SAS offering spring premium economy deals to Europe

Update: Some offers mentioned below are no longer available. View the current offers here.

One of the best ways to get to Europe with some extra comfort — but without breaking the bank — is to fly premium economy. Right now, a European carrier is offering some pretty compelling prices to a long list of European cities.

Scandinavian Airlines is currently pricing round-trip fares to Europe in premium economy as low as $600 — or even below that mark in some instances.

In many cases, this amount is roughly what you'd pay for an economy ticket ... and premium economy typically far exceeds coach fares, falling somewhere between economy and business class.

The current deals span a variety of routes between the U.S. and Europe in cities SAS serves. You'll find these discounted SAS premium economy prices available during much of the peak spring break travel months, as well as during the late summer and early fall periods.

So, if you're actively searching for spring break options and live in a city served by SAS, it may be a good time to check prices.

Deal basics

Airline: SAS

Routes: Boston, Chicago, Los Angeles, Miami, New York City, San Francisco and Washington, D.C., to multiple European destinations

How to book: Directly with the airline

Travel dates: February through May and August through October

Book by: Soon before options run out

Special thanks to Going for scouting these deals. For $49 a year, the site's Premium membership offers discounts of up to 90% and comes with a 14-day free trial. The Elite membership also finds premium economy, business-class and first-class deals.

Sample flights

There's a wide range of U.S. and European city pairs included in this deal. Depending on the route, you may find fares for as low as $600.

If you're thinking of taking advantage of these premium economy offerings, your best bet is to head over to Google Flights, find your ideal itinerary and price point, and then book the flight directly through the SAS website. (If you're a United MileagePlus loyalist, you can enter your United Airlines loyalty number when booking the flight since SAS is a member of Star Alliance.)

Most SAS flights from the U.S. fly to Copenhagen Airport (CPH), so you'll likely have to make a connection there if you're headed to a different European city. In some cases, the layover offered may be pretty significant (10 hours or more).

One way to use this scenario to your advantage? Spring for a very long stopover (20-plus hours), and give yourself some time to explore Copenhagen in addition to wherever else you're visiting.

Here are just a few of the options we found (not that all deals are for premium economy fares):

- Boston to Athens, Greece, for $785

- Boston to Milan for $812

- Boston to Rome for $830

- Chicago to Dublin for $670

- Chicago to London for $786

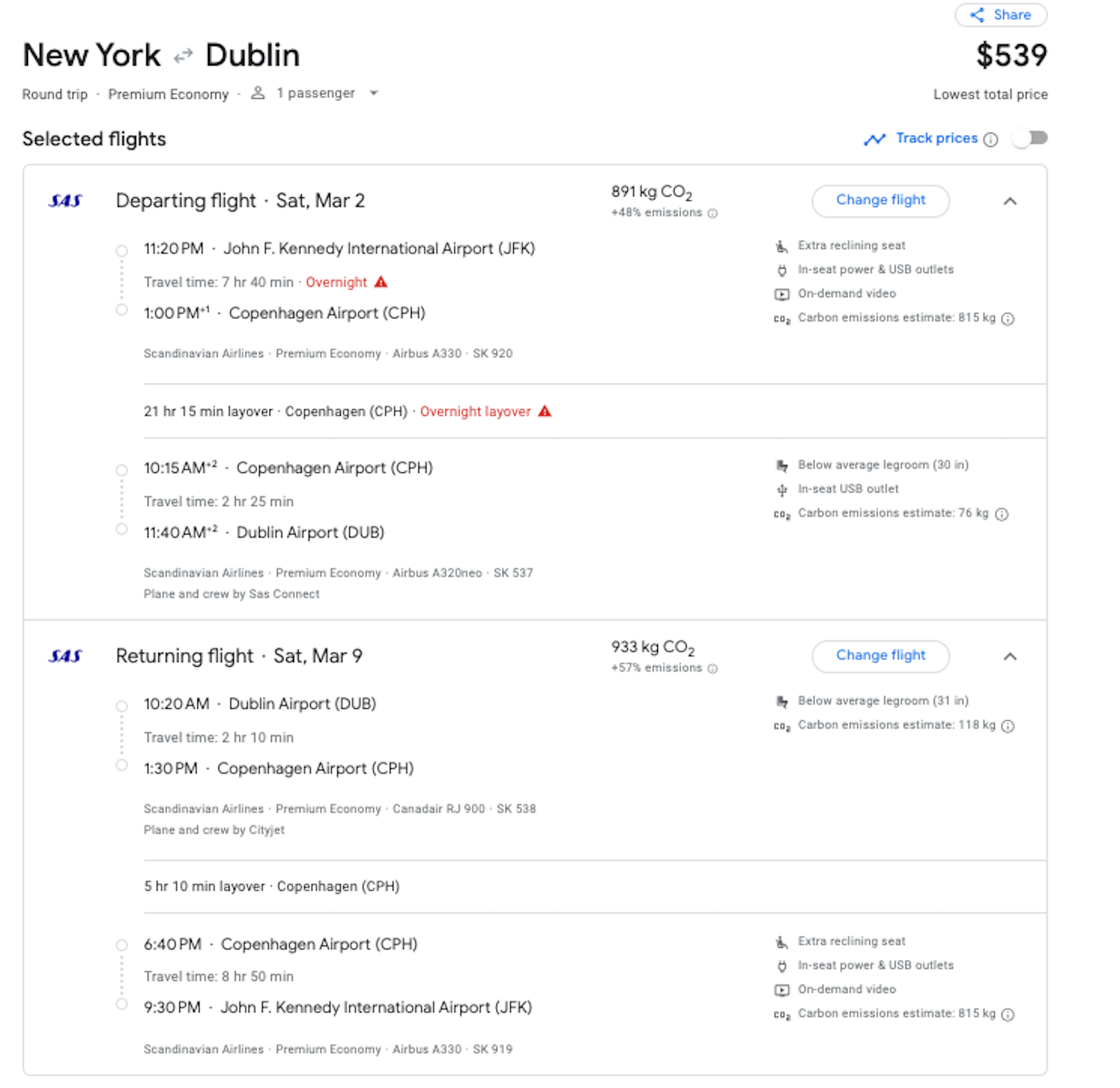

- New York to Dublin for $539

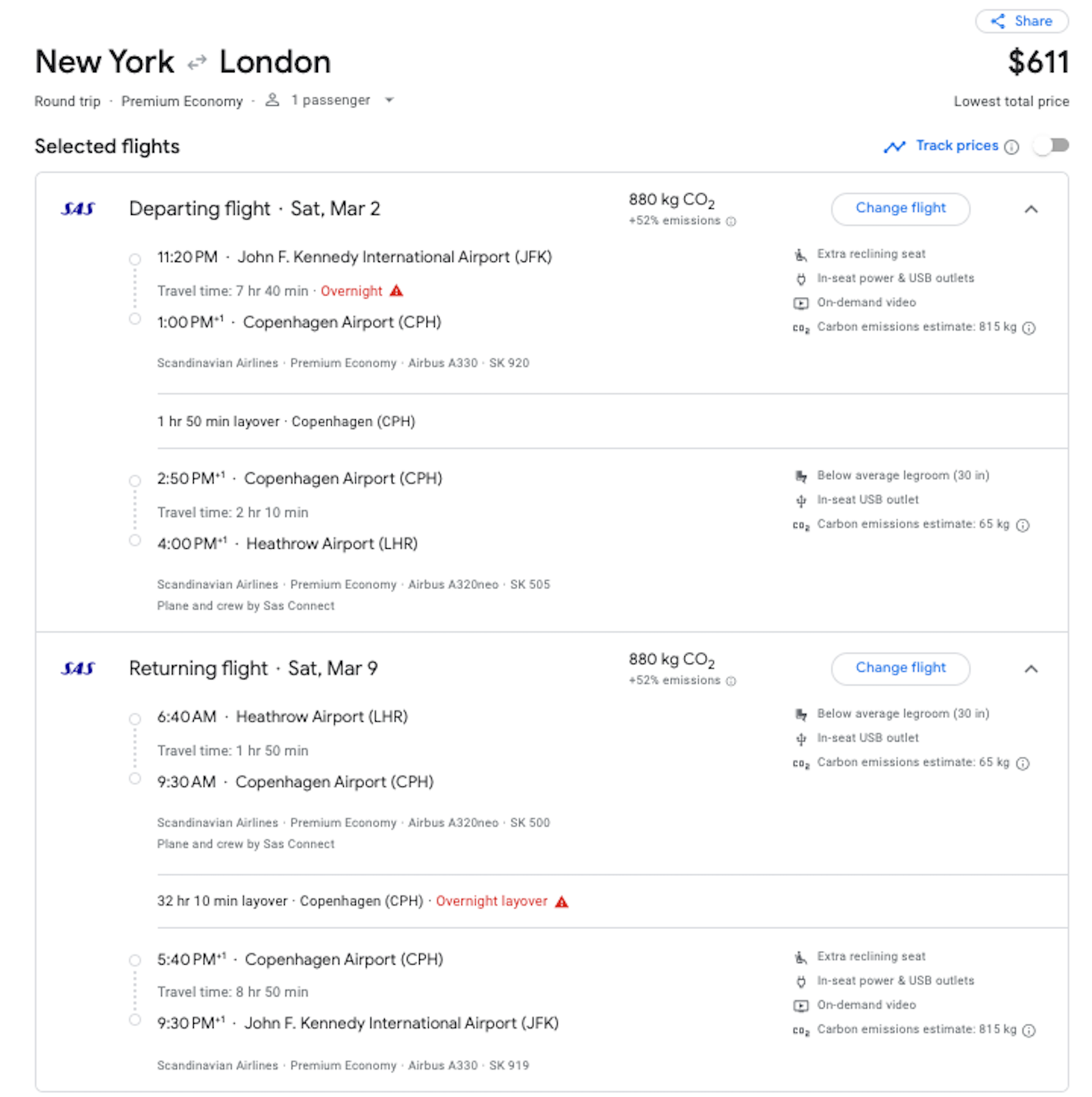

- New York to London for $611

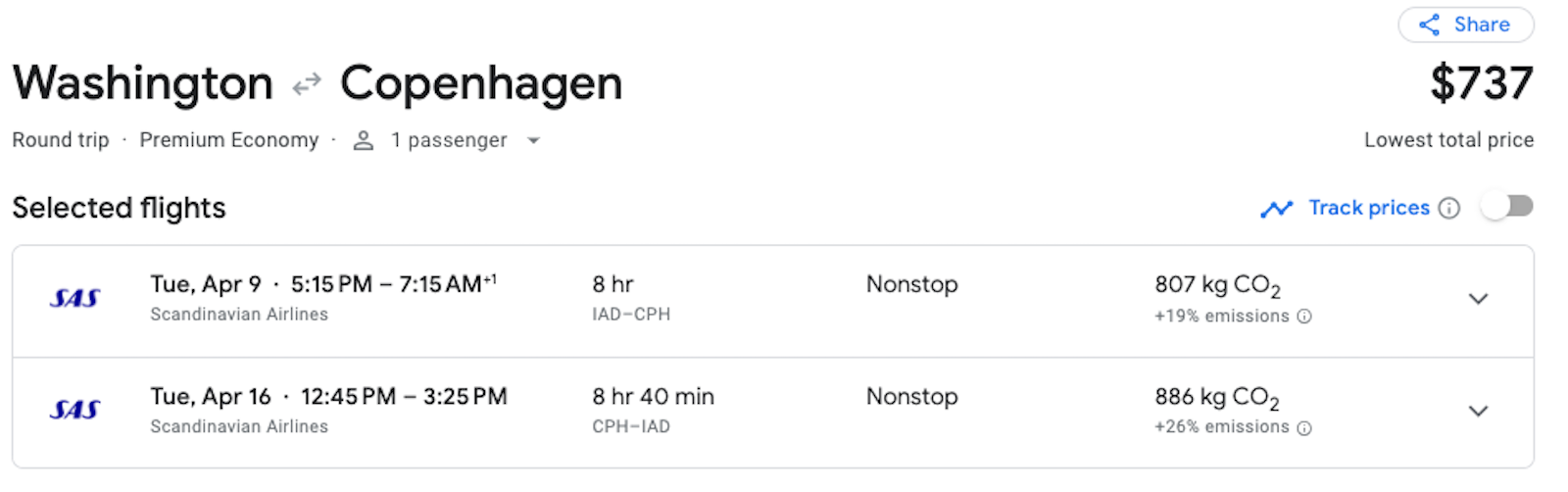

- Washington, D.C., to Copenhagen for $737

- Washington, D.C., to Milan for $830

Below is one of the cheapest and simplest options: a round-trip fare from Dulles International Airport (IAD) outside Washington, D.C., to CPH. The $737 nonstop itinerary departs at 5:15 p.m. in early April, right around peak spring travel season. The flight gets into Copenhagen at 7:15 a.m. local time. It's an afternoon flight on the return trip.

One of the cheapest options is a flight from New York to Dublin for $539 — again, in premium economy. This is a case where you'll want to use a long layover to your advantage. After a late-night departure from John F. Kennedy International Airport (JFK), you'll touch down in Denmark at 1 p.m. Then, you'll have until midmorning the following day to explore the city — enough time for a bit of sightseeing and dinner before continuing on to Dublin Airport (DUB) the next day.

It's a shorter (and slightly inconvenient) five-hour layover on the return trip.

Here's another stopover option: JFK to London's Heathrow Airport (LHR). You'll have a short layover of less than two hours on the outbound trip, but on the way home, you'll arrive at CPH at 9:30 a.m. after the first early morning leg of the return trip.

Then, you'll have 32 hours (until 5:40 p.m. the next day) to explore Copenhagen before continuing home.

Maximize your purchase

Don't forget to use a credit card that earns bonus points on airfare purchases, such as:

- Chase Sapphire Preferred Card: 2 points per dollar spent on travel

- American Express® Gold Card: 3 points per dollar spent on airfare when booked directly through the airline or American Express Travel

- The Platinum Card® from American Express: 5 points per dollar spent on airfare when booked directly through the airline or American Express Travel® (on up to $500,000 of these purchases per calendar year, then 1 point per dollar)

- Chase Sapphire Reserve: 8 points per dollar on all Chase Travel℠ purchases and 4 points per dollar on flights booked directly through the airline

- Citi Strata Premier® Card (see rates and fees): 3 points per dollar spent on air travel

Bottom line

As you turn your eyes to your 2024 travels, now is a good time to see if you might be able to lock in a premium economy ticket to Europe — and the extra comfort that it provides — at roughly the price you might otherwise pay for a coach ticket.

Depending on your travel preferences, you may also be able to visit Copenhagen and a second European city for the price of flying to one destination.

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without