New Chase Offers: Up to $700 in savings and bonus points on cruises

We love maximizing rewards and taking advantage of all sorts of offers here at TPG. It's great to see credit card issuers offer unique ways to save on purchases, especially those we were already looking to make.

Chase Offers is a great way for cardholders of both Chase debit and credit cards to earn cash back on various purchases. These offers are often targeted to specific cards and differ from person to person.

Chase has added a nice range of offers to several of the cards in its lineup. Let's explore how you can get up to $700 cash back from eligible purchases and earn bonus points from cruises booked via Voyages by Chase Travel℠.

Away

Away provides a nice variety of luggage for all travelers, and the current offer is seriously worth considering.

Chase Sapphire Reserve® (see rates and fees) cardholders will receive a $200 statement credit after spending $500 on Away purchases made directly with Away.

Meanwhile, Chase Sapphire Preferred® Card (see rates and fees) holders receive a slightly lower $100 statement credit after spending $400 on Away purchases.

This is an excellent way to save some serious cash on new luggage. Whether you're looking to replace old luggage or take your luggage to the next level for upcoming trips, Away luggage is a great investment, especially with its lifetime limited warranty.

This offer is available until May 21.

Kenny Flowers

If you're looking to purchase new clothes or a wardrobe for an upcoming summer trip or next year's spring break getaway, look no further. Kenny Flowers is a leisure-focused brand that provides resort-style clothing to help you look trendy, whether poolside or golfing.

From now until May 31, Chase Sapphire Reserve cardholders who spend a minimum of $180 can earn 30% back (with a maximum reward of $80).

Chase Sapphire Preferred Card holders who spend a minimum of $150 can earn 20% back (with a maximum reward of $45) for purchases made until May 31.

ResortPass

ResortPass is a fairly new concept that allows you to pay a fee to access hotel facilities such as the pool, gym, spa or private beach without booking a room or staying the night. It's great for those who want to use a hotel or resort they aren't staying at when on vacation or enjoy some amenities at a local property.

Sapphire Preferred Card holders who spend more than $100 can earn $25 back in statement credits (up to two purchases). The Sapphire Reserve offers a slightly better offer: $50 back in statement credits after spending more than $100 (up to two purchases).

Sapphire Preferred Card holders can receive a maximum of $50 in statement credits, whereas Sapphire Reserve cardholders can receive up to $100.

Chase Travel offers

The Chase Travel portal is great for booking airfare, hotels, car rentals, cruises and even travel experiences. For example, as a Sapphire Reserve cardholder, you earn 8 points per dollar spent on all purchases made through Chase Travel (excluding purchases that qualify for the $300 travel credit). Sapphire Preferred Card holders earn 5 points per dollar spent on Chase Travel purchases.

Eligible cardholders of Chase Sapphire, Ink Business and Freedom credit cards can now receive a statement credit for Chase Travel purchases.

Qualifying purchases must be made from now through July 29, but the actual travel can occur anytime. Cardholders must spend a minimum of $600 in a single transaction to qualify for the $100 statement credit.

Eligible personal credit cards include:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Chase Freedom Unlimited® (see rates and fees)

- Chase Freedom Flex® (see rates and fees)

Eligible Chase business credit cards that could be targeted for the same offer include:

- Ink Business Premier® Credit Card

- Ink Business Cash® Credit Card (see rates and fees)

- Ink Business Unlimited® Credit Card (see rates and fees)

- Ink Business Preferred® Credit Card (see rates and fees)

Voyages by Chase

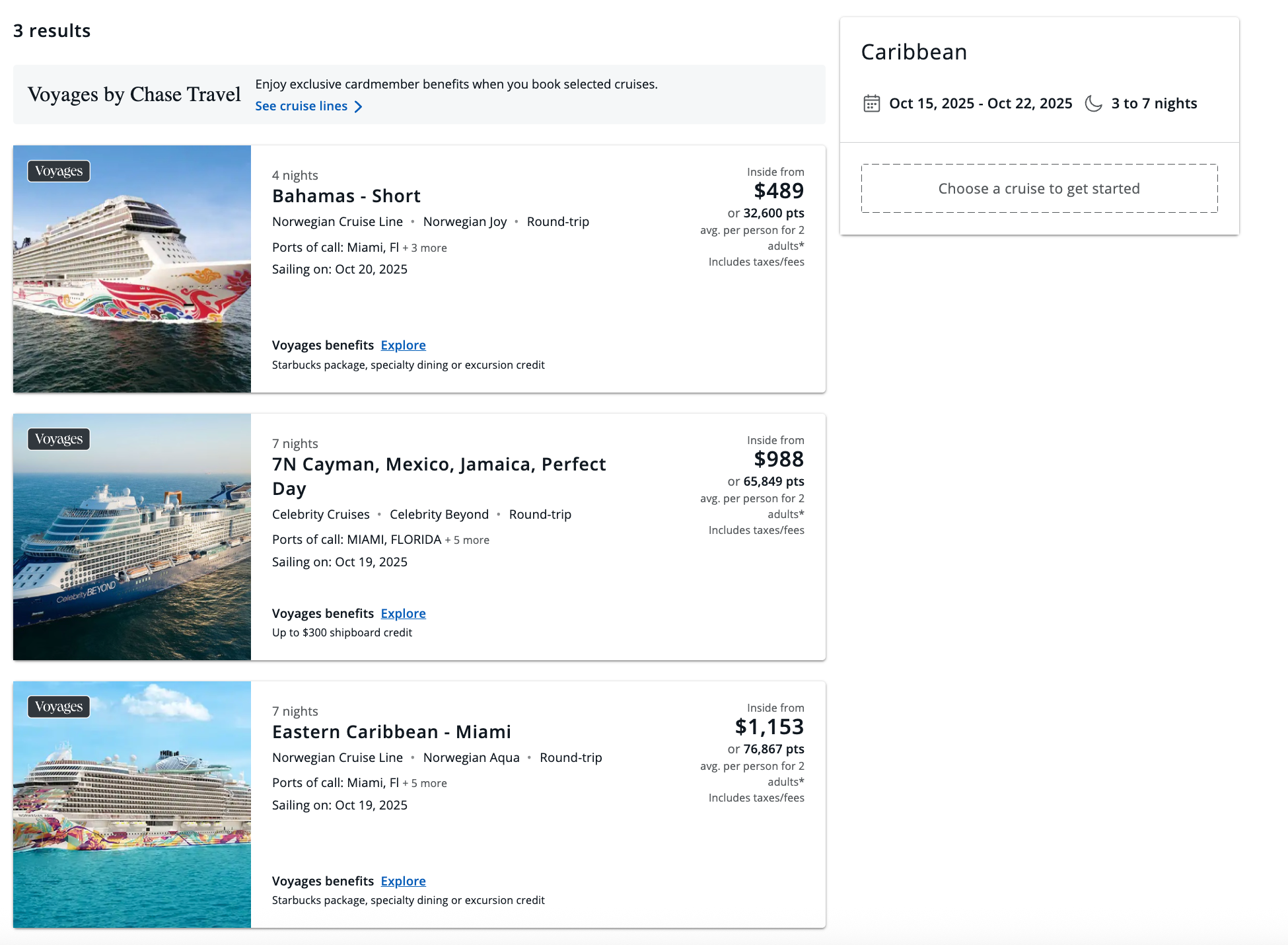

Voyages by Chase launched in 2024, but until now, you could only book cruises via a phone call. Chase has now added the ability to search and book (some) cruises through the Chase Travel portal.

You can search for cruises by region or country, and if you filter by "Voyages by Chase Travel cruises," you'll see the cruises that offer exclusive cardmember benefits.

Cardholders can earn Ultimate Rewards points on cruise bookings and receive exclusive benefits like onboard credits, package upgrades and more when booking with select cruise partners.

Sapphire Preferred cardholders earn an impressive 5 points per dollar on these purchases through Chase Travel.

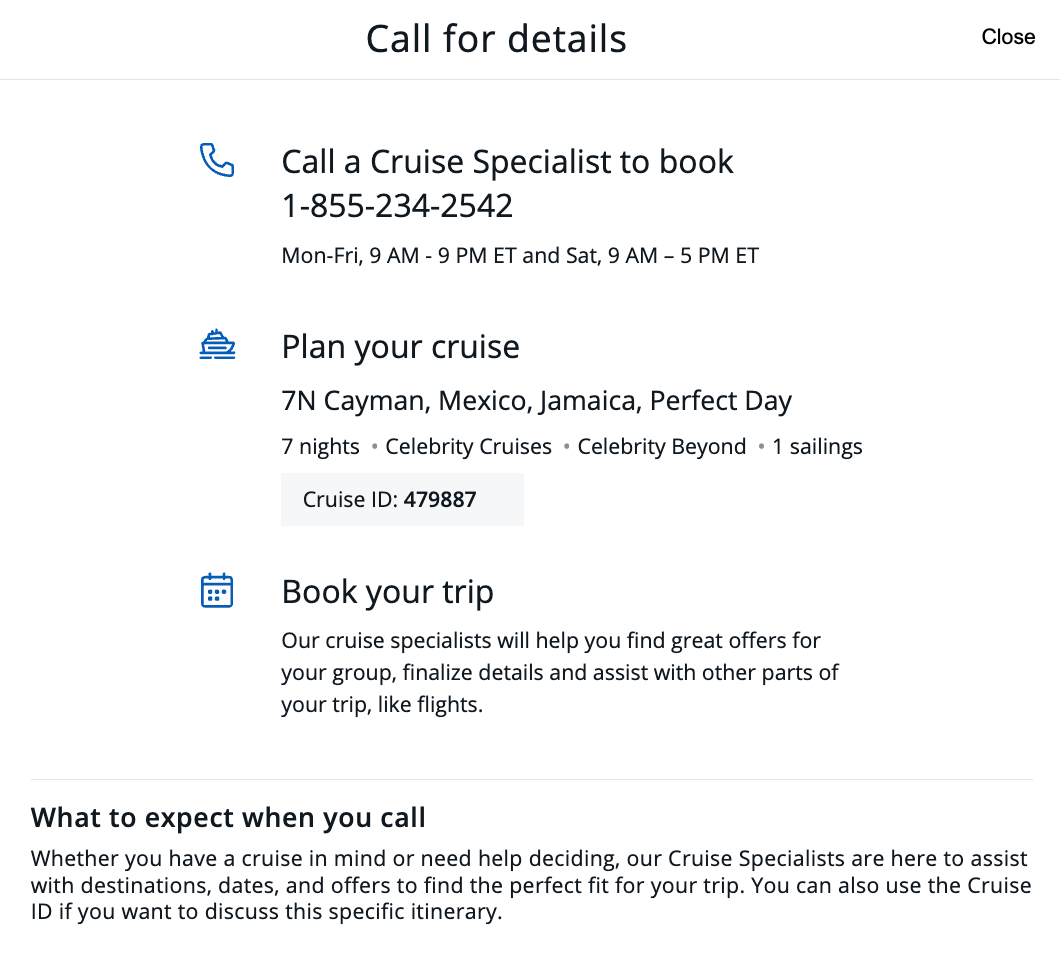

It's helpful to search for cruises and get a sense of available destinations and what each cruise line has to offer. At the moment, to book most cruises, you must still call Chase Travel and provide the cruise ID.

Related: A beginners guide to picking a cruise line

Bottom line

If you're a current Chase cardholder, it's worth logging in and seeing if your card has these offers. While these offers can net you up to $700 in savings, they may not be for everyone.

The easiest offers to use would be the ones for Away luggage and Kenny Flowers, considering the substantial savings you'll receive. If these offers aren't for you, it's still worth it to see what other offers have been added to your Chase cards.

If you hold several Chase credit cards, personal or business, you can earn even more cash back on these purchases, so be sure to make it a habit to check your offers.

Related: The power of the Chase Trifecta: Maximize your earnings with 3 cards

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app