Airport parking crisis? How to save money while securing a space

As travel bounces back to pre-pandemic levels, we've already seen expensive flights, scarce rental cars and limited hotel rooms affect those looking to get away.

Now, due to an increase in the number of those flying, combined with more of those travelers driving themselves to the airport than before, parking is the latest part of the travel infrastructure to feel the strain.

Sold-out airport lots and price increases have been reported across the country, with dire warnings about limited availability ahead for the busy Memorial Day weekend and the summer travel season. Here's what you're likely to find when you pull into the airport this summer -- and how to ensure your car has a place to park.

Sold-out airport parking and increasing prices across the country

In a May 10 press release, San Francisco International Airport warned its customers that "SFO expects parking garages to be at or near capacity during the summer travel season." To make matters worse, one Park 'N Fly lot near SFO was just sold last week to a shopping mall developer for $85 million, taking 1,840 spaces off the market and further hurting supply. Doug Yakel, public information officer at the airport, told The Points Guy "while parking rarely sells out, given the anticipated traffic, we recommend guests book their parking at least one week prior to the start of their trip."

Other airports are facing a parking surge as well.

Los Angeles International Airport (LAX) shared via its Twitter account on May 16 that "Sunday was our busiest day at the TSA checkpoints since early 2020 ... This means you need to arrive early and plan your parking ahead of time at parking.flylax.com especially as the Memorial Day holiday nears!"

The Port of Seattle issued a parking alert for Seattle-Tacoma International Airport on May 15: "The SEA parking garage is near capacity and continues to be extra busy this weekend. Please allow extra time to find a parking spot or consider alternate transportation." This increase in demand comes despite SEA raising airport parking rates by 7% in March.

Phoenix Sky Harbor International Airport raised its parking rates 10%-25% in February for its garages, with Greg Roybal, public information officer for the airport, telling The Arizona Republic "the increase is due to high demand for parking."

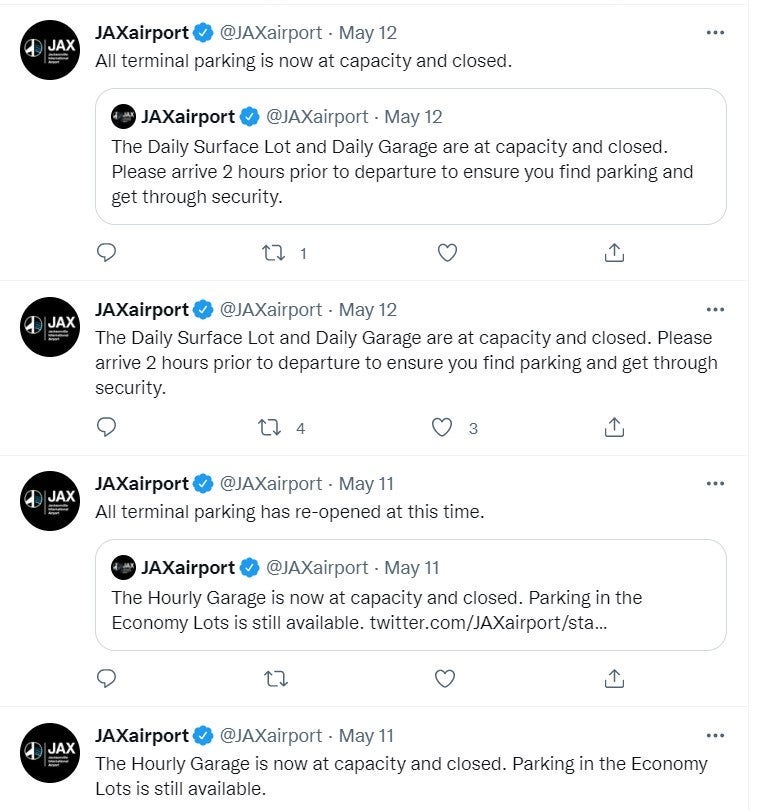

During at least the last two months running, Jacksonville International Airport (JAX) has reported on a nearly daily basis via its Twitter account that some or all of its airport parking facilities had reached capacity and were temporarily closing. It suggests travelers allow extra time before their flights to deal with the parking situation.

Baltimore/Washington International Thurgood Marshall Airport (BWI) reopened a 1,400-space express parking area last week to meet increased demand. The lot had been closed since March 2020.

Last week, the Dallas City Council approved increases in parking fees of up to 44% at the Southwest Airlines hub Dallas Love Field (DAL). According to local outlet WFAA, Mark Duebner, the city's director of aviation, requested the increase because "As customer demand returns to pre-pandemic levels, parking rates need to be adjusted to reduce demand" as they've seen "parking availability dwindle."

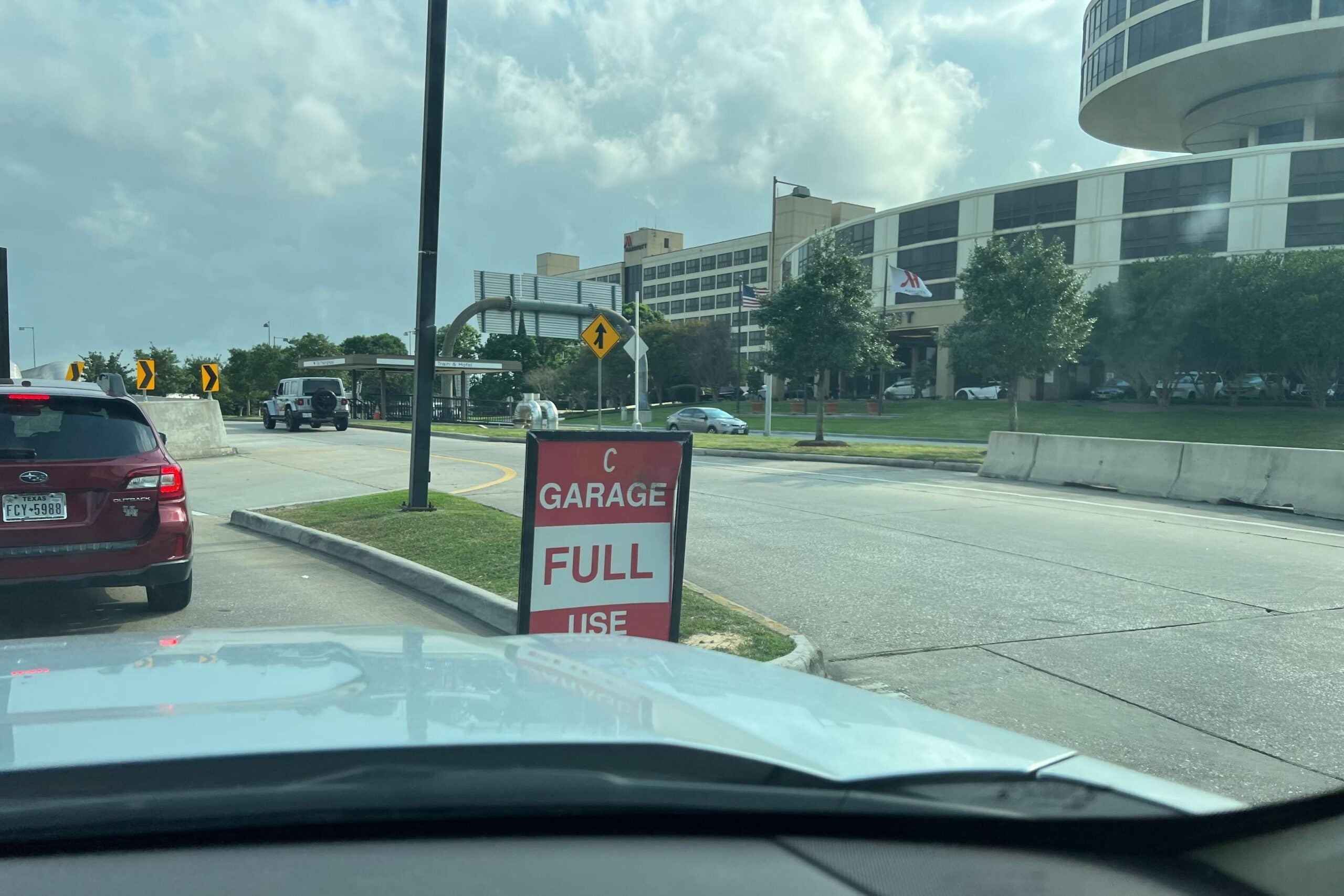

At Houston's George Bush Intercontinental Airport (IAH), the situation is compounded by large-scale construction on a new international terminal that has taken multiple parking garage areas offline. The remaining on-site garages at IAH, especially at Terminal C, have already sold out multiple times in recent months.

Related: Tips to deal with a 'sold-out summer'

Strategies to deal with airport parking shortages

Reserve a spot ahead of time

Much like how you can no longer wait until the last minute to book your rental car, the same is true with airport parking spots. You can't assume there will just be an available spot at the airport -- especially during peak travel times.

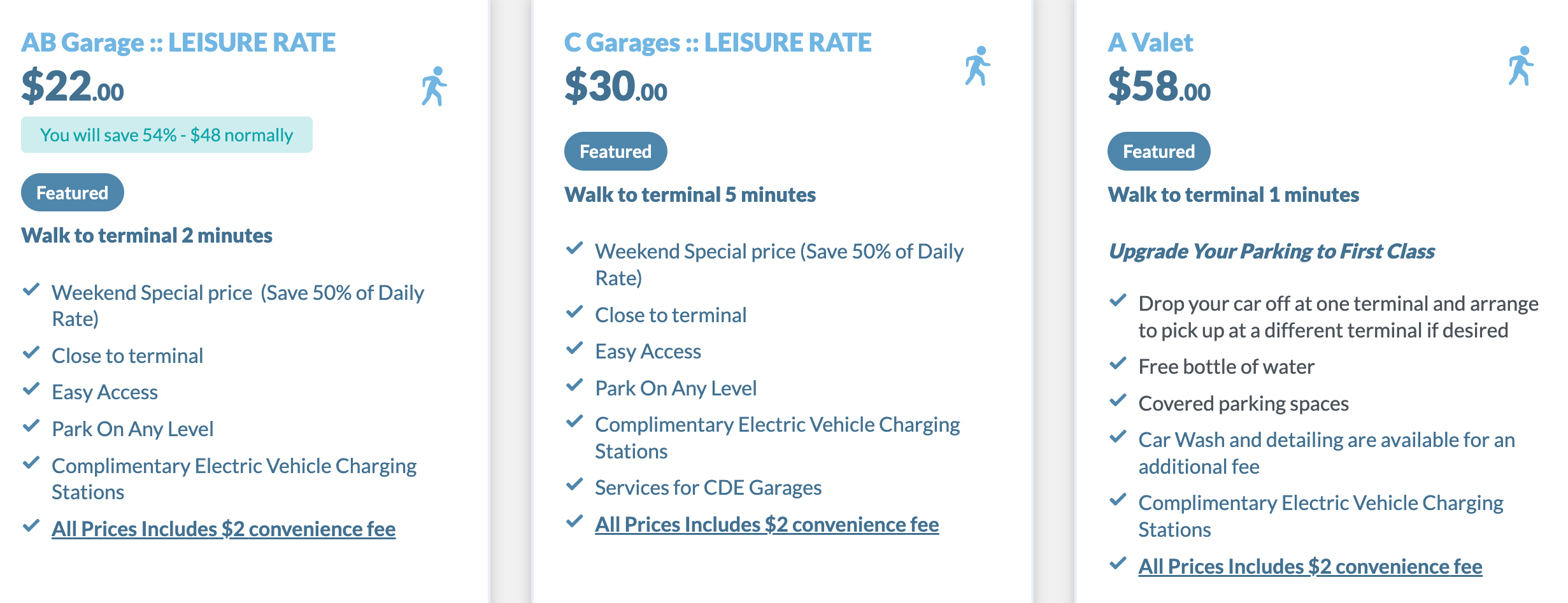

Reserving a spot in advance (even on the day of your flight) not only secures you a coveted spot. You may potentially get it at a lower rate. For example, at IAH there are days the garages sell out. However, if you book online in advance you can still save 33% on the regular rates during weekdays and up to 50% off on the weekends.

While on-site parking may have the most acute space and demand constraints, even off-site parking lots can sell out. Be sure to use their reservation systems when available. Signing up for an airport or off-site airport parking app (like Park 'N Fly) can also provide discounts and special deals on top of ensuring you have a spot and managing shuttle service on the go.

San Francisco Airport suggests "travelers book parking early using SFO's online booking system, which allows users to choose their parking dates and times and enter payment information." If you don't have reservations, you should check ahead on the airport website or Twitter feed, where you may see alerts about parking capacity and shut-downs.

Expand your parking search off-site

Off-site airport parking can provide cheaper rates in exchange for dealing with a longer shuttle ride to reach the airport.

Increased parking rates are encouraging new entries and expansions in the airport-adjacent parking market. Around SFO, I've seen multiple new parking areas open in the past year. However, before booking with any off-site location, and particularly new offerings, carefully look at their shuttle service options and hours, and read user reviews of the parking lot service.

When booking alternate lots in my eternal quest for deals, I've had to deal with slow or unavailable shuttle service and some lots located in questionable areas. However, sometimes all it takes is 10 extra minutes of a shuttle service each way to save some cash and have access to an expanded list of parking options.

Use public transportation

While accessing and riding public transit with a full set of luggage is never fun, it will be significantly cheaper than any other option (aside from having a friend drop you off).

For example, BART trains from Oakland to SFO cost about $12, while a morning trip via Lyft, when available, is estimated at $70 (but actual prices can be higher) and taxis can run more than $100. Going by train from New York's Penn Station to Newark Liberty International (EWR) via NJ Transit, connecting to the AirTrain, will cost you $15.25 each way for an adult ticket, which may well be much more affordable than the $38-per-day rate for the on-airport lot.

Stay at an airport-adjacent hotel the night before your trip

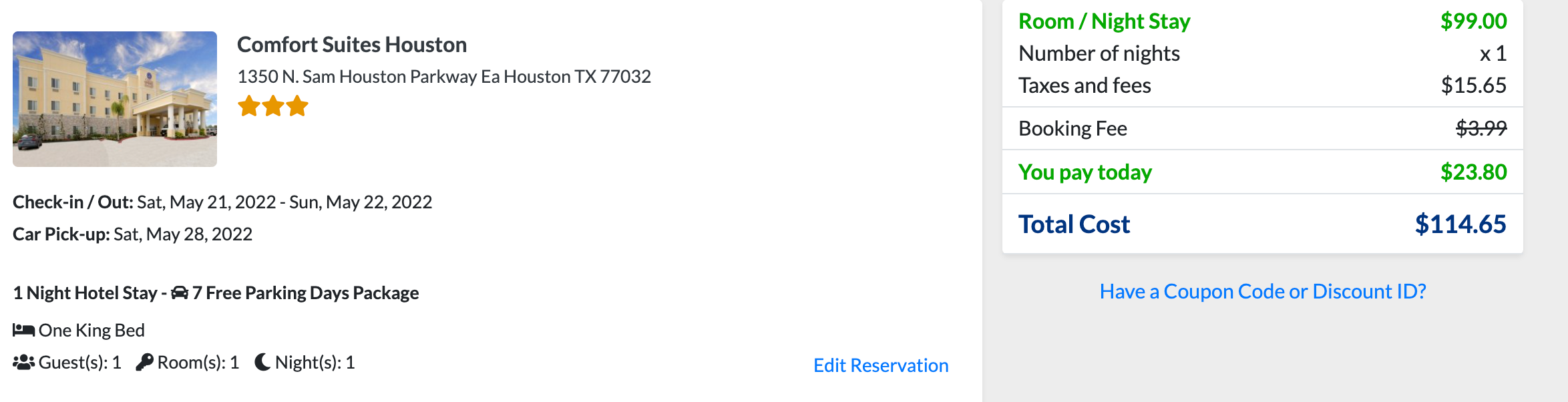

Some hotels near airports offer free or greatly discounted parking at their lots for guests. Particularly if you're going on a longer trip, parking your car for a week or two at an airport hotel will more than make up for the price of one room night.

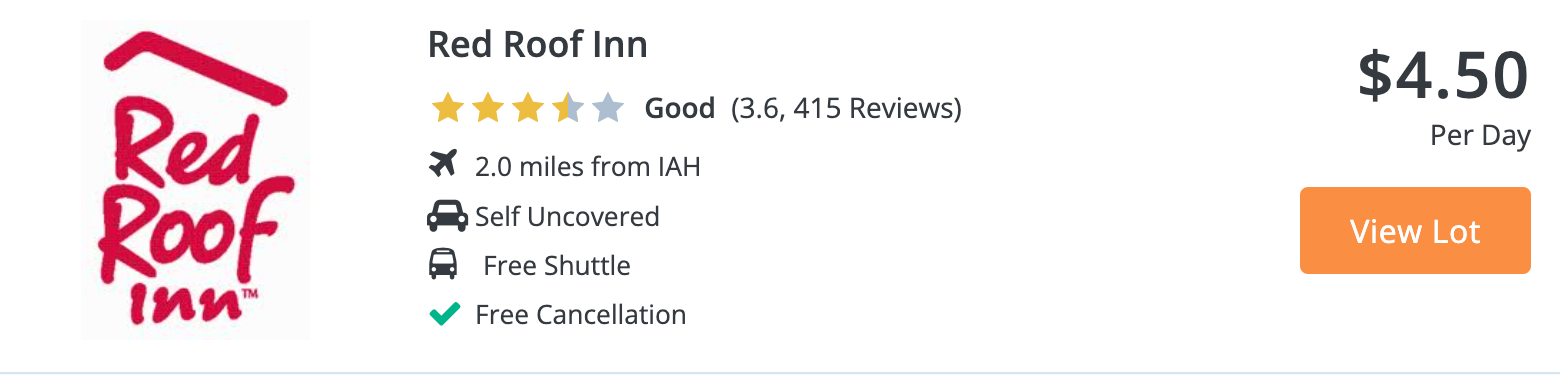

Websites such as ParkSleepFly.com also make hotel parking available without a hotel room for rates starting at just a few dollars per day in some locations, which can help if you run into shortages at the airport itself.

Airport hotels generally have reliable shuttle service to the airport to serve their customers, many of whom are traveling airline staff members. I've personally saved money using this strategy multiple times at hotels near SFO.

Bottom line

Whether you want to save time with on-airport parking or search for discounted off-airport parking, like with everything else, there are ways to save money and time.

Regardless of your strategy, you should plan ahead for parking your car (or using alternate transport) at the airport this summer so you aren't left scrambling looking for a spot or a ride as the minutes before boarding tick by.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app