Complete guide to saving money with Capital One Offers

Editor's Note

There are many ways to save money when you swipe a credit card with a given merchant. Many TPG readers are likely familiar with some of the most popular options — like Amex Offers and Chase Offers. Even Citi Merchant Offers recently added more cards as it expanded to more customers. However, you may not know as much about the similar platform from Capital One.

Capital One Offers launched in 2020 and has grown since then, expanding the number of offers, their quality, and the number of customers who have access.

However, Capital One's site is a bit different from others, as it functions more like an online shopping portal than a repository of discount opportunities.

Here's what you need to know about Capital One Offers and how this can help you save money when shopping online.

What is the Capital One Offers platform?

The Capital One Offers site hosts a program that provides statement credits when you make select purchases with your Capital One credit card. As with Amex Offers, Chase Offers and Citi Merchant Offers, you must add an offer to your card before making a purchase.

Capital One Offers provides cash back as a statement credit after eligible purchases with over 100 merchants. Whether your card earns miles or cash back, you'll earn these offers in the form of cash back. Unfortunately, there is no option for bonus miles instead.

The terms state that credits can take up to three billing cycles to post to your account, and the offers are available only to U.S. cardholders. When logged in to your account on either platform, you can find the offers in the app or on the website.

Related: Tips and tricks to get maximum value from your Capital One miles

What cards provide access to Capital One Offers?

All consumer (personal) credit cards issued in the U.S. by Capital One are eligible for Capital One Offers, so long as the account is in good standing. Unfortunately, business credit cards are not eligible for these offers.

Thus, cash-back-earning cards from the Savor and Quicksilver families of cards are eligible. Additionally, cards earning Capital One miles, such as the Capital One Venture Rewards Credit Card, Capital One VentureOne Rewards Credit Card and Capital One Venture X Rewards Credit Card, also participate.

How to find Capital One Offers

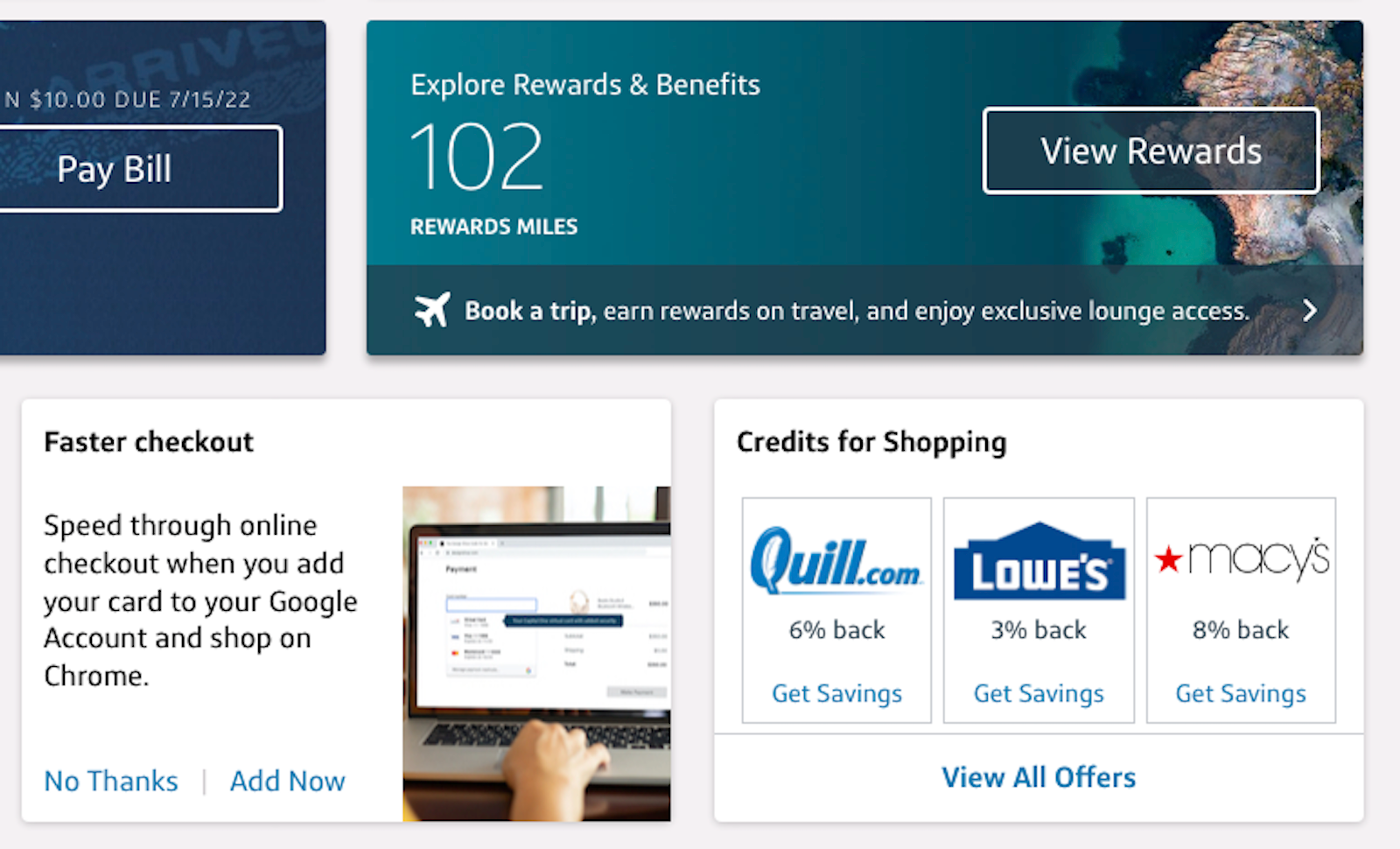

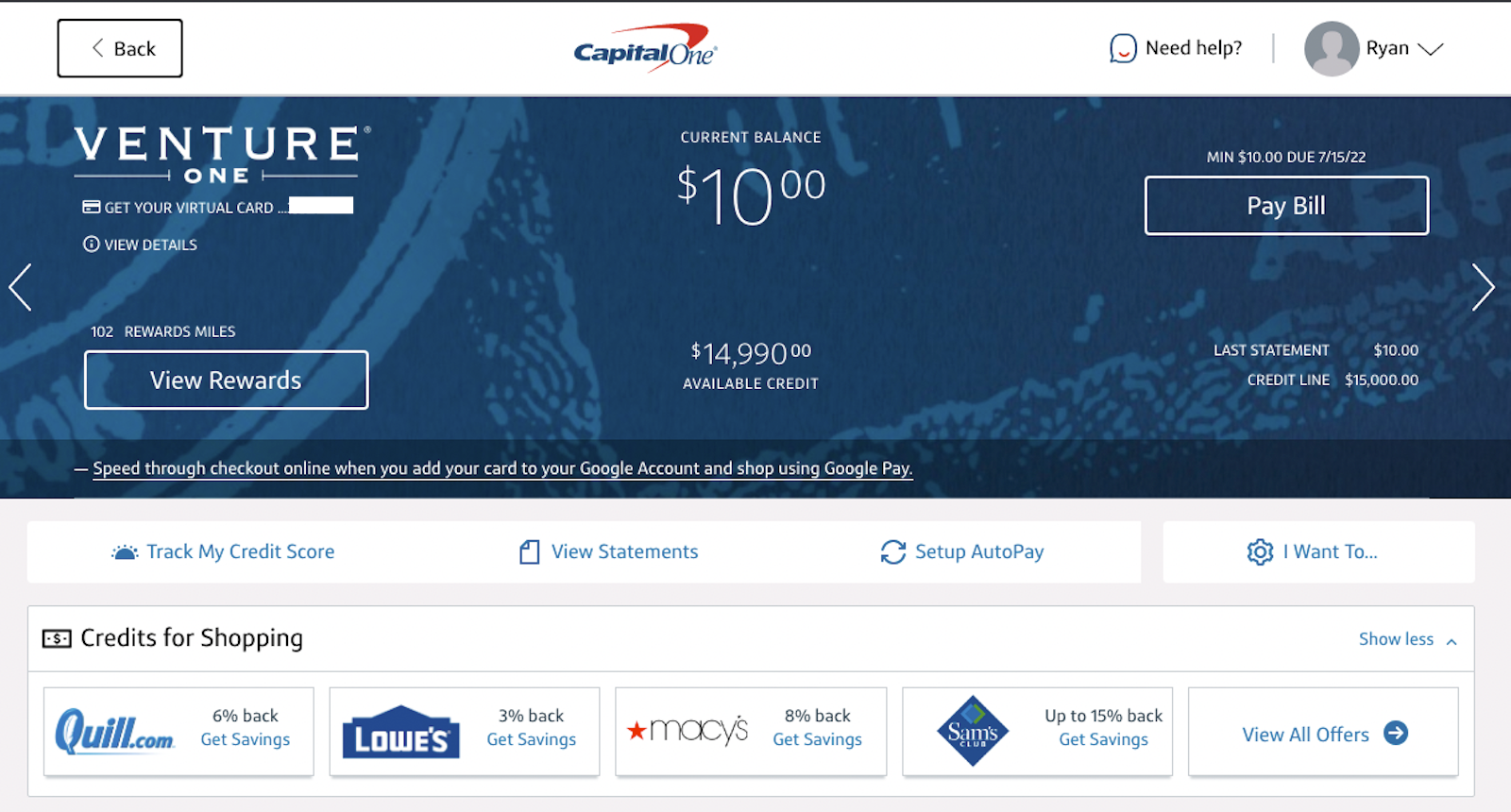

You can access Capital One Offers from the website and from the issuer's mobile app. Start by logging in to your account, then locate "Credits for Shopping" on the right side of your user portal. Click on "View All Offers" to go to the Capital One Offers page.

Additionally, if you are in the card management area for one of your credit cards, you can look for "Credits for Shopping." This is found under your current balance and payment details. From there, click on "View All Offers" on the right side to view all available offers for your card.

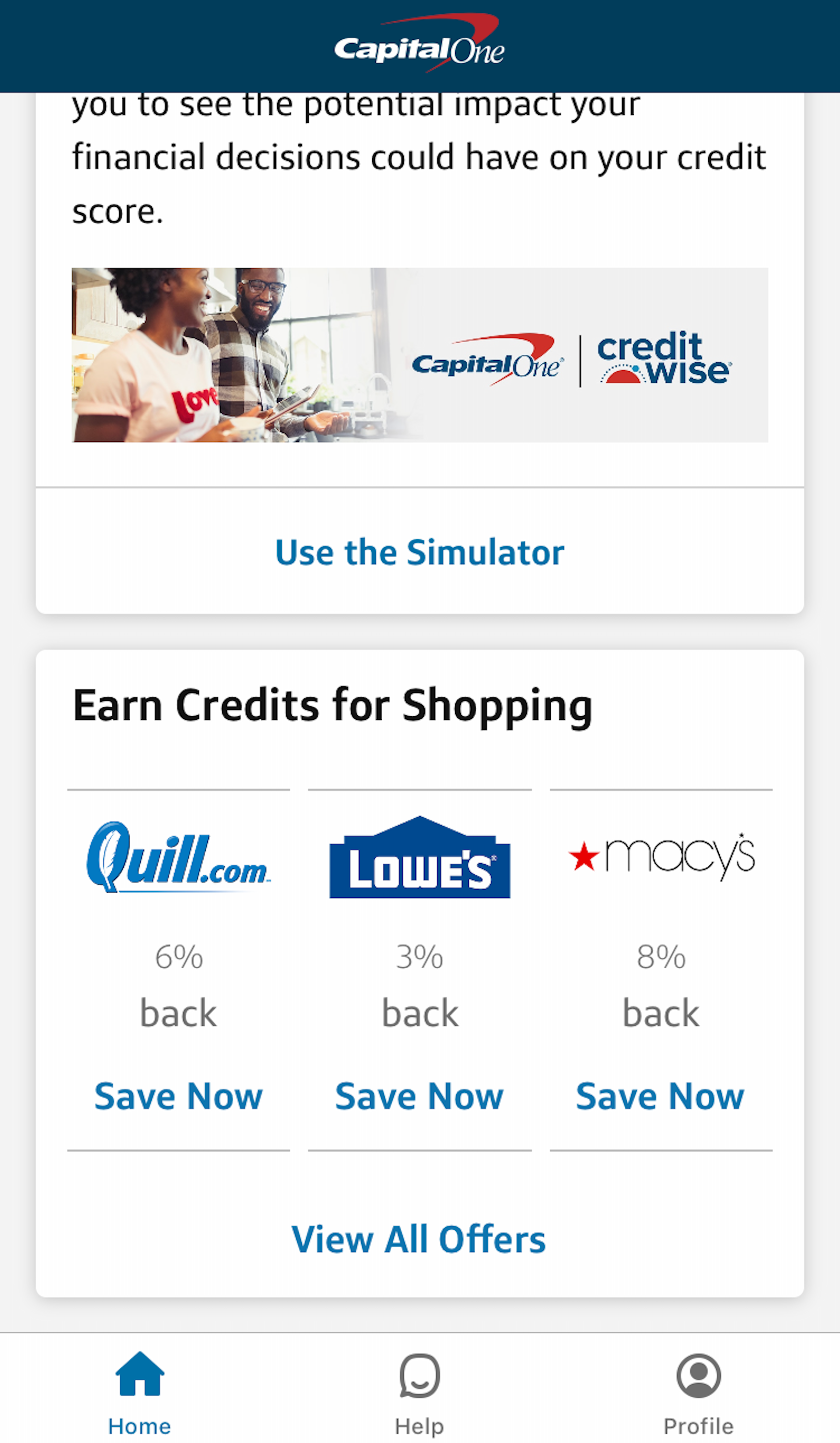

Within the mobile app, after logging in, all you need to do is scroll down. You can access Capital One Offers at the bottom of the page by clicking on "View All Offers."

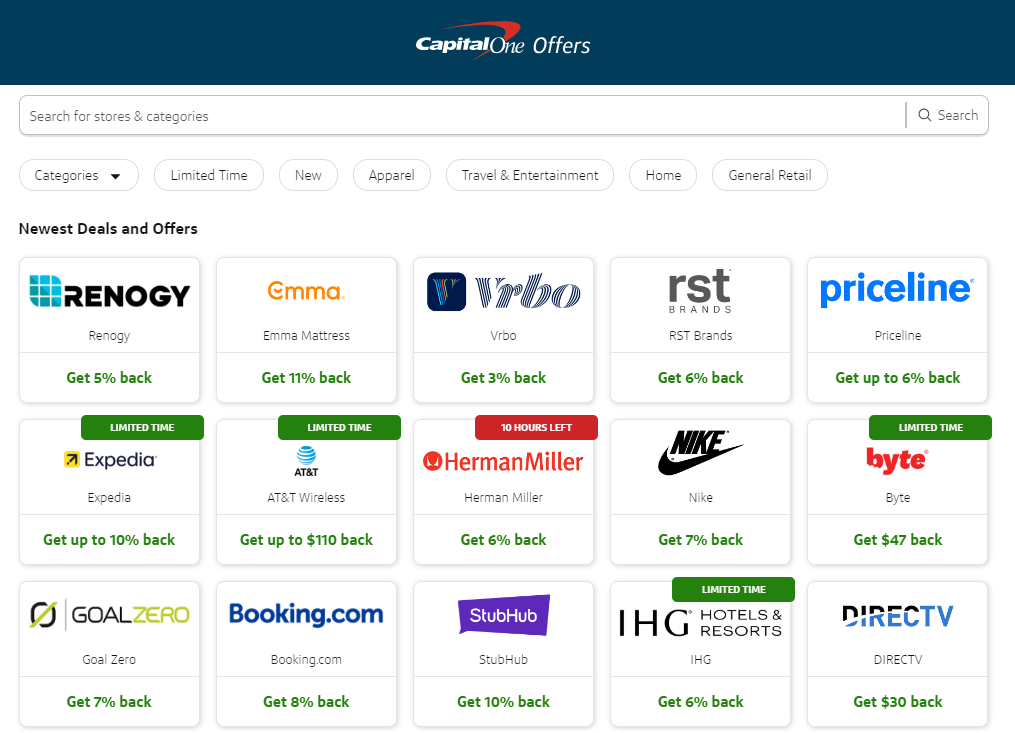

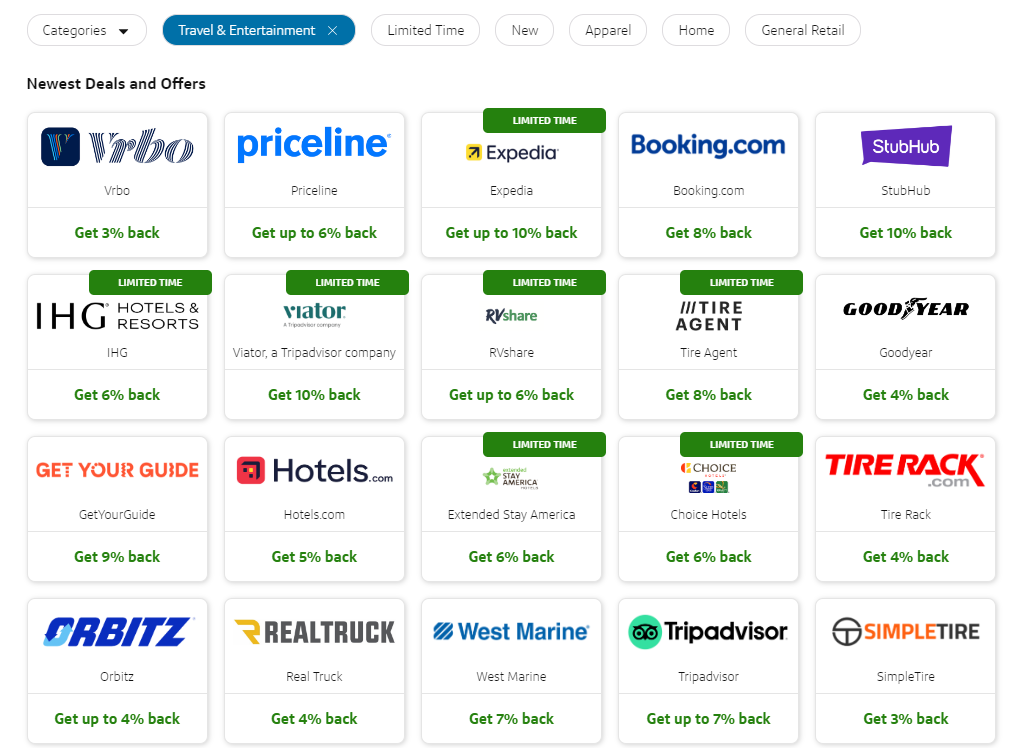

What deals are available with Capital One Offers?

Unfortunately, the offers aren't grouped or organized in any meaningful way. There's no option to sort them into alphabetical order, nor can you filter by category or merchant. There are offers for different types of spending, such as travel, meal kits, shopping sites and more.

Thus, you'll need to search for offers using the name of the merchant you're interested in. You can also search with a keyword, such as "hotel" (as shown below). Unfortunately, this type of search isn't always reliable and might not find everything you'd expect.

In this example, several hotel brands are included in the results. However, the search also displayed results for online travel agencies like Priceline and Booking.com, plus there are unrelated results for West Marine and Stubhub.

The silver lining to this setup is that you don't have to worry about which offers are attached to which of your credit cards. With Amex Offers, you may see an offer on one of your cards but not on another — a card you may prefer to use with that merchant. Capital One Offers are not associated with a particular card and thus can be used with whichever card you prefer to use at that merchant. This allows you to choose the best card to earn the most miles or cash back, depending on the spending category.

Related: The best rewards credit cards for each bonus category

How to use Capital One Offers

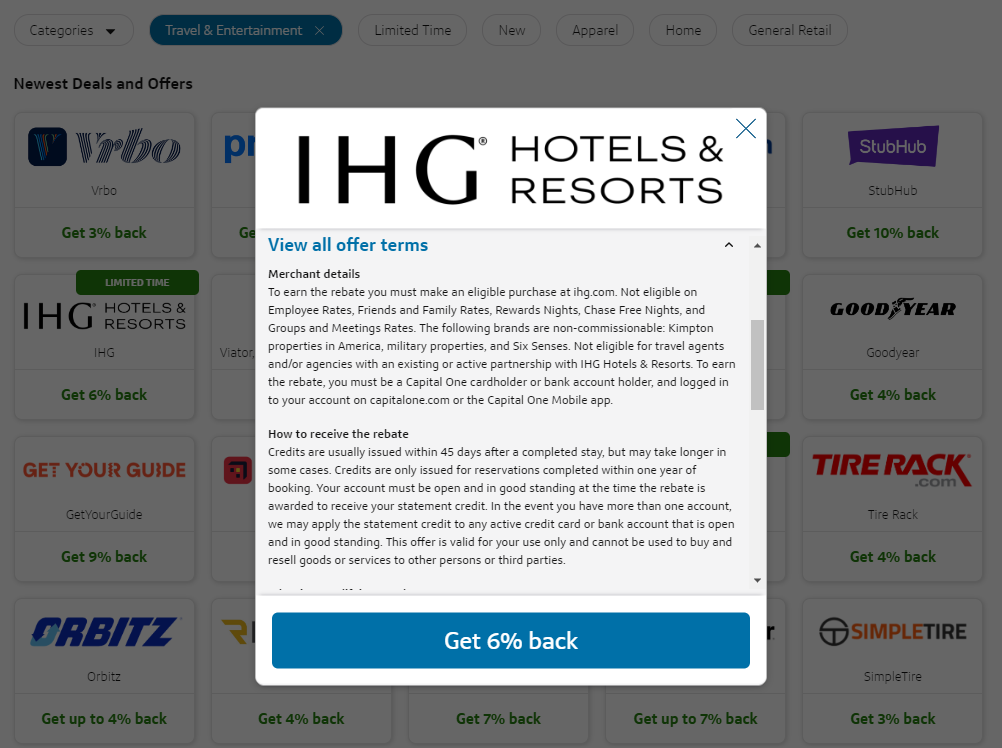

Whether using the app or website, you can click "Save Now" on any offer. Doing so will take you to the offer details page. Here, you can read the applicable terms.

For instance, if you use the below offer from IHG, you'll only receive the credit after your stay and only if the stay is completed within one year of booking. Thus, if your reservation is for nine months from now, you would only receive the credit after you complete that stay. This can be a long time to wait for (and keep track of) your statement credit.

If you want to take advantage of the offer, click on the "Continue to Merchant" button and complete your transaction with an eligible Capital One credit card. It's important that you use the link provided and that you don't alter the URL in your web browser's address bar. This has important tracking information to ensure that Capital One knows you took advantage of the offer.

After completing the offer on the merchant's website, you'll find a "Welcome Back" page on Capital One Offers. This page reminds you of the applicable terms and that many offers can take up to three billing cycles to complete reimbursement — unless your offer has a different timeline, such as our example above.

CAPITALONE.COM

Related: Earn even more rewards by adding this 1 small step to your online shopping routine

What to know about Capital One Offers

Now that we understand how to find and use Capital One Offers, there are some important things you should know.

GETTY IMAGES

It functions like a shopping portal

Capital One Offers is like an online shopping portal. You need to follow the links associated with the offers, keep the window open and be sure to not edit the URL in your browser's address bar. Altering anything in this process can mean your transaction won't track with Capital One — thus you won't get the rebate.

You can't stack promotions

Because Capital One Offers operates like a shopping portal of its own, you can't combine these offers with other offers. In fact, the terms on the offers say adding coupons, discount codes or clicking through other portals means you will likely forfeit any statement credits from Capital One Offers.

On the other hand, both Amex Offers and Chase Offers simply need to be activated on a participating card. You're then free to make the qualifying purchase through a site like Rakuten (though additional restrictions may apply).

Compare these against other offers

Because you can't stack Capital One Offers with other shopping portals, discount codes or coupons, you should consider whether other offers are better. Receiving 3% back from a Capital One Offer might be less valuable than the ability to stack several offers by shopping in a different way.

Reading the terms is important

Each offer has its own particular terms. Large sections of these will be the same, but it's important to note the terms before using an offer. Pay attention to how long it can take to receive your rebate. In addition, watch for exclusions on things like trial memberships, gift cards and items placed in your shopping cart prior to activating the Capital One Offer.

Some offers can be used more than once

While some offers can be used multiple times, others can't. Make sure you note this in the terms of a merchant's offer. If you can only use an offer once, be sure to purchase everything you want in one transaction. Coming back later for a second purchase on these "one use only" offers means you won't get any cash back on the subsequent transactions.

Your credit may not be issued on the card used for the purchase

Each offer includes this interesting bit: "In the event you have more than one Capital One credit card, we may apply the statement credit to any active credit card account that is open and in good standing." This means you might pay for an offer with your Capital One Venture X but receive the credit on your Capital One QuicksilverOne Cash Rewards Credit Card. Make sure to check any eligible cards you have in order to ensure your cash back posts as expected.

Related: How credit card merchant offers can save you hundreds of dollars every year

Bottom line

The Capital One Offers site provides discounts on a wide variety of purchases on many of the issuer's popular cards — including the Venture Rewards and Venture X. Unfortunately, these offers can't be stacked with other ways to save — including shopping portals, coupons and most discount codes.

Because of this, you should always check to see what offers are available across all of your credit cards and various online portals to be sure you're getting the best deal. If Capital One Offers has the best deal available, you should know how to find and use them after reading this guide.

For more information, check out our guide on the best Capital One cards.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app