How to transfer American Express Membership Rewards points to Delta

If you want solid value from your Amex points, transferring them to partner hotel or airline loyalty programs is often your best bet.

Did you know you can transfer your American Express Membership Rewards points to 18 airline and three hotel partner programs? Plus, Membership Rewards are easy to earn and redeem.

Here's how to transfer Amex points to Delta Air Lines' SkyMiles program and other things you should know before transferring your Membership Rewards points.

How to transfer Amex points to Delta

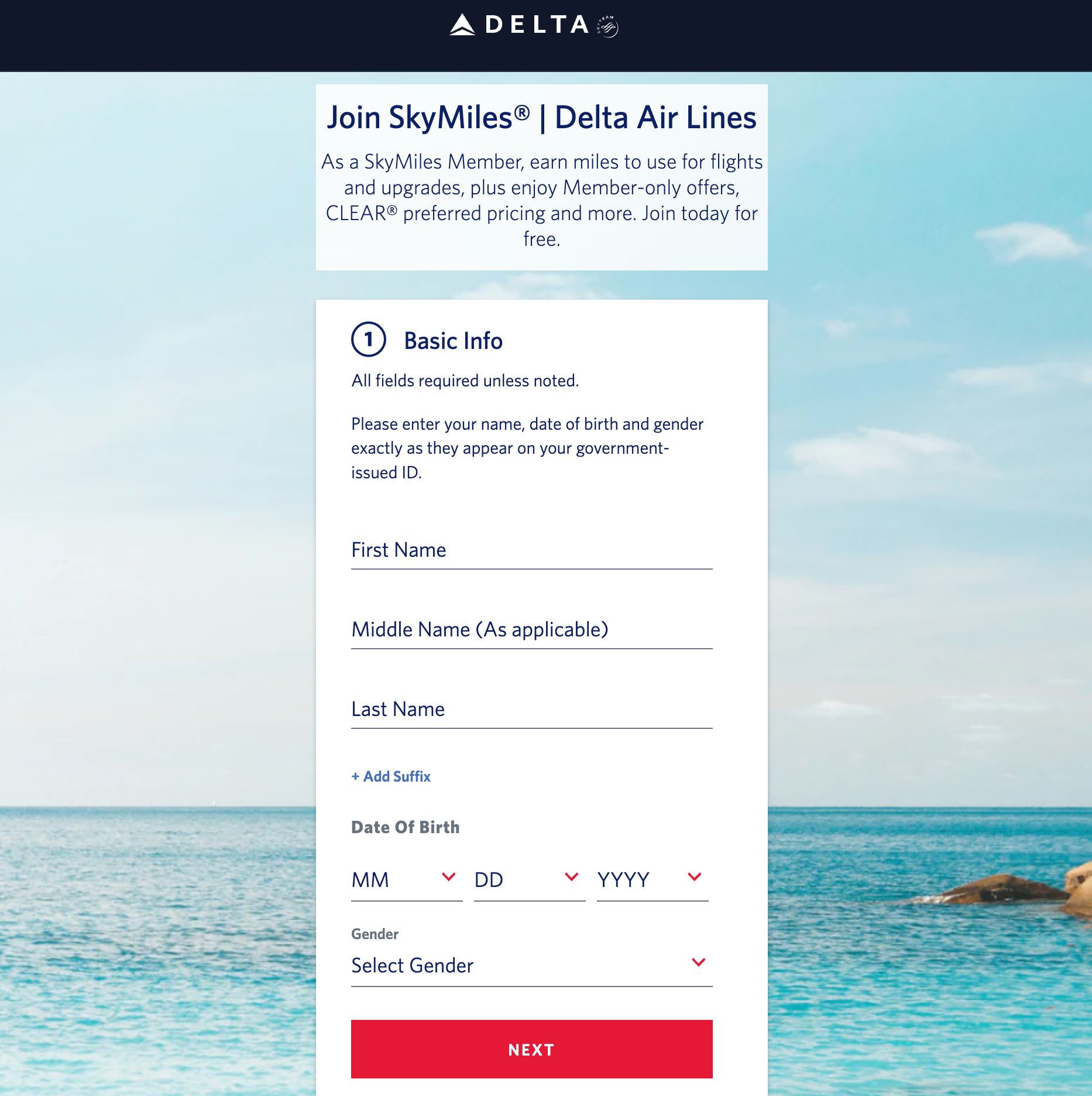

Before learning how to transfer Membership Rewards points to Delta, make sure you have a SkyMiles account. If you don't, head to Delta's website, click "Sign Up" and create an account.

Then, to transfer Amex points to SkyMiles, log in to your Membership Rewards account, click on the "Rewards" tab at the top and select "Transfer Points" from the drop-down box.

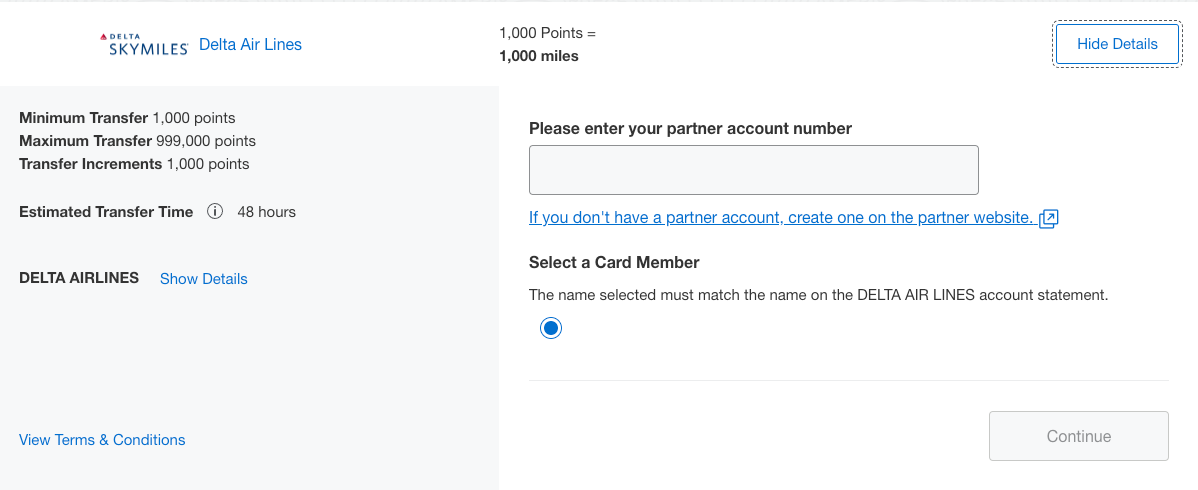

You'll then see a list of transfer partners to choose from. Select "Delta SkyMiles," and then you'll need to link your account to your Membership Rewards account by entering your SkyMiles account number, ensuring the name on your SkyMiles account exactly matches the name on your Membership Rewards account.

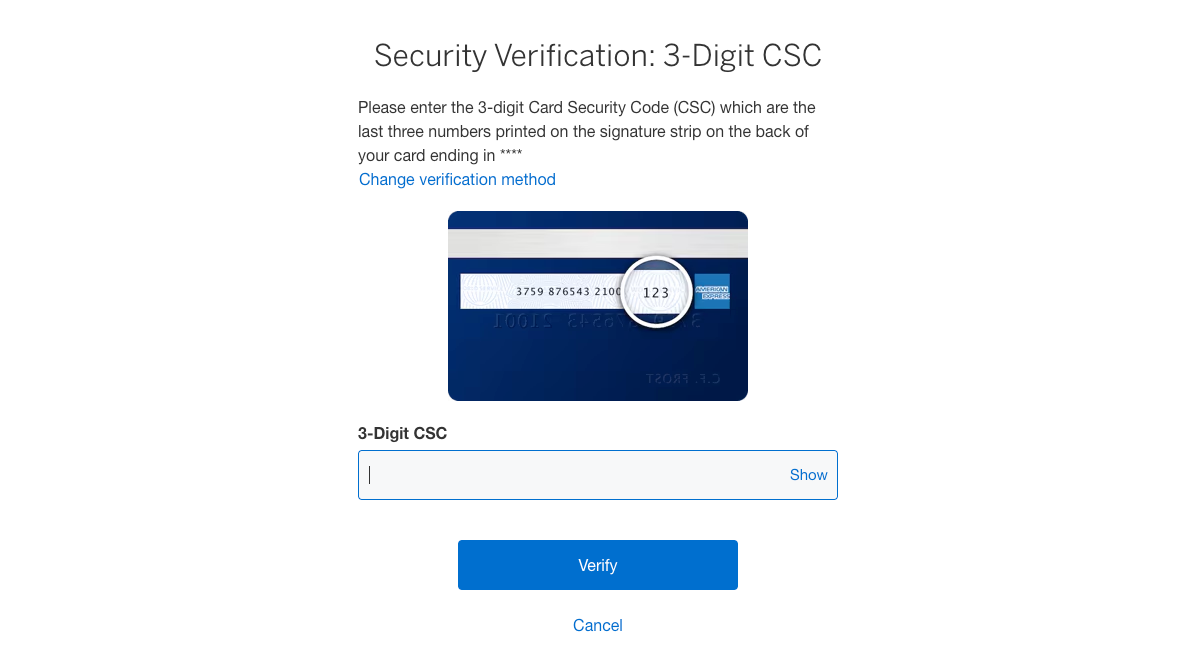

You'll then be prompted to enter the 3-digit card security code on the back of your Amex card.

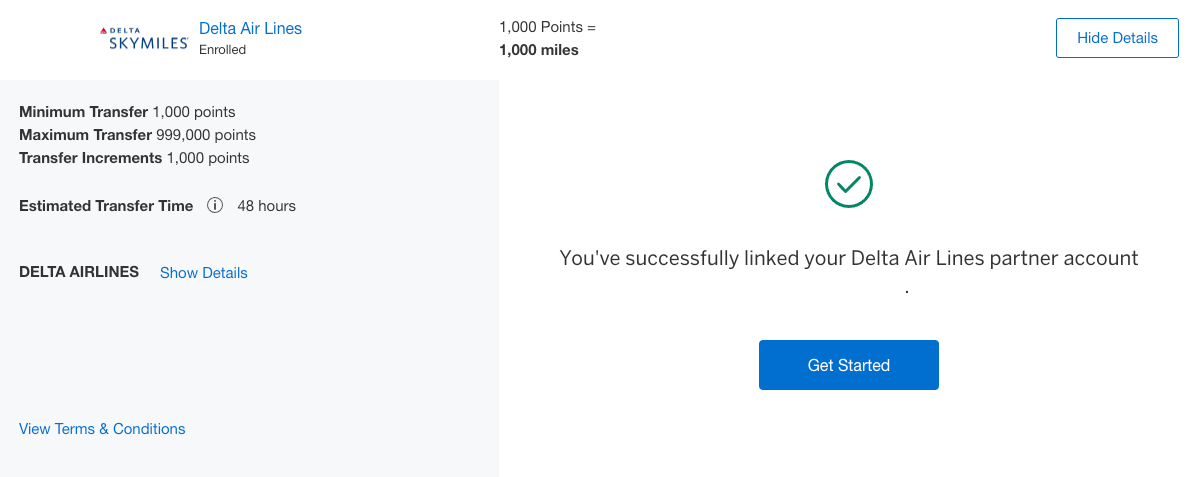

Once you enter that you should receive a confirmation that your accounts are now linked.

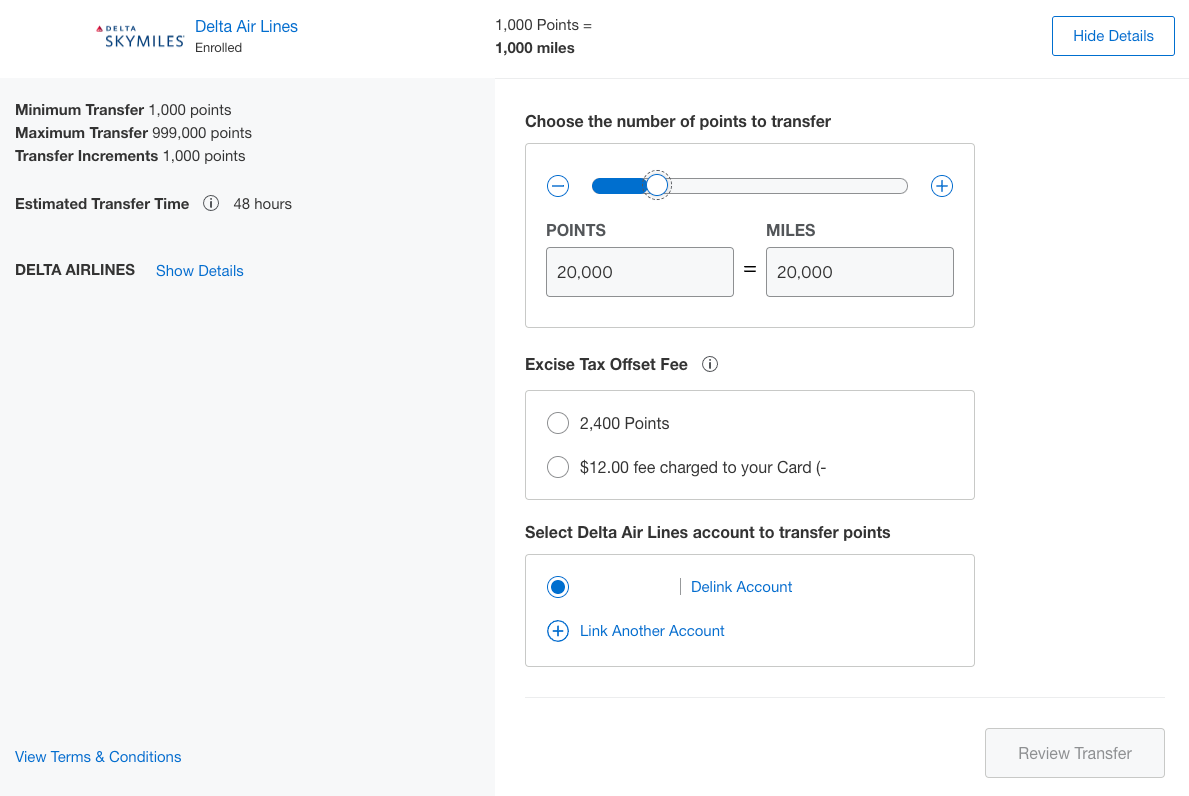

Then click "Get Started" and select how many Amex points you would like to transfer to SkyMiles in increments of 1,000, with a minimum of 1,000 and a maximum of 999,000, using the slider to reach your desired number. Unfortunately, you will be charged a small excise tax offset fee.

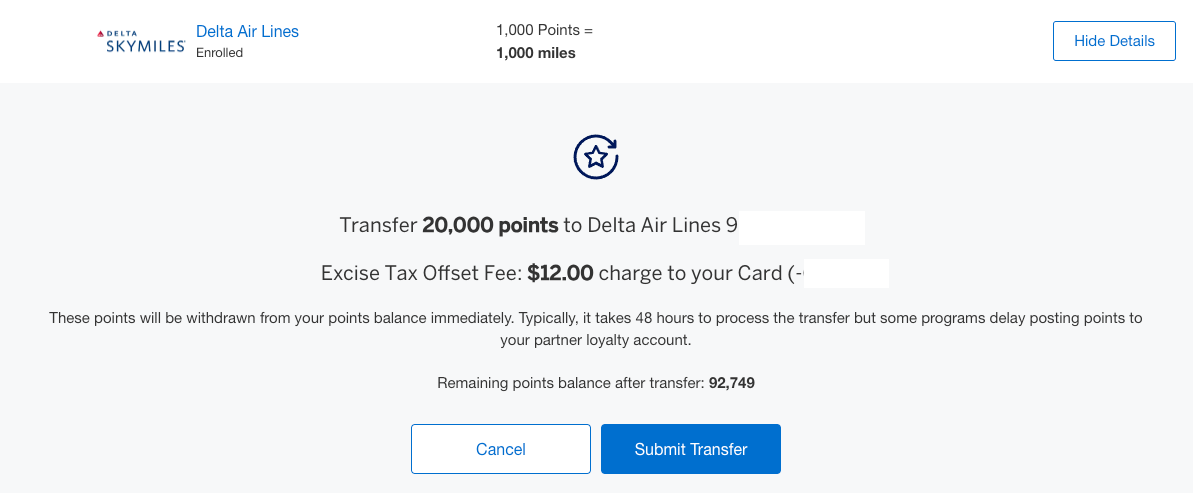

Once you've selected your ideal transfer amount, click "Review Transfer" and then "Submit Transfer" on the next screen. The excise tax offset fee will be charged directly to your card.

While Amex claims transfers will take 48 hours, the transfers from Membership Rewards to Delta SkyMiles have been instant in our testing.

Amex to Delta transfer ratio

The Amex to Delta transfer ratio is 1:1. You must transfer American Express points in increments of 1,000, which means you can convert 1,000 Amex points into 1,000 Delta SkyMiles. You might occasionally find a transfer bonus that boosts the Amex to Delta transfer ratio, but these are rare.

Based on TPG's August 2024 valuations, Amex points are worth 2.0 cents each, and SkyMiles are worth 1.15 cents each. Since transferable points are more valuable, you'll lose theoretical value when you transfer Amex points. But, as we'll discuss in the next section, this doesn't mean you shouldn't transfer Amex points to Delta.

Related: Best American Express credit cards

Should I transfer Amex points to Delta?

Delta SkyMiles isn't the most valuable transfer partner based on our valuations. For example, fellow SkyTeam member Virgin Atlantic's Flying Club has a higher valuation at 1.4 cents each, as does Air France-KLM's Flying Blue program at 1.3 cents per point, per TPG's August 2024 valuations.

So you may want to reserve your Membership Rewards points for transfers to these higher-value partners — especially if you haven't accrued a large balance of Amex points. But you can get good value from SkyMiles on some redemptions. Be sure to read our guide on redeeming Delta SkyMiles to get started.

How to earn Amex Membership Rewards points

The best way to earn lots of Membership Rewards points quickly is by utilizing welcome offers on Amex cards. Here are some of our favorites:

- The Platinum Card® from American Express: Find out your offer and see if you are eligible for as high as 175,000 Membership Rewards points after spending $12,000 on purchases in your first six months of card membership. Welcome offers vary and you many not be eligible for an offer.

- American Express® Gold Card: Find out your offer and see if you are eligible for as high as 100,000 Membership Rewards points after spending $6,000 on purchases within the first six months of card membership. Welcome offers vary and you may not be eligible for an offer.

- The Business Platinum Card® from American Express: Earn 200,000 Membership Rewards points after you spend $20,000 on eligible purchases within the first three months of card membership.

Bottom line

These are the steps you need to follow to transfer your American Express Membership Rewards points to Delta SkyMiles.

While there are some higher-value transfer partners than Delta SkyMiles to which you can consider transferring your Membership Rewards points, you can still find good value in the SkyMiles program. Remember that transfers from Amex to partner programs are irreversible, so make sure you're certain you have a use for the miles when you transfer them out of Amex.

Once you transfer Amex points to Delta and find an award flight you want to book, follow the steps above to transfer the number of points you need to book your award flight.

Remember, you must transfer points in increments of 1,000, so you may be required to transfer slightly more points than you need to book your flight.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app