Stuck in a long rental car line? Here are 3 ways to get out

When you factor in both car and staffing shortages, there has perhaps never been a better time to ensure you're enrolled in the loyalty program with your rental car company of choice.

Given that many car companies' loyalty programs offer skip-the-counter — and thus skip-the-line — benefits, TPG has reported on how this can be a crucial step toward making your car-renting experience more pain-free.

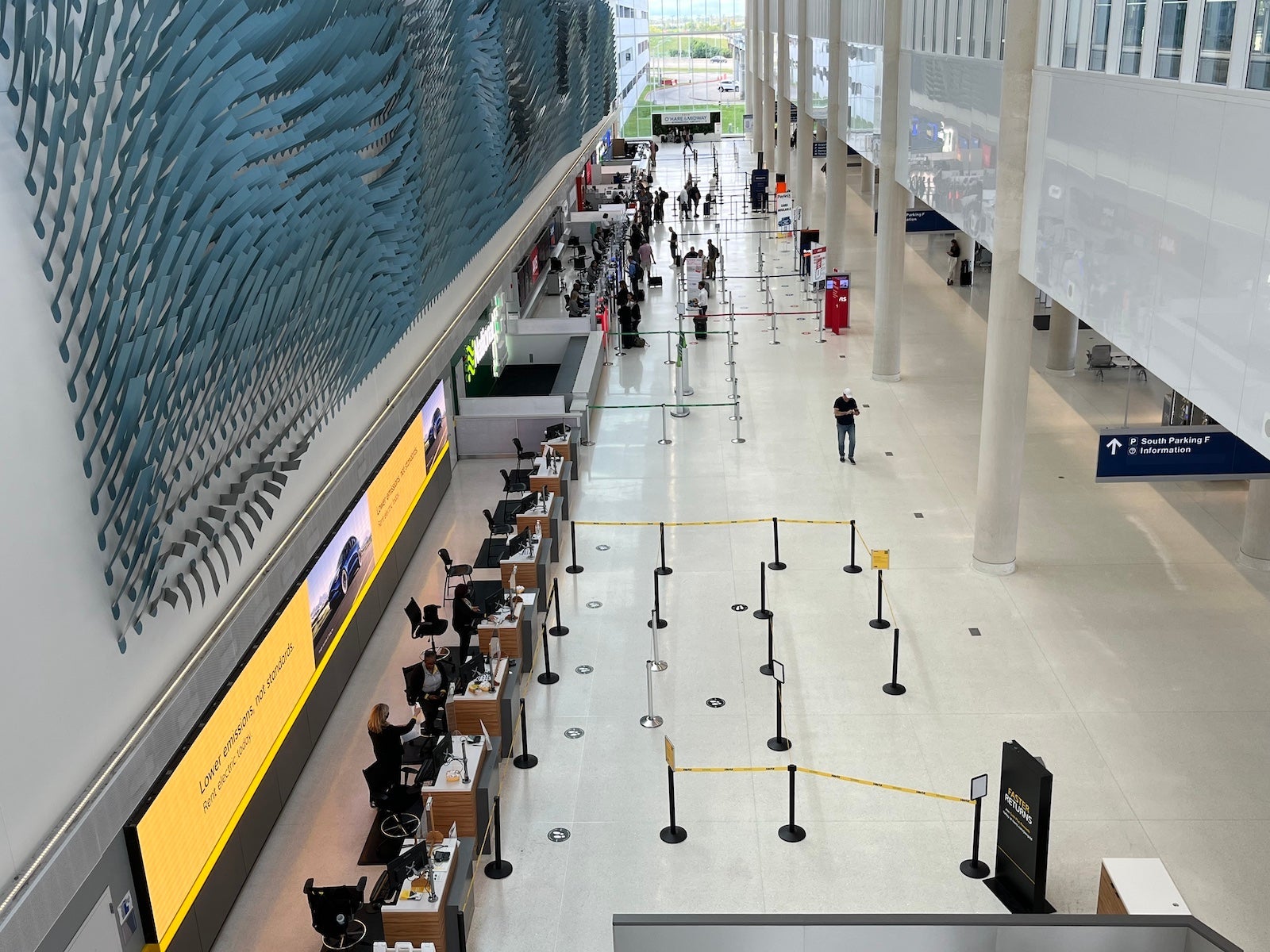

Given my own disdain for waiting in long lines, you can imagine my horror when my father told me about his experience last month at the rental car center at O'Hare International Airport (ORD) in Chicago.

Arriving late at night, he encountered a wait at the Dollar counter he suspected could last a good two hours; fellow customers a bit farther up in the line told him they'd already waited some 90 minutes.

He found himself wondering whether he should endure the wait (before a long drive, no less) or choose from the few, high-priced remaining car options at another rental company.

Certainly, your best bet is to try and avoid these types of situations altogether by joining loyalty programs in advance that can often allow you to skip the counter, where available, and get to your car quickly. Given all the details you have to remember when planning a trip, though, I could certainly see this being an item that slips your mind. It did for me for quite some time.

Even if you find yourself in a situation like my dad — not a loyalty program member, and knee-deep in an exceptionally long line — don't resign yourself to an hourslong wait. You likely still have a way out that will get you to your car relatively quickly. Here's what you should do next.

Related: Renting a car this summer? Things are getting better, but it could still be dicey

Enroll in your rental car company's loyalty program on the spot

If you're not a member of your rental car company's loyalty program but find yourself waiting in a long line, the first thing I'd suggest trying is enrolling in the company's loyalty program right there, on the spot, with your phone, in hopes of immediately earning yourself counter-skipping privileges.

Keep in mind that these are free programs — and thus free line-skipping privileges — the major rental car companies offer.

For instance, Avis Preferred members can get free access to QuickPass, which allows them to skip the counter at most major airport locations, choose a car and head right to it, scanning out of the lot with a QR code.

Hertz Gold Plus Rewards customers can skip the counter and head right to the car after following the steps in the Hertz app.

Dollar customers can join Dollar Express Rewards to skip the counter and go right to the lot. Dollar says the staff will place your rental agreement in your vehicle, but there are still ways for you to change cars.

A number of other companies have similar programs.

If you're renting with a company that does, go ahead and set up a loyalty account, and then be sure to add your reservation to that account. You'll have to enter your personal information, including your driver's license number. That's normally something you'd present at the counter.

Obviously, the company will need credit card information on file, too.

Once you complete this process, see if you can check the car in and then follow the steps to skip the counter and head right to your car.

See if you can cancel for free and book at another company

This is something to consider if, for some reason, the previous option doesn't work. There's no reason why it shouldn't, but we all know technical glitches and the like can happen.

The key question here: Did you prepay for your car? Certainly prepaying can be a way to save a good chunk of money on your car rental. However, some travelers like the flexibility of not prepaying. This can be a case where that choice pays off.

Long line at your rental car company but not a soul in line at the other company's counter nearby?

Check the fine print of your rental agreement (especially if at any point you put down a credit card to hold your reservation). Can you cancel? If so, great — but don't do it yet.

Now check the other company's site to see if you can still get an affordable rate on a car. Lock that rate in (no reason to not prepay, now) and then, only then, cancel your existing reservation.

Consider a neighborhood car rental location

We'll call this the "last resort" option. Maybe you're at a rental car center that doesn't have any skip-the-line options, and all the lines are incredibly long.

While averse to brainstorming the reasons this might become necessary, I'll just point out that when all else fails, you can always check to see if there is affordable availability at any nearby neighborhood rental car centers.

If the price is right, I actually love renting from these locations because they're usually quiet, low-key and easy. I've rented cars from major rental car companies in a hotel basement, a tiny booth in a shopping center and a business park storefront.

Sometimes the prices are much higher than what you'd find at an airport location, but I've also had cases where there was little difference. If you've locked in a reservation, it likely wouldn't be too difficult to reach a location like this with a quick Uber ride.

Keep in mind, though, that many of these neighborhood locations tend to adhere to more traditional business hours, so if you're without a car at 10 p.m., this may not be a viable option.

Bottom line

For most travelers, option No. 1 is undoubtedly the best choice if you find yourself in a long line at the rental car counter. It would have been for my dad in his situation.

Keeping your reservation and simply trying to enroll in that company's loyalty program to jump the line is likely to be your most pain-free option.

In a year in which travelers have encountered snags from a number of fronts when renting a car, though, it helps to have a plan B and plan C so waiting in a multihour line is a true last resort.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app