will be required to have three unique travelers and maintain $5,000 in qualifying Business Extra flight activity during the previous 12-month period to redeem points. This new policy will go into effect immediately for new members who join the program on Oct. 4, 2021, or later.

As for what's next, American writes that "we're continuing to evaluate the Business Extra program to provide members with more options, value and flexibility for their business travel."

Sole proprietors and other small businesses with minimal spending in the Business Extra program will want to redeem their points and cash out soon.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app