Discover Is More Widely Accepted Than You Might Think

This page includes information about Discover products that are not currently available on The Points Guy and may be out of date.

To paraphrase another issuer's old tagline: Discover card, don't leave the US with it. At least, that's been the knock on Discover, even as it promotes no foreign transaction fees on cards like the Discover it Miles. That benefit does little good if no foreign merchant will accept the card.

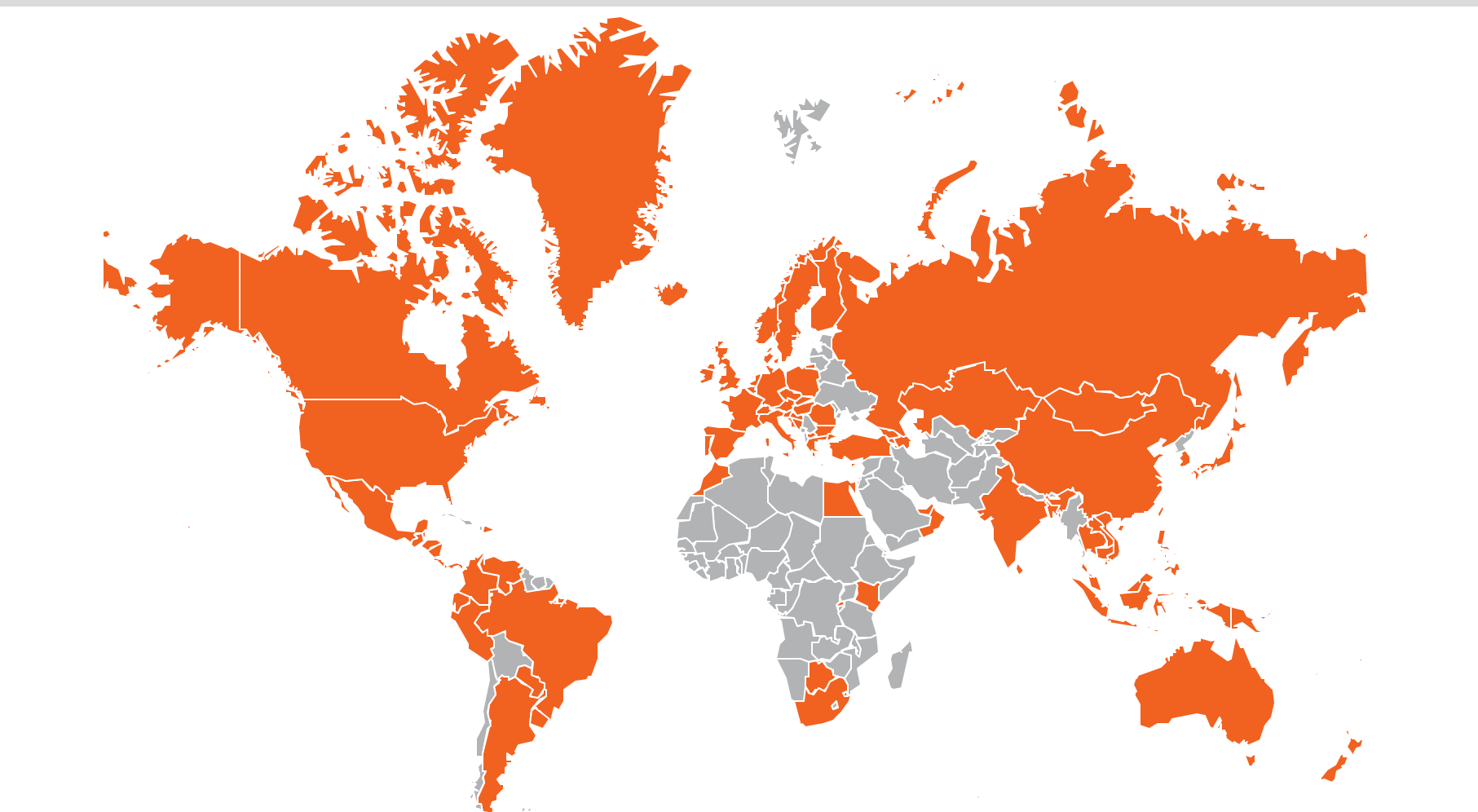

But the reality is that Discover is actually accepted at more 30 million foreign merchants across 190 countries and territories — outside of the US. As you pack your wallet on your next international trip, it may help to note that Discover has established network alliances across the globe, including relationships in China, Japan, Korea, India, Brazil, Turkey, Nigeria and throughout Europe. In September 2018, Discover announced yet another alliance to expand acceptance in Mexico. Discover, Diners Club International, PULSE and network affiliate cards are now accepted on Prosa's network in Mexico at both point-of-sale and ATM locations.

That doesn't mean Discover can be used everywhere within the countries which it has agreements, just as the issuer isn't accepted everywhere in the US. Still, in 2015, according to some studies, Discover actually became one of the most widely accepted payment card globally. In the US, it has the third highest acceptance rate among card networks, beating out American Express.

If you do travel with the card, just be aware there are still some some gaps in coverage. The issuer has a handy tool you can use to see if the country you're traveling to accepts Discover. The area with the least coverage is Africa, where Discover is accepted only in Botswana, Egypt, Kenya, Morocco, Rwanda and South Africa. It also has coverage gaps in the Middle East, but it is accepted in the United Arab Emirates.

Check the tool to see where Discover cards are accepted at merchants and ATMs. You typically can use your Discover card wherever you see the Discover or Diners Club International symbols displayed. Other foreign partners include Union Pay on mainland China and JCB in Japan.

You'll, of course, want to bring at least one backup credit card with you on foreign trips — in case the shop where you found that adorable tchotchke only accepts Visa. While you're at it, I'd pack some local currency too, just to be extra safe.

Featured image by Caiaimage/Chris Ryan / Getty Images

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app