Everything you've ever wanted to know about airline safety cards

"Please give us your attention as we show you one of the safest worlds there is: the world of the safety card."

So says a clever Delta Air Lines inflight safety video. Commercial aviation is extremely safe, but as you read those safety cards, you might even admire the beautiful graphics.

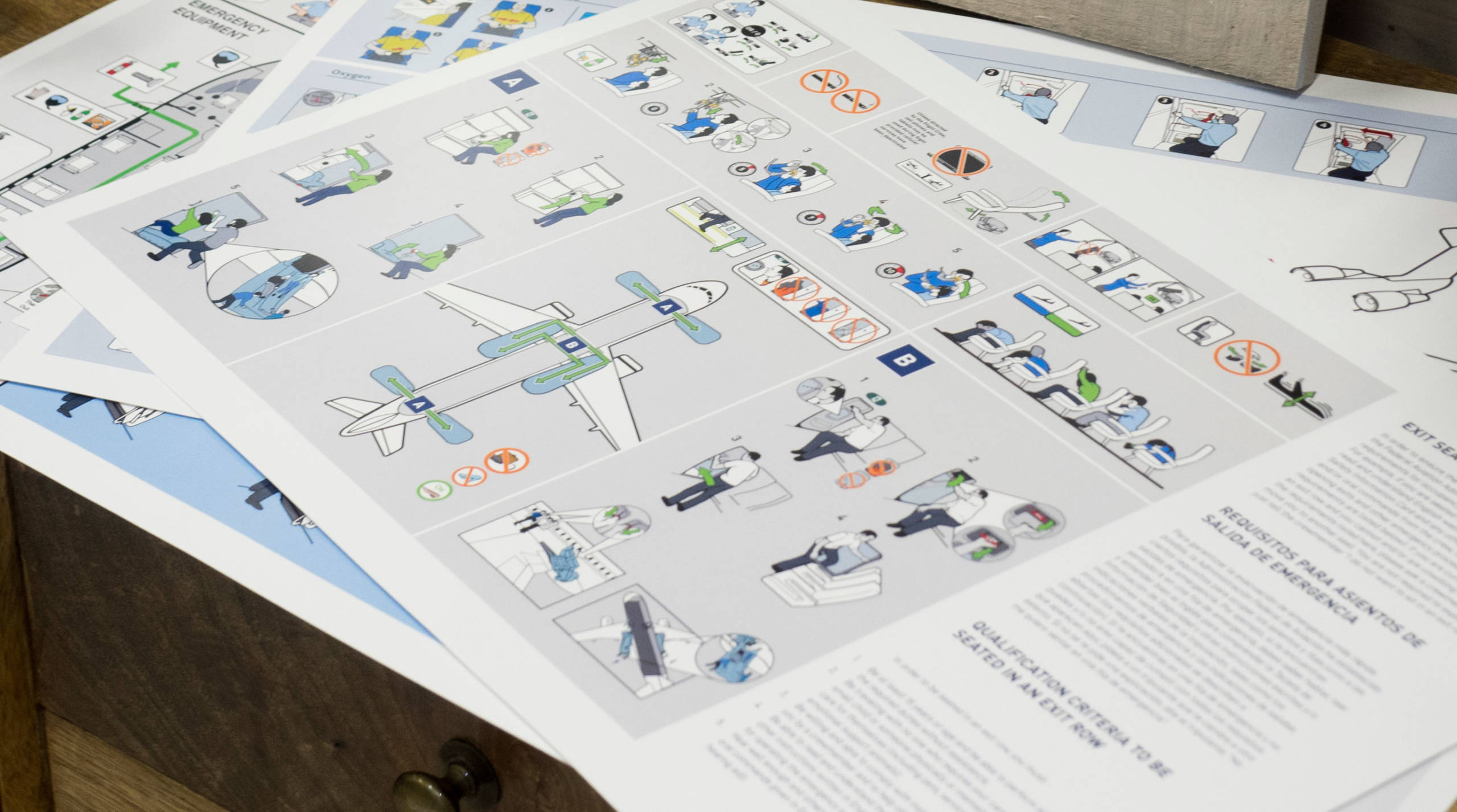

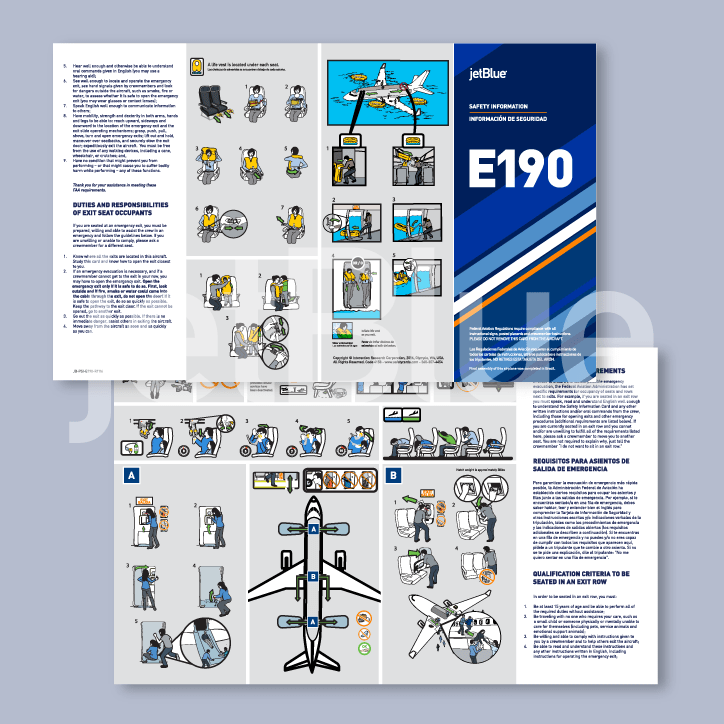

Most of them are the product of Interaction Research Co., based in Olympia, Washington, and headed by CEO Trisha Ferguson. IRC has been designing the safety cards for the vast majority of airlines around the world since 1971.

"We've worked with 80% of the carriers worldwide over the last 50 years," Ferguson said in an interview. The company designs and prints millions of cards per year with airlines like JetBlue and American currently among IRC's major clients.

The safety card is actually critical to takeoff. "If you don't have a safety card on board, in every seat, the plane is grounded," Ferguson said, citing FAA rules. Regulations also require that the safety card be the tallest item in the seatback pocket, for ease of access.

IRC was founded in 1971 by Daniel Johnson, who had worked at Douglas Aircraft Corporation as an accident psychologist in the 1960s. "He's a human-factors and ergonomics psychologist," Ferguson explained. Johnson saw the need for passenger education and started IRC in his garage in Long Beach, California. In 1978, Dr. Johnson testified to Congress in favor of making safety briefing cards and videos mandatory throughout the industry.

"He knew that if passengers would have been educated, they could have saved their lives. There was too much emphasis on [listening to] crew instruction during an emergency," Ferguson said.

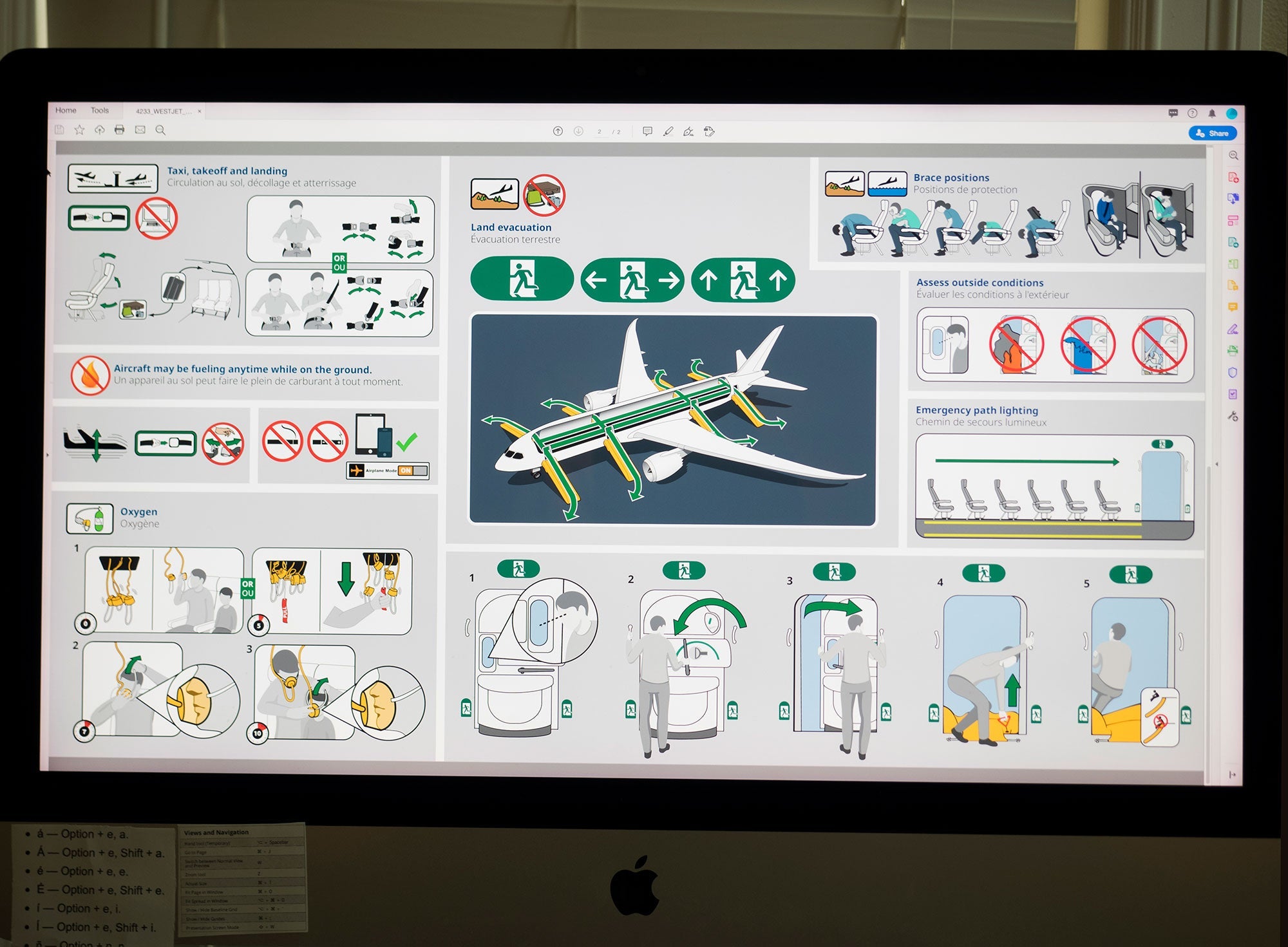

The cards that IRC designs vary by aircraft and airline -- an Embraer E190's card is different from a Boeing 787's. The U.S. Department of Transportation regularly releases advisory circulars with required updates, Ferguson said. The cards change because regulations change, and so can the onboard equipment the cards describe, such as life vests, rafts or emergency illumination of the floor. And when one airline purchases used aircraft from another airline, safety cards also need to change.

"Most of us think we are very educated. But every aircraft has so many variables," Ferguson said. "To give you an example, the emergency exit doors on the Boeing 737-300, compared to the Boeing 737-900, have different operations. On the [737-900], you simply pull the handle down and the door opens outward on a hinge. If you try to pull in the door inwards like on the 737-300, you will literally keep the door from opening."

Design Principles

According to Ferguson, IRC's advantage is 50 years of designing cards based on how the human brain works. "If you looked at the early safety information provided to passengers, almost all of (the cards) were very heavy on text and words and light on illustrations," she said.

In contrast, Ferguson said, IRC, from the beginnning, researched how humans observe and consume information. "There are formulas, colors, content considerations, flow and sequence considerations. How we read in the U.S., for example, from left to right and top to bottom, differs from countries in the Middle East," where IRC's clients are also found. Whenever it designs a new illustration, IRC asks a third-party agency to perform one-on-one, on-the-street tests with up to 50 individuals. The goal is to have new artwork understood by at least 90% of the subjects.

IRC can design cards using an airline's "house" style and look. That's the case for 80% of its clients, Ferguson said. Her company has a library of illustrations that can be modified and inserted into a templated design. (For graphic design nerds, the work is done with Adobe Illustrator and InDesign.) IRC now owns a subsidiary printing company and can get proofs done within 24 hours and cards out in two weeks or less.

But do passengers actually read the cards? There aren't any statistics, but clearly airlines want more people to read them.

Take the case of one airline which, Ferguson said, attempted humor in the late 1990s. The idea was to invite passengers to find a character, like a ballerina or a magician, hidden inside the pages of the safety card. "It lasted about five years before the airline went back to the standard characters. They tried to make the card novel and attractive to increase [the number of] people reading," she said, noting that it's a difficult task. Humor doesn't always translate well to such a serious subject.

Read Your Safety Card Before Every Flight

"On a personal level," Ferguson said, "I knew IRC was making a difference when an Ethiopian Boeing 767 crashed in 1996. It ran out of fuel after being hijacked, and the crash was caught on video. Of the 175 people aboard, 50 survived. And I woke up on the morning of the crash and saw a news report of a survivor saying the only reason they survived was because of reading our safety card."

"We know that the more educated you are, the higher the likelihood of survival and avoiding injury to you and others," she added. But does she read the cards on every flight she takes? "Yes," she said emphatically. And, apparently, so do her seatmates.

"Last night I was on a flight, and someone asked me what I did for a living. Nine times out of 10 when I explain, they'll pull out the safety card and give it a read."

You should, too.

Mike Arnot is the founder of Boarding Pass NYC, and a marketing consultant to airlines, none of which appear in this article.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app