How to earn and use the Southwest Companion Pass

Editor's Note

Southwest Airlines has ended its bags-fly-free policy for most customers, retired its Wanna Get Away fares as part of a fare rebrand, and made several other customer-unfriendly changes. But, at least so far, one of the most advantageous offerings in the travel industry — the Southwest Companion Pass — remains intact.

This valuable benefit lets you bring a companion along for free (excluding applicable taxes and fees) on unlimited Southwest Airlines flights until the pass expires. For frequent Southwest flyers, this benefit alone can easily amount to thousands of dollars saved annually.

So, here's what you should know about earning and using the Southwest Companion Pass.

How to earn the Southwest Companion Pass

To earn a Southwest Companion Pass valid through the end of the next calendar year, you must accrue 135,000 qualifying points or complete 100 qualifying flights within a calendar year.

You can earn qualifying points through various means, including flying with Southwest (including the cash portion of Cash + Points bookings) and engaging with its partners. The latter includes making purchases via the Rapid Rewards shopping portal, completing hotel stays and car rentals with partners, and using a Southwest credit card for purchases.

Cobranded Southwest credit cards are often the simplest way to earn the Companion Pass since you'll earn qualifying points on purchases, and the welcome bonus points are qualifying.

Here's a look at some of the current offers:

- Southwest Rapid Rewards® Plus Credit Card (see rates and fees):Earn a Companion Pass (valid through Feb. 28, 2027) plus 20,000 bonus points after spending $3,000 on purchases in the first three months from account opening.

- Southwest Rapid Rewards® Priority Credit Card (see rates and fees): Earn a Companion Pass (valid through Feb. 28, 2027) plus 40,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

- Southwest® Rapid Rewards® Premier Business Credit Card (see rates and fees): Earn 60,000 points after you spend $3,000 on purchases in the first three months from account opening.

- Southwest® Rapid Rewards® Performance Business Credit Card (see rates and fees): Earn 80,000 points after you spend $5,000 on purchases in the first three months from account opening.

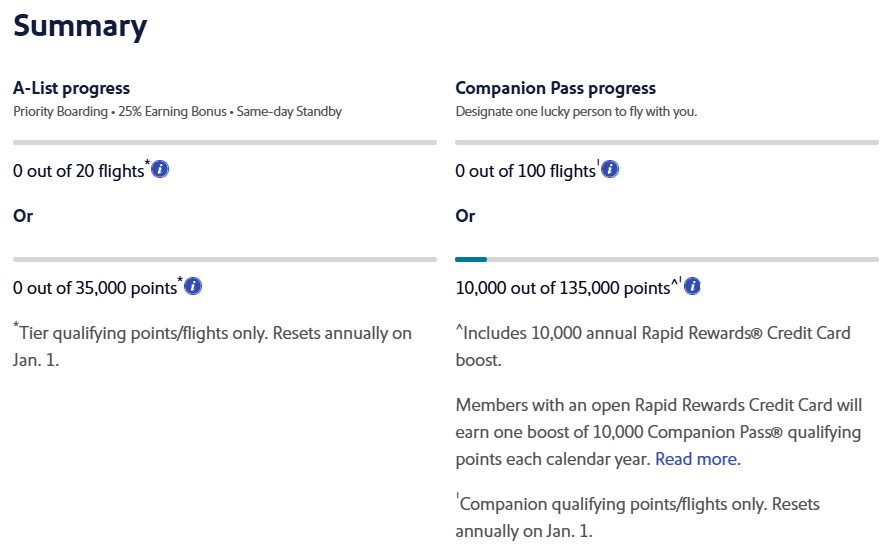

Additionally, travelers with a cobranded Southwest credit card get 10,000 qualifying points each calendar year (note the boost is limited to one per Rapid Rewards member per calendar year, not per card), effectively reducing the Companion Pass requirement to 125,000 qualifying points yearly.

It's also worth noting that Southwest occasionally offers promotions for limited-time Companion Passes.

How to use the Southwest Companion Pass

Once you've earned a Companion Pass, Southwest makes it very easy to use.

Set up your Companion Pass

Southwest will send you a congratulatory email within a few days of earning your Companion Pass. (You can always log in to your Southwest Rapid Rewards account to track your progress toward earning it.)

Upon receiving the email, click the link to set up your initial companion choice. The process is quick, but you'll need to provide information about your companion, including their legal name (matching their ID) and birth date.

If you want to keep the same companion for the duration of your Companion Pass, you'll only need to set it up once. However, remember you can change your companion up to three times each calendar year.

Related: 2 for 1: How airline companion tickets can save you serious money on your next trip

Book your flight

Before using your Companion Pass, you must book your own Southwest flight. If you're traveling with someone who isn't your designated companion, book their flight at this time too. For example, suppose you are a family of four with one adult holding the Companion Pass and the other adult designated the companion. In that case, you should initially book tickets for the Companion Pass holder and the two kids.

You can pay for your flights with cash or redeem Southwest points when using a Companion Pass; however, if you purchase the tickets with cash, remember to include each traveler's Rapid Rewards number when booking so they can earn Southwest points on their flights.

Related: Southwest A-List status: What it is and how to earn it

Add your companion to your reservation

Once you have booked your flight, you can add your companion to your reservation. Doing so immediately after booking your flight is the best way to ensure you add your companion before the flight sells out.

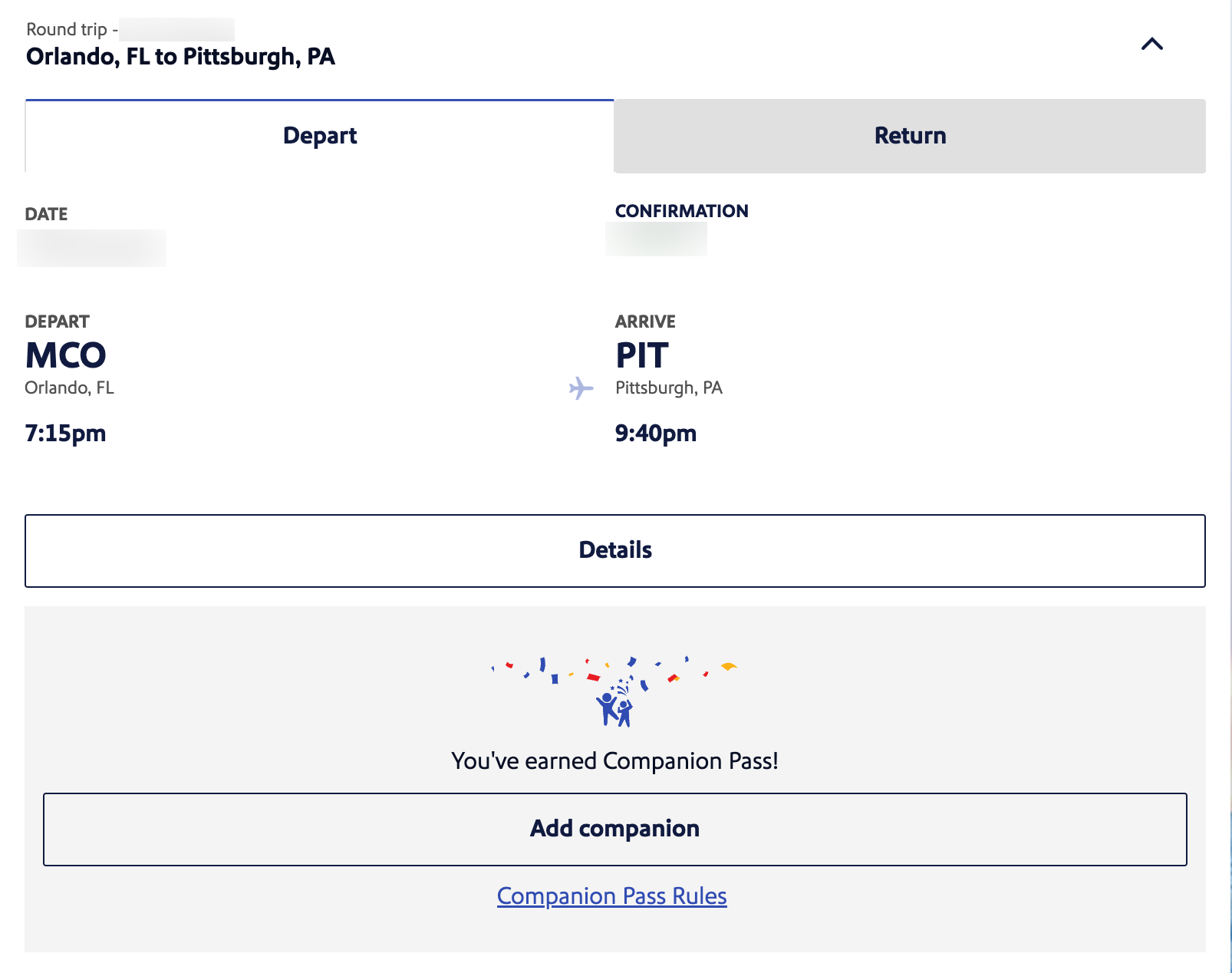

To add your companion to a flight, log in to your Southwest account and find the flight in your upcoming trips. If you haven't added your companion yet, you should see an "Add companion" button for the flight.

Click the button and double-check the prefilled information. Proceed through the process until you reach the point where you'll need to pay the taxes and fees for your companion's flight. Pay the taxes and fees, and your companion will be confirmed on the flight. Your companion will get a different confirmation number than you, though.

Related: Southwest Airlines adds Alaska flights amid 2025 expansion spree

Bottom line

The Companion Pass might provide significant value if you frequently fly Southwest with a favorite companion. Likewise, consider if you would fly Southwest frequently with another traveler if you could do so for about half the cost. This could save you plenty on any upcoming travel.

- Southwest launches vacation bundles: 5 Rapid Rewards points per dollar, and 2 free bags

- 15 lessons from 15 years of having the Southwest Companion Pass

- Southwest looking for new loyalty opportunities and a return to international flying

- What to know about Southwest Airlines' 8 boarding groups starting in January

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app