5 reasons I love the Chase Freedom Unlimited as a credit card beginner

Editor's Note

It's no secret that stepping into the world of credit card points and miles can be intimidating. Intricate rewards structures, hefty annual fees and unattainable sign-up bonuses are hard enough for the pros to grasp. But for a beginner like myself, it can feel impossible.

That said, when it came time to sign up for my first credit card, one stood out among the rest, alleviating every reservation I previously held about credit cards.

Here are five reasons why I love the Chase Freedom Unlimited® (see rates and fees) as a credit card beginner.

Straightforward earning

With many credit cards using rotating bonus categories and complex tier structures, I worried about choosing a card I could fully maximize. I have a lot on my mind, and keeping track of which spending category switched this month is simply not on my to-do list.

Thankfully, the Chase Freedom Unlimited eliminates the guesswork with its straightforward yet lucrative rewards structure:

- 5% back on travel booked through Chase Travel℠

- 3% back on dining (including takeout and eligible delivery services)

- 3% back at drugstores

- 1.5% back on all other purchases

For me, the 3% back on dining has been the MVP in terms of my spending. I'm always on the go, meeting up with friends, so eating out has become a regular part of my lifestyle. I can confidently make the most of my restaurant excursions with the Chase Freedom Unlimited.

The 1.5% back on all other purchases should also not be understated. Even the points and miles experts get excited about it. Most cards in the market only offer 1% outside of bonus categories, putting the Chase Freedom Unlimited a step above. I can earn at least 1.5% back on every purchase, every day, without any limitations. Now, that's definitely something to write home about.

Related: The complete guide to Chase Ultimate Rewards

Hassle-free sign-up bonus

Another feature that attracted me to the Chase Freedom Unlimited as a credit card beginner was its unique sign-up bonus.

With this card, you can earn $200 cash back after spending $500 on purchases in the first three months from account opening. Earning back 40% of an initial spending requirement is ultra valuable, and potentially even more significant if you can pair it with a Chase card that earns Ultimate Rewards points.

Related: The best time to apply for these popular Chase credit cards based on offer history

No annual fee

Now, points and miles experts often talk about how the benefits of their cards, such as lounge access, hotel statement credits and airline companion passes, make up for the annual fee. And they're right — if you're a frequent traveler.

As a beginner, though, I'm not jetting across the globe frequently to take advantage of these perks. So, signing up for one of those elite cards would actually cost me money. I simply want to earn rewards on my trips to McDonald's and maybe a flight to Florida next year.

That's why the fact that the Chase Freedom Unlimited has no annual fee is a game changer for me. I don't have to worry about any extra costs year after year.

Related: The complete guide to credit card annual fees

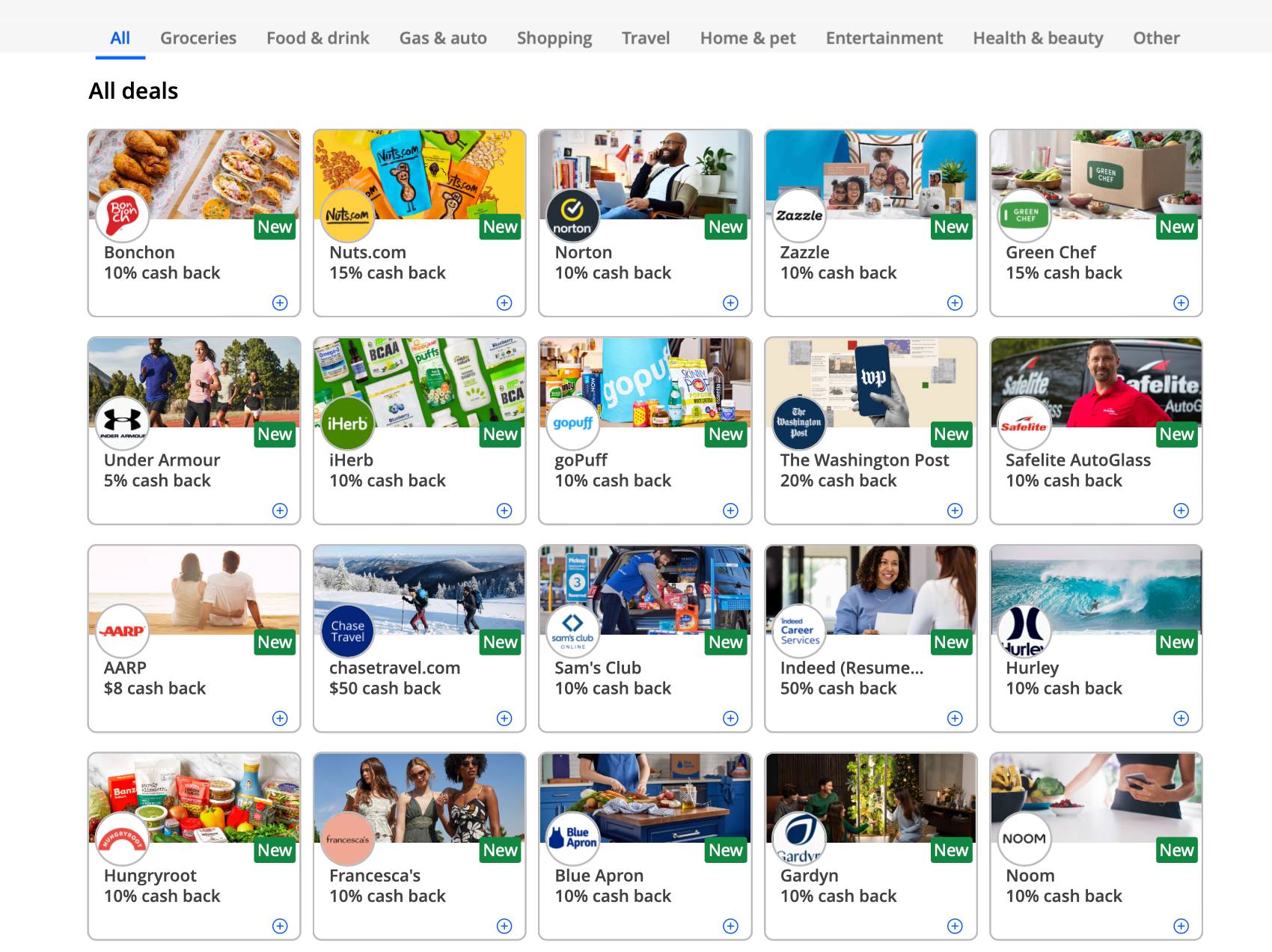

Personalized Chase Offers

One often overlooked feature that I absolutely love is the Chase Offers program. As a cardholder, I can simply add offers — like 5% back or $20 off — to my account and save even more. It's a no-brainer, right?

In the past, I've earned 5% back on my fuel purchase at Kroger, my go-to gas station. I've also saved on purchases at Little Caesars, OfficeMax and Arby's. These tailored offers make me feel like I'm getting exclusive deals that fit my lifestyle perfectly.

Related: How to book travel (and save points) with Chase Travel

Future pairing power

While I may be a beginner now, that doesn't mean I'm not aiming to become a pro in the credit card game. Therefore, it was crucial for me to choose a card that would have long-term value in my wallet. Fortunately, the Chase Freedom Unlimited is the perfect fit, as it pairs seamlessly with several other cards in the Chase lineup.

One excellent candidate for pairing is the Chase Sapphire Preferred® Card (see rates and fees), which happens to be the card I plan to add to my wallet next. On its own, the Freedom Unlimited maximizes earnings with its 1.5% back on all non-bonus purchases. However, when you pair it with the Sapphire Preferred, you can transfer these points to any of Chase's 14 travel partners for maximum value.

In my view, the Freedom Unlimited helps you accumulate points, while the Sapphire Preferred allows you to redeem those points more advantageously. It's a winning combination that will set me up for success in the long run.

Related: Better together: The ultimate guide to the best credit card pairings

Bottom line

The Chase Freedom Unlimited offers surprisingly great earning rates with no annual fee, making it the perfect starter credit card for a beginner like me. As I look toward the future of my points and miles game, I'm eager to pair the Freedom Unlimited with a higher-tier Chase card to maximize my points even more. The Chase Freedom Unlimited can truly be your catalyst to becoming a points and miles pro, just like it has for me.

To learn more, read our full review of the Chase Freedom Unlimited.

Apply here: Chase Freedom Unlimited

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app