American Airlines Further Restricts Service, Emotional Support Animal Rules

In the past few years, there's been a surge in the number of animals on airplanes, with the largest increase coming in the number of emotional support animals. With backlash growing and incidents increasing, airlines finally started cracking down in early 2018 with Delta, United, Alaska, American Airlines, JetBlue and Southwest all rolling out restrictions. Since then, Delta has tightened its policy and then tightened it yet again.

Now, AA is back with further restrictions on the type, number, age and documentation required for both service animals and emotional support or psychiatric-service animals. These changes go into effect on April 1, 2019 regardless of when you booked your travel.

Four policies are changing on that date:

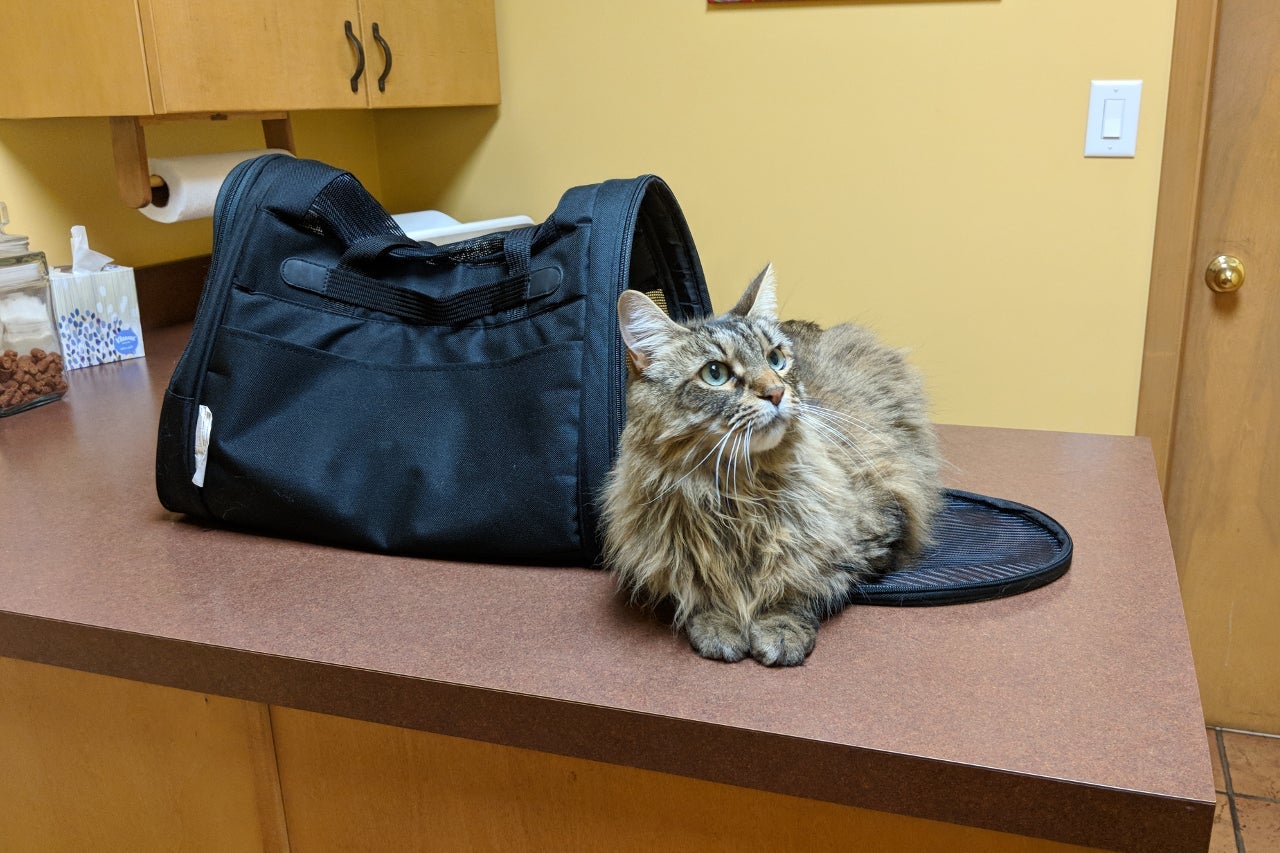

- Animal types limited to only dogs and cats. Trained miniature horses are permitted only as a service animal

- Limit of one emotional support or psychiatric service animal per person

- Animal must be four months or older

- A new Veterinary Health Form will also be required for emotional support or psychiatric-service animals, in addition to the other forms required

In addition to these new restrictions, AA requires that the animal must be "clean and well-behaved" and be able to fit at your feet, under your seat or in your lap. For animals traveling in a pet carrier, the bag must be able to fit under the seat in front with the animal in it.

Emotional support or psychiatric-service animals can't be in an exit row, protrude or block aisles, occupy a seat or eat from tray tables. For those that don't fit, the passenger will have to buy a ticket for the animal, transport it as a checked pet, or rebook on a flight with more open seats.

AA's new changes mostly are matching policies we've seen implemented at Delta, which banned support animals younger than four months back in December. However, AA hasn't copied Delta's complete ban of pitbull-type dogs and all animals on flights longer than eight hours. Instead, American Airlines requires travelers to fill out an Animal Sanitation Form for flights of eight hours or more.

Once these rules go into effect, there will be up to four forms required to fly with an emotional support or psychiatric service animal:

- Medical / Mental Health Professional Form

- Veterinary Health Form

- Confirmation of Animal Behavior Form

- Animal Sanitation Form for flights of eight hours or more

All forms must be submitted to the Special Assistance Desk at least 48 hours before travel. If requirements aren't met, the traveler will need to pay the fee to transport the animal as a pet.

We at TPG love our pets and want to make traveling with them as easy, safe and affordable as possible. Here's our coverage on how you can do so when you need to travel with your pet:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app