How to Avoid Excess Toll Road Charges for Rental Cars

Toll roads are becoming increasingly common in many major cities. Sometimes these tolls are imposed to fund new construction, while other times drivers are offered the choice of using "express" toll lanes that may have less traffic. When this trend was combined with the move toward cashless tolling systems, rental car companies smelled a new profit stream that reeked of a scam to their customers. In this post, I'll explain how certain rental agencies handle these charges, and what you can do to avoid paying more than your share.

How This Scam Works

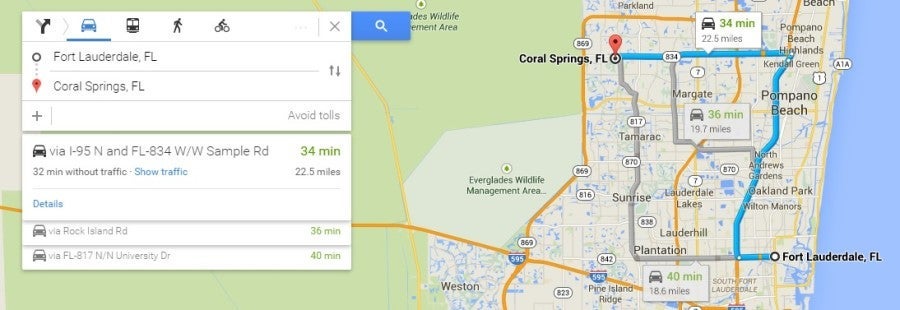

To visit my grandmother in Coral Springs, Florida (about a half hour north of Fort Lauderdale), I have always taken the Sawgrass Expressway and forked over two quarters each way for the privilege. But a couple years ago I was forced to drive my rental car through the automated toll plaza, as the cash toll booth was being demolished before my eyes.

As a result, I was stuck paying both the toll itself and Alamo's "convenience charge" of $3.95 per day, which is quadruple what my round-trip cost would have been if I had been able to pay cash. Adding insult to injury, my account was charged for the full toll price rather than the discounted price paid by all other vehicles with transponders. Furthermore, from the moment I triggered the first toll, I would be charged the $3.95 daily fee per day (or fraction of a day, with a maximum of $19.75) regardless of whether I passed through another toll during my rental.

You can rest assured that the $3.95 fee does not go to an army of skilled bureaucrats sifting through a mountain of toll invoices that arrive in the mail — it's all handled electronically, and nearly all of these charges are retained as profit.

That's not even the worst of it. In Florida, Dollar and Thrifty charge a $15 administrative fee per toll unless customers opt in to the $8.99 per day "all inclusive" plan (so I can come out ahead if I visit grandma 10 times each day!).

Other Aspects of the Scam

The key elements of any scam include making it as hard as possible for customers to be aware of any potential charges. Here, the rental car companies employ a well-worn playbook that looks like this:

First, they provide little (if any) information on the company website, so customers are blindsided once they arrive at their destination. For example, consider Fox Rent A Car. If this company is trying to be more transparent about its tolling practices in light of its class action lawsuit for undisclosed fees, I can't find any evidence of it online. The only reference to tolls on the Fox website is in the FAQ under What if I receive a Parking Ticket or use a Toll Road? (as if they're the same thing). The answer warns of an unspecified "service charge," and cautions driver to "only access Toll Roads that allow for payment when entering." To top that off, Advantage Rent A Car's website makes no reference whatsoever to tolling charges.

Next, companies make sure that any required disclosures at the rental counter are as vague as possible. If you're lucky, you'll see a small placard pointing out that some roads may have a toll that cannot be paid with cash, and that customers will be automatically billed for the toll, along with any "applicable service fees," or some such understatement.

Finally, companies pull an old classic by burying any legally required disclosures deep, deep within the fine print of a contract that no one ever reads.

How Different Rental Car Companies Handle Tolls

Advantage and Hertz use the PlatePass company, which charges a $4.95 daily fee plus tolls at the higher cash or toll-by-plate rate, with a $24.75 maximum fee per rental. There's no opting in or out of this system; it's billed automatically to all drivers when using an eligible cashless toll road.

Avis/Budget automatically charge a $3.95 daily fee, ($19.75 maximum per month) plus tolls at the cash rate.

Dollar/Thrifty are supposed to give customers the option of an all-inclusive toll package or a per-toll charge of $15 (both of which seem to vary based on rental location). Yet on my most recent visit to Florida, no one volunteered this information or offered me any choice. Thankfully, I made sure to opt in to the daily flat rate, which still billed me several multiples of the actual toll charges, but far less than if I had to pay an additional $15 per toll.

Fox seems to be inviting future lawsuits by not disclosing anything about tolls (at least on its website). As best I can tell, Fox considers driving on a toll road some sort of violation, and hands things over to a company called Violation Management Services (VMS). If you have any doubt about what's going on on here, consider that VMS advertises to potential new clients that receive toll charges (the rental car companies, not you) that they can turn the "cost center into a self-sustaining component" of the business.

National, Alamo and Enterprise automatically charge a $3.95 fee per day ($19.75 maximum per rental period) plus tolls.

Silvercar is once again the exception to the rule. It is the only rental car company that I'm aware of that simply passes along the toll costs with no markups! (Check out this review of Silvercar for more info.)

Tips for Avoiding This Scam

1. Education. You may want to spend a few minutes learning about toll roads at your destination as part of your travel planning. Before leaving home, sit down with Google Maps or your favorite mapping site, plot your course, and see whether it necessarily involves cashless toll roads.

2. Avoid toll roads. Google Maps (and presumably other mapping sites) allow you the option to avoid toll roads. You might find a free option that's just a few minutes longer than a tolled option. For example, I live in Denver, where we have an outer beltway that charges a toll by scanning your license plate and mailing you a bill. Nevertheless, I often drive for years without using it, as it rarely saves me much time.

3. Choose the right rental car company. At the top of the list is Silvercar, which imposes no "convenience charges" on its customers. Next, I find Avis and Budget to be the least obnoxious about extra charges, as they add $3.95 per day with a maximum of $19.75 a month. All else being equal, this is substantially less than the competition. At the bottom of the list are companies like Fox that don't even disclose policies, and treat toll charges like some sort of a legal violation with stiff penalties.

4. Check out the toll road's website. A great resource for finding out what fees to expect with various rental car companies is the toll road's website. To the credit of the agencies that operate these toll roads, many are at least trying to be more transparent, presumably after having to deflect intense criticism from travelers who were taken by rental car agencies. For example, Florida's SunPass program clearly discloses far more in one simple web page than all of the major rental car company websites combined.

5. Pay for it yourself. Before cashless tolls took over, smart travelers would simply bring change and avoid rental car charges the way hotel guests use their mobile phones to avoid inflated telephone bills. But it may surprise you to learn that you can pay for a toll directly, if you take a few steps in advance.

For example, in Florida, you can buy your own SunPass portable transponders at supermarkets and drugstores for about $20, plus a minimum cash load of $10. At that price, most travelers (except those renting from Silvercar), will come out ahead after just a few days! New York and other states that are part of the EZ Pass network also sell transponders at retail locations. This solution makes great sense when you plan on visiting the same location more than once.

In other states, you can simply register your rental car with the local tolling authority. For instance, in the Denver metro area, the ExpressToll system (which operates the E-470 beltway and other express lanes) allows you to register your plate and set up direct billing before going through the tolls. The easiest way to do this is to create an account ahead of time, and then simply add the rental car to the account at the time of rental.

Conclusions

While I love the concept of cashless tolls, I hate companies that seek to underhandedly extract profit at the expense of travelers even more than I hate toll booths. From now on, I'll just have to plan ahead to either avoid toll roads or choose the least expensive rental car option. On my last trip to Florida, I ended up paying an extra $20 in fees to use toll roads; next time I plan to pick up my own SunPass transponder and opt out of the inflated charges.

What are your strategies for dealing with excessive rental car charges, tolls or otherwise?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app