Why you should get (and keep) the IHG One Rewards Premier card

Editor's Note

Whether you stay at IHG hotels and resorts a few times each year or weekly, you should seriously consider the IHG One Rewards Premier Credit Card (see rates and fees).

This card has a compelling welcome offer to attract new cardholders. But it is also one of my favorite cards to keep long-term due to its many perks, which can easily offset its modest $99 annual fee.

Here's why I love my IHG One Rewards Premier card and plan to keep it in my wallet for the foreseeable future.

Welcome offer

The welcome offer for the IHG One Rewards Premier Credit Card is 175,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

So, based on TPG's June 2025 valuations, the welcome offer is worth $875.

Note that the IHG One Rewards Premier card and its welcome offer aren't available if you are a:

- Current cardmember of any personal IHG One Rewards credit card

- Previous cardmember who received a new cardmember bonus within the last 24 months for any personal IHG One Rewards credit card

The Chase 5/24 rule may also prevent you from being approved for a new Chase credit card.

Related: Is the IHG One Rewards Premier card worth the annual fee?

Anniversary night

Even if you don't spend many nights in hotels or prefer a different hotel loyalty program, the IHG One Rewards Premier Credit Card may still be worth its $99 annual fee. After all, most cardholders can get more than $99 of value each year from one benefit: the IHG anniversary night certificate you receive after each account anniversary.

You can use the anniversary night for a night with a redemption rate of 40,000 points or less. If you want to use your anniversary night toward a night costing more than 40,000 points, you can redeem points from your IHG account to top up the certificate. You must redeem your anniversary night and complete your stay within 12 months of the certificate's issue date.

I've gotten good value from my anniversary nights over the years. And as long as you're getting more than $99 of value from your anniversary night certificate each year, keeping the IHG One Rewards Premier card long-term likely makes sense, especially once you consider the card's other perks.

Related: The 19 best IHG hotels in the world

Fourth-night reward perk

My favorite perk of the IHG One Rewards Premier Credit Card is the "redeem three nights, get fourth reward night free" benefit. In short, this perk lets you pay zero points for every fourth night when you redeem IHG points for a stay of four nights or longer.

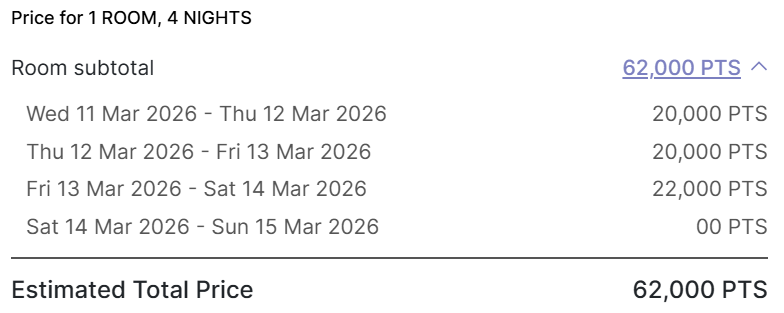

Let's look at an example. For the following stay, I'd pay zero points for my fourth night due to the IHG fourth-night reward perk.

This perk also works for longer stays. For example, here's an eight-night stay during which my fourth and eighth nights would cost zero points after the fourth-night reward perk.

Every fourth night will cost zero points, regardless of whether these nights are the cheapest or most expensive of your stay. Best of all, you can use this benefit unlimited times. So, if you frequently redeem IHG points for stays of four nights or longer, this card benefit will likely save you a significant amount of points.

Related: How my IHG One Rewards Premier Credit Card pays for itself each year

Other valuable benefits

The IHG One Rewards Premier Credit Card offers other useful benefits to cardholders, including:

- Automatic IHG Platinum Elite status for as long as you keep your IHG One Rewards Premier card

- The ability to earn Diamond Elite status through the end of the following calendar year, during any calendar year you make at least $40,000 in purchases with your IHG One Rewards Premier card

- No foreign transaction fees

- A Global Entry, TSA PreCheck or Nexus credit of up to $120 every four years as reimbursement for an application fee charged to your card

- A $25 United Airlines TravelBank cash deposit in your MileagePlus account twice a year (on or around Jan. 5 and July 5; you must complete a one-time registration for this perk)

- Earn a $100 statement credit and 10,000 bonus points each calendar year you make at least $20,000 in purchases with your IHG One Rewards Premier card

Plus, you'll earn 10 points per dollar at IHG hotels and resorts, 5 points per dollar on other travel and hotels, gas stations and dining at restaurants (including takeout and eligible delivery services), and 3 points per dollar spent on other purchases with your card.

Related: The best hotel credit cards with annual fees under $100

Bottom line

Once you have the IHG One Rewards Premier Credit Card, two card benefits — the anniversary night certificate and the fourth-night-reward perk — should provide significantly more value than the $99 annual fee each year. As such, I believe the IHG One Rewards Premier card is valuable to get and keep long-term.

Check out our full IHG Premier Credit Card review for more details.

Apply here: IHG One Rewards Premier Credit Card

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app