Earn at Least 30,000 Points With IHG's Q1 Accelerate Promotion

Update: Some offers mentioned below are no longer available – IHG Rewards Club Select Credit Card

Each quarter, IHG offers its Rewards Club members an individualized slate of "Accelerate" challenges. Challenges include staying a certain number of nights, at a certain number of brands or using a certain type of rate plan (i.e., Points and Cash).

Today, the Q1 2017 Accelerate promotion has been released for stays between January 1 and April 15, 2017. To see your challenges, click here to register for the promotion.

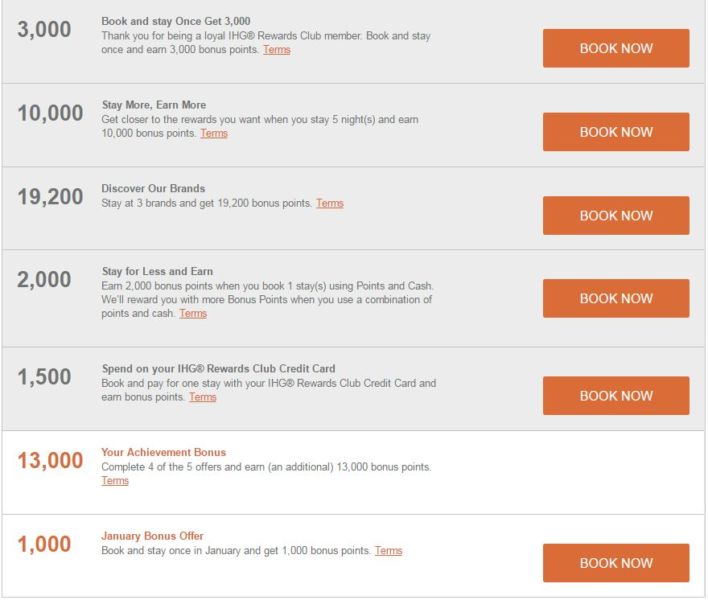

My offer was fairly solid:

- 3,000 Book and stay Once Get 3,000

- 10,000 Stay More, Earn More — 5 night(s)

- 19,200 Discover Our Brands — 3 brands

- 2,000 Stay for Less and Earn — 1 stay(s) using Points and Cash

- 1,500 Spend on your IHG Rewards Club Select Credit Card — pay for one stay with your IHG Rewards Club Select Credit Card

- 13,000 Your Achievement Bonus — Complete 4 of the 5 offers [above]

- 1,000 January Bonus Offer — Book and stay once in January

If this is your first Accelerate challenge, it's good to know that IHG will give you credit toward multiple challenges from the same stay. So, I can earn the maximum 49,700 points from my promotion in just three stays over five nights. Here's one possible combination:

- 1 night at a Holiday Inn Express paid for with my IHG Rewards Club Select Credit Card

- 2 nights at a Holiday Inn using a Points and Cash rate

- 2 nights at a Candlewood Suites in January

Here are some terms and conditions to keep in mind for your planning:

- Each member will have the opportunity to earn at least 30,000 points

- Each offer must be completed between January 1, 2017 and April 15, 2017 (both dates inclusive)

- A stay is defined as one night or consecutive nights at the same hotel, regardless of frequency of check-in/out. So, you can't rack up multiple stays at the same hotel just by checking out and checking back in.

- The following don't count as qualifying stays: any stay at a Kimpton Hotel, net wholesale individual and group rate, certain package rates, employee discount rate, friends and family rate, crew rate, special discounted contract rates, seasonal worker/crew rate, 50% travel club discount rate, travel industry discount rate, distressed passenger rate, IHG Rewards Club Reward Nights/Airline Hotel Reward rate, rates booked through third-party websites, complimentary hotel stays and any other rates not defined as a Qualifying Room Rate at IHG's sole discretion

If your offer is good enough for you to focus on IHG hotels over the next few months, make sure to also register for this year's Priceless Surprises promotion. If you stay twice and pay for the stays with a MasterCard — such as the IHG Rewards Club Select Credit Card — you'll earn a MasterCard gift card and an entry into the grand prize.

What is your Accelerate offer?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app