American Airlines Reports 2018 Profit 44% Short of CEO's Prediction

American Airlines CEO Doug Parker hasn't been shy about making bets and confident claims about the airline's prospects — but he's rarely been proven to be right yet. Parker ended up well shy of his bet that AA's stock price would hit $60 per share before an analyst turned 60 in November 2018. The airline's market value was $10 billion less than it would've been if he was right.

Thursday morning, he fell short of another publicly stated goal, this time regarding just how profitable the airline would be.

For years, Parker has confidently told investors that American Airlines should make $5 billion per year in pre-tax profit. Even as fuel prices spiked last year, he told investors that he was confident in the airline's ability to make $5 billion, no matter what fuel prices were.

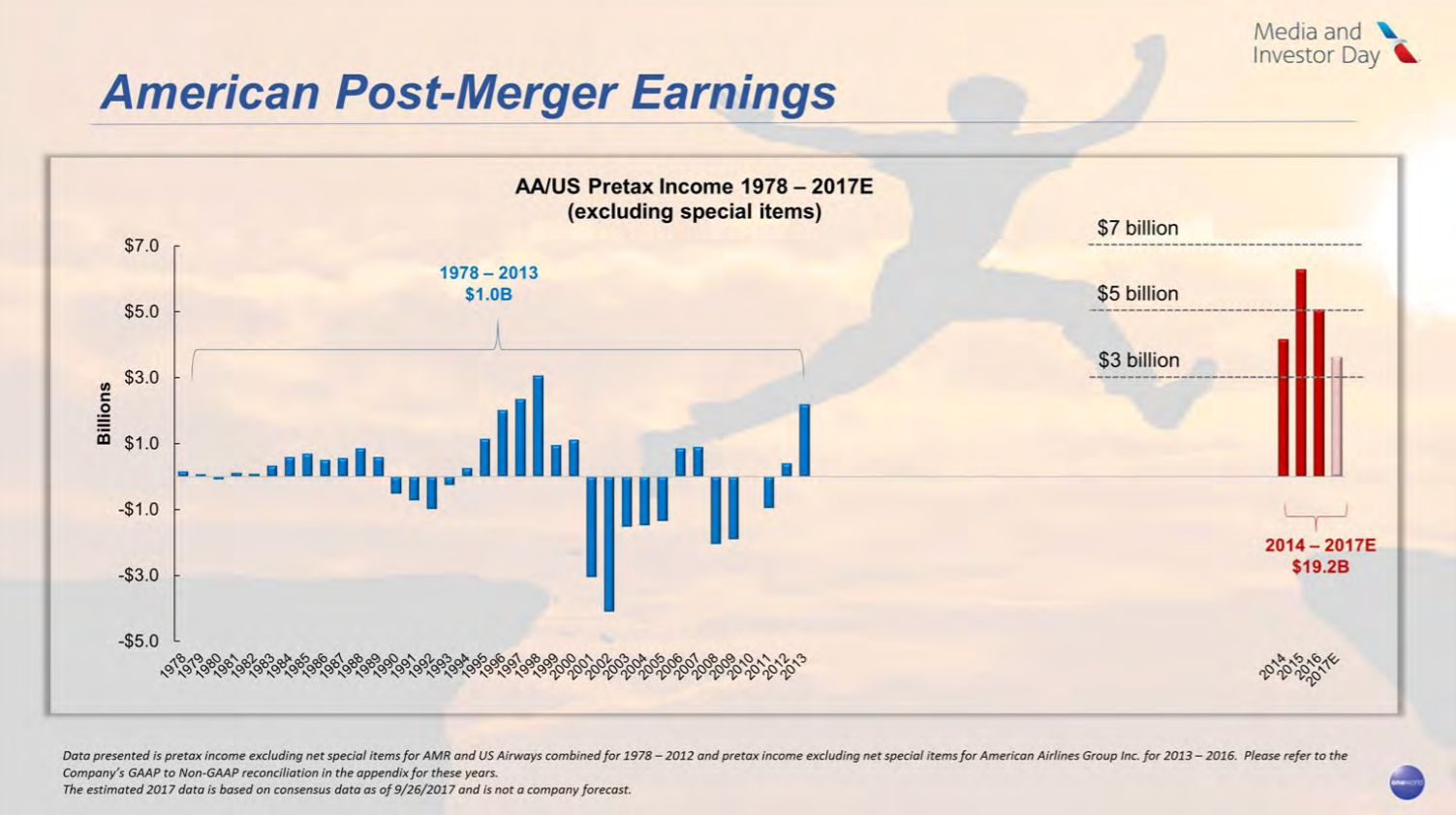

The CEO was so confident in this level of profitability that he's been clear that airline executive bonuses are structured around the assumption of $5 billion of pre-tax profit per year. For reference of just how aggressive this goal is, consider that the combined airlines that currently make up American Airlines earned a total of $1 billion in pre-tax profit from 1978 to 2013.

However, as Parker assured investors at a Media & Investor Day in September 2017, the "industry and our airline have been materially and permanently transformed." In this new version of the industry, the CEO stated he was confident that the airline will never lose money again.

In 2017, American Airlines' profits weren't too far off of Parker's $5 billion goal. The airline posted a solid $4.1 billion pre-tax profit excluding net special items.

Thursday morning we found out how the airline did in 2018: it earned $2.8 billion in pre-tax profit excluding net special items. That's a 32% decrease in pre-tax profits (excluding net special items) year-over-year and 44% short of Parker's stated goal of $5 billion in pre-tax profits.

It gets worse when you factor in those special items. Based on generally-accepted accounting principles, American Airlines made $1.9 billion in pre-tax profits in 2018. That's still a healthy sum, especially when you consider the airline industry's history. However, this is short of Parker's profit predictions, and American Airlines' competitors:

| Pre-tax GAAP profits, USD billion | 2018 | 2017 | % Change |

|---|---|---|---|

American Airlines | $1.88 | $3.40 | -45% |

Delta | $5.15 | $5.50 | -6% |

United | $2.66 | $3.04 | -13% |

Last week, Delta reported $5.15 billion in pre-tax profit. And, even though United's profit dropped by double digits from 2017 to 2018, its profits still overtook American Airlines last year. Using generally-accepted accounting principles, AA's pre-tax profits dropped 45% from the prior year.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter here!

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app