Will a potential airline strike affect travel this year? It depends

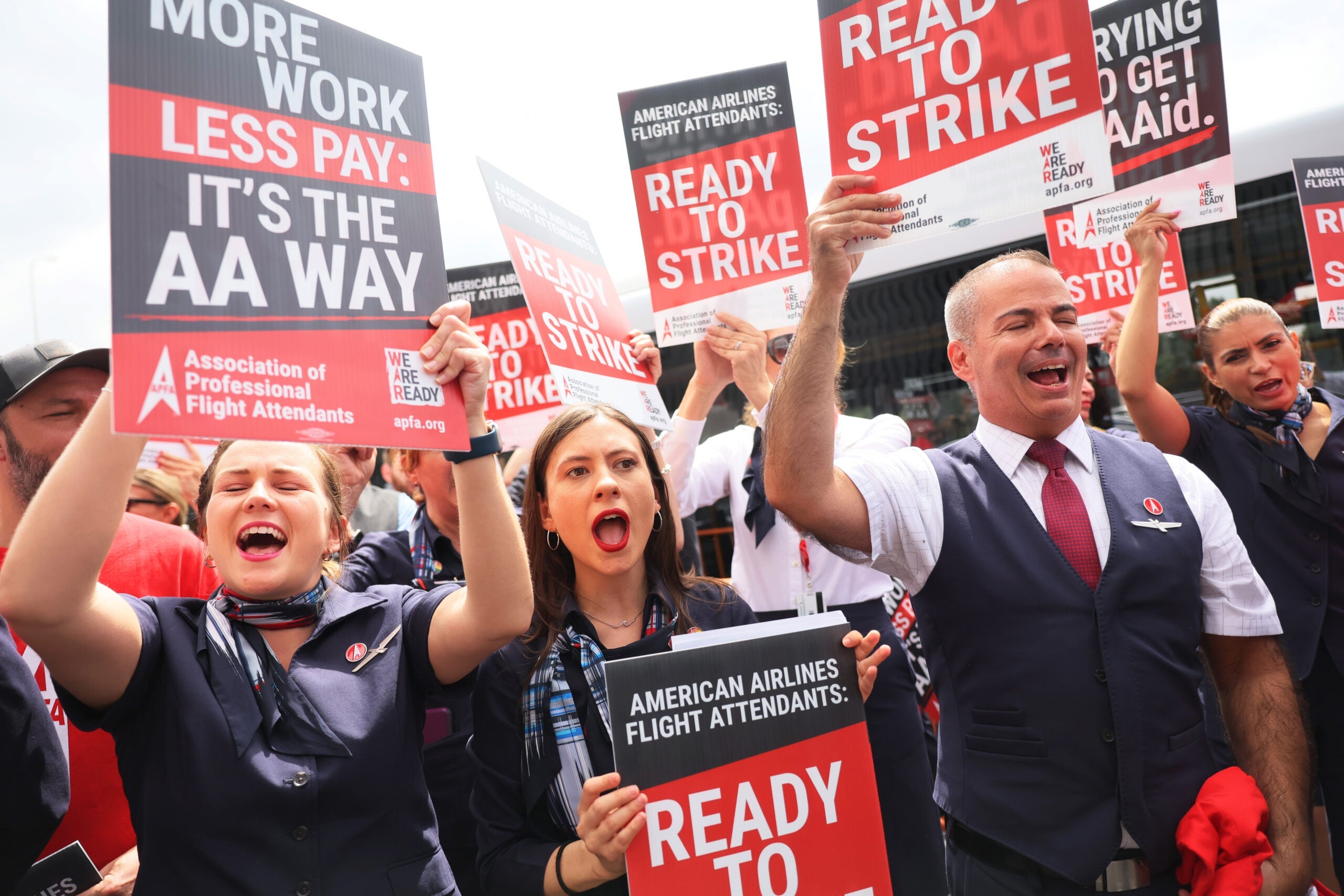

Following a summer of landmark picketing, negotiating and deal-reaching for some of America's pilots' unions, flight attendants are moving into the spotlight. Some groups of cabin crew are weighing a strike as they call for substantial salary increases and better working conditions.

Flight attendants are advocating for the same significant pay increases pilots received during the summer, citing the growing cost of living. The Alaska Airlines chapter of the Association of Flight Attendants is even potentially threatening a strike during this year's holiday travel season.

One of the key demands for flight attendants is to be better compensated for their time; under the current model, they are not paid for any work done on the ground, including during boarding. (Delta, where flight attendants are not unionized but where a union drive is underway, began paying flight attendants for boarding last year.)

"This is about gaining back our lives, getting back our productivity, being able to put that in our pockets and not just sending that to Wall Street," AFA president Sara Nelson said.

And while pilots' unions at the likes of American Airlines and United Airlines reached agreements with their airlines, tensions remain for pilots at other carriers. Southwest Airlines' contract negotiations with its pilots are still in limbo, as its union overwhelmingly voted to exit mediation in May; this paved the way for the union to begin the process of authorizing a strike.

In a year where the labor movement has gained significant traction — with public opinion of labor unions reaching its most favorable point since 1965 — talks of labor action and strikes at American auto manufacturers and Kaiser Permanente healthcare have made headlines.

But at airlines, compared to other industries, it's less likely that the movement toward a strike will actually lead to an industry-wide walkout.

The Railway Labor Act may keep airliners in the sky

An airline strike is always a possibility. The last one in the U.S. was in 2010 when Spirit Airlines pilots walked out over disagreements on pay increases.

Nevertheless, a strike remains unlikely because it's much harder for airline employees to walk out than those in other industries. Even if a strike were to occur, it could take years to come to fruition.

While the National Labor Relations Act governs collective bargaining for most industries, the Railway Labor Act oversees the railroad and airline industries — and the law makes it difficult for airline employees to actually pull off a strike.

Because the federal government considers airlines an essential service for interstate commerce, negotiations between airlines and their employees are subject to a different process than most industries. This particular process is tailored to avoid the prospect, as much as possible, of transportation grinding to a halt. The RLA also gives the federal government the authority to intervene in order to stave off a strike, as was the case late last year when American railway workers prepared to walk off the job.

One key provision in the RLA that seeks to prevent strikes is its long and tightly regimented cooling-off periods.

When the Southwest Airlines Pilots Association asked to exit mediation in May, that didn't mean the union could immediately strike. Instead, they would have a 30-day cool-off period. They could only exit mediation if the National Mediation Board — the agency that oversees airline labor relations — were to grant the union's request.

Joseph Schwieterman, a professor at DePaul University's School of Public Service who specializes in urban planning, transportation and public policy, said some of the provisions in the RLA can cause the negotiation process to be extremely drawn out.

"It also has the effect of creating lots of theatrics, where parties send messages through the media about their arguing stance, so things can drag on for months," he said.

Nelson said while the RLA is different from the NLRA, the negotiation framework between employees and management remains roughly the same.

"The reality is that if the purpose of it is to get a deal, having the right strike assists in the collective bargaining process," Nelson said.

Charles Westbrooks, an aeronautics professor at Embry-Riddle University, said another reason negotiations stall is because the labor contracts are amendable under the RLA, meaning that they don't expire.

As a result, under the RLA, all employees work under the existing contract, and airlines have to pay them the same wages until the union and management achieve an agreement.

For example, before United decided to increase pilot pay by 40% over four years in July, talks between the airline and its pilots' union had been going on since 2019, when its contract was first up for renewal.

But before United reached an agreement with the union this past summer, pilots still had to work under the same payscales, even though their contract period had ended four years ago.

"You can't do any slowdown or any kind of job action during the status quo period," Westbrooks said, since that would violate the RLA. "And this is where it goes on forever."

Why an actual strike could be averted

If a strike occurred, passengers would most likely end up stranded at the airport, the cost of flights would soar, and airlines probably wouldn't be able to handle the excess passenger demand due to persistent labor shortages and their apprehension to cancellations, Schwieterman said.

"I don't know how that would play out," he said. "People would be stranded all over the world."

Schwieterman added that he believes an airline strike would also most likely be unpopular to the public, given commercial airlines' low approval ratings.

However, Nelson, the flight attendants' union chief, said she believes that if flight attendants end up striking, they'll be able to ride off the momentum from the autoworkers' strike, which started Sept. 15.

She added that she believes passengers will identify with flight attendants' struggles and support a strike if it were to happen.

"People identify with us," Nelson said. "They go through the frustrating experience with the airlines with us, not against us. We're all in it together in that metal tube."

Westbrooks also emphasized that any airline strike would be unlikely because the blowback would also make its way to Washington. So, even if airline employees were close to walking out, it's likely that the White House and Congress would step in to prevent any work stoppages.

"The president is not going to allow this to happen," Westbrooks said. "He cannot — as much of a union man as he likes to pretend that he is."

Even as flight attendants now debate the merits of a strike, Westbrooks added that it would be in the airlines' best interest to avert a strike and prevent any widespread public backlash.

"It would be profoundly foolish on management's part to allow their [employees] to go on strike," he said.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app