Quick Points: These award tickets are best to book at the last minute

It sounds irresponsible — maniacal, even — but you may find yourself days away from the vacation of a lifetime without a single detail booked. Your bags are packed. You've submitted your vacation request at work. And you're just beginning to browse for flights and hotels.

Not everyone has the chops for it, but booking last-minute travel can pay off in a big way. Especially if you're a frequent award traveler — some of the most aspirational and valuable awards magically appear a few weeks (or days) out.

Let's take a look at a few examples. You might just be inspired to give last-minute reservations a go.

Some of the best flight and hotel awards appear within a few weeks of travel

It's not ideal, but waiting to book your flights and hotels a week or two before departure can be your only chance to achieve your bucket list items.

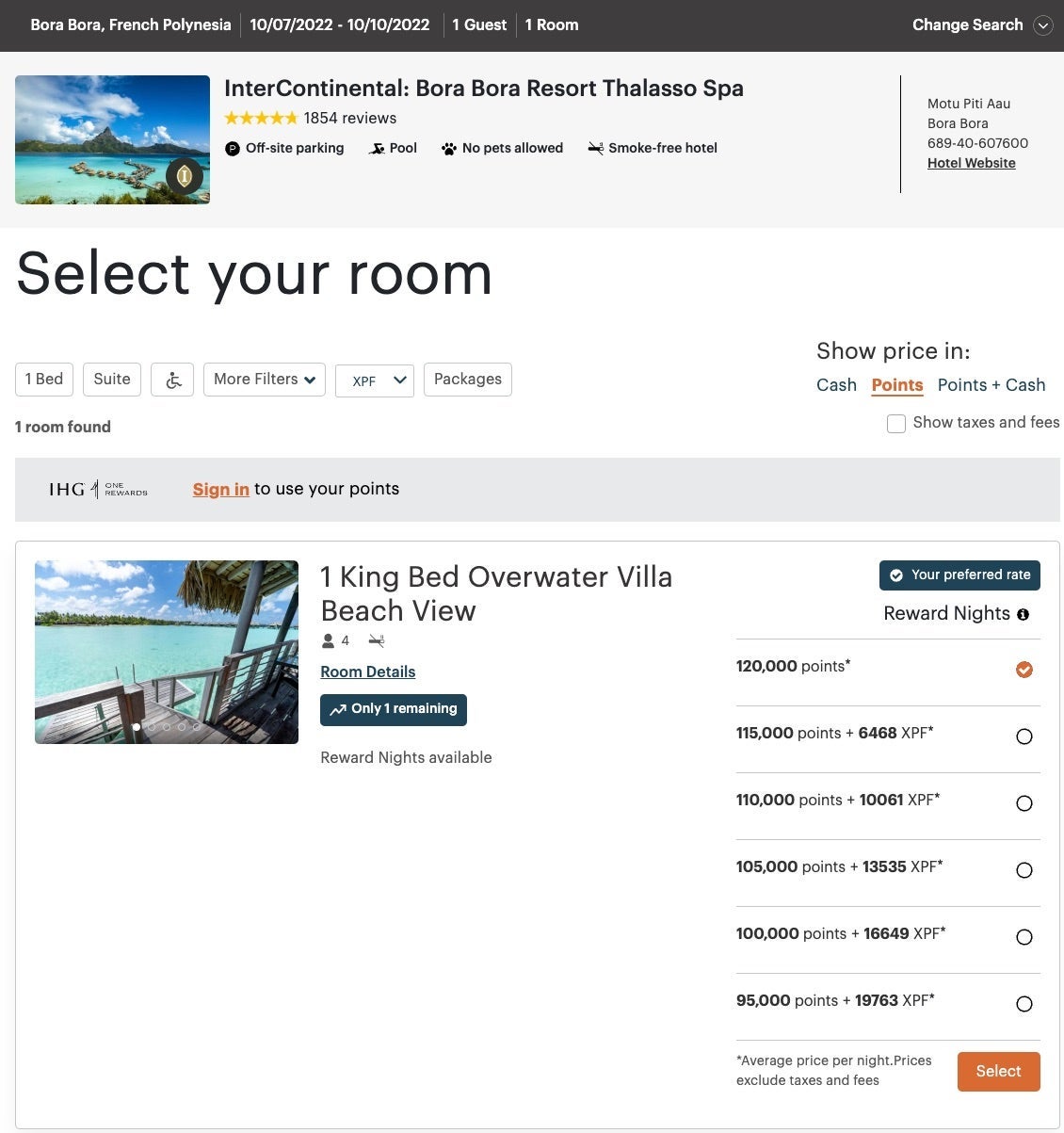

InterContinental Bora Bora Resort Thalasso Spa

One of the biggest unicorns in the hotel award space is the InterContinental Bora Bora Resort Thalasso Spa. This IHG hotel is almost impossible to book with points.

Despite costing 120,000 IHG points per night, demand is high — in large part because points book directly into an overwater villa (often $1,300 and above per night).

However, if you search for award availability just a week or two out, you can often find what you're looking for. Here's a three-night stay available on points for next week — it really doesn't get much better than that.

Conrad Maldives Rangali Island

Similarly, the Conrad Maldives Rangali Island makes an appearance on many a bucket list.

For most of the calendar year, you'll find the hotel charges over 500,000 Hilton points for a premium room. The hotel makes standard rooms available in waves.

But here's the thing: Standard room availability is nearly guaranteed within a month from the current date.

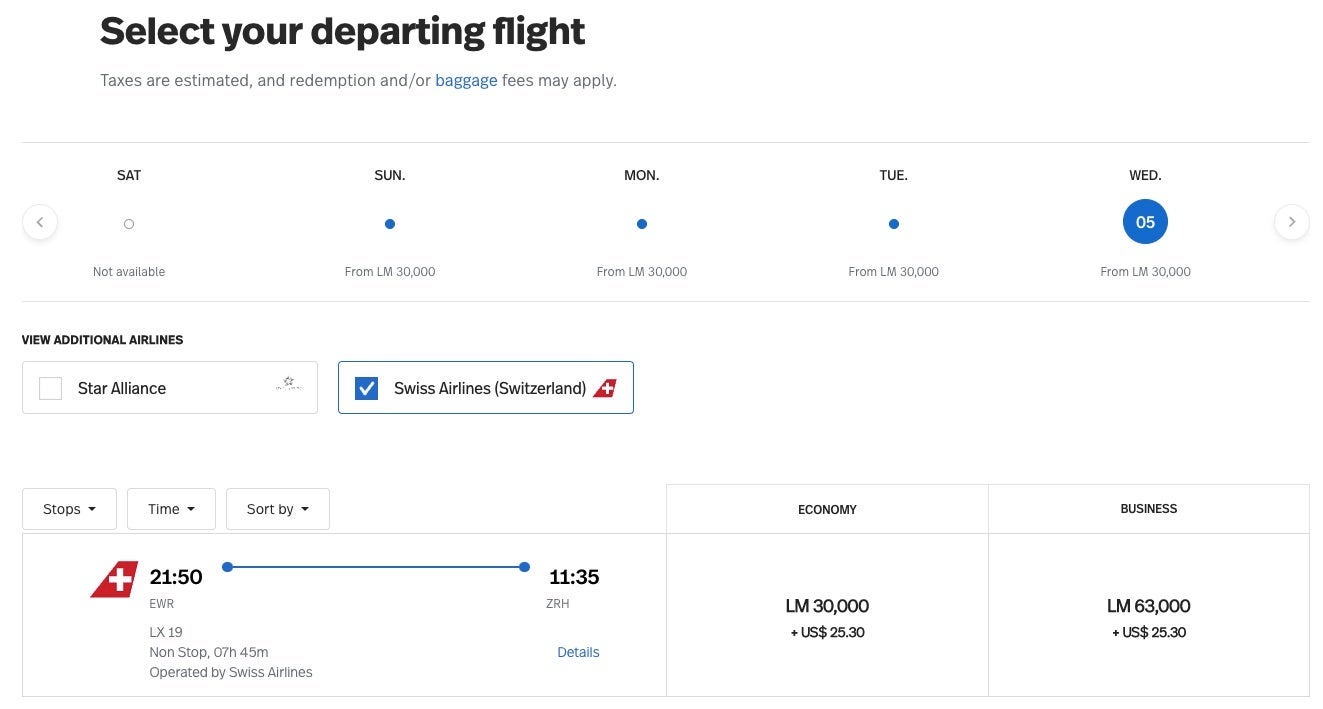

Swiss business-class seats

Swiss International Air Lines business class tends to have good availability eight days from the current date — and it often gets scooped up quickly, as you'll likely notice availability isn't nearly as good on days 1-7 from today.

Our favorite ways to book are through Avianca or Air Canada Aeroplan. You can search routes between Zurich Airport (ZRH) and the following cities:

- Boston: Boston Logan International Airport (BOS).

- New York: John F. Kennedy International Airport (JFK).

- Newark: Newark Liberty International Airport (EWR).

- Miami: Miami International Airport (MIA).

- Chicago: O'Hare International Airport (ORD).

- San Francisco: San Francisco International Airport (SFO).

- Los Angeles: Los Angeles International Airport (LAX).

If you've got ice in your veins, you can hold off on booking flights until eight days from your desired departure date and snag a quality business-class seat to Europe on Swiss.

Lufthansa first class

Lufthansa releases its first-class award inventory to its partners up to 30 days before departure. However, you'll need to reserve your flights at least three days prior to departure — so there's a balance as to how "last minute" you can book.

This deal is still extremely hard to find. Lufthansa's first-class seats are a darling of the points and miles community. After flying them once, you'll understand why.

We recommend using ExpertFlyer (owned by TPG's parent company, Red Ventures) to alert you when seats become available. Set your route search between Frankfurt Airport (FRA) and the following U.S. cities:

- Chicago: ORD.

- Houston: George Bush Intercontinental Airport (IAH).

- Los Angeles: LAX.

- Miami: MIA.

- Newark: EWR.

- San Francisco: SFO.

Related: 6 tips for booking Lufthansa first-class awards

Bottom line

It takes a bit of faith to book last-minute flights and hotels. However, with some of the best deals in award travel, there's really no other way to book.

Tangentially, it's good to have a backup plan just in case the stars don't align for you.

When I've done this in the past, I've booked safety-net flights and hotels that I would have been at peace with using if award space didn't open up. It'll keep you sane during your frantic, white-knuckled week of award searches before your departure date.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app