BP Visa Credit Card: Earn 3.75% Cash Back on All Spend Until September 30

Update: Some offers mentioned below are no longer available. View the current offers here.

Every Monday to Saturday afternoon, one of my guilty pleasures is going through the mail. These days, there are routinely multiple credit card offers and mailers for both me and my wife. Many of these are the usual subprime offers that aren't notable or smaller offers from cards that don't hold much value. Every now and then however, a true gem shows up that otherwise would typically be overlooked.

Back in a June, a mailer showed up for the BP Visa Credit Card, issued by Synchrony Bank. Gas loyalty programs have been on the rise, and as my family drives more and more, saving on gas has become a bit of an obsession for me. These oil company co-branded cards have traditionally been rather weak, but like I always do, I scoured the fine print to see if there was anything interesting.

Amazing Value in the Fine Print

The BP Visa Credit Card does not have a traditional sign-up bonus. For the first 90 days after you open the card, however, you earn a 25 cent/gallon savings towards your next fill-up at a BP gas station with every $100 you put on the card. If you spend $400 at any merchant that accepts Visa (not just BP stations) you'd walk away with $1 per gallon in savings on your next fill-up of up to 20 gallons. If you maximized the 20 gallons allowed, you'd save $20 at the pump, or 5% of the $400 you put on the BP Visa Credit Card. While 5% cash back towards gas is pretty good, most of us may not have much use for saving only at a BP gas station -- or can't use that much gas. Thankfully, the current rewards program allows for another way to use your savings earned.

As I always do when I get mailers, I kept reading through the different papers and found a separate slip with the following fine print referring to a change in the rewards structure beginning October 1 of this year, which can still be found under the current rewards program terms and conditions:

"If you do not redeem at the pump by then (September 30, 2019), your Rewards will be issued to you as a statement credit within one to two billing periods after September 30, 2019 in an amount equal to the total amount of your earned Rewards multiplied by 15. For example, if you have earned $0.25 (twenty-five cents) off per gallon in Rewards, a statement credit in the amount of $3.75 (three dollars and seventy-five cents) will be applied to your account."

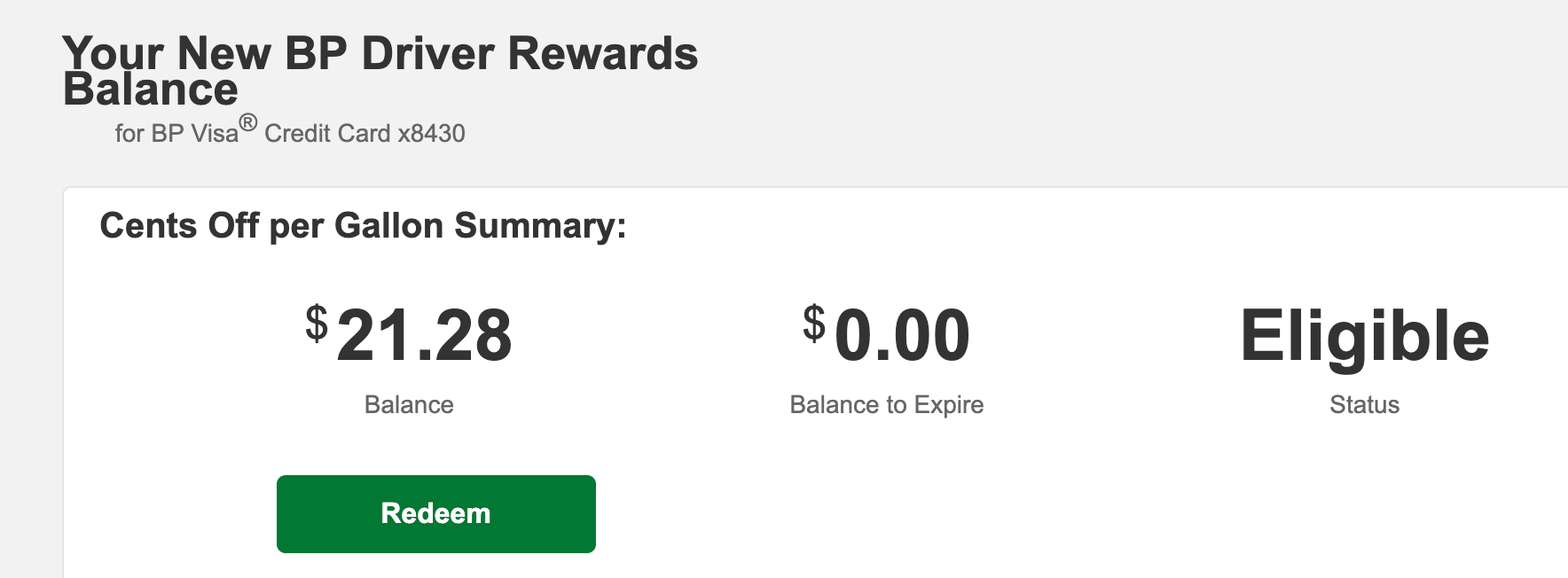

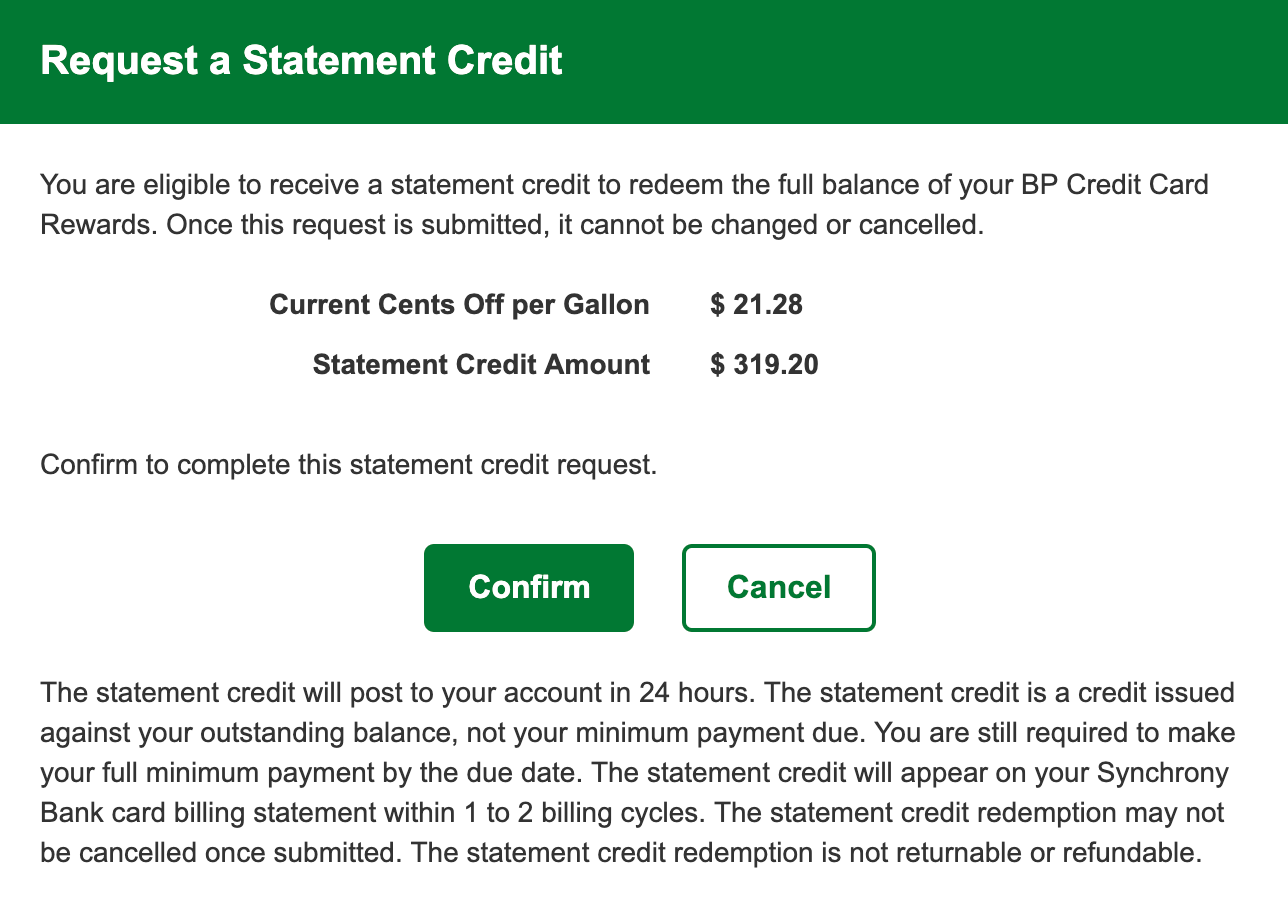

Said more simply, for every $100 you put on the card between now and September 30th, you'll earn a $3.75 statement credit or 3.75% cash back. That is the highest cash-back earn rate for all spend of any credit card I have ever seen and the card carries no annual fee. I've been using the card for a couple months and have earned $21.28 savings per gallon. (The card rewards you incrementally even if you don't spend an entire $100 on the card.)

Multiply 21.28 in savings by 15 and I am eligible for $319.20 cash back towards a statement credit on my account.

You can add authorized users for no fee, so my wife has also been using this account. I've been using the card for all non-bonus category spend, as I am not aware of any other card that can give me a higher return. The Alliant Credit Union Visa Signature gives you 3% cash back on all spend for the first year (then 2.5% thereafter) but carries a $99 annual fee (waived for the first year). Some people were lucky enough to get a Chase Freedom Unlimited offering 3% cash back (3x points) on all spend for the first year (up $20,000 spent), but I don't think I'll ever be under 5/24 to be eligible for that kind of offer. The Bank of America®️ Premium Rewards®️ Visa®️ can earn up to 2.625% cash back on all spend if you're also a Platinum Honors member with Bank of America. Really though, no other cards comes close to giving you this high of a return on non-bonus category spend.

New Program and Getting Approved

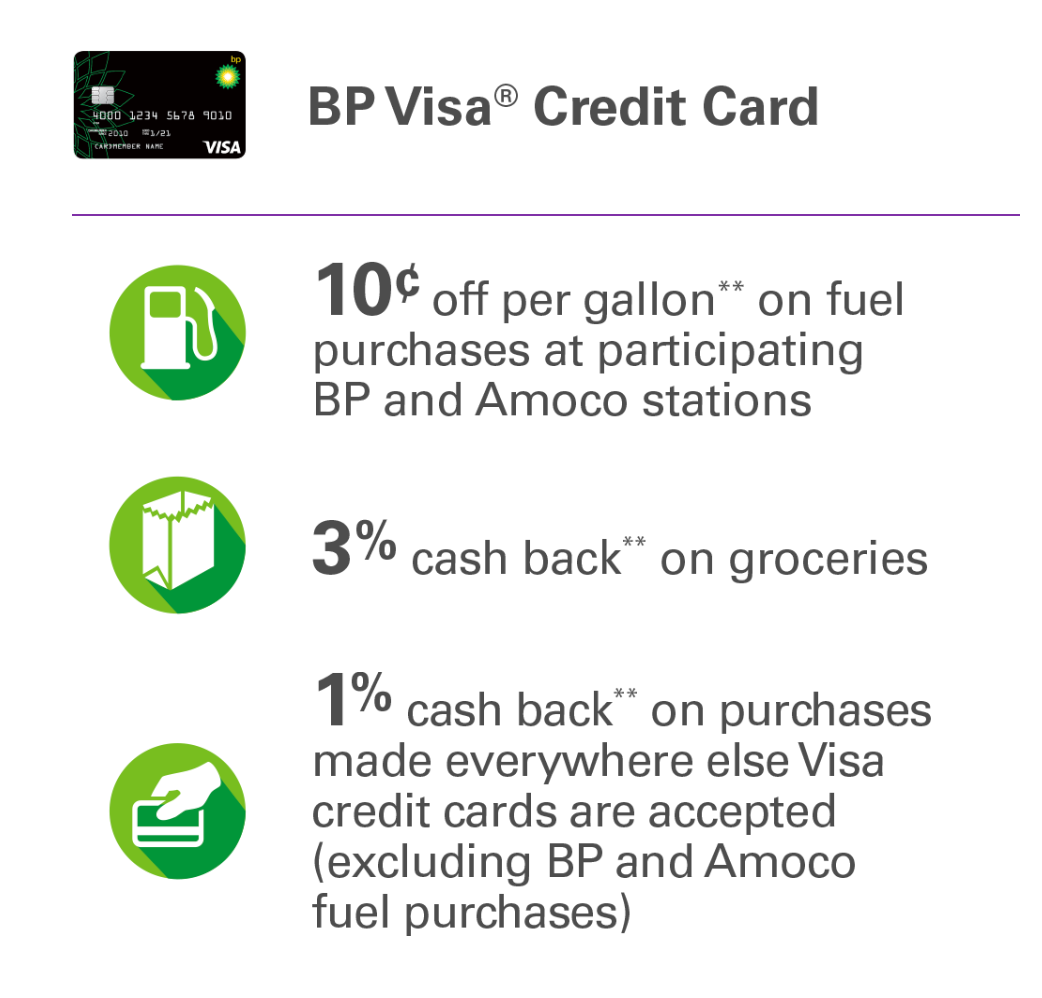

Beginning October 1, the rewards program will switch to a much less lucrative structure, with a flat 10 cents off per gallon every time you fill up using the card, 3% cash back at grocery stores and 1% cash back everywhere else.

While 3% cash back at grocery stores without an earning cap is pretty solid, it certainly can't compare with the card's current offering of 3.75% cash back on all spend or other cards offering a higher return on your spend for groceries. In my experience, getting approved for a Synchrony Bank-issued credit card has never been difficult, even with as many cards as I have open and inquiries on my report. The hiccups with the bank are usually only small credit lines being given; payments can take several days to clear and release your spending ability on the aforementioned small credit lines.

Bottom Line

Sometimes the best offers lie in places we'd never think to look. I am certainly glad my daily mail reading habit has paid off and given me over $300 back in my pocket that otherwise probably would have been half as much. I can certainly see why BP and Synchrony decided they needed to switch to a new rewards earning structure given the high cost of offering such a return, even though this card never got much coverage or exposure.

If this offer catches your eye, make sure to apply as soon as possible so you can take advantage of every day left before October 1 to earn 3.75% cash back on all your spend with no annual fee.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app