A complete guide to Capital One's Lifestyle Collection for hotels

Editor's Note

Capital One launched its first luxury hotel program — the Premier Collection — in 2023, joining the ranks of well-established hotel programs by American Express, Chase and Citi.

Capital One Travel has since expanded this to include the Lifestyle Collection. This collection is open to a broader range of cardholders than the Premier Collection, allowing more people to book boutique hotels using their Capital One miles and enjoy benefits typically reserved for those with hotel status.

But should this program change the way you choose a hotel? Here's what you need to know.

Related: How to save 10% on all hotels and 5% on all flights with Capital One

What is the Capital One Lifestyle Collection?

The Lifestyle Collection includes boutique properties in popular locations. These properties incorporate modern design and highlight local art and culture. They also feature quality dining and access to unique entertainment.

The Lifestyle Collection includes some known brands such as Virgin Hotels, The Standard, Design Hotels and The Line, as well as smaller boutique hotels like The Ludlow in New York City and The Lyle in Washington, D.C. However, many properties from major hotel brands like Hilton, Hyatt, Marriott and IHG are missing from the collection.

Related: Best Capital One credit cards

Which credit cards include Lifestyle Collection access?

The Lifestyle Collection is available to the following cardholders:

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business Card

- Capital One Venture Rewards Credit Card

- Capital One Spark Miles for Business

While the Lifestyle Collection offers a less impressive list of benefits than the Premier Collection, it offers hotel program access to some cardholders who may not be able to justify shelling out the higher annual fee for the Venture X or Venture X Business.

Related: Is the Capital One Venture X worth the annual fee?

What are the benefits of the Lifestyle Collection?

When you book a Lifestyle Collection hotel through a Capital One Travel portal, you'll earn bonus miles on your purchase. Venture X and Venture X Business cardholders earn 10 miles per dollar spent, while Venture and Spark Miles cardholders earn 5 points per dollar spent, through their respective travel portals.

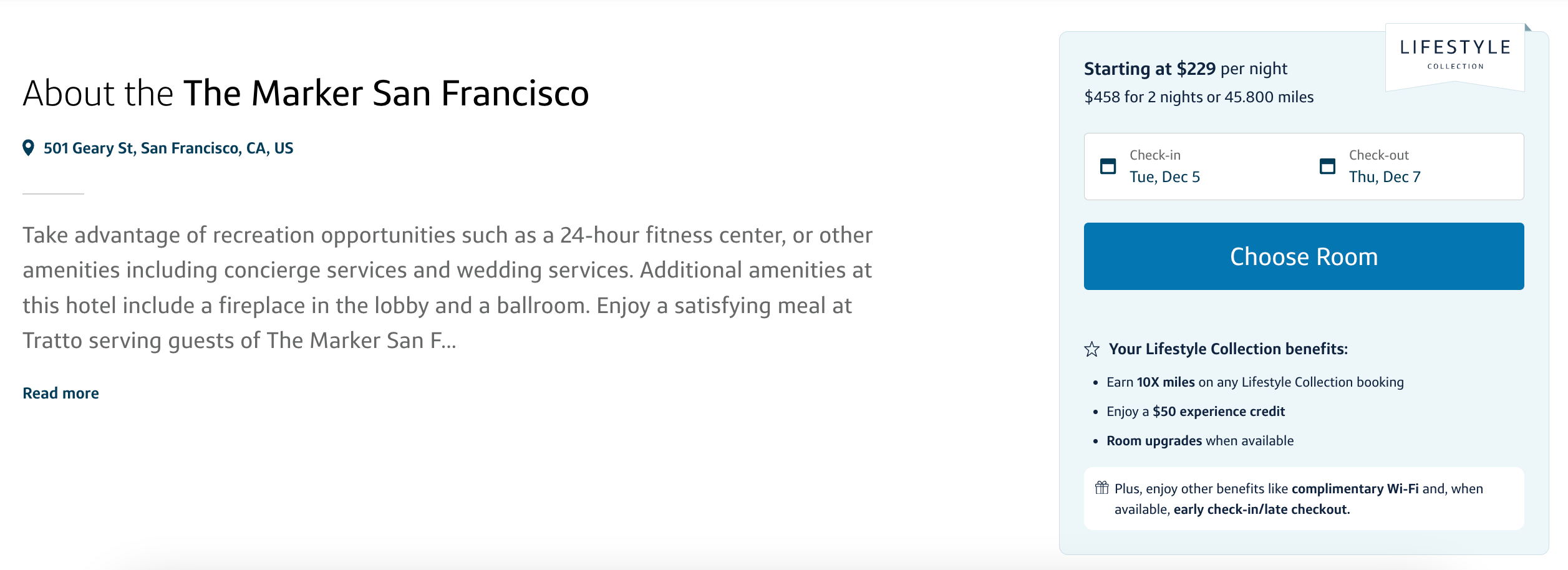

In addition to earning bonus miles, you'll get these perks with the Lifestyle Collection:

- A $50 experience credit to use toward rooftop drinks, signature hotel restaurants, room service or other activities

- Complimentary Wi-Fi

- Room upgrades, when available

- Early check-in and late checkout, when available

Plus, there is no minimum stay requirement to book a Lifestyle Collection hotel, a notable difference from Amex's The Hotel Collection, which requires staying at least two nights.

Free Wi-Fi and a (non-guaranteed) chance for early check-in probably won't sway your decision when selecting a hotel for your next trip. Still, the $50 experience credit and ability to earn bonus miles on a boutique hotel stay could make booking via the Lifestyle Collection a better option than booking your stay directly through the hotel website.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

How to book Lifestyle Collection hotel stays

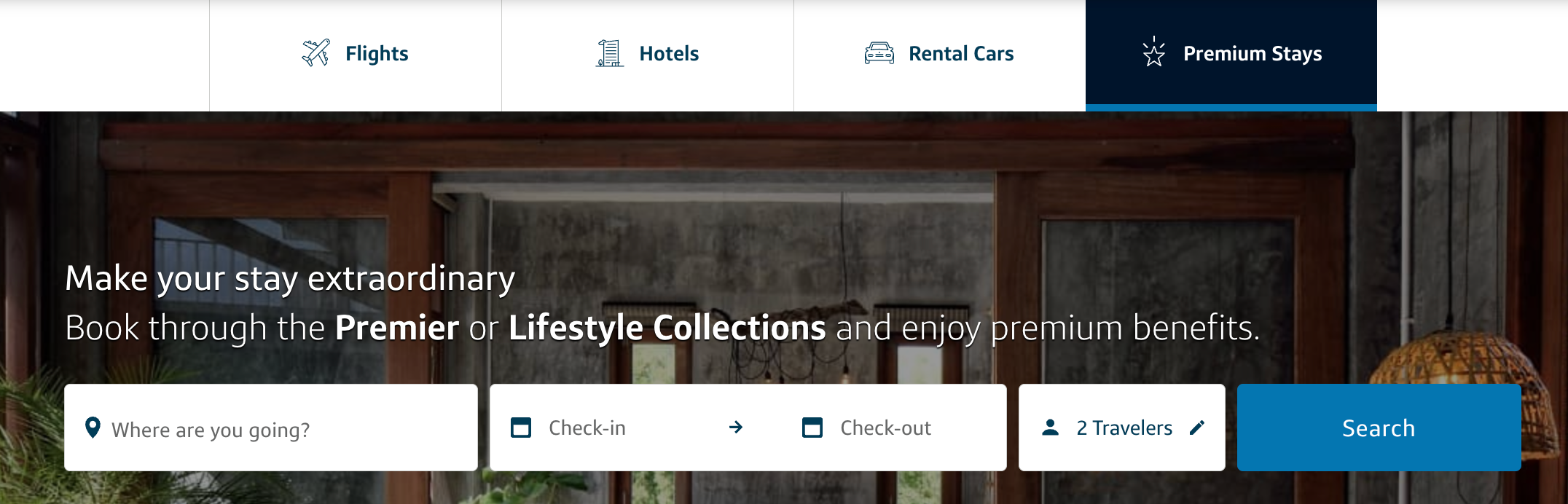

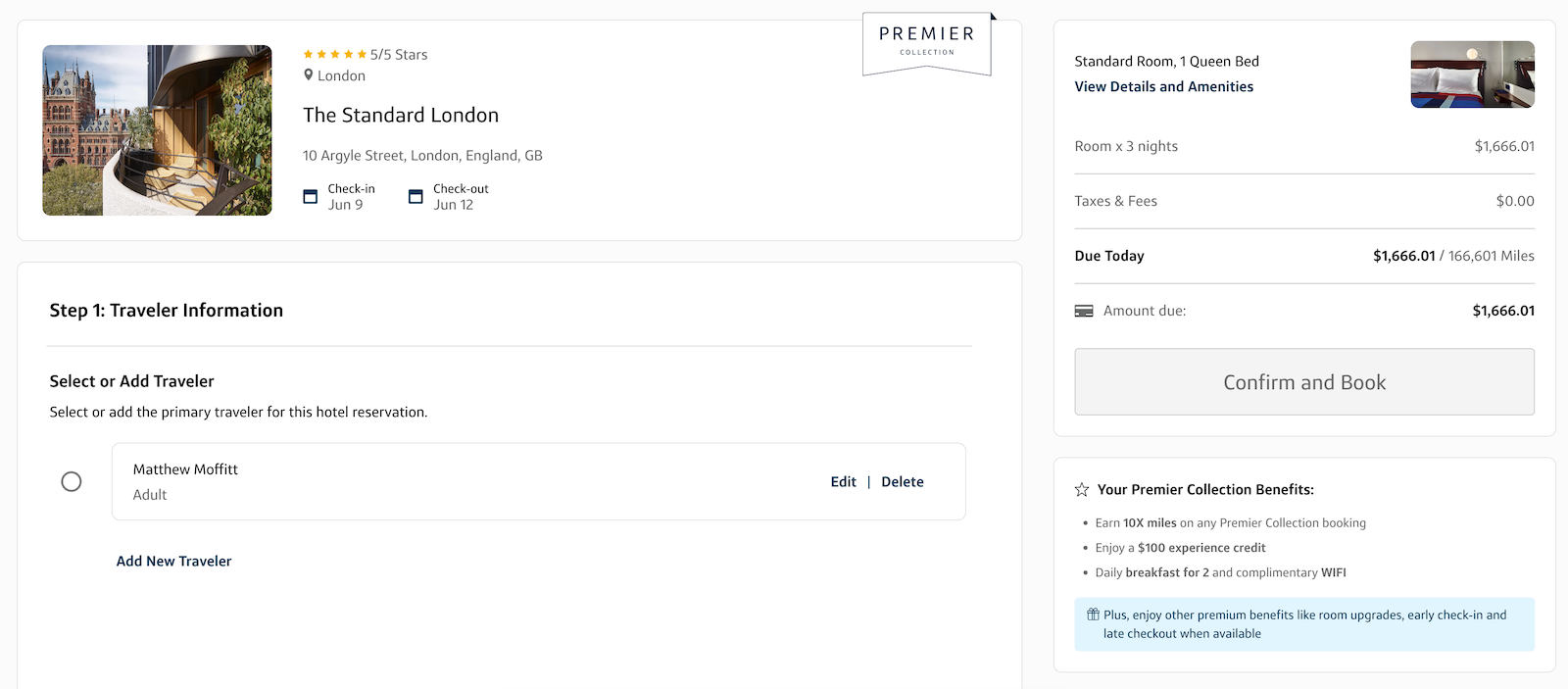

To book a hotel with the Lifestyle Collection, you must book through Capital One Travel.

Once logged in, you can click on the "Premium Stays" tab at the top right or "Hotels" to see both Lifestyle Collection and non-Lifestyle Collection accommodation options.

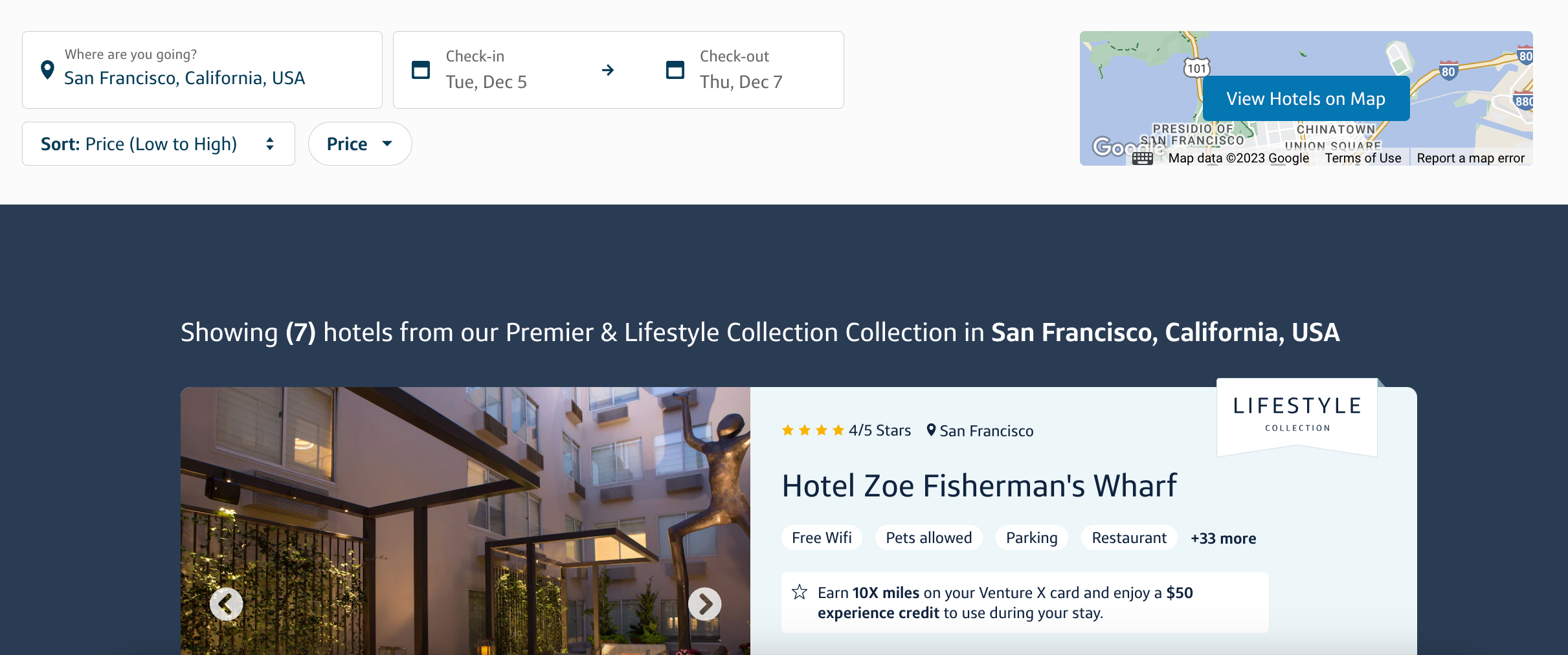

Search for your intended destination as you normally would.

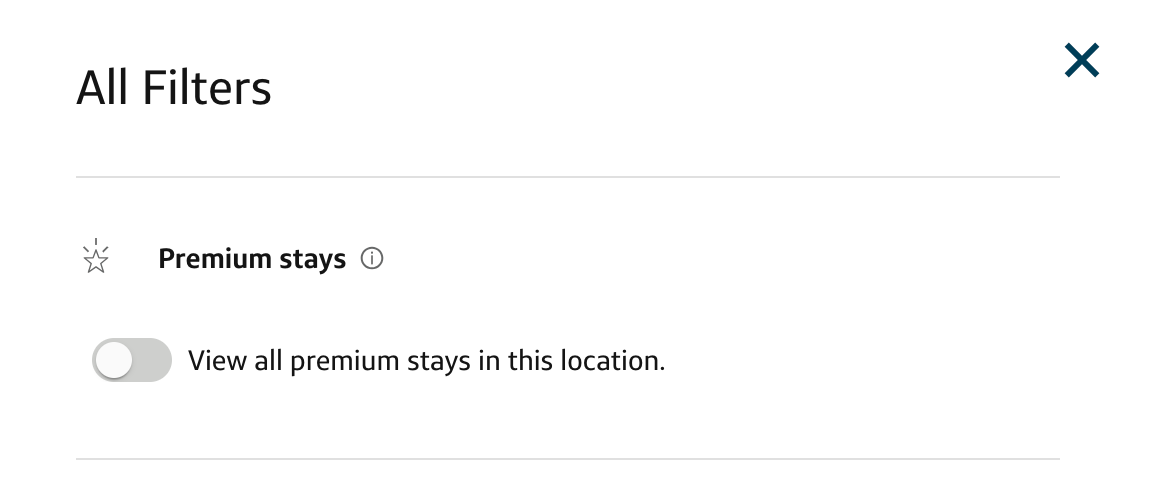

If you've chosen the "Hotels" tab, you can filter for Premium stays in your location.

Scroll through the list to see highlights of the hotels, such as available amenities and pricing. Clicking on a hotel provides details about its offerings and location.

When making a paid reservation with these cards, you will earn 5-10 Capital One miles per dollar. Per TPG's October 2024 valuations, these miles are worth 1.85 cents apiece, meaning you would earn a healthy 9.25%-18.5% return on spending.

Finally, you have the option to pay cash or redeem your miles at 1 cent apiece to pay. (We recommend paying in cash as you can get better value for your Capital One miles on other redemptions.)

Related: How to earn, redeem and transfer Capital One miles

Can I pay for the Lifestyle Collection with my Capital One miles?

Yes. Since the Lifestyle Collection is through the Capital One portal, you can redeem your miles at a rate of 1 cent per mile.

This is a lower redemption value than TPG's October 2024 valuation of 1.85 cents that you could get by transferring your miles to transfer partners, but it's a good option if you have a lot of miles or if this is a better fit for your plans than other options.

Related: Tips and tricks to get maximum value from your Capital One miles

Is the Lifestyle Collection worth it?

Since the available hotels aren't exclusive to the Lifestyle Collection, you'll want to do some research and compare prices before booking. You might be able to find a better price directly through the hotel's site or via another third-party booking agency like Hotels.com.

Additionally, your hotel status may not be recognized, so you could sacrifice any additional earning potential and perks associated with your status.

Still, Venture X and Venture X Business cardholders can apply their $300 credit to a property in the Lifestyle Collection, so combining this credit and the Lifestyle Collection perks could make this a better option than booking anywhere else.

Related: Who should (and shouldn't) get the Capital One Venture X card?

Bottom line

The Capital One Lifestyle Collection is accessible to a wider range of cardholders than its Premier Collection but offers fewer perks. It can be a good way to enjoy some hotel benefits if you don't want to pay a higher annual fee for a premium credit card and don't have hotel status.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app